Digital Lending Platform Market Growth Predicted at 20% Through 2027: GMI

Major digital lending platform market players include FIS, Finanstra, Fiserv, Elli Mae.

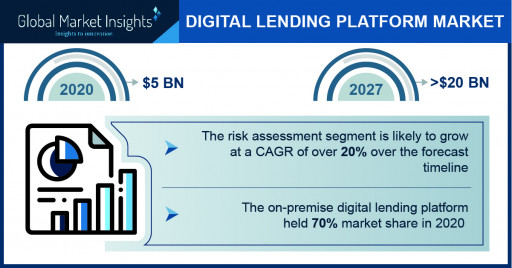

According to the latest report "Digital Lending Platform Market By Component (Solution, Service), Deployment Model (On-Premise, Cloud), Business Model (Customer Driven, Staff Driven), Product (Personal Loan, Automotive Loan, SME Finance Loan, Mortgage Loan), Application (Banks & NBFCs, Credit Unions, Fintech Companies, P2P lenders), Regional Outlook, Price Trends, Competitive Market Share & Forecast 2027", by Global Market Insights Inc., the market valuation of the digital lending platform will cross $20 billion by 2027. The growing emphasis of financial institutions on digitalization to increase business productivity for better outcomes is projected to witness a positive impact on market growth.

The growing demand for the digital lending platform is primarily driven by the emergence of advanced technologies, such as AI and blockchain, that aid market players to innovate new operating models to offer credits to several individuals and businesses. The data-driven AI digital lending platform is expected to speed up the online lending process. The rising need to generate actionable insights to reduce operational costs, identify potential defaulters, improve customer engagement, and better decision-making is driving the deployment of AI technology in the digital lending platform.

Request for a sample of this research report at https://www.gminsights.com/request-sample/detail/3019

The risk assessment segment in the digital lending platform market is poised to showcase a 20% growth rate by 2027 as it provides a basis for risk evaluation and decisions about risk control in addition to improving risk evaluation decisions of digital lenders.

The on-premise segment captured 70% of the market share in 2020 due to the growing needs among financial institutions to streamline resources, improve operational productivity & control using the intranet of the organization, and reduce the total cost of ownership attributed to the minimal or zero subscription fees.

The digital lending platform market for customer-driven business models is estimated to grow at the fastest CAGR through 2027, led by changing customer preferences, increasing need to build customer loyalty, and the growing demand for flexible loan repayments. The rise in the number of online channels and increasingly tech-savvy customers have provided opportunities for the customer-driven digital lending platform. In addition to it, changing customer preferences and the increasing number of Generation-Y customers are anticipated to drive the demand for customer-driven business models.

The automotive loan segment in the digital lending platform market accounted for a significant revenue share in 2020 owing to growing demand from automobile dealers to increase their automobile sales. The integration of advanced analytics and AI with the digital lending platform for automotive loans helps consumers in automating credit decisions, less costly underwriting, and quicker approval & disbursal of loans.

The credit union segment is set to register exponential growth during the forecast period. The growing demand for frictionless & hassle-free loan processing and a customer-centric approach from a credit union is impelling the demand for the market. The financial institutions are catering to the growing need to streamline data input, form management, customer communication, credit adjudication, and loan closure using the digital lending platform.

Europe's digital lending platform market is predicted to observe exponential growth during the forecast timeframe The penetration of the 4G LTE network across the Europe region is enabling financial institutions to shift toward the digital platforms to support the financial needs of customers. The growing smartphone penetration is also enabling the use of different lending applications to access paperless lending services. The increasing adoption of the digital lending platform across the region is insisting companies develop solutions to meet customer needs.

Request for customization of this research report at

https://www.gminsights.com/roc/3019

Major players operating in the market are FIS, Finanstra, Fiserv, Elli Mae, etc. The companies are focusing on innovative product development via collaboration or partnership to gain a competitive advantage in the market.

Table of Contents (ToC) of the report:

Chapter 3 Digital Lending Platform Market Insights

3.1 Introduction

3.2 Industry segmentation

3.3 Impact of COVID-19 outbreak

3.3.1 Global outlook

3.3.2 Impact by region

3.3.3 Impact on industry value chain

3.3.4 Impact on competitive landscape

3.4 Digital lending platform ecosystem analysis

3.4.1 Digital lending platform provider

3.4.2 Digital lending service provider

3.4.3 Cloud service providers

3.4.4 System integrators

3.4.5 Distributors

3.4.6 End users

3.5 Technological & innovation landscape

3.6 Patent analysis

3.7 Investment portfolio

3.8 Regulatory landscape

3.9 Digital lending platform Vs traditional lending

3.10 Industry impact forces

3.10.1 Growth drivers

3.10.2 Industry pitfalls & challenges

3.11 Growth potential analysis

3.12 Porter's analysis

3.13 PESTEL analysis

Browse Complete Table of Contents at

https://www.gminsights.com/toc/detail/digital-lending-platform-market

About Global Market Insights Inc.

Global Market Insights Inc., headquartered in Delaware, U.S., is a global market research and consulting service provider, offering syndicated and custom research reports along with growth consulting services. Our business intelligence and industry research reports offer clients with penetrative insights and actionable market data specially designed and presented to aid strategic decision making. These exhaustive reports are designed via a proprietary research methodology and are available for key industries such as chemicals, advanced materials, technology, renewable energy, and biotechnology.

Contact Us:

Arun Hegde

Corporate Sales, USA

Global Market Insights Inc.

Phone: 1-302-846-7766

Toll Free: 1-888-689-0688

Email: sales@gminsights.com

Press Release Service by Newswire.com

Original Source: Digital Lending Platform Market Revenue to Cross USD 20 Bn by 2027: Global Market Insights Inc.