Covenant Logistics currently trades at $60.46 and has been a dream stock for shareholders. It’s returned 351% since December 2019, blowing past the S&P 500’s 91.3% gain. The company has also beaten the index over the past six months as its stock price is up 23.8%.

Is now the time to buy Covenant Logistics, or should you be careful about including it in your portfolio? Dive into our full research report to see our analyst team’s opinion, it’s free.We’re happy investors have made money, but we're swiping left on Covenant Logistics for now. Here are three reasons why you should be careful with CVLG and a stock we'd rather own.

Why Do We Think Covenant Logistics Will Underperform?

Started with 25 trucks and 50 trailers, Covenant Logistics (NASDAQ: CVLG) is a provider of expedited long haul freight services, offering a range of logistics solutions.

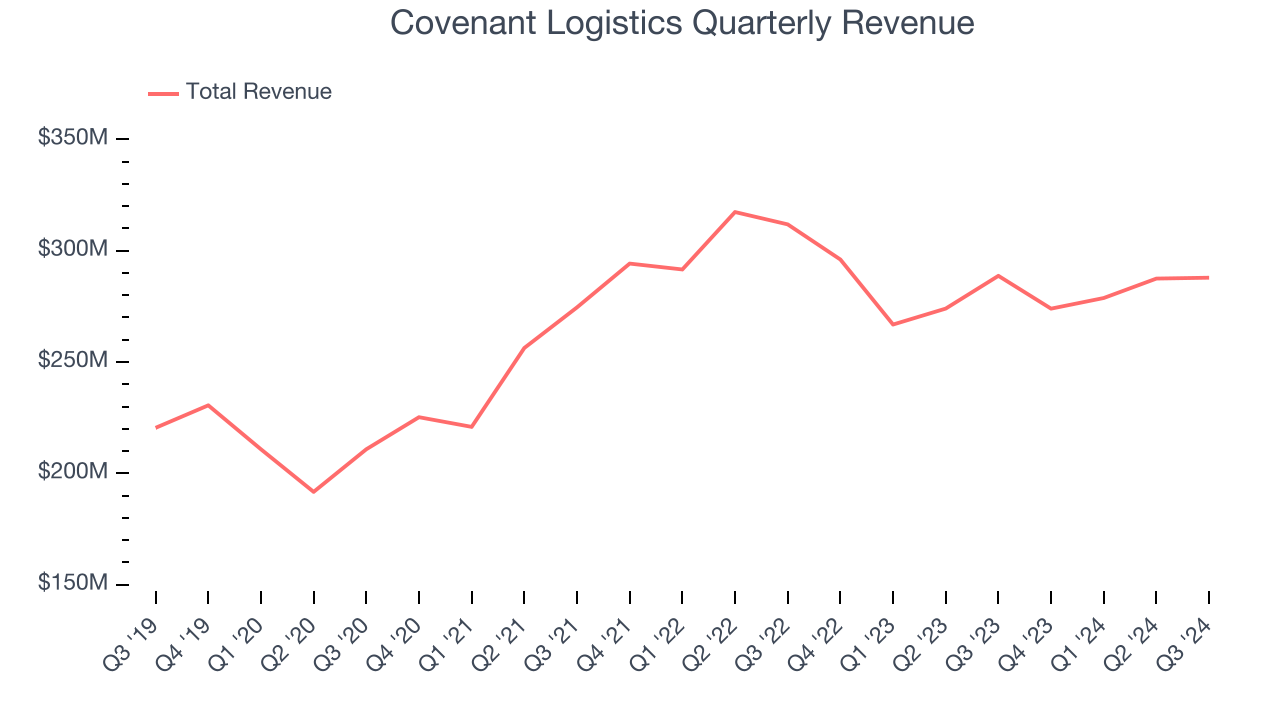

1. Long-Term Revenue Growth Disappoints

A company’s long-term sales performance signals its overall quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years. Unfortunately, Covenant Logistics’s 4% annualized revenue growth over the last five years was sluggish. This fell short of our benchmark for the industrials sector.

