Online freelance marketplace Fiverr (NYSE: FVRR) announced better-than-expected revenue in Q3 CY2024, with sales up 7.7% year on year to $99.63 million. The company expects next quarter’s revenue to be around $101.2 million, close to analysts’ estimates. Its non-GAAP profit of $0.64 per share was also 5.7% above analysts’ consensus estimates.

Is now the time to buy Fiverr? Find out by accessing our full research report, it’s free.

Fiverr (FVRR) Q3 CY2024 Highlights:

- Revenue: $99.63 million vs analyst estimates of $96.39 million (3.4% beat)

- Adjusted EPS: $0.64 vs analyst estimates of $0.61 (5.7% beat)

- EBITDA: $19.65 million vs analyst estimates of $18.18 million (8.1% beat)

- Revenue Guidance for Q4 CY2024 is $101.2 million at the midpoint, roughly in line with what analysts were expecting

- EBITDA guidance for the full year is $74 million at the midpoint, above analyst estimates of $71.75 million

- Gross Margin (GAAP): 81%, down from 83.7% in the same quarter last year

- Operating Margin: -3.5%, in line with the same quarter last year

- EBITDA Margin: 19.7%, up from 17.9% in the same quarter last year

- Free Cash Flow Margin: 10.6%, down from 21.8% in the previous quarter

- Active Buyers: 3.8 million, down 364,000 year on year

- Market Capitalization: $884.6 million

“Our strong Q3 results underscored the consistency of our execution and the resilience of our business. We have a clear strategy for driving growth catalysts amid the uncertain macro environment. The investments we made in strengthening our value-added product portfolio have clearly paid off, as we continue to diversify our business model and expand into a platform where businesses can lean into both technology and human experts,” said Micha Kaufman, founder and CEO of Fiverr.

Company Overview

Based in Tel Aviv, Fiverr (NYSE: FVRR) operates a fixed price global freelance marketplace for digital services.

Gig Economy

The iPhone changed the world, ushering in the era of the “always-on” internet and “on-demand” services - anything someone could want is just a few taps away. Likewise, the gig economy sprang up in a similar fashion, with a proliferation of tech-enabled freelance labor marketplaces, which work hand and hand with many on demand services. Individuals can now work on demand too. What began with tech-enabled platforms that aggregated riders and drivers has expanded over the past decade to include food delivery, groceries, and now even a plumber or graphic designer are all just a few taps away.

