Gene-editing is making huge headlines in the medical sector stemming from the first FDA approval for a CRISPR/cas9 treatment for sickle cell disease SCD and TDT from CRISPR Therapeutics AG (NASDAQ: CRSP) and partner Vertex Pharmaceuticals Inc. (NASDAQ: VRTX). CASGEVY made global headlines when it received FDA approval on December 8, 2023.However, on the same day, the FDA also approved LYFGENIA (lovotibeglogene autotemcel), which is another gene therapy treatment for SCD by bluebird bio (NASDAQ: BLUE). At the same time, CRISPR Therapeutics is getting the bulk of the attention, while Little Bluebird Bio benefits from the secular tailwinds forming with gene therapy. bluebird has 3 FDA approved gene therapies:

LYFGENIA (lovotibeglogene autotemcel) was FDA approved on the same day as gene-editing therapy CASGEVY on December 8, 2023, for the treatment of sickle cell disease (SCD). LYFGENIA is the longest-studied approved gene therapy for SCD. It's designed to allow the production of anti-sickling hemoglobin to decrease vaso-occlusive events.

ZYNTEGLO (betibeglogene autotemcel) is a gene therapy treatment for beta-thalassemia characterized by the inefficient production of healthy red blood cells. Patients receive functional copies of the beta-globin gene. Studies have shown that 89% of patients achieved transfusion independence.

SKYSONA (elivaldogene autotemcel) is a gene therapy treatment for early active cerebral adrenoleukodystrophy (CALD). It’s the first and only gene therapy proven to slow the progression of neurologic dysfunction in boys with early and active CALD.

How to play BLUE with LEAPS options for growth and income

BLUE is attractive to speculators because its frankly a cheap stock. Much cheaper than CRSP, with large relative upside potential. We can look to play the stock options using Long-term Equity AnticiPation Securities (LEAPS) or LEAP calls, which are relatively cheap. Fundamentally, BLUE is a solid speculation that will benefit from the continued headlines for gene therapies, including gene editing. It's also the rare company with 3 FDA approvals for gene therapies. It's LYSENIA is a $3.3 million treatment, but it's making progress with reimbursement from insurers, especially as CASGEVY makes ground on it.

BLUE weekly cup breakout into gap zone

Since we’re looking at LEAPS, we will use a larger weekly time frame to see the big picture of the price landscape for our technical analysis. Hard to believe, but BLUE was trading at a high of $152.88 in March 2018. BLUE fell to a low of 87 cents in February 2023, forming a rounding bottom. The weekly market structure low (MSL) buy triggers above $1.47. The daily MSL triggered above $1.13. The weekly cup lip line formed in January 2024 at $1.53, making it the ley line in the sand resistance, gap zone reentry and breakout level. The weekly relative strength index (RSI) is rising through the 40-band. Pullback support levels at $1.40, $1.26, $1.13 and 97 cents.

