Semiconductor company Semtech (NASDAQ: SMTC) beat Wall Street’s revenue expectations in Q3 CY2024, with sales up 17.9% year on year to $236.8 million. On top of that, next quarter’s revenue guidance ($250 million at the midpoint) was surprisingly good and 3.3% above what analysts were expecting. Its non-GAAP profit of $0.26 per share was 11.7% above analysts’ consensus estimates.

Is now the time to buy Semtech? Find out by accessing our full research report, it’s free.

Semtech (SMTC) Q3 CY2024 Highlights:

- Revenue: $236.8 million vs analyst estimates of $232.1 million (17.9% year-on-year growth, 2% beat)

- Adjusted EPS: $0.26 vs analyst estimates of $0.23 (11.7% beat)

- Adjusted EBITDA: $51.1 million vs analyst estimates of $47.8 million (21.6% margin, 6.9% beat)

- Revenue Guidance for Q4 CY2024 is $250 million at the midpoint, above analyst estimates of $242 million

- Adjusted EPS guidance for Q4 CY2024 is $0.32 at the midpoint, above analyst estimates of $0.27

- EBITDA guidance for Q4 CY2024 is $56.9 million at the midpoint, above analyst estimates of $50.1 million

- Operating Margin: 7.5%, up from -6.2% in the same quarter last year

- Free Cash Flow was $29.1 million, up from -$12.42 million in the same quarter last year

- Inventory Days Outstanding: 128, down from 132 in the previous quarter

- Market Capitalization: $3.83 billion

"We are very pleased to report broad-based growth across each of our end markets, and particularly in data center, where we project AI-driven product demand to be a long-term and transformational growth engine for Semtech. Our results validate that our customers and target markets are moving toward us and highlight the effectiveness of our initiatives to drive market share gain and SAM expansion," said Hong Hou, Semtech's President and Chief Executive Officer.

Company Overview

A public company since the late 1960s, Semtech (NASDAQ: SMTC) is a provider of analog and mixed-signal semiconductors used for Internet of Things systems and cloud connectivity.

Semiconductor Manufacturing

The semiconductor industry is driven by demand for advanced electronic products like smartphones, PCs, servers, and data storage. The need for technologies like artificial intelligence, 5G networks, and smart cars is also creating the next wave of growth for the industry. Keeping up with this dynamism requires new tools that can design, fabricate, and test chips at ever smaller sizes and more complex architectures, creating a dire need for semiconductor capital manufacturing equipment.