Sales Growth

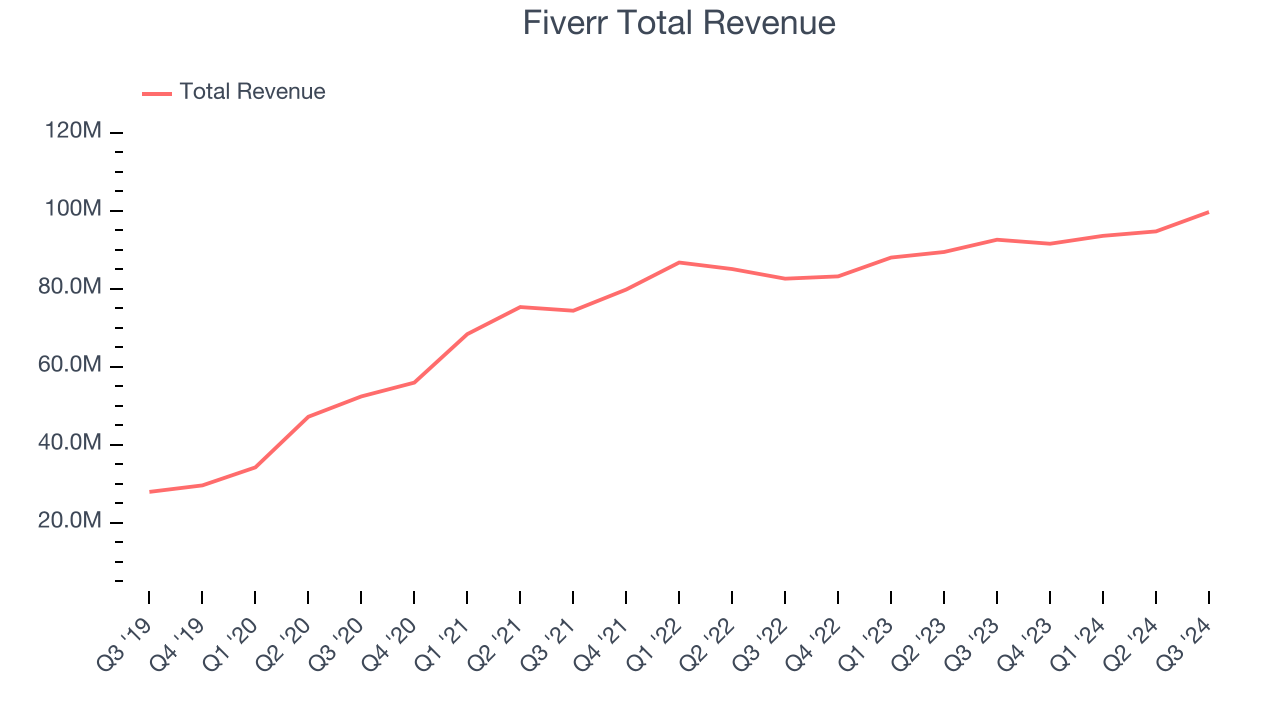

A company’s long-term performance is an indicator of its overall business quality. While any business can experience short-term success, top-performing ones enjoy sustained growth for multiple years. Thankfully, Fiverr’s 11.5% annualized revenue growth over the last three years was decent. This is a useful starting point for our analysis.

This quarter, Fiverr reported year-on-year revenue growth of 7.7%, and its $99.63 million of revenue exceeded Wall Street’s estimates by 3.4%. Management is currently guiding for a 10.6% year-on-year increase next quarter.

Looking further ahead, sell-side analysts expect revenue to grow 8.2% over the next 12 months, a deceleration versus the last three years. This projection is underwhelming and shows the market believes its products and services will see some demand headwinds. At least the company is tracking well in other measures of financial health.

Today’s young investors won’t have read the timeless lessons in Gorilla Game: Picking Winners In High Technology because it was written more than 20 years ago when Microsoft and Apple were first establishing their supremacy. But if we apply the same principles, then enterprise software stocks leveraging their own generative AI capabilities may well be the Gorillas of the future. So, in that spirit, we are excited to present our Special Free Report on a profitable, fast-growing enterprise software stock that is already riding the automation wave and looking to catch the generative AI next.

Buyers

Buyer Growth

As a gig economy marketplace, Fiverr generates revenue growth by expanding the number of services on its platform (e.g. rides, deliveries, freelance jobs) and raising the commission fee from each service provided.

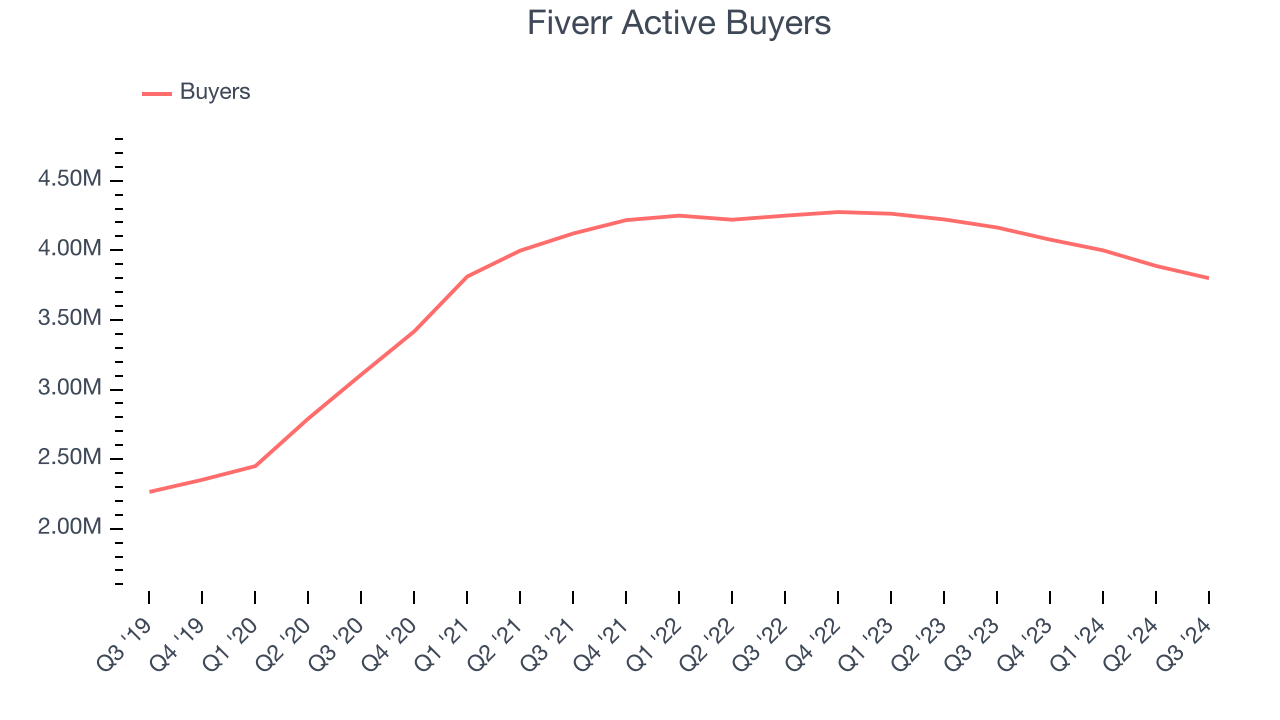

Fiverr struggled to engage its active buyers over the last two years as they have declined by 3.5% annually to 3.8 million in the latest quarter. This performance isn't ideal because internet usage is secular. If Fiverr wants to accelerate growth, it must enhance the appeal of its current offerings or innovate with new products.

