While solar energy solutions provider SolarEdge Technologies Inc. (NASDAQ: SEDG) shares have recently rallied off their 52-week lows, they are still trading down 66% year-to-date (YTD). Aside from a tough macroeconomic environment, high interest rates, and the bankruptcy of a large customer, the company has weathered the storm and may be on the verge of a turnaround. Solar energy stocks have started to rebound off their highs. SolarEdge recently announced that it is meeting significant U.S. milestones, causing sentiment to reverse and its stock trajectory.

SolarEdge operates in the oils/energy sector, competing with solar energy companies like Sunrun (NASDAQ: RUN), SunPower (NASDAQ: SPWR), and First Solar Inc. (NASDAQ: FSLR).

Impact of PM&M Electric's Chapter 7 Bankruptcy on SolarEdge

One of the worst nightmares for any business occurs when a large customer with a large bill files for bankruptcy. SolarEdge disclosed on June 25, 2024, that one of their large customers had recently filed Chapter 7 bankruptcy. This particular customer, PM&M Electric, owns SolarEdge for $11.4 million. The company stated it may not receive payment under a secured promissory note. Any monies the company does recover will likely occur after a significant delay. Chapter 7 bankruptcy is a liquidation process. Chapter 7 is filed when there’s no chance for profitability through a Chapter 11 reorganization.

SolarEdge Achieves U.S. Milestones Generating Jobs and Bonus Tax Credits

On July 11, 2024, SolarEdge announced significant achievements in its U.S. manufacturing strategy, revealing that it now partners with leading global electronics manufacturers for its U.S. production. Austin, Texas, houses its first facility, which opened in late 2023 to manufacture 50,000 residential Home Hub Inverters in Q2 2024. Its second facility in Seminole, Florida, is expected to produce 2 million domestic content Power Optimizer units quarterly. Commercial inverter and Power Optimizer production is expected to start in 2025.

The two facilities have created 1,500 U.S. jobs, which will increase to 1,750 jobs by year's end. The 100% domestic content products are designed to help its customers qualify for bonus tax credits in Q4 2024. The company intends to produce DC-optimized inverter systems for residential applications that meet the requirements set forth by the U.S. Treasury for residential and commercial applications by early 2025. This will enable its residential and commercial customers to reach the required 40% domestic content threshold to access additional bonus tax credits.

