APi has been treading water for the past six months, recording a small return of 3.6% while holding steady at $38.71. The stock also fell short of the S&P 500’s 12.4% gain during that period.

Is there a buying opportunity in APi, or does it present a risk to your portfolio? Dive into our full research report to see our analyst team’s opinion, it’s free.We don't have much confidence in APi. Here are three reasons why APG doesn't excite us and a stock we'd rather own.

Why Is APi Not Exciting?

Started in 1926 as an insulation contractor, APi (NYSE: APG) provides life safety solutions and specialty services for buildings and infrastructure.

1. Slow Organic Growth Suggests Waning Demand In Core Business

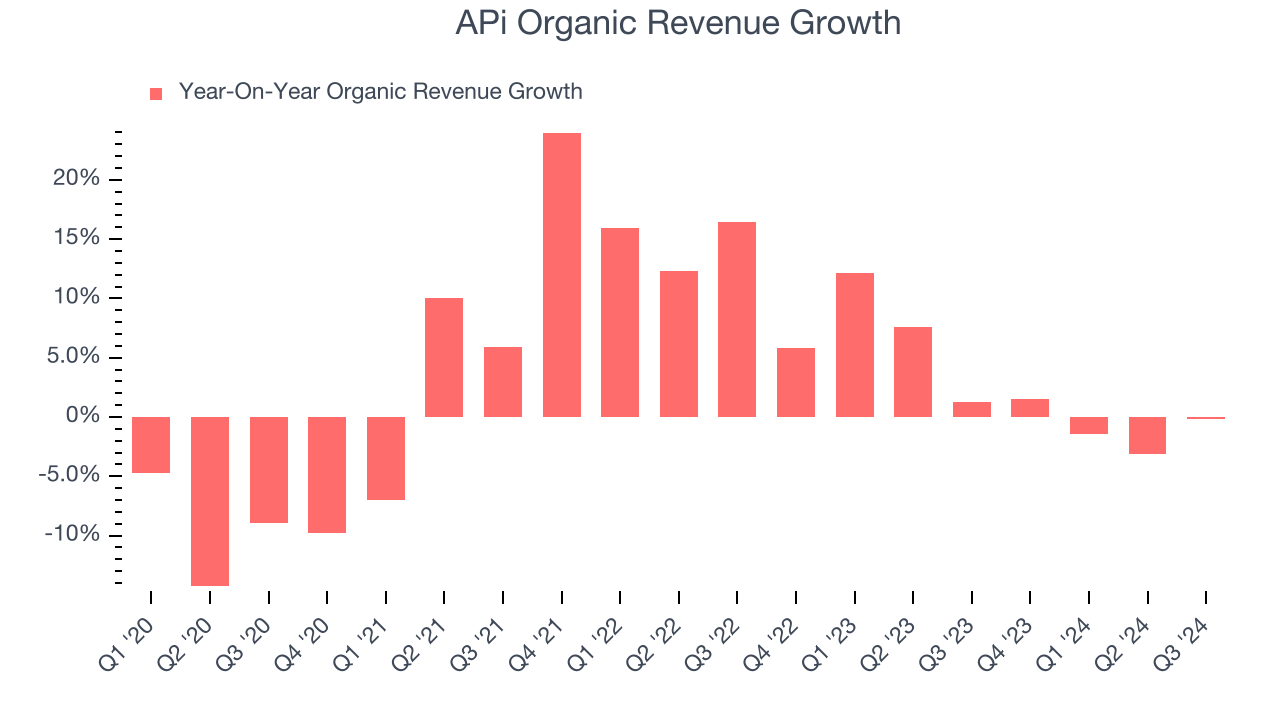

In addition to reported revenue, organic revenue is a useful data point for analyzing Construction and Maintenance Services companies. This metric gives visibility into APi’s core business because it excludes one-time events such as mergers, acquisitions, and divestitures along with foreign currency fluctuations - non-fundamental factors that can manipulate the income statement.

