Data warehouse-as-a-service Snowflake (NYSE: SNOW) reported Q3 CY2024 results exceeding the market’s revenue expectations, with sales up 28.3% year on year to $942.1 million. Its non-GAAP profit of $0.20 per share was 31.7% above analysts’ consensus estimates.

Is now the time to buy Snowflake? Find out by accessing our full research report, it’s free.

Snowflake (SNOW) Q3 CY2024 Highlights:

- Revenue: $942.1 million vs analyst estimates of $898.5 million (28.3% year-on-year growth, 4.9% beat)

- Adjusted EPS: $0.20 vs analyst estimates of $0.15 (31.7% beat)

- Adjusted Operating Income: $58.89 million vs analyst estimates of $26.61 million (6.3% margin, significant beat)

- Product Revenue Guidance for Q4 CY2024 is $908.5 million at the midpoint (1.7% beat vs. expectations of $893.6 million)

- Operating Margin (GAAP): -38.8%, down from -35.5% in the same quarter last year

- Free Cash Flow Margin: 0%, down from 6.8% in the previous quarter

- Net Revenue Retention Rate: 127%, in line with the previous quarter

- Market Capitalization: $43.66 billion

“Snowflake delivered a strong third quarter, with product revenue of $900 million, up 29% year-over-year, and remaining performance obligations of $5.7 billion, with year-over-year growth accelerating to 55%,” said Sridhar Ramaswamy, CEO of Snowflake.

Company Overview

Founded in 2013 by three French engineers who spent decades working for Oracle, Snowflake (NYSE: SNOW) provides a data warehouse-as-a-service in the cloud that allows companies to store large amounts of data and analyze it in real time.

Data Storage

Data is the lifeblood of the internet and software in general, and the amount of data created is accelerating. As a result, the importance of storing the data in scalable and efficient formats continues to rise, especially as its diversity and associated use cases expand from analyzing simple, structured datasets to high-scale processing of unstructured data such as images, audio, and video.

Sales Growth

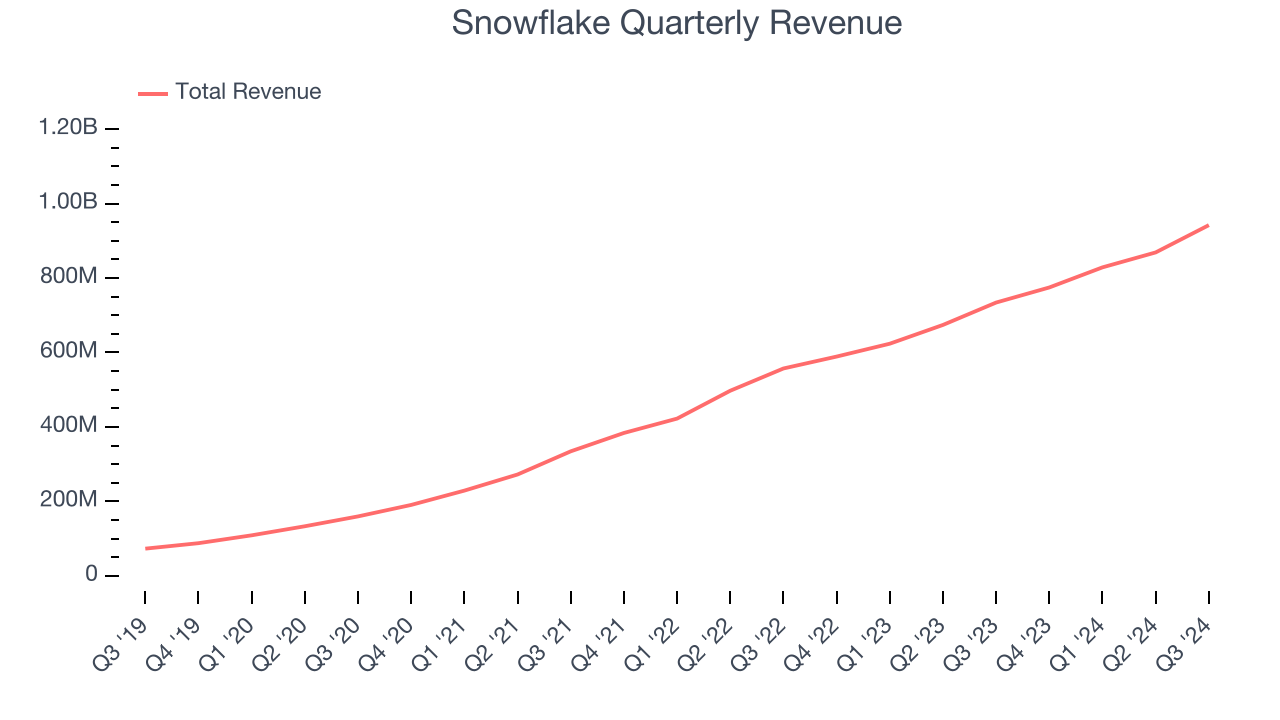

A company’s long-term performance is an indicator of its overall quality. While any business can experience short-term success, top-performing ones enjoy sustained growth for multiple years. Thankfully, Snowflake’s 49.3% annualized revenue growth over the last three years was incredible. Its growth beat the average software company and shows its offerings resonate with customers.