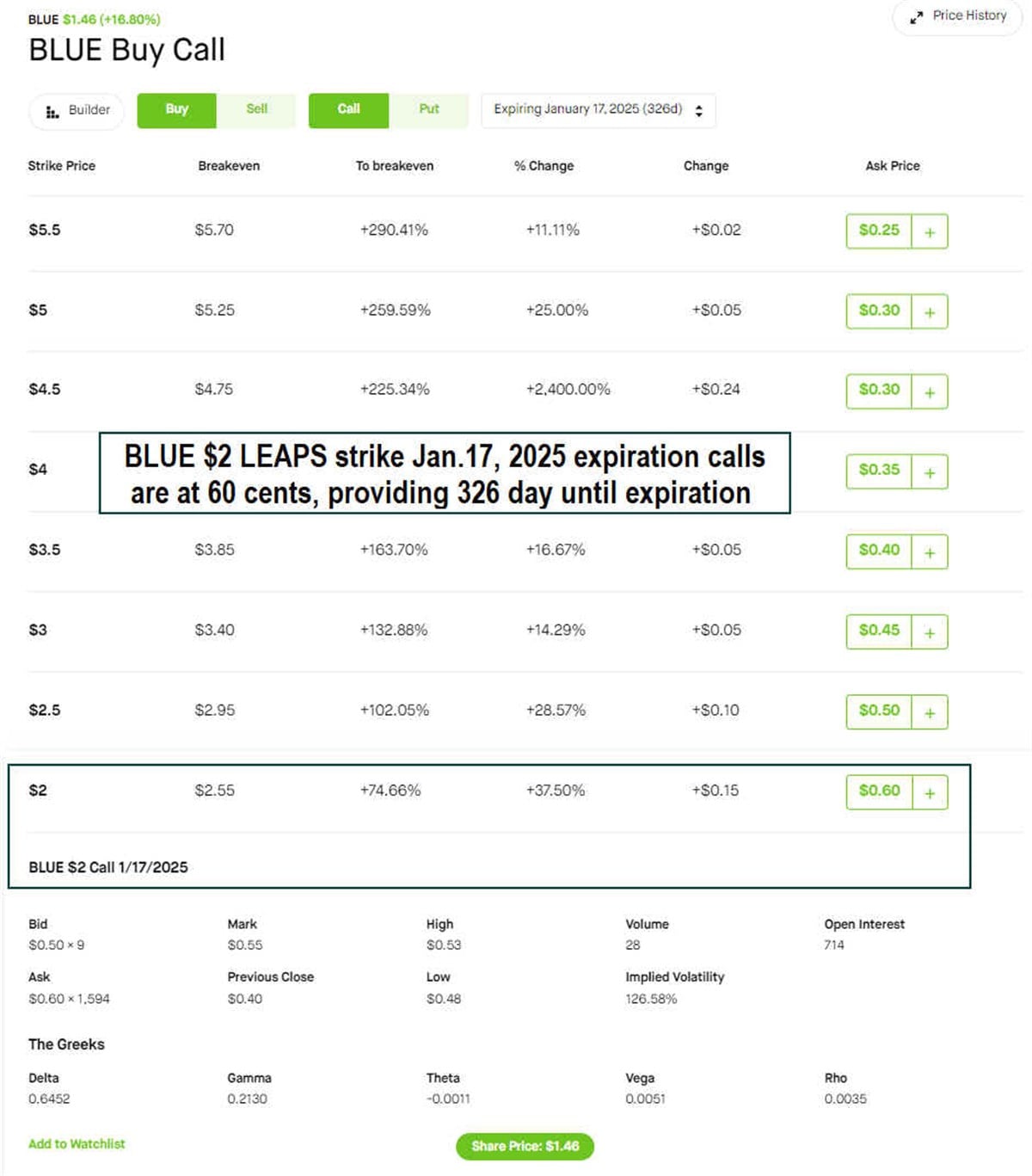

Long BLUE $2 LEAPS calls

Since we are giving BLUE time to break out and accelerate to the upside, we take the BLUE $2 LEAPS expiring January 17, 2025, or in 326 days for 60 cents. This is an out-of-the-money (OTM) directional options trade. Analyzing the option Greeks tells us that the 64.5 Delta implies the call options will gain 64.5 cents for each $1 move in the underlying shares.

The Theta implies the option will lose .0011 cents in value per day from time decay until expiration. The breakeven cost on the option is $2.55 on expiration. If BLUE surges ahead of time, the Delta will spike at the rate of the Gamma, and the option will be worth more. The $2.26 is the gap fill level, with the next gap fill at $3.94, and a swing high of $5.53 was made on the FDA approval date of December 8, 2023. That would be the upside target.