Over the last two years, APi’s organic revenue averaged 2.9% year-on-year growth. This performance was underwhelming and suggests it may need to improve its products, pricing, or go-to-market strategy, which can add an extra layer of complexity to its operations.

2. Weak Operating Margin Could Cause Trouble

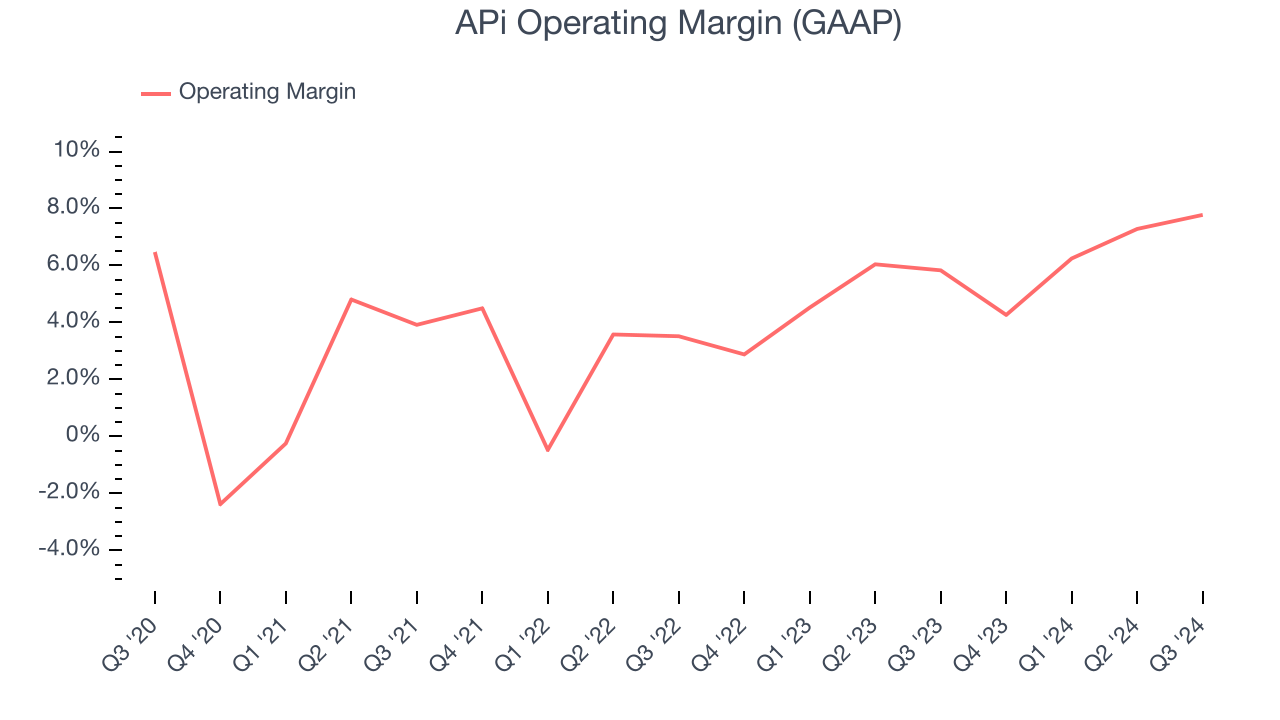

Operating margin is an important measure of profitability as it shows the portion of revenue left after accounting for all core expenses–everything from the cost of goods sold to advertising and wages. It’s also useful for comparing profitability across companies with different levels of debt and tax rates because it excludes interest and taxes.

APi was profitable over the last five years but held back by its large cost base. Its average operating margin of 2.7% was weak for an industrials business. This result isn’t too surprising given its low gross margin as a starting point.