This quarter, Snowflake reported robust year-on-year revenue growth of 28.3%, and its $942.1 million of revenue topped Wall Street estimates by 4.9%.

Looking ahead, sell-side analysts expect revenue to grow 20.2% over the next 12 months, a deceleration versus the last three years. This projection is still commendable and suggests the market is factoring in success for its products and services.

Here at StockStory, we certainly understand the potential of thematic investing. Diverse winners from Microsoft (MSFT) to Alphabet (GOOG), Coca-Cola (KO) to Monster Beverage (MNST) could all have been identified as promising growth stories with a megatrend driving the growth. So, in that spirit, we’ve identified a relatively under-the-radar profitable growth stock benefitting from the rise of AI, available to you FREE via this link.

Customer Retention

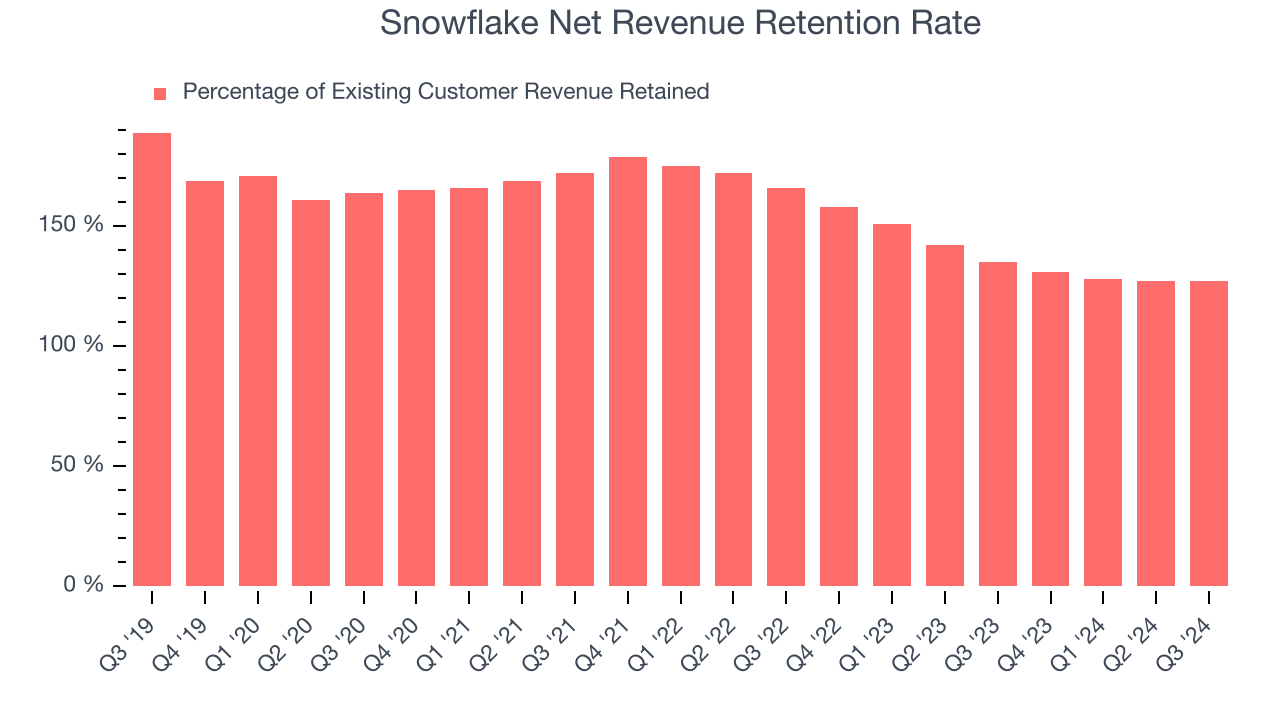

One of the best parts about the software-as-a-service business model (and a reason why they trade at high valuation multiples) is that customers typically spend more on a company’s products and services over time.

Snowflake’s net revenue retention rate, a key performance metric measuring how much money existing customers from a year ago are spending today, was 128% in Q3. This means that even if Snowflake didn’t win any new customers over the last 12 months, it would’ve grown its revenue by 28.3%.

Despite falling over the last year, Snowflake still has an excellent net retention rate. This data point proves that the company sells useful products, and we can see that its customers are satisfied and increasing usage over time.

Key Takeaways from Snowflake’s Q3 Results

It was encouraging to see Snowflake beat analysts’ revenue expectations this quarter with a net revenue retention rate (NRR) that didn't fall at all from last quarter. Operating margin in the quarter also beat, and Q4 product revenue guidance was ahead. Overall, we think this was a very good quarter with some key metrics above expectations, a relief for a company that has shown some uneven earnings performance in the last year. The stock traded up 13.2% to $146.22 immediately after reporting.

Snowflake may have had a good quarter, but does that mean you should invest right now? If you’re making that decision, you should consider the bigger picture of valuation, business qualities, as well as the latest earnings. We cover that in our actionable full research report which you can read here, it’s free.