Vancouver, British Columbia--(Newsfile Corp. - August 27, 2025) - Hayasa Metals Inc. (TSXV: HAY) (OTCQB: HAYAF) (FSE: FR2) ("Hayasa" or the "Company") is pleased to announce that it has entered into an amended and restated option and joint venture agreement (the "Agreement") which grants Teck Resources Limited ("Teck") the sole and exclusive option to acquire up to an 80% interest in Mendia Resources LLC ("Mendia"), the company that owns the geological exploration license relating to the Vardenis copper-gold project located in east-central Armenia (the "Vardenis Project"). The Agreement supersedes the option agreement previously entered into by the Company to acquire up to a 100% interest in Mendia.

Joel Sutherland, CEO of Hayasa, commented, "Having Teck as an investor is a positive signal for any junior exploration company. I speak for all of us at Hayasa when I say that we are exceptionally pleased Teck has elected to partner with us on advancing Vardenis. The introduction of Teck at the project level continues the momentum we are seeing in the region, and we expect that the next 12 months will be exciting times for HAY shareholders."

Dennis Moore, President and Chairman of Hayasa, added, "The partnership with Teck highlights the geological potential of Vardenis and reflects the strategic value of our work to date. We are delighted to align with a world-class operator that brings both technical expertise and financial capacity. This agreement lays a clear path forward for the project while preserving long-term upside for our shareholders."

Highlights of the Agreement

The Agreement provides for the following:

- The Company and the existing majority shareholder of Mendia (the "Existing Shareholder") will grant Teck the sole and exclusive option to acquire a 70% interest in Mendia (the "Initial Option"), which may be exercised by Teck upon (i) incurring an aggregate of US$15 million in exploration expenditures on the Vardenis Project by December 31, 2029, (ii) fulfilling its firm commitment to complete 4,300 meters of diamond drilling on the Vardenis Project by October 31, 2026, including 3,000 meters by December 31, 2025, and (iii) making any required payments to the Existing Shareholder.

- If Teck exercises the Initial Option, it will have a further sole and exclusive option to acquire an additional 10% interest in Mendia, which would bring Teck's total interest in Mendia to 80% (the "Second Option"). Teck may exercise the Second Option by delivering to Hayasa and the Existing Shareholder a National Instrument 43-101 compliant pre-feasibility study in respect of the Vardenis Project within six years of exercising the Initial Option. Teck will receive the remaining 10% interest in Mendia held by the Existing Shareholder for a US$3.5 million payment. Following Teck's exercise of the Second Option, the shareholders of Mendia are expected to be as follows: Teck (80%) and Hayasa (20%).

- During the term of the Initial Option and, if applicable, the Second Option, Teck will be solely responsible for funding all expenditures and costs relating to the Vardenis Project, including costs related to keeping the Vardenis Project in good standing.

- Hayasa will initially be the manager of the Vardenis Project during the term of the Initial Option, with Teck having the right to replace Hayasa as the manager at any time.

- If Teck incurs a minimum of US$2.5 million in the 30-month period following the date of the Agreement but chooses not to exercise the Initial Option, the Agreement will terminate and Teck will be granted a 1.0% net smelter returns royalty on the Vardenis property, payable by Mendia.

- If Teck exercises the Initial Option and elects not to pursue the Second Option, or if Teck exercises the Second Option, a corporate joint venture (the "Joint Venture") will be deemed to be formed between Teck and Hayasa (and if applicable, the Existing Shareholder) (each, a "Shareholder") in accordance with the terms of the Agreement. A Shareholder's interest in Mendia will be converted to a 1.0% net smelter return if its interest is diluted to below 10% or if it defaults on cash calls in certain circumstances.

- For a period of 18 months from the Joint Venture formation date (the "Deferral Period"), Hayasa may elect to defer the contribution of its proportionate share of the costs of approved programs, which costs will be contributed by Teck on behalf of Hayasa and will become repayable by Hayasa within 18 months from the end of the Deferral Period.

The Agreement is subject to certain conditions precedent, including the approval of the TSX Venture Exchange.