3. Previous Growth Initiatives Haven’t Paid Off Yet

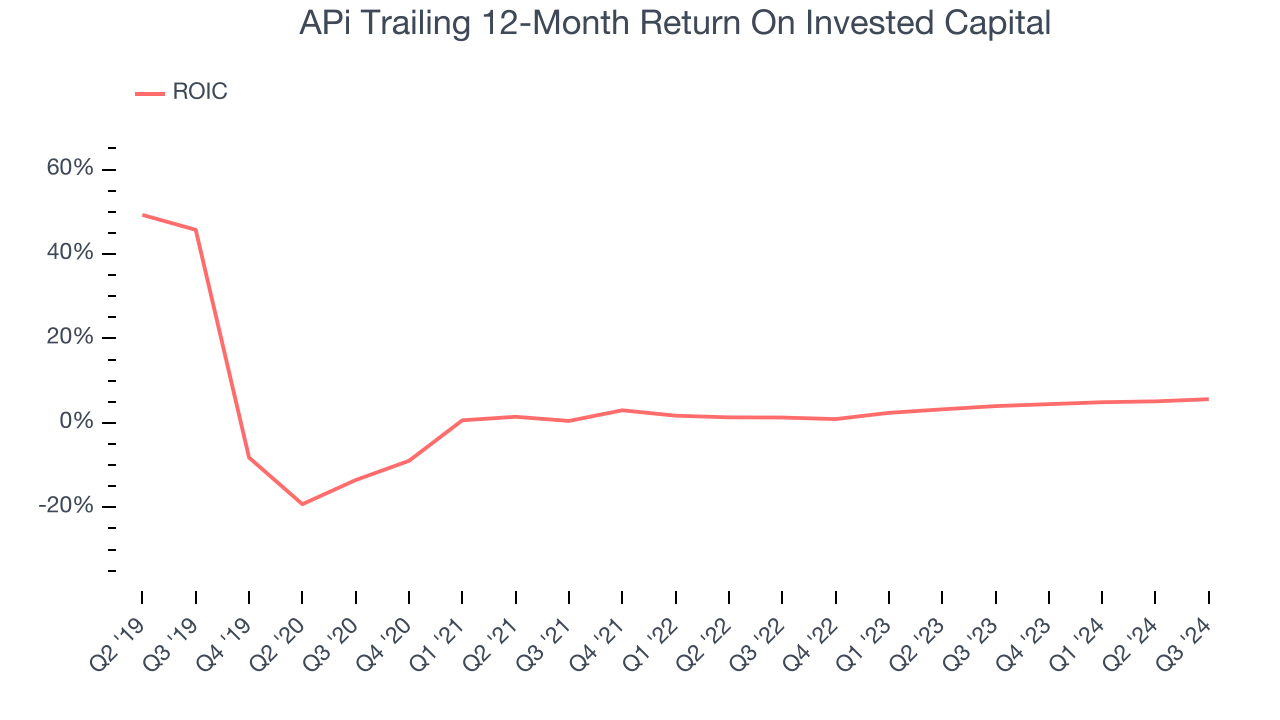

Growth gives us insight into a company’s long-term potential, but how capital-efficient was that growth? Enter ROIC, a metric showing how much operating profit a company generates relative to the money it has raised (debt and equity).

APi’s five-year average ROIC was negative 0.4%, meaning management lost money while trying to expand the business. Its returns were among the worst in the industrials sector.

Final Judgment

APi isn’t a terrible business, but it isn’t one of our picks. With its shares trailing the market in recent months, the stock trades at 18.8× forward price-to-earnings (or $38.71 per share). This valuation multiple is fair, but we don’t have much faith in the company. We're pretty confident there are more exciting stocks to buy at the moment. Let us point you toward Google, whose cloud computing and YouTube divisions are firing on all cylinders.

Stocks We Like More Than APi

With rates dropping, inflation stabilizing, and the elections in the rearview mirror, all signs point to the start of a new bull run - and we’re laser-focused on finding the best stocks for this upcoming cycle.

Put yourself in the driver’s seat by checking out our Top 6 Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,691% between September 2019 and September 2024) as well as under-the-radar businesses like Comfort Systems (+783% five-year return). Find your next big winner with StockStory today for free.