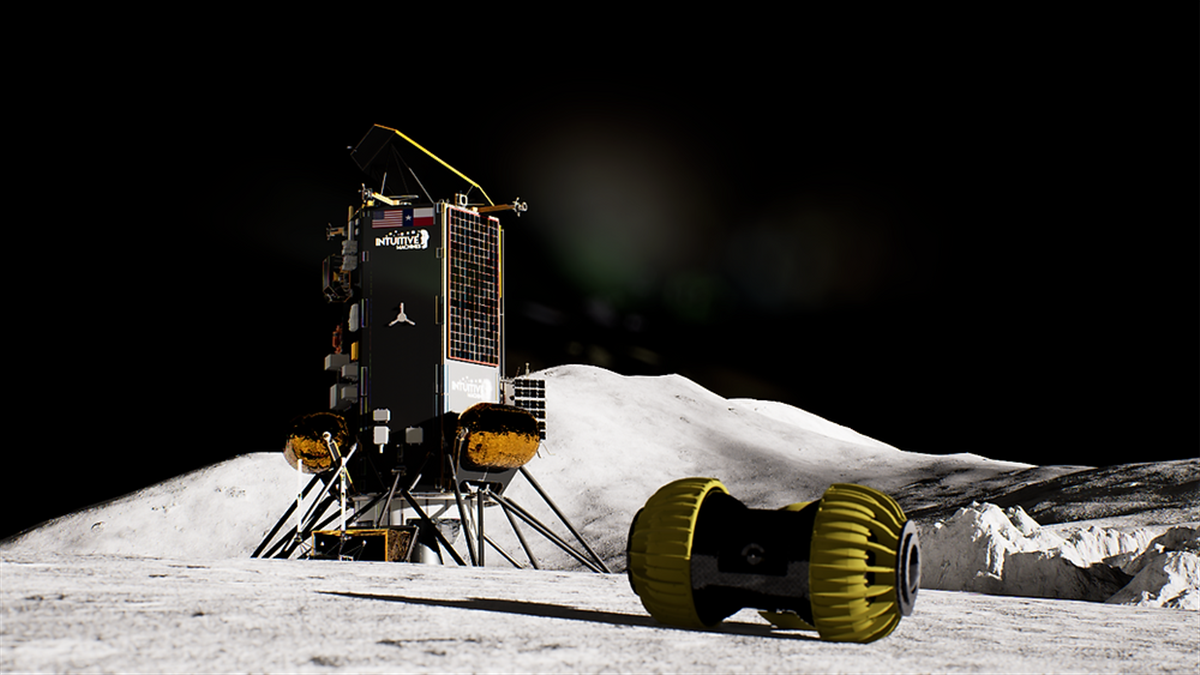

Intuitive Machines (NASDAQ: LUNR) has positioned itself as a pivotal player in the space exploration and aerospace sector, where ambition and innovation collide. Intuitive Machines embodies the spirit of the new space age from its historic lunar landing, marking the United State’s return to the Moon after a hiatus of over 50 years, to its expanding portfolio of lunar technologies and services.

Intuitive Machine’s earnings release for the fourth quarter and full year of 2023 (Q4 FY 2023) provides a detailed picture of the company’s financial performance and offers clues about its trajectory. After a successful lunar touchdown, has Intuitive Machines landed a compelling financial report, setting the stage for a long and profitable mission?

Houston, We Have Revenue Growth

The company’s latest earnings report reveals a mix of progress and continued challenges in Intuitive Machines' financial performance. The company experienced a year-over-year revenue decrease. In FY 2023, revenue reached $79.5 million compared to $85.9 million in FY 2022. This decrease is primarily attributable to project milestones and contract completion timing.

NASA's Commercial Lunar Payload Services (CLPS) initiative and the more recent OMES III contract are key drivers of the company's revenue. It's important to note that government contracts can have revenue recognition patterns that impact the timing of income reflected on financial statements.