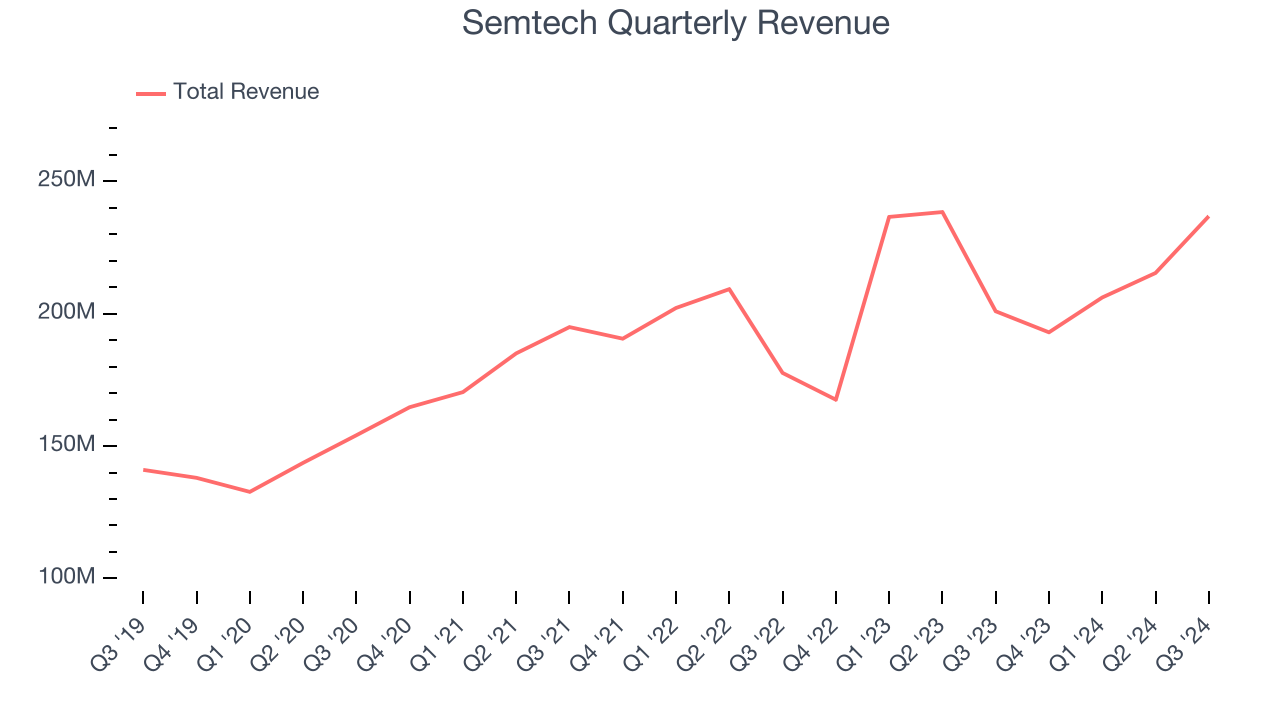

Sales Growth

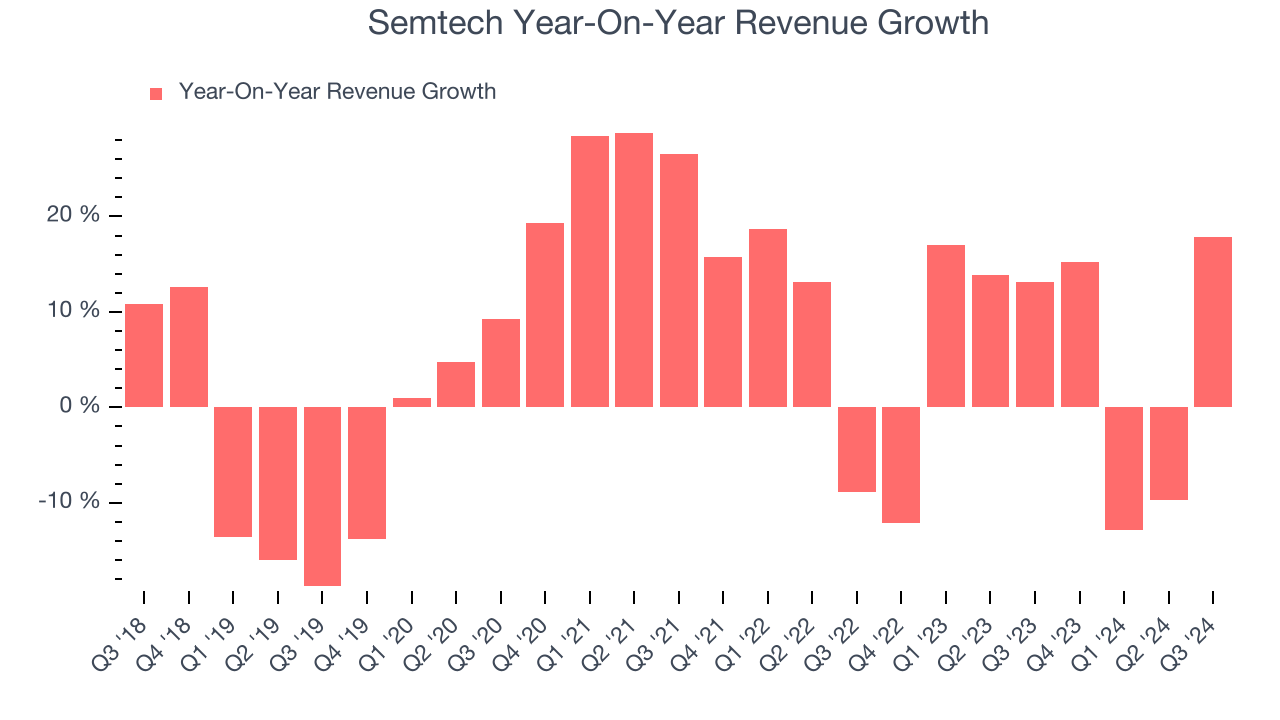

A company’s long-term sales performance signals its overall quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years. Luckily, Semtech’s sales grew at a decent 8.4% compounded annual growth rate over the last five years. Its growth was slightly above the average semiconductor company and shows its offerings resonate with customers. Semiconductors are a cyclical industry, and long-term investors should be prepared for periods of high growth followed by periods of revenue contractions.

We at StockStory place the most emphasis on long-term growth, but within semiconductors, a half-decade historical view may miss new demand cycles or industry trends like AI. Semtech’s recent history shows its demand slowed as its annualized revenue growth of 4.5% over the last two years is below its five-year trend.

This quarter, Semtech reported year-on-year revenue growth of 17.9%, and its $236.8 million of revenue exceeded Wall Street’s estimates by 2%. Company management is currently guiding for a 29.6% year-on-year increase in sales next quarter.

Looking further ahead, sell-side analysts expect revenue to grow 21.6% over the next 12 months, an improvement versus the last two years. This projection is admirable and indicates its newer products and services will fuel higher growth rates.

Here at StockStory, we certainly understand the potential of thematic investing. Diverse winners from Microsoft (MSFT) to Alphabet (GOOG), Coca-Cola (KO) to Monster Beverage (MNST) could all have been identified as promising growth stories with a megatrend driving the growth. So, in that spirit, we’ve identified a relatively under-the-radar profitable growth stock benefitting from the rise of AI, available to you FREE via this link.

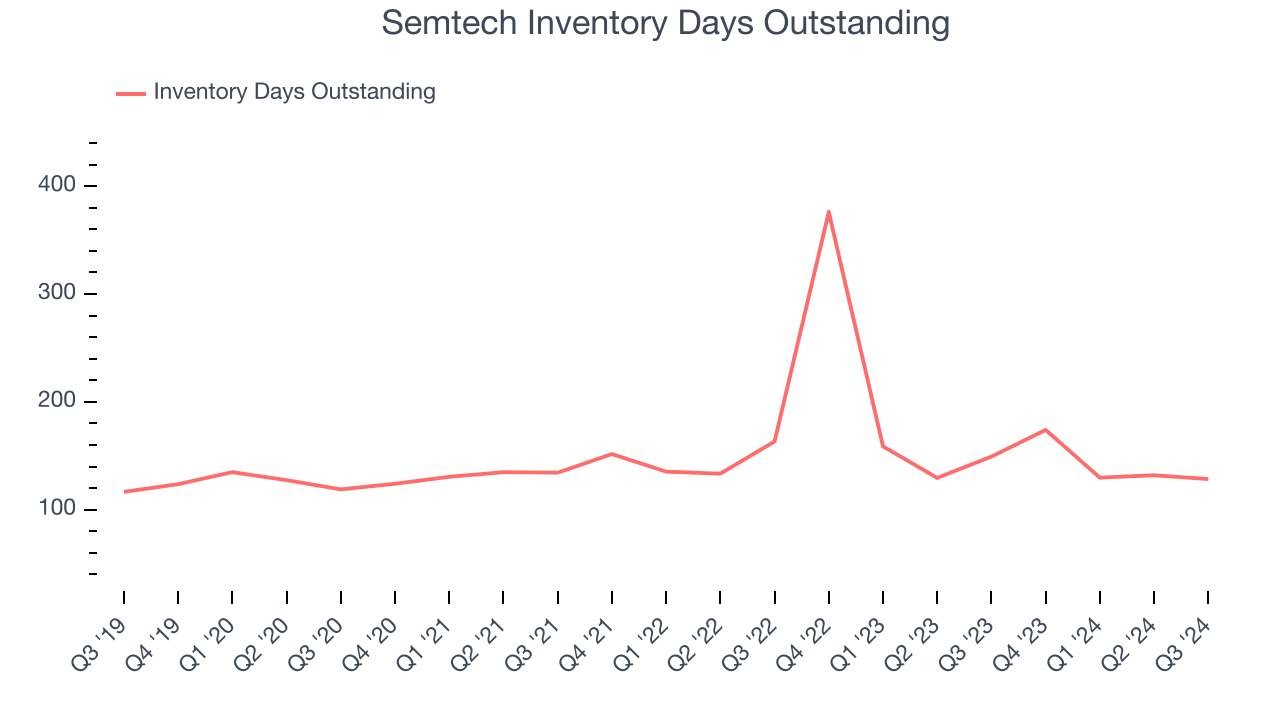

Product Demand & Outstanding Inventory

Days Inventory Outstanding (DIO) is an important metric for chipmakers, as it reflects a business’ capital intensity and the cyclical nature of semiconductor supply and demand. In a tight supply environment, inventories tend to be stable, allowing chipmakers to exert pricing power. Steadily increasing DIO can be a warning sign that demand is weak, and if inventories continue to rise, the company may have to downsize production.

This quarter, Semtech’s DIO came in at 128, which is 21 days below its five-year average. At the moment, these numbers show no indication of an excessive inventory buildup.

Key Takeaways from Semtech’s Q3 Results

We were impressed by how significantly Semtech blew past analysts’ revenue and EBITDA expectations this quarter. We were also excited its full-year guidance for the same metrics outperformed Wall Street’s estimates. Zooming out, we think this quarter featured some important positives. The stock traded up 11.7% to $60.01 immediately after reporting.

Indeed, Semtech had a rock-solid quarterly earnings result, but is this stock a good investment here? If you’re making that decision, you should consider the bigger picture of valuation, business qualities, as well as the latest earnings. We cover that in our actionable full research report which you can read here, it’s free.