Cloud storage and e-signature company Dropbox (Nasdaq: DBX) met Wall Street’s revenue expectations in Q3 CY2024, but sales were flat year on year at $638.8 million. Its non-GAAP profit of $0.60 per share was 12.7% above analysts’ consensus estimates.

Is now the time to buy Dropbox? Find out by accessing our full research report, it’s free.

Dropbox (DBX) Q3 CY2024 Highlights:

- Revenue: $638.8 million vs analyst estimates of $637.2 million (in line)

- Adjusted EPS: $0.60 vs analyst estimates of $0.53 (12.7% beat)

- Adjusted Operating Income: $231.5 million vs analyst estimates of $204.1 million (13.4% beat)

- Gross Margin (GAAP): 82.5%, up from 81.1% in the same quarter last year

- Operating Margin: 20%, in line with the same quarter last year

- Free Cash Flow Margin: 42.3%, up from 35.4% in the previous quarter

- Annual Recurring Revenue: $2.58 billion at quarter end, up 2.1% year on year

- Customers: 18.24 million, up from 18.22 million in the previous quarter

- Billings: $636 million at quarter end, in line with the same quarter last year

- Market Capitalization: $9.08 billion

“As we've shared over the last year, we're in a transitional period as a company and we continue to face a challenging environment in 2024. We recently announced a reduction in our workforce to both increase efficiency in and strengthen our core business, and accelerate growth in our new bets, like Dropbox Dash,” said Dropbox Co-Founder and Chief Executive Officer Drew Houston.

Company Overview

Founded by the long-serving CEO Drew Houston and Arash Ferdowsi in 2007, Dropbox (NASDAQ: DBX) provides a file hosting cloud platform that helps organizations collaborate and share documents.

Document Management

The catch phrase "digital transformation" originally referred to the digitization of documents within enterprises. The growth of digital documents has spurred an explosion of collaboration within and between businesses, which in turn is driving the demand for e-signature and content management platforms.

