On Monday, Chegg (NYSE: CHGG) announced that it is laying off 4% of its workforce and parlaying the cost savings into executing its AI strategy. Chegg has been one of the headline "AI losers," or companies that see their business model under threat due to the rise of AI chatbots like ChatGPT. The effort is part of a company-wide reorganization to adapt to the breakthroughs seen in the AI space.

However, some are asking if the company is moving too late after seeing 48% subscription declines last quarter, to which the market treated Chegg to a 50% overnight stock price decline, primarily driven by fears that ChatGPT disrupted a flat-footed Chegg.

Is AI Disrupting Chegg?

Disruption is part of the technology industry. Some companies see it coming and adapt, while others get caught flat-footed. Many investors worry that ChatGPT and other AI developments caught Chegg asleep at the wheel, and the company is only now rushing to act.

Chegg CEO Dan Rosenweig was accused of downplaying AI’s significance after its Q4 2022 conference call after he said, "we’re going to track it, but we’ve seen nothing” concerning customers lost from ChatGPT. As we noted in our February article on Chegg, the company hadn’t made an AI-related acquisition since 2018.

Chegg's first-quarter earnings results provided little relief to worried investors. The company issued disappointing guidance, with a second-quarter forecast of $175-$178 million compared to Wall Street's expected $196 million. But subscribers are the real sticking point. And it shows students running from Chegg into the arms of ChatGPT, reporting a 5% year-over-year decline in its subscriber count.

CEO Dan Rosenweig told investors on the earnings conference call that “since March, we saw a significant spike in student interest in ChatGPT. We now believe it’s having an impact on our new customer growth rate.”

Chegg's subscriber growth is the lifeblood of its business. Sustainable revenue growth for a B2C service business is only possible by growing its subscriber count. This is especially important for a stock whose valuation implies significant future growth. Chegg is barely profitable, reporting just $2.2 million in net income in Q1 compared to its $1.2 billion market cap.

Wall Street isn't happy with the stock, as it received a barrage of downgrades. After its first-quarter results, firms including Jeffries, Piper Sandler, Morgan Stanley, Barrington, and BMO Capital either downgraded or slashed targets for Chegg.

College students use Chegg to cheat on their homework and, sometimes, exams. Chegg's pretty good at it, too. Over the years, it's built up a substantial proprietary database of homework answers based mainly on user contributions.

However, it's just these types of proprietary databases that ChatGPT and other AI chatbots threaten to disrupt. Large language models like those that power ChatGPT thrive on their ability to use semantic patterns to give you a satisfactory answer. Inaccuracy is a problem but becomes less of an issue with each model update.

In addition to potentially replacing Chegg’s job, ChatGPT can convincingly write college-level essays, act as a study buddy, and provide additional context to confusing problems.

Chegg’s AI Strategy

Despite accusations of missing the boat on AI earlier this year, Chegg is now aggressively pursuing opportunities in AI, going as far as reorienting the company’s strategy towards doing so.

The company's first move is the release of CheggMate, an AI study buddy based on OpenAI's GPT-4. The bot will create practice exams; study plans and act as a virtual assistant to students. CheggMate is currently in a free beta with a waitlist.

While many companies are releasing copycat chatbots that are essentially frontends for OpenAI's API, Chegg's has the potential to differentiate. CheggMate is trained on Chegg's massive proprietary database of homework and exams, making it specially equipped to deal with students' problems.

With the company’s recent announcement of layoffs focused on reorganizing to better focus on AI, Chegg has the potential to save itself from disruption. But is it too little, too late?

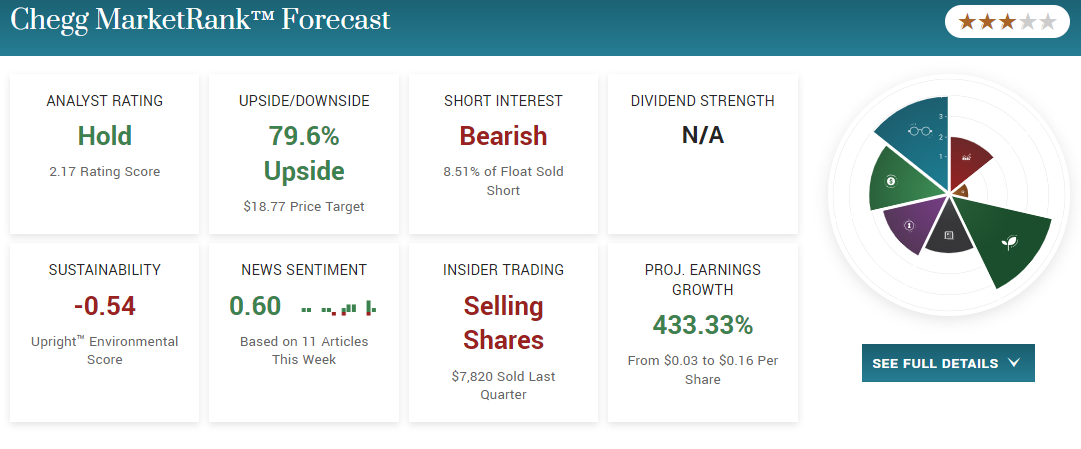

Check out MarketBeat’s MarketRank Forecast for Chegg: