Over the last six months, Western Digital’s shares have sunk to $71.51, producing a disappointing 7.6% loss - a stark contrast to the S&P 500’s 14.2% gain. This may have investors wondering how to approach the situation.

Is there a buying opportunity in Western Digital, or does it present a risk to your portfolio? Get the full breakdown from our expert analysts, it’s free.Even with the cheaper entry price, we're swiping left on Western Digital for now. Here are three reasons why we avoid WDC and a stock we'd rather own.

Why Do We Think Western Digital Will Underperform?

Founded in 1970 by a Motorola employee, Western Digital (NASDAQ: WDC) is a leading producer of hard disk drives, SSDs and flash memory.

1. Revenue Spiraling Downwards

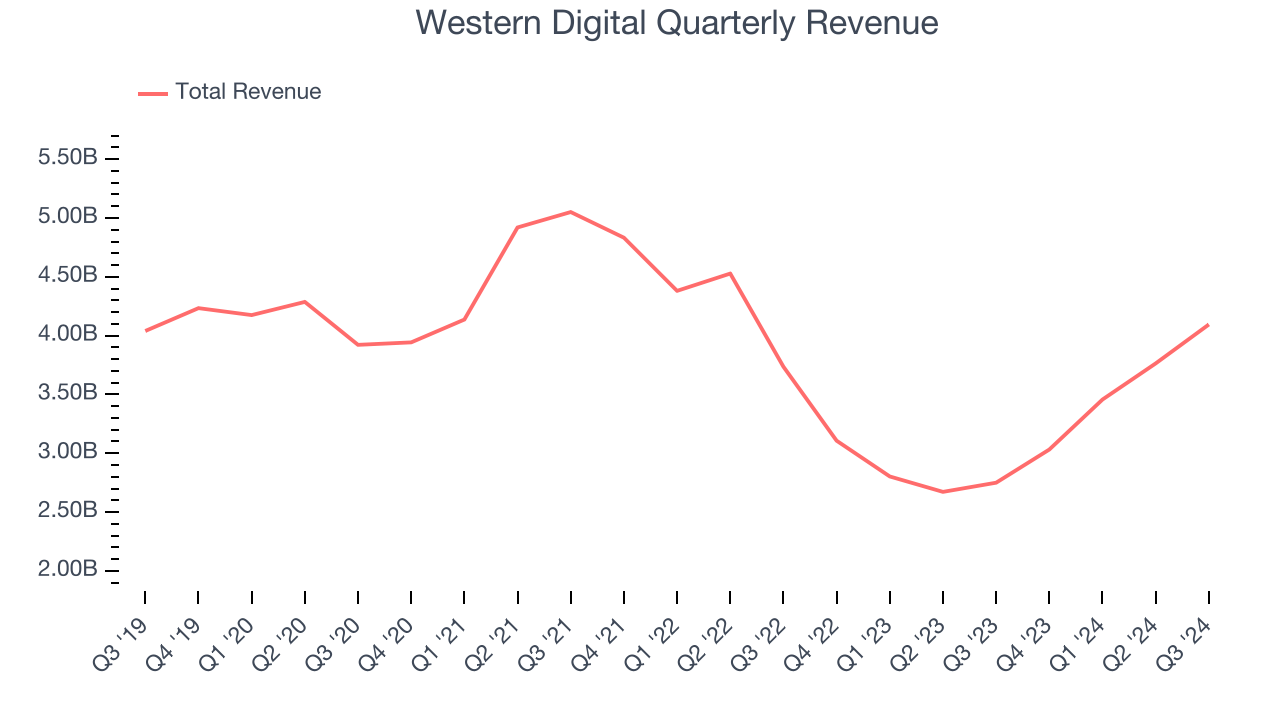

A company’s long-term performance is an indicator of its overall quality. While any business can experience short-term success, top-performing ones enjoy sustained growth for years. Western Digital struggled to consistently generate demand over the last five years as its sales dropped at a 1.6% annual rate. This fell short of our benchmarks and is a sign of poor business quality. Semiconductors are a cyclical industry, and long-term investors should be prepared for periods of high growth followed by periods of revenue contractions.