In Q3, Fiverr’s active buyers once again decreased by 364,000, a 8.7% drop since last year. The quarterly print was lower than its two-year result, suggesting its new initiatives aren’t moving the needle for buyers yet.

Revenue Per Buyer

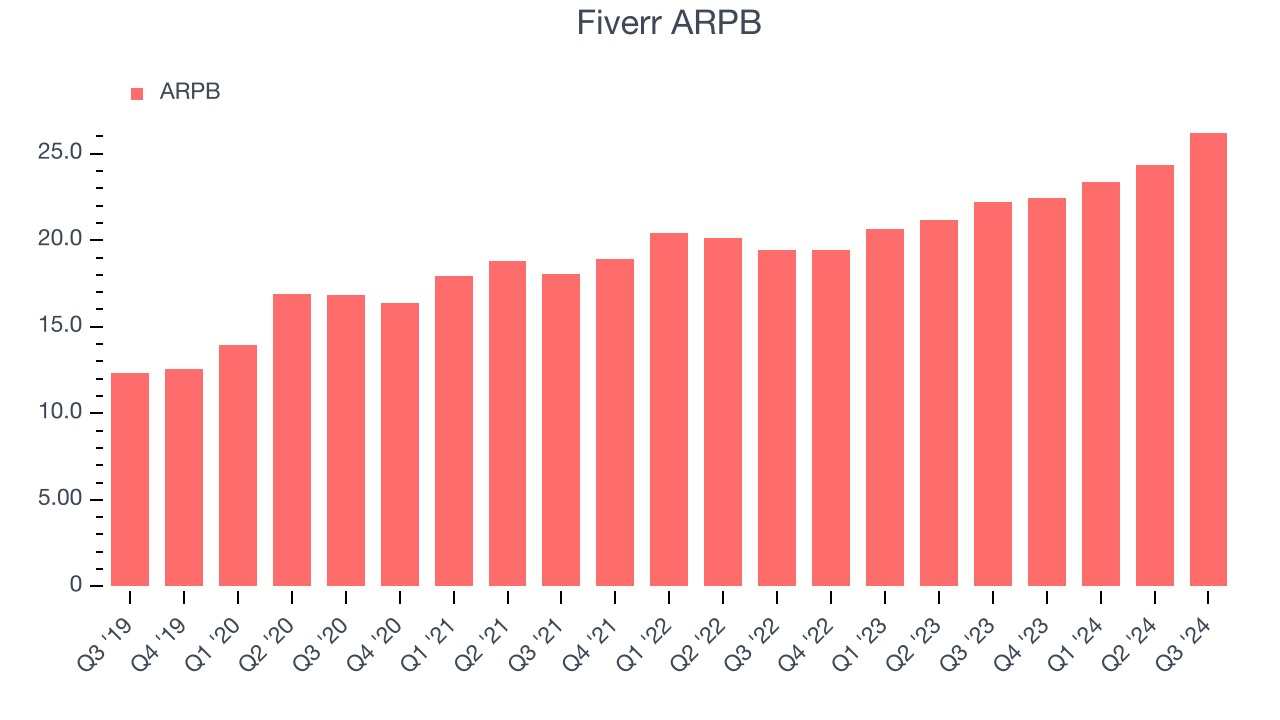

Average revenue per buyer (ARPB) is a critical metric to track for consumer internet businesses like Fiverr because it measures how much the company earns in transaction fees from each buyer. This number also informs us about Fiverr’s take rate, which represents its pricing leverage over the ecosystem, or "cut" from each transaction.

Fiverr’s ARPB growth has been exceptional over the last two years, averaging 10.6%. Although its active buyers shrank during this time, the company’s ability to successfully increase monetization demonstrates its platform’s value for existing buyers.

This quarter, Fiverr’s ARPB clocked in at $26.22. It grew 18% year on year, faster than its active buyers.

Key Takeaways from Fiverr’s Q3 Results

We like that Fiverr beat analysts’ revenue, EBITDA, and EPS expectations this quarter. We were also glad its full-year EBITDA guidance exceeded Wall Street’s estimates. Holding aside expectations, its number of buyers declined, which is a negative. Overall, though, this quarter was solid. The stock traded up 5.5% to $26.45 immediately following the results.

Fiverr may have had a good quarter, but does that mean you should invest right now?What happened in the latest quarter matters, but not as much as longer-term business quality and valuation, when deciding whether to invest in this stock. We cover that in our actionable full research report which you can read here, it’s free.