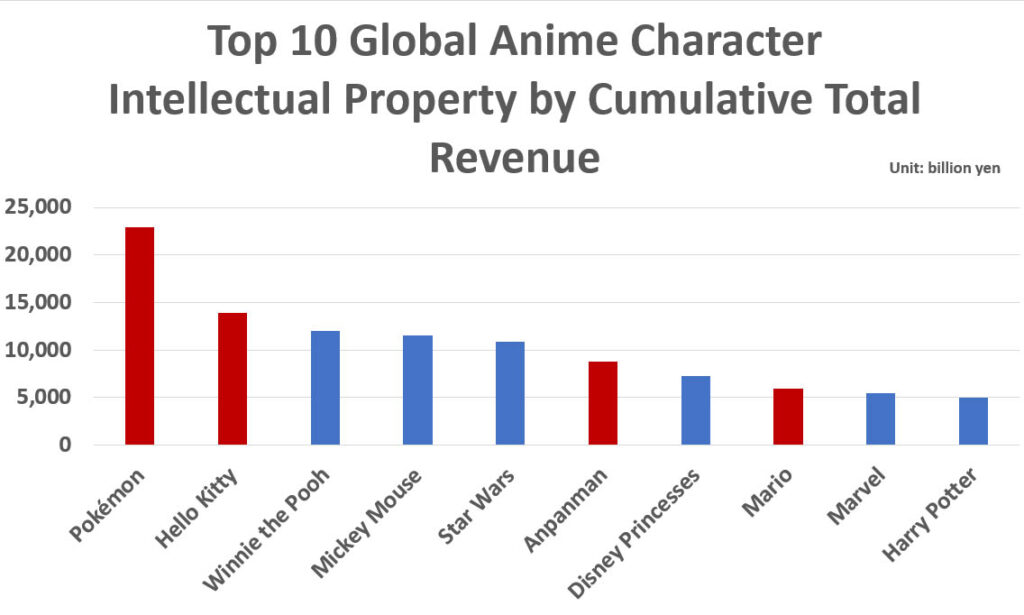

Japan holds four of the top ten anime character IPs by cumulative revenue worldwide. Their global appeal attracts large numbers of international tourists to anime-related locations, boosting local economies and promoting Japanese brands internationally.

TOKYO, JAPAN (MERXWIRE) – Japan’s anime content industry continues to expand at an astonishing rate, becoming a key driver of overseas markets and tourism. According to data released by Japan’s Ministry of Economy, Trade and Industry, Japan holds four of the top ten spots globally for cumulative anime character IP revenue, including Pokémon, which tops the list, as well as Hello Kitty, Anpanman, and Mario.

Other international IPs on this list include Winnie the Pooh, Mickey Mouse, Star Wars, Disney Princesses, Marvel, and Harry Potter. It’s worth noting that the global influence of Japanese IP is reflected not only in its name recognition but also in its actual market size. The global retail market for character licensing is approximately 23 trillion yen. In contrast, the global market for Japanese anime character IP alone is worth approximately 3.7 trillion yen, of which the domestic market accounts for approximately 2.2 trillion yen.

The international appeal of anime is also becoming a key factor in attracting foreign tourists to Japan. A survey by the Japan Tourism Agency shows that the proportion of visitors to Japan who choose “visiting movie and anime-related sites” as their next travel goal has increased from 10.9% in 2023 to 13.1% in 2024. During the same period, expected domestic consumer spending in movie and anime-related areas jumped from 527.6 billion yen to 951 billion yen.

In recent years, many regions have successfully integrated anime IP with tourism, boosting their economies. The Pokémon Center in Tokyo not only attracts fans from around the world, but also collaborates with airlines to launch Pokémon-painted aircraft, ensuring anime-inspired travel experiences from the moment they board the plane. Kumamoto Prefecture’s bronze statues of “One Piece” characters have become a popular tourist attraction, attracting numerous international tourists.

The Anpanman Children’s Museum in Yokohama and Sanrio Puroland in Tokyo have also become popular destinations, extending visitor stays and boosting the surrounding accommodation and restaurant industries. Nijigen No Mori on Awaji Island has also launched themed activities such as the “Crayon Shin-chan Adventure Park” and a “Demon Slayer” night walk experience, attracting a large number of anime fans from Southeast Asia, Europe, and the United States.

To further consolidate its overseas market, the Japanese government has launched a plan to promote the overseas expansion of the cultural industry. This plan involves selecting an IP suitable for local markets, improving licensing and brand protection, and collaborating with local businesses and cultural institutions.

Experts point out that with the continued growth of anime fans worldwide, the export of Japanese anime content will not only be limited to film, television, and publishing, but will also penetrate tourism, retail, catering, and city marketing, becoming a key driver of the globalization of Japanese anime.