2. Low Gross Margin Reveals Weak Structural Profitability

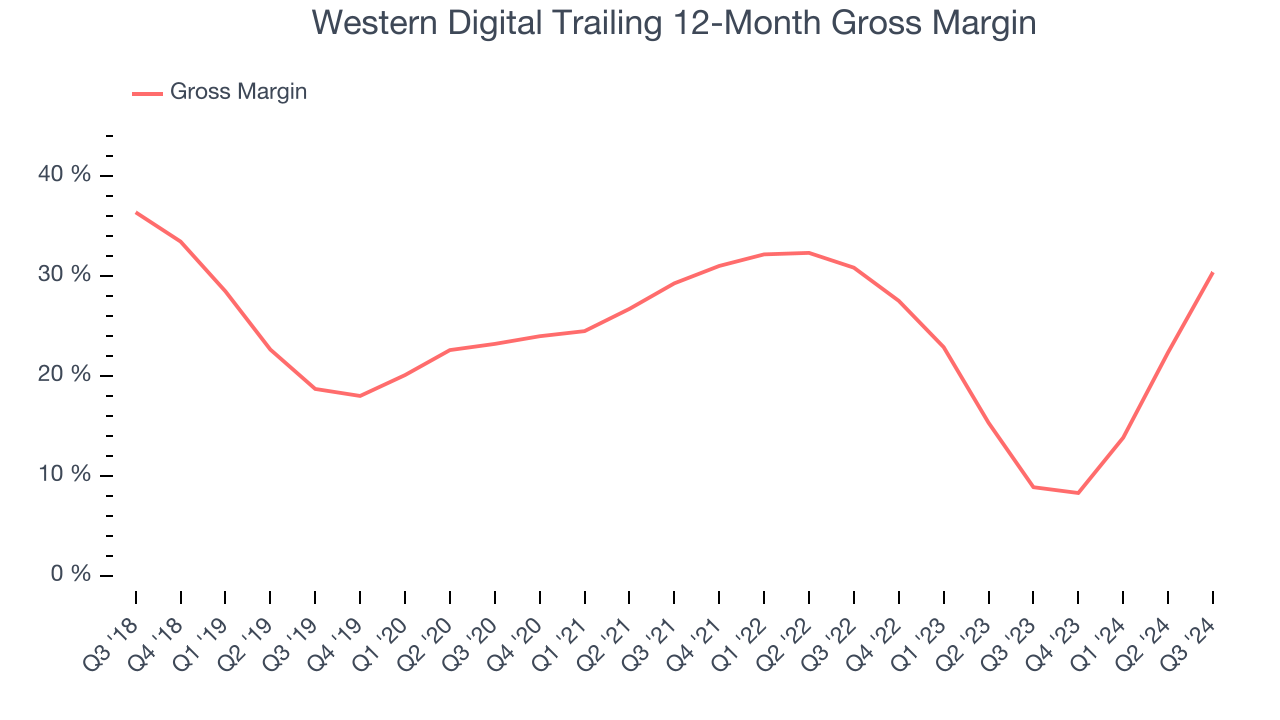

In the semiconductor industry, a company’s gross profit margin is a critical metric to track because it sheds light on its pricing power, complexity of products, and ability to procure raw materials, equipment, and labor.

Western Digital’s gross margin is one of the worst in the semiconductor industry, signaling it operates in a competitive market and lacks pricing power. As you can see below, it averaged a 20.9% gross margin over the last two years. Said differently, Western Digital had to pay a chunky $79.11 to its suppliers for every $100 in revenue.