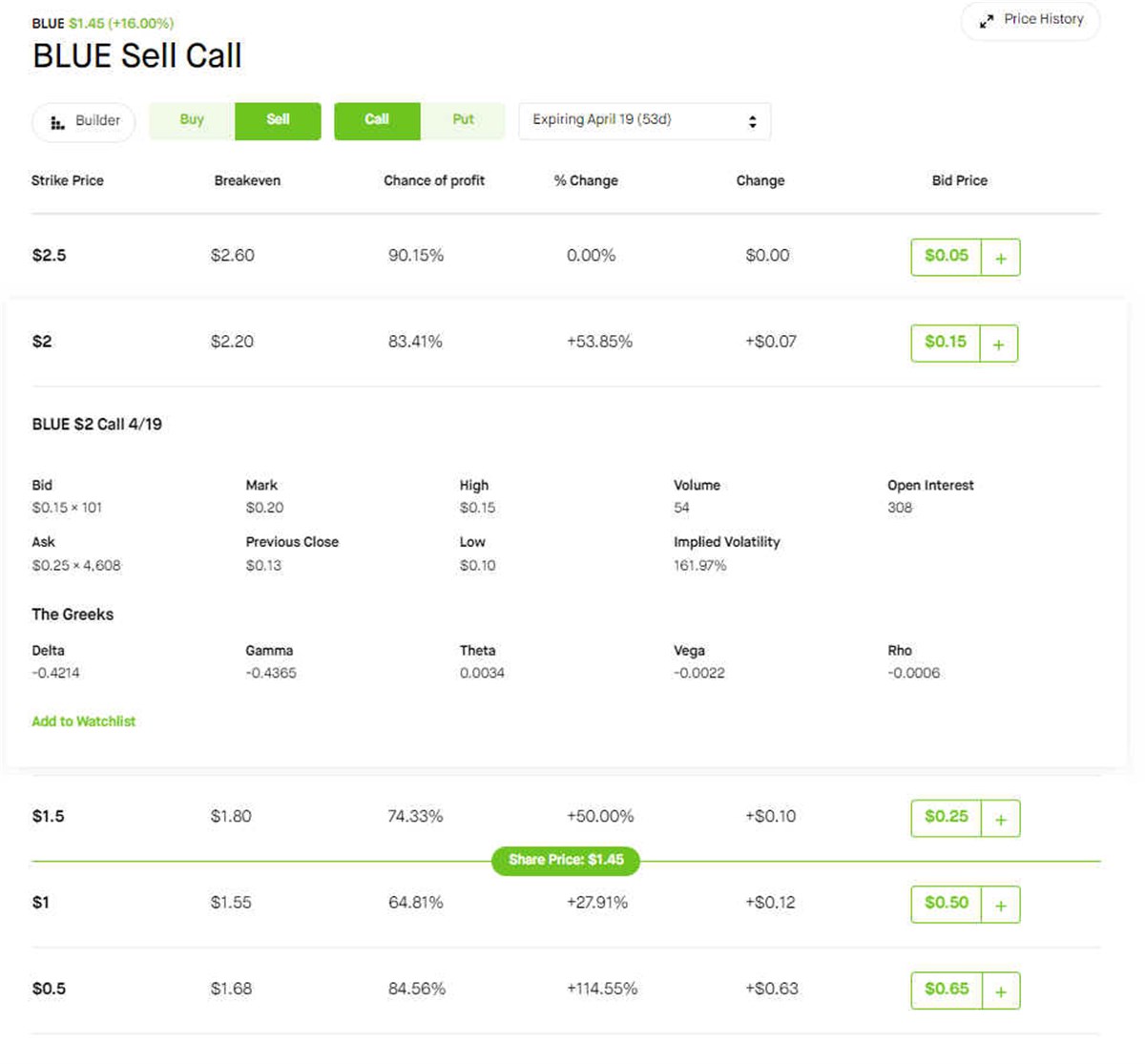

Sell OTM calls for income.

If BLUE rises above $2.00 and gets in the money (ITM), we can start generating income using the long call diagonal debit spread (LCDDS) strategy. Since we already own the LEAPS call option, we can sell OTM calls against the long LEAPS call position.

Even without going ITM, ee can sell the BLUE $2 Calls expiring April 19, 2024, in 53 days for 15 cents per contract. The $2 LEAPS cost us 60 cents. The 15-cent premium represents a 25% yield for holding the LEAP calls for 53 days. If BLUE spikes to $2.00, then our LEAPS calls would also rise in value too, with the potential to be assigned.

If you don't want to risk assignment, you can sell deeper OTM calls, like the $2.50 April calls, which will provide lower premiums. As BLUE shares rise, you can select higher strike prices. The premiums also buffer any downside moves.