Floor And Decor currently trades at $114.10 per share and has shown little upside over the past six months, posting a small loss of 1.6%. The stock also fell short of the S&P 500’s 12.9% gain during that period.

Is now the time to buy Floor And Decor, or should you be careful about including it in your portfolio? Get the full stock story straight from our expert analysts, it’s free.We're cautious about Floor And Decor. Here are three reasons why we avoid FND and a stock we'd rather own.

Why Is Floor And Decor Not Exciting?

Operating large, warehouse-style stores, Floor & Decor (NYSE: FND) is a specialty retailer that specializes in hard flooring surfaces for the home such as tiles, hardwood, stone, and laminates.

1. Shrinking Same-Store Sales Indicate Waning Demand

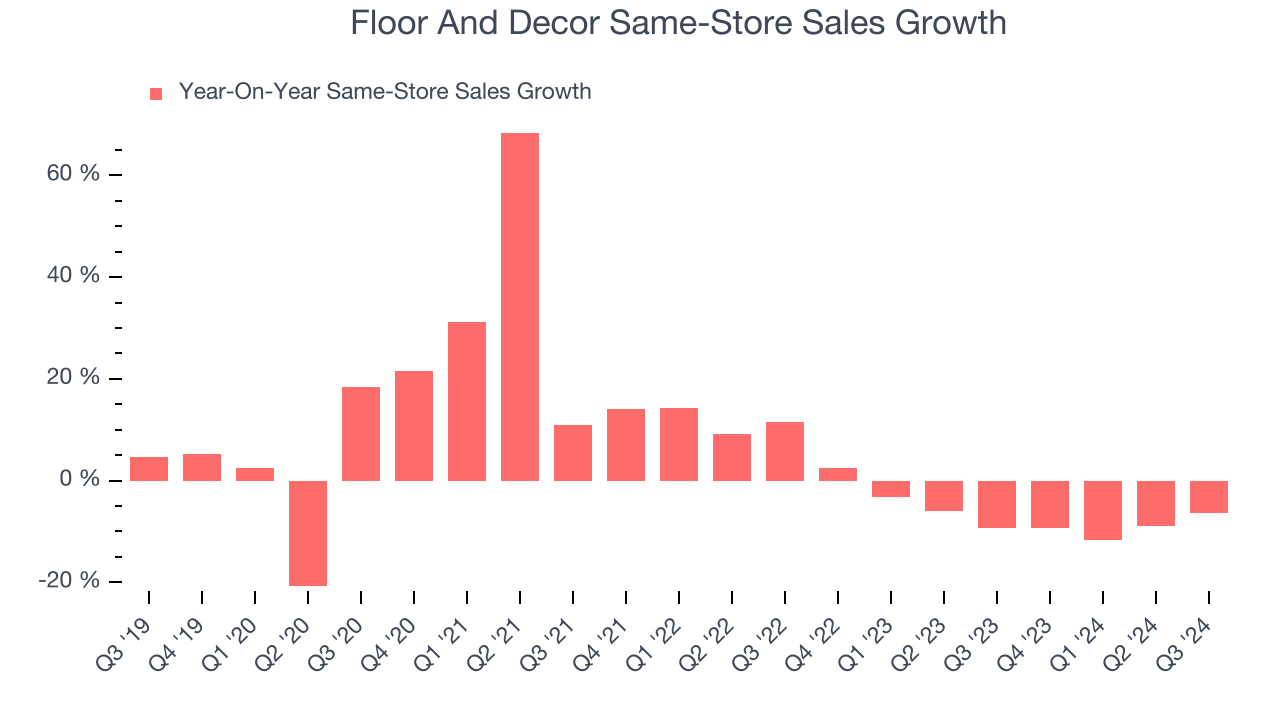

Same-store sales is an industry measure of whether revenue is growing at existing stores, and it is driven by customer visits (often called traffic) and the average spending per customer (ticket).

Floor And Decor’s demand has been shrinking over the last two years as its same-store sales have averaged 6.6% annual declines.