3. Cash Burn Ignites Concerns

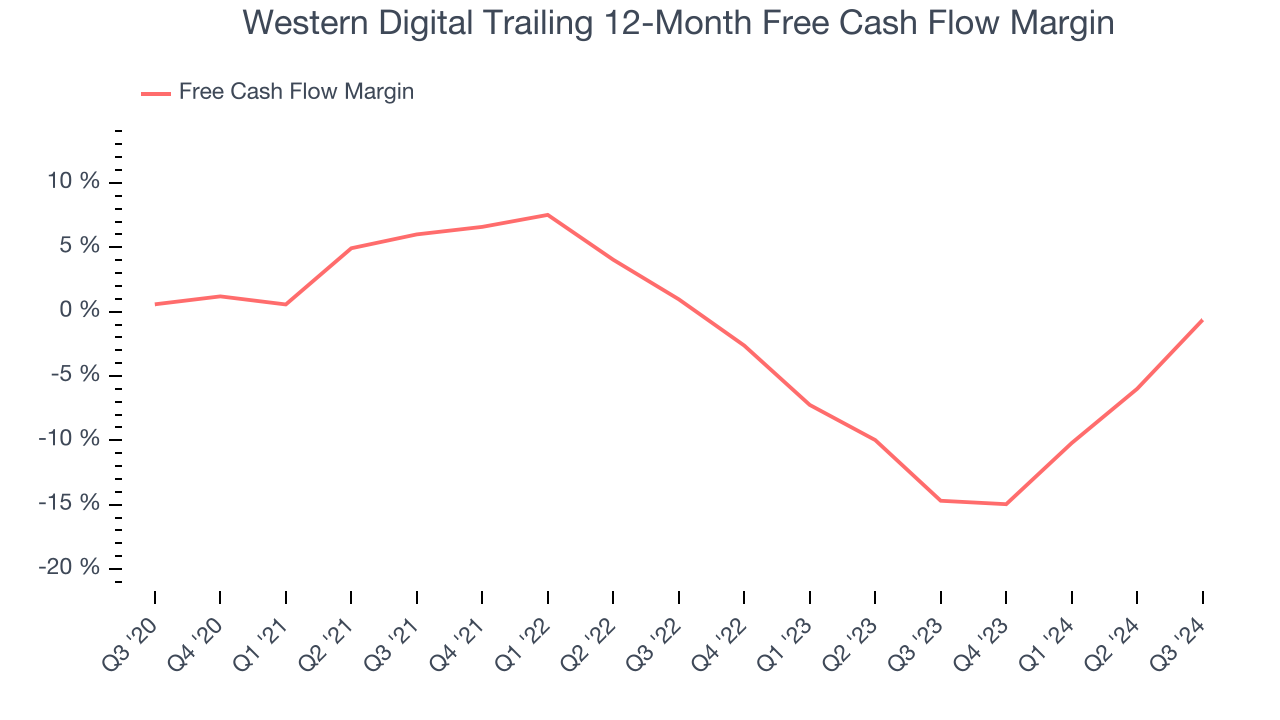

If you’ve followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills.

Western Digital’s demanding reinvestments have drained its resources over the last two years, putting it in a pinch and limiting its ability to return capital to investors. Its free cash flow margin averaged negative 6.8%, meaning it lit $6.84 of cash on fire for every $100 in revenue.

Final Judgment

Western Digital falls short of our quality standards. Following the recent decline, the stock trades at 8.7x forward price-to-earnings (or $71.51 per share). While this valuation is optically cheap, the potential downside is still huge given its shaky fundamentals. There are superior stocks to buy right now. We’d recommend looking at Wabtec, a leading provider of locomotive services benefiting from an upgrade cycle.

Stocks We Like More Than Western Digital

The elections are now behind us. With rates dropping and inflation cooling, many analysts expect a breakout market to cap off the year - and we’re zeroing in on the stocks that could benefit immensely.

Take advantage of the rebound by checking out our Top 9 Market-Beating Stocks. This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,691% between September 2019 and September 2024) as well as under-the-radar businesses like Comfort Systems (+783% five-year return). Find your next big winner with StockStory today for free.