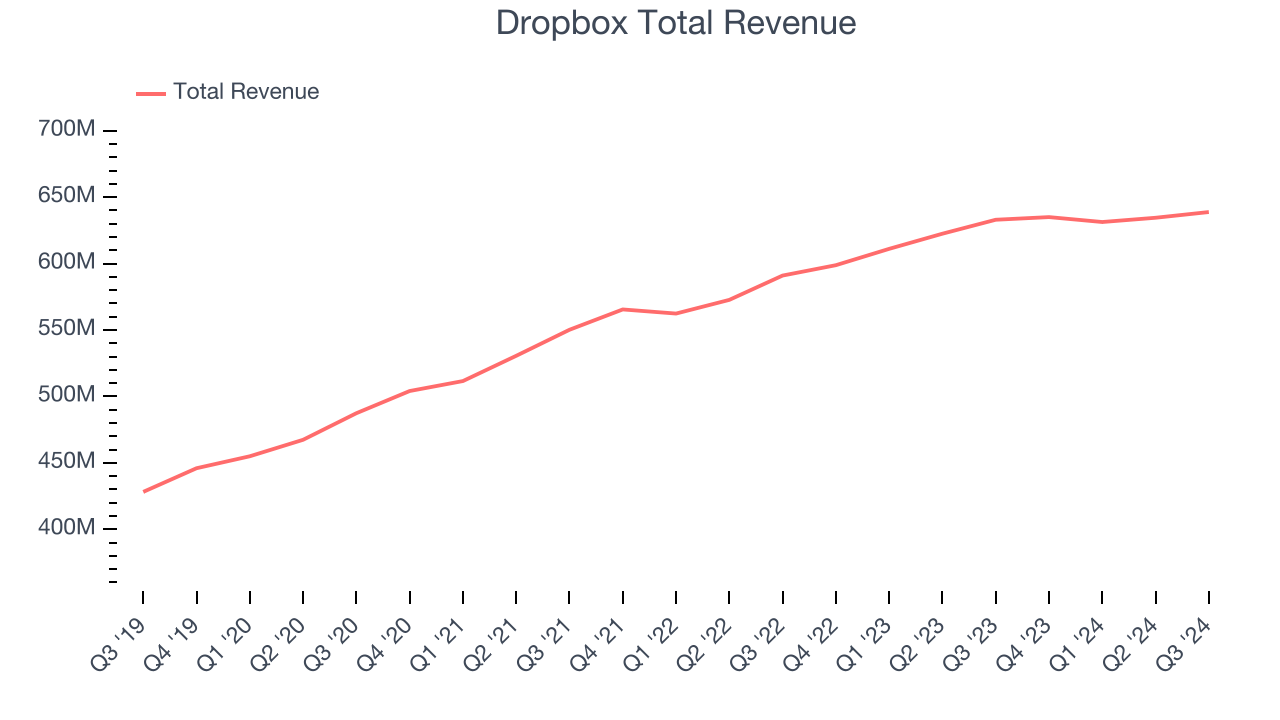

Sales Growth

Examining a company’s long-term performance can provide clues about its business quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul. Unfortunately, Dropbox’s 6.6% annualized revenue growth over the last three years was weak. This shows it failed to expand in any major way, a rough starting point for our analysis.

This quarter, Dropbox’s $638.8 million of revenue was flat year on year and in line with Wall Street’s estimates.

Looking ahead, sell-side analysts expect revenue to grow 1.2% over the next 12 months, a deceleration versus the last three years. This projection is underwhelming and illustrates the market thinks its products and services will see some demand headwinds.

Here at StockStory, we certainly understand the potential of thematic investing. Diverse winners from Microsoft (MSFT) to Alphabet (GOOG), Coca-Cola (KO) to Monster Beverage (MNST) could all have been identified as promising growth stories with a megatrend driving the growth. So, in that spirit, we’ve identified a relatively under-the-radar profitable growth stock benefitting from the rise of AI, available to you FREE via this link.

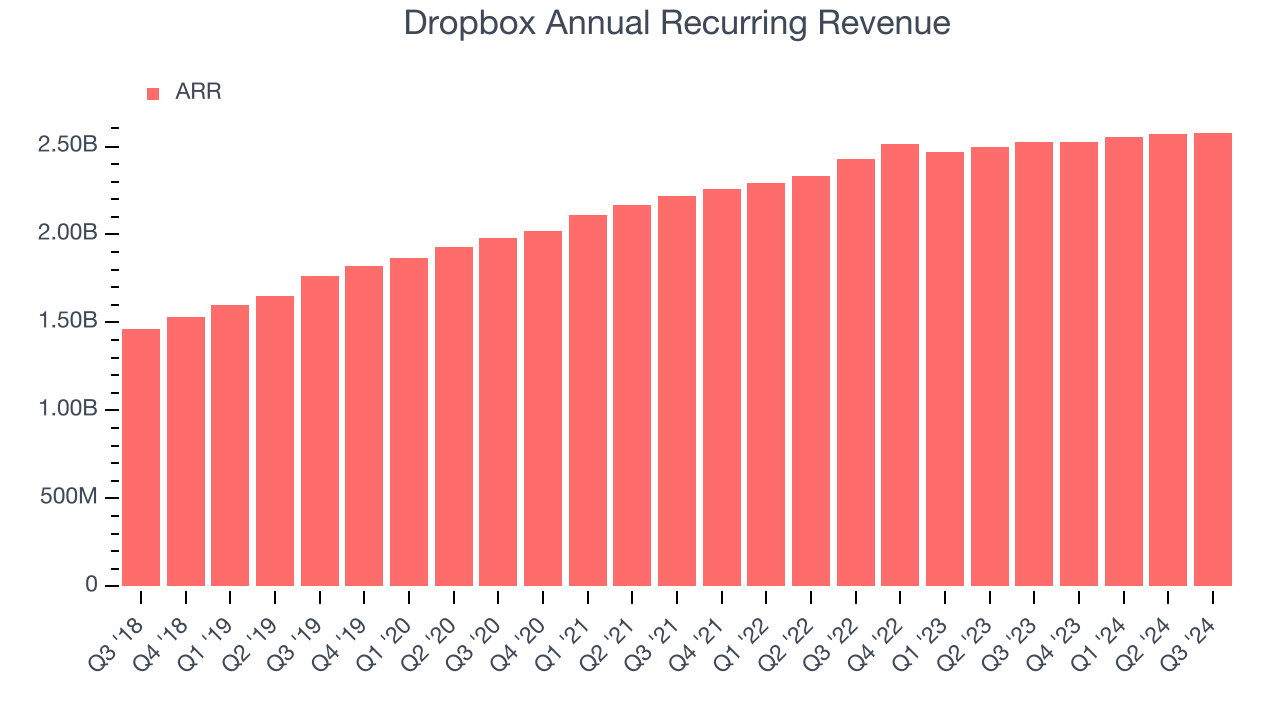

Annual Recurring Revenue

Investors interested in Dropbox should track its annual recurring revenue (ARR) in addition to reported revenue. While reported revenue for a SaaS company can include low-margin items like implementation fees, ARR is a sum of the next 12 months of contracted revenue purely from software subscriptions, or the high-margin, predictable revenue streams that make SaaS businesses so valuable.