2. Less Negotiating Power with Suppliers

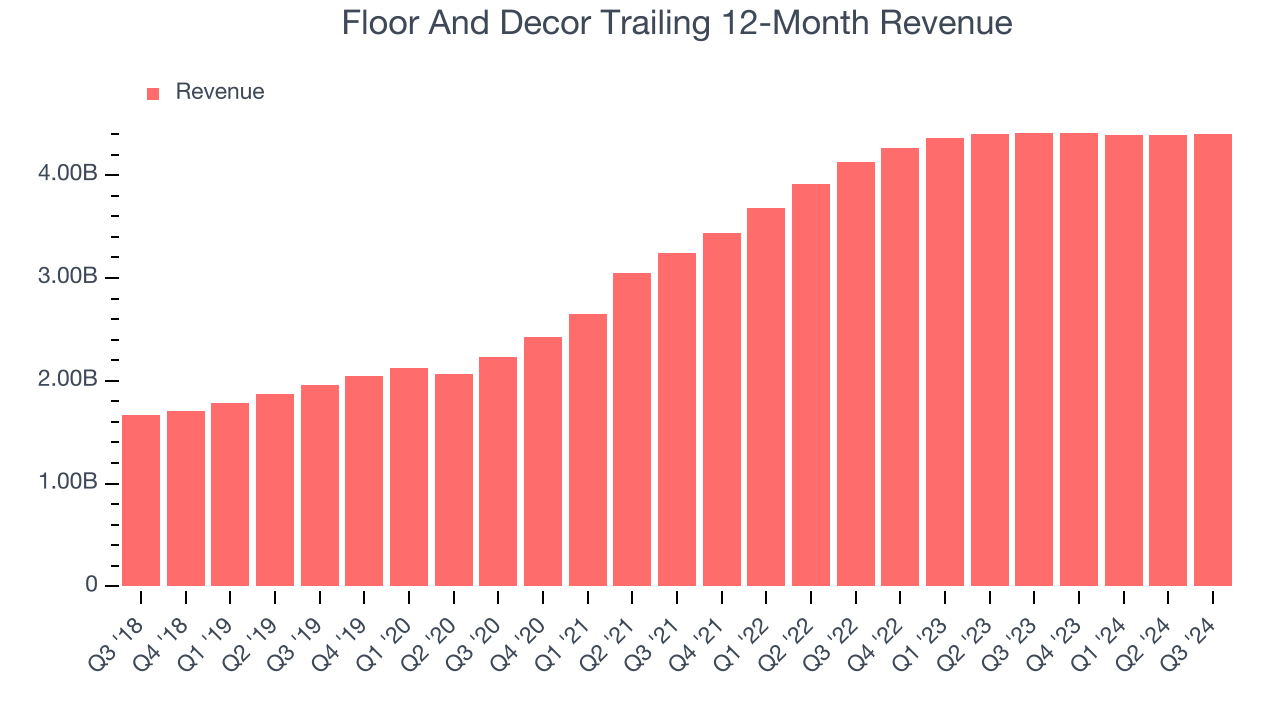

Floor And Decor is a small retailer, which sometimes brings disadvantages compared to larger competitors benefiting from economies of scale and negotiating leverage. On the other hand, it can grow faster because it’s working from a smaller revenue base and has more white space to build new stores.

3. Previous Growth Initiatives Haven’t Paid Off Yet

Growth gives us insight into a company’s long-term potential, but how capital-efficient was that growth? Enter ROIC, a metric showing how much operating profit a company generates relative to the money it has raised (debt and equity).

Floor And Decor historically did a mediocre job investing in profitable growth initiatives. Its five-year average ROIC was 9.3%, somewhat low compared to the best consumer retail companies that consistently pump out 25%+.

Final Judgment

Floor And Decor isn’t a terrible business, but it isn’t one of our picks. With its shares lagging the market recently, the stock trades at 57.3× forward price-to-earnings (or $114.10 per share). This valuation tells us it’s a bit of a market darling with a lot of good news priced in - you can find better investment opportunities elsewhere. Let us point you toward Yum! Brands, an all-weather company that owns household favorite Taco Bell.

Stocks We Like More Than Floor And Decor

With rates dropping, inflation stabilizing, and the elections in the rearview mirror, all signs point to the start of a new bull run - and we’re laser-focused on finding the best stocks for this upcoming cycle.

Put yourself in the driver’s seat by checking out our Top 9 Market-Beating Stocks. This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,691% between September 2019 and September 2024) as well as under-the-radar businesses like Comfort Systems (+783% five-year return). Find your next big winner with StockStory today for free.