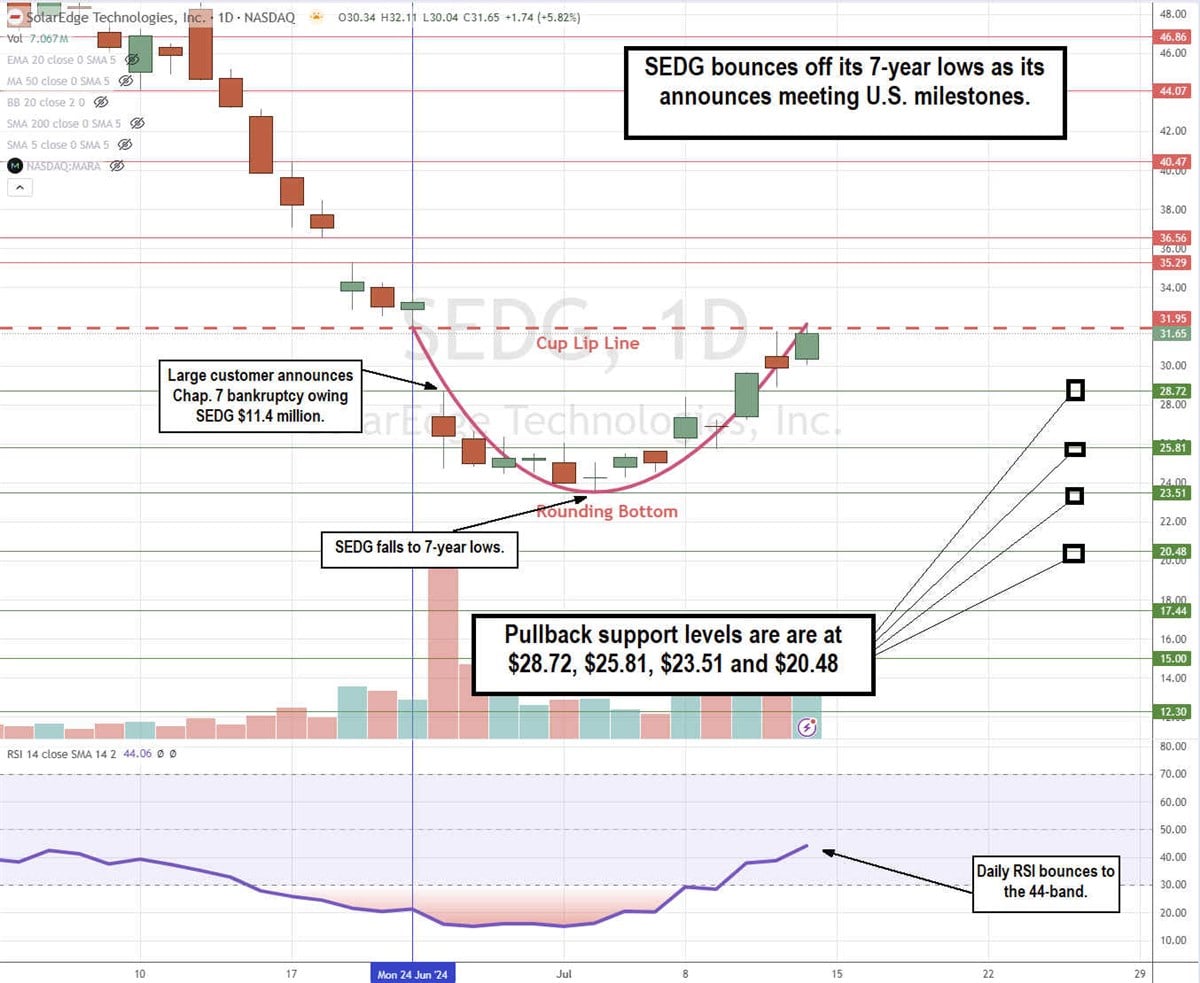

SEDG Completes a Daily Cup Pattern

The daily candlestick chart on SEDG illustrates a cup pattern. The cup lip line formed on the gap down after it disclosed a large customer filing Chapter 7 bankruptcy, owing the company $11.4 million. SEDG fell to a low of $23.51 and formed a rounding bottom as it staged a steady rally back to retest the cup lip line at $31.65. The daily relative strength index (RSI) finally bounced back up through the oversold 30-band on its way 50 the 45-band. Pullback support levels are at $28.72, $25.81, $23.51, and $20.48.

SolarEdge's Q1 2024 Earnings Were Disappointing

SolarEdge reported Q1 2024 EPS losses of $1.90, missing consensus estimates by $1.90. Revenues collapsed 78.3% YoY to $204.4 million versus $195.43 million.

SolarEdge issued downside guidance for Q2 2024 revenues of $250 million to $280 million versus $306.88 million consensus estimates. The company has been in the process of inventory clearing during typical seasonality. The spring season historically accelerates installations, and the company expects channel inventory to continue to decline as revenues improve. SolarEdge is focused on its suite of new products, which will be released in Q2 2024 and will position it for the next industry growth cycle.

SolarEdge CEO Zvi Lando commented, “Also on the operational side in the North American market, we plan to consolidate our product portfolio around an 11.4kW made in the U.S. inverter and 650-watt optimizer platform. The initiative will reduce the number of hardware platforms and the number of SKUs across our North American portfolio. This will result in a more streamlined manufacturing process and improve efficiencies across supply chain logistics, inventory management, and services.”

The bar has been set very low ahead of its Q2 2024 earnings release, due at the end of July 2024.

SolarEdge Technologies analyst ratings and price targets are at MarketBeat. The consensus analyst price target of $73.19 implies a 154.14% upside. There are 31 analyst ratings comprised of 25 Hold, 4 Buy, and 2 Sell recommendations.