While Intuitive Machines recorded a net operating loss of $(56.2) million in FY 2023, a narrower loss of $(5.9) million in the fourth quarter of 2023 is encouraging. This reduction in quarterly operating loss indicates efforts to rein in costs. Furthermore, achieving a positive gross margin in December 2023, primarily due to OMES III revenue, highlights improving operational efficiency.

This positive margin signifies that the company generates an acceptable profit after deducting direct costs associated with delivering its lunar services.

Intuitive Machines ended 2023 with a solid backlog of $268.6 million, an increase from $201.9 million in the prior year. Backlog denotes contracted work yet to be completed and translated into revenue. Thus, this substantial backlog bodes well for future revenue potential.

The company's cash position strengthened considerably, reaching $54.6 million by March 1, 2024. This increase resulted primarily from warrant exercises by an institutional investor, providing enhanced financial flexibility to pursue growth initiatives and investments.

Statements made during the earnings call indicated Intuitive Machines will continue to focus on innovation, strategic partnerships, cost control, and efficient execution of its expanding lunar programs. Navigating the cost-intensive aerospace industry remains challenging, but revenue growth, improving margins, a healthy backlog, and sufficient cash reserves offer encouraging signs.

Lunar Ambitions in a Competitive Orbit

NASA's Artemis campaign represents a major frontier in 21st-century lunar exploration, and Intuitive Machines plays a significant role in this endeavor. Their successful lunar landing mission demonstrated the company's technical proficiency and bolstered its reputation within the industry.

Existing contracts secured within the Artemis program and the potential to win additional awards indicate that Intuitive Machines is likely to remain a fixture in NASA's ambitious lunar plans.

Recognizing opportunities beyond government contracts, Intuitive Machines proactively seeks to participate in the burgeoning commercial lunar market. The company's strategic focus on services such as lunar data gathering and analysis positions it as a knowledge facilitator in the rapidly evolving space economy.

If Intuitive Machines successfully monetizes lunar data and participates in developing lunar resource utilization efforts, significant new revenue streams could be unlocked.

However, it's essential to acknowledge that Intuitive Machines is not the sole player in the commercial space race. Companies like Astrobotic and Firefly Aerospace also vie for dominance in lunar markets.

To maintain and expand its market share, Intuitive Machines must continuously refine its value proposition, highlighting the unique advantages of its services and technologies. Success in this competitive landscape hinges on demonstrating innovation and delivering reliable performance.

Countdown to Investor Impact

The current status of Intuitive Machines' lunar lander is a critical factor for investors to monitor. The lander's ability to successfully restart upon the return of ample sunlight to its South Pole landing site will determine the immediate outcome of the mission and likely significantly impact investor sentiment in the near term.

Positive news for Intuitive Machines on this front could boost the company's stock price, while a failure to restart could lead to a decline.

Beyond the lunar lander, investors should closely track any recent news developments or announcements from Intuitive Machines. New strategic partnerships, contract wins, or leadership changes could signal positive momentum or potential challenges for the company.

Additionally, it's crucial to pay attention to shifts in Intuitive Machine’s insider stock holdings. Major shareholders buying or selling sizable amounts of stock can convey either confidence in the company's future or raise concerns about its trajectory.

While these specific updates offer insights into Intuitive Machines' outlook, investors must also be aware of the broader risks that characterize the aerospace sector. This industry is known for being capital-intensive, requiring significant investments in technology development and infrastructure.

Projects often have extended timelines, meaning that returns on investment may not be realized for years. Considering these inherent risks is essential when making informed investment decisions about any aerospace company, including Intuitive Machines.

Intuitive Machines embodies the spirit of the transformative age in space exploration. The company's successful lunar landing, participation in the Artemis program, and push for commercial space activities underscore its ambition. Investors must carefully weigh the company's strong revenue growth, promising backlog, and technological advancements against the operating losses, competitive landscape, and risks characteristic of the aerospace industry.

As Intuitive Machines continues to chart its course amongst the stars, staying attuned to company developments will guide informed investment decisions.