The earnings action has quieted down, but the analysts' activity remains hot. The activity in the 1st week of September is driven by a handful of small tech names with 1 thing in common: exposure to the blossoming AI-powered client-service industry. This is worth noting because AI-powered services are expected to be the largest and fastest-growing segment of a large market.

Here’s where the analyst’s love is flowing.

Zscaler is a Resilient Play On Cybersecurity and Enterprise Software

Enterprise software and cybersecurity stocks are poised to rebound in Q4, and Zscaler (NASDAQ: ZS) may lead the group. The company’s top and bottom line results in Q2 not only showed strength, but the guidance was also solid. The response from the analysts community included an encouraging letter from Wedbush’s Dan Ives, who views the company as resilient and showing strong momentum.

Among the details, he pointed out large client growth and impressive margins. He maintained an Outperform rating and raised his target to $185, slightly above the Marketbeat.com consensus.

Zscaler is the Most Upgraded stock from the first week of September. The stock received 23 post-release revisions, including over a dozen boosted targets and several reiterated ratings with a consensus above the broad average. The current consensus implies about 15% upside for the stock, and it is trending higher again.

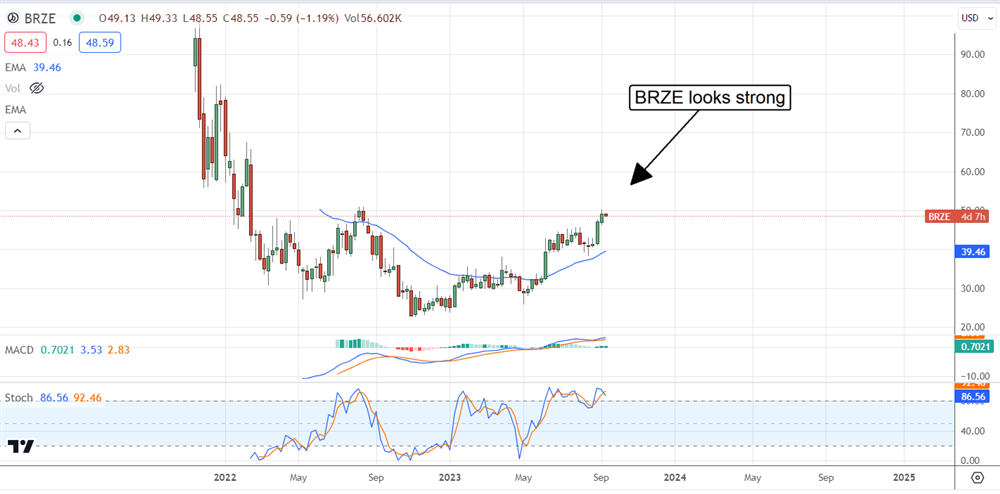

Braze Impresses in Q2, Leads Industry Higher

Braze (NASDAQ: BRZE) operates a platform to aid businesses with customer engagement. The platform helps manage customer engagement tools such as emails, in-app/in-browser messaging, data management, and data analysis. Its Q2 results include 33% revenue growth, top and bottom-line outperformance, and a favorable outlook for the rest of the year.

The combined result is that analysts are impressed and raising their targets. 14 of the 19 analysts tracked by Marketbeat issued a revision, including a boosted price target. The consensus estimate implies about 9% upside for the market, and most new targets are well above that level. Additionally, Braze will be added to the Russell 3000 soon, a move that will broaden and increase stock ownership.

GitLab Helps Developers Get Projects Done

GitLab (NASDAQ: GTLB) is quickly emerging as a critical player in the development of AI applications. Its DevSecOPs platform is a go-to resource for development teams working remotely who desire cutting-edge tools and the highest levels of security. Q2 results include near-40% YOY growth, outperformance, and increased guidance aided by the AI revolution.

The results triggered 11 boosted price targets in the 1st week following the report, and more are expected. The MarketBeat consensus rating is Moderate Buy, with a price target about 18% above recent action. The price target is trending higher and would put the market into a complete reversal if reached.

Freshworks Gets a Lift From Braze Results

Freshworks (NASDAQ: FRSH) is another customer engagement platform. It reported a solid 20% increase in revenue in early August. The analysts began raising their targets then and increased the pace of revisions following Braze’s report. Since then, Freshwork’s stock has received 9 boosted price targets, and the consensus target is trending higher.

The new consensus is up about 30% compared to last year and 10% above the current action. Freshworks reports Q3 earnings earliest of this group. The report is due November 1st and is expected to show slowing growth. That said, growth will slow to about 16% from the prior quarter’s 20%, but the estimates are still rising, and the consensus may be too low.

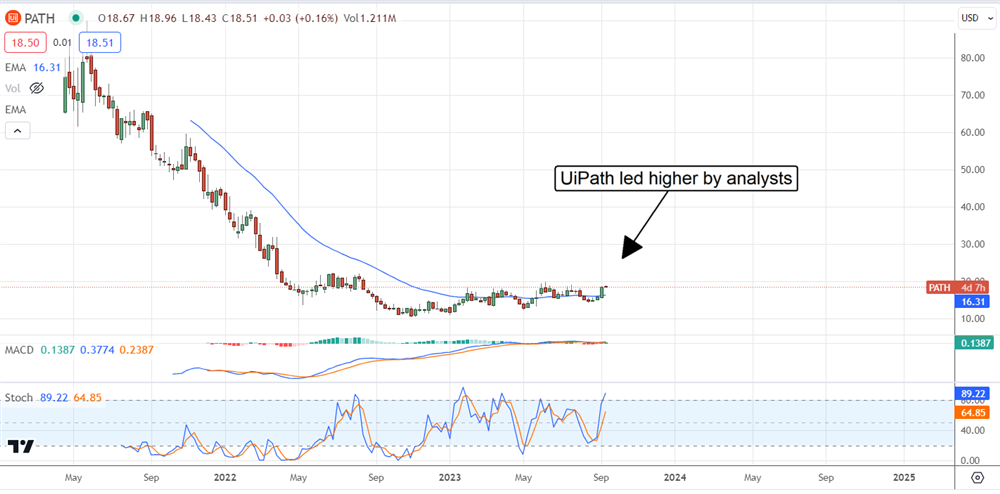

UiPath Blazes a Trail With Digital Robots

UiPath (NYSE: PATH) develops and markets a line of digital robots that help automate business functions across the enterprise. Its q2 results stand out for growth and outperformance because its competitor, C3.ai (NYSE: AI), performed poorly. The analysts are taking note of the disparity, and 9 have issued updates. Their revisions have UiPath stock in 5th position as the Most Upgraded Stock for September, and more are expected. Until then, the analysts rate the stock a firm Hold with a price target about 6% above the current action and trending higher.