Over the last year, Dropbox’s ARR growth has flat-out bad, averaging 2.2% year-on-year increases and coming in at $2.58 billion in the latest quarter. This performance mirrored its revenue and suggests there may be increasing competition that is causing challenges in securing longer-term commitments.

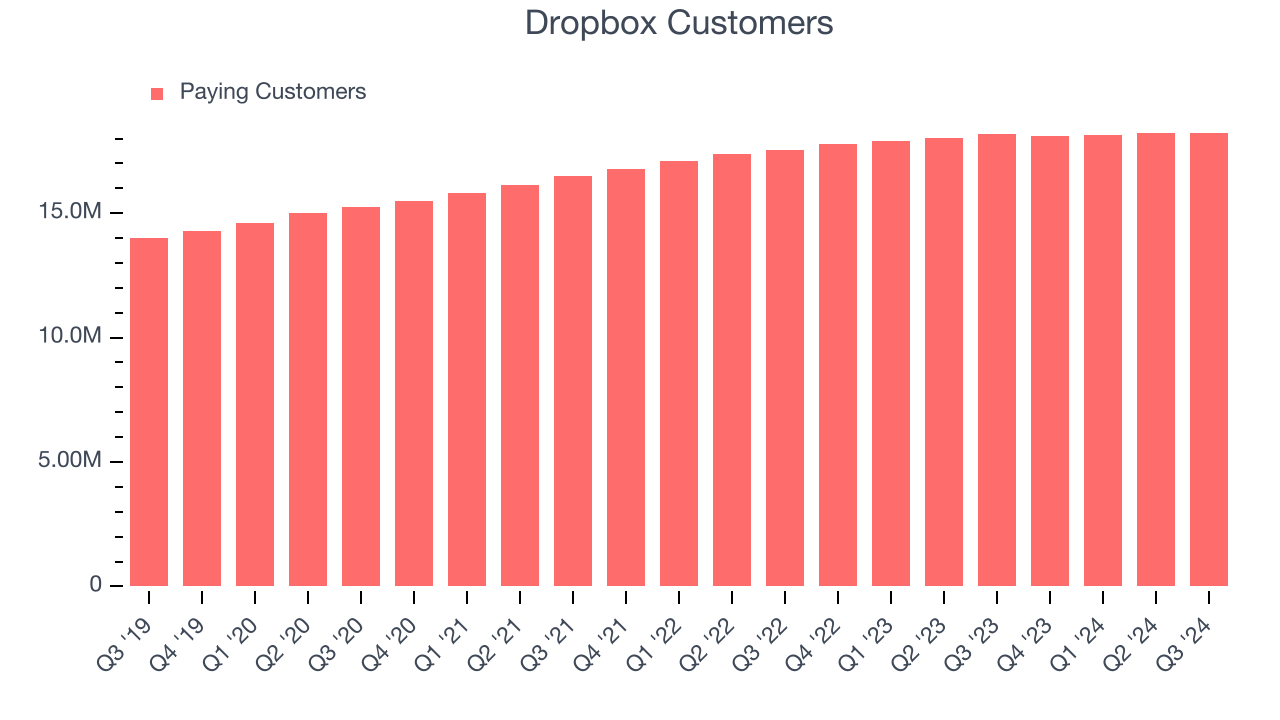

Customer Growth

Dropbox reported 18.24 million customers at the end of the quarter, an increase of 20,000 from the previous quarter. That’s slower customer growth than we have seen previously, suggesting that the company’s customer acquisition momentum is slowing.

Key Takeaways from Dropbox’s Q3 Results

It was encouraging to see Dropbox narrowly top analysts’ ARR (annual recurring revenue) expectations this quarter. On the other hand, its customer growth slowed and its billings missed Wall Street’s estimates. Overall, this quarter could have been better. The stock traded down 2.7% to $27.15 immediately following the results.

The latest quarter from Dropbox’s wasn’t that good. One earnings report doesn’t define a company’s quality, though, so let’s explore whether the stock is a buy at the current price. The latest quarter does matter, but not nearly as much as longer-term fundamentals and valuation, when deciding if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free.