The FQ4/CQ1 earnings reporting season is all but finished, leaving investors and analysts to look ahead at what will come with the next reporting cycle. While risks are present, the outlook for most stocks, including Netflix (NASDAQ: NFLX), Meta Platforms (NASDAQ: META), and Snowflake (NYSE: SNOW), is bullish. They are among the Most Upgraded Stocks listed on MarketBeat and well-positioned for stock price advances before and after their upcoming earnings reports.

Netflix Takes Top Billing in Q4 Cycle

[content-module:CompanyOverview|NASDAQ: NFLX]No stranger to the Most Upgraded Stock list, Netflix rose several positions in Q1 to take the top spot. This stock’s analysts issued 33 reports, including positive revisions, bullish initiations, and upgrades. The result is that sentiment is firming within the Moderate Buy range and nearing a solid Buy, and the price target is increasing. The consensus reported by MarketBeat is just over $1000 in mid-March, about 7% upside from the 30-day moving average, with revisions trends leading to the high-end range.

The latest report released is from Moffett Nathanson. They upgraded the stock to Buy from Neutral, citing the company’s improving ad capability and engagement trends as central to the outlook. In their view, the company is on track to improve monetization and accelerate profitability, which has not yet been priced into the market. They set a target of $1,100, a 15% upside from mid-March trading levels, while the high-end targets are near $1,400. This is a critical development for the company and investors, setting the stock up for a split.

Netflix will report its fiscal Q1 results in early April, and the bar is being set low. Nearly 100% of analysts tracked by MarketBeat are lowering their targets, expecting revenue growth to slow to under 13% and for the margin to come under pressure. The likely scenario is that this company will outperform on the top and bottom lines and improve the outlook with guidance.

Meta Platforms a Top Pick by Analysts: AI and Cash Flow Are Why

[content-module:CompanyOverview|NASDAQ: META]Meta Platforms is another regular member of MarketBeat’s Most Upgraded Stock list, featured in the second position at the end of the Q1 reporting season. This stock also received 33 positive mentions, including numerous upgrades and price target revisions.

The takeaway is that AI technology has bolstered the existing business and opened new avenues for revenue, and the company is taking advantage of them. A lean into AI assistants is aiding the outlook, which includes an expectation for significantly higher share prices and fresh all-time highs.

The analysts’ consensus $720 price target is sufficient for a new all-time high when reached. However, the market for this stock could move significantly higher due to the revision trends. The positive revision trend points to an above-consensus price point ranging from $775 to $940, another 7% to 30% upside. Meta reports at the end of April and has a low bar to beat, with analysts lowering their forecast estimates since the last report. That report, like Netflix’s, includes substantial top and bottom-line outperformance and indications of sustainable strength.

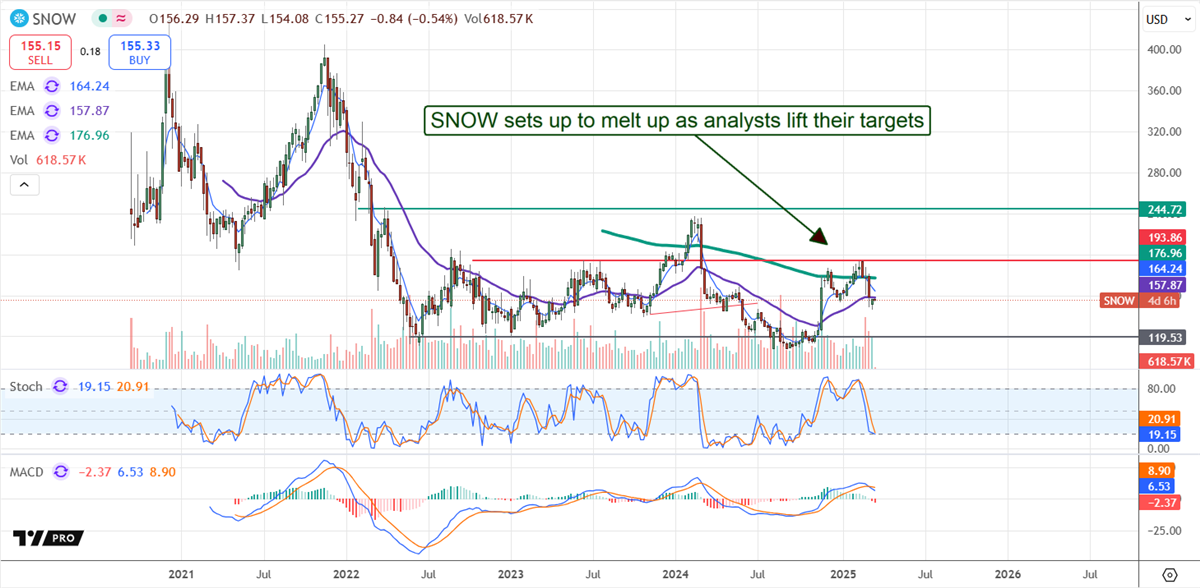

Snowflake Analysts’ Sentiment Melts Up After Q4 Results

[content-module:CompanyOverview|NYSE: SNOW]Snowflake’s Q4 results were what the market wanted, better than expected on the top and bottom lines and compounded by strong guidance. The result is 30 analyst updates, upgrades, and price target revisions since the report was released, sufficient to land the stock in the 3rd position on the Most Upgraded Stock list.

Analysts view a new deal with Microsoft to use OpenAI models, providing generative AI solutions directly on its platform, and cautious guidance as positives for the business that will help sustain the growth outlook.

Takeaways from the analysts' data include an increasing number covering the stock, firming sentiment verging on Strong Buy, and a rising price target. The price target forecasts a 30% upside for this market by year’s end, with most leading to the high-end range.

Where Should You Invest $1,000 Right Now?

Before you make your next trade, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis.

Our team has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and none of the big name stocks were on the list.

They believe these five stocks are the five best companies for investors to buy now...