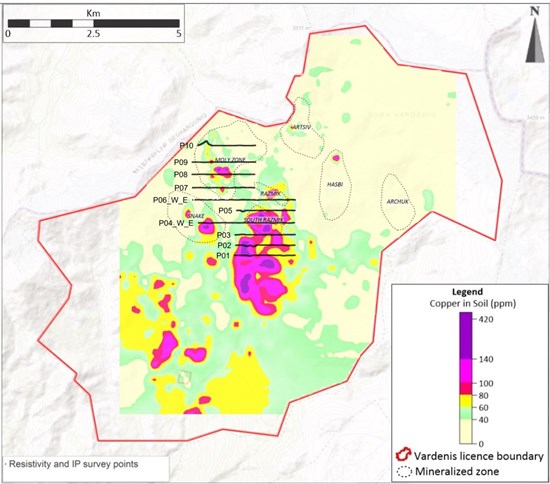

Figure 1. Vardenis license area with copper geochemistry and prospects

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/3169/264065_b5de1b1a74b2480c_002full.jpg

About the Vardenis Project

The Vardenis Project is located in the Central Tethyan Belt in east central Armenia, on a road-accessible property spanning 9,399 hectares. In 2023, the Company entered into an option agreement with Mendia and its majority shareholder, which secured the Company's option to earn a 100% interest in the Vardenis Project (see Hayasa's news release dated June 6, 2023). This option agreement has been superseded by the Agreement.

The Vardenis project lies 25 km along strike and within the same belt as the 4.8 million ounce Amulsar gold deposit, where production is planned to commence in early 2026. A former Dundee Precious Metals project, previous exploration at Vardenis defined an area of advanced argillic and QSP (quartz-sericite-pyrite) alteration, 35 km2 in size, which hosts seven mineralized zones arranged in a concentric arc. In late 2023, the Company completed 770 meters of diamond drilling in the Razmik copper-molybdenum zone which encountered long sulfide-rich intervals displaying strong alteration, brecciation and quartz veining indicative of porphyry-style mineralization.

Chief Financial Officer Paul Hansed to retire at year end

Hayasa also announces that its Chief Financial Officer, Paul Hansed, will be retiring at the end of the 2025 calendar year. Paul's career spans 17 years in the junior mining sector, following a distinguished tenure of 19 years at KPMG. He will remain actively involved in training and onboarding his successor, who the Company expects to announce prior to year-end.

Joel Sutherland, CEO, commented: "Paul is an excellent CFO, his attention to detail is unequalled and his perspective will be missed. It is our hope that 2026 brings a lower handicap Paul's way and, in all seriousness, we wish Paul peace and prosperity as he begins his retirement."

Dennis Moore, President and Chairman, added: "Paul has been a pillar of strength for this company, providing trusted financial leadership during a critical period of growth. We are grateful for his dedication and service, and we wish him every success in his well-earned retirement."

Qualified Person

The content of this news release was reviewed by Dennis Moore, Hayasa's President and Chairman, a qualified person as defined by National Instrument 43-101 – Standards of Disclosure for Mineral Projects.

About Hayasa Metals Inc.

Hayasa Metals Inc. is a Canadian-based exploration company focused on advancing its copper and gold projects in the Tethyan Mineral belt of Armenia. The Company controls both the Urasar copper-gold project and the Vardenis copper-gold project. The Company is committed to responsible exploration and sustainable development practices while creating long-term value for shareholders. Hayasa trades on the TSX Venture Exchange under the symbol HAY and on the OTCQB under HAYAF.

On behalf of the Board of Directors,

Joel Sutherland

CEO

Hayasa Metals Inc.

For further information, contact:

joel@hayasametals.com

www.hayasametals.com

https://twitter.com/Hayasametals

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Forward-looking statements

This news release contains forward-looking statements. All statements other than statements of historical fact included in this news release are forward-looking statements that involve risks and uncertainties. There can be no assurance that such statements will prove to be accurate and actual results and future events could differ materially from those anticipated in such statements. Important factors that could cause actual results to differ materially from the Company's expectations including the risks detailed from time to time in the filings made by the Company with securities regulators. The reader is cautioned not to place undue reliance on any forward-looking information. Forward-looking statements contained in this news release are expressly qualified by this cautionary statement. The forward-looking statements contained in this news release are made as of the date of this news release and the Company will update or revise publicly any of the included forward-looking statements only as expressly required by Canadian securities law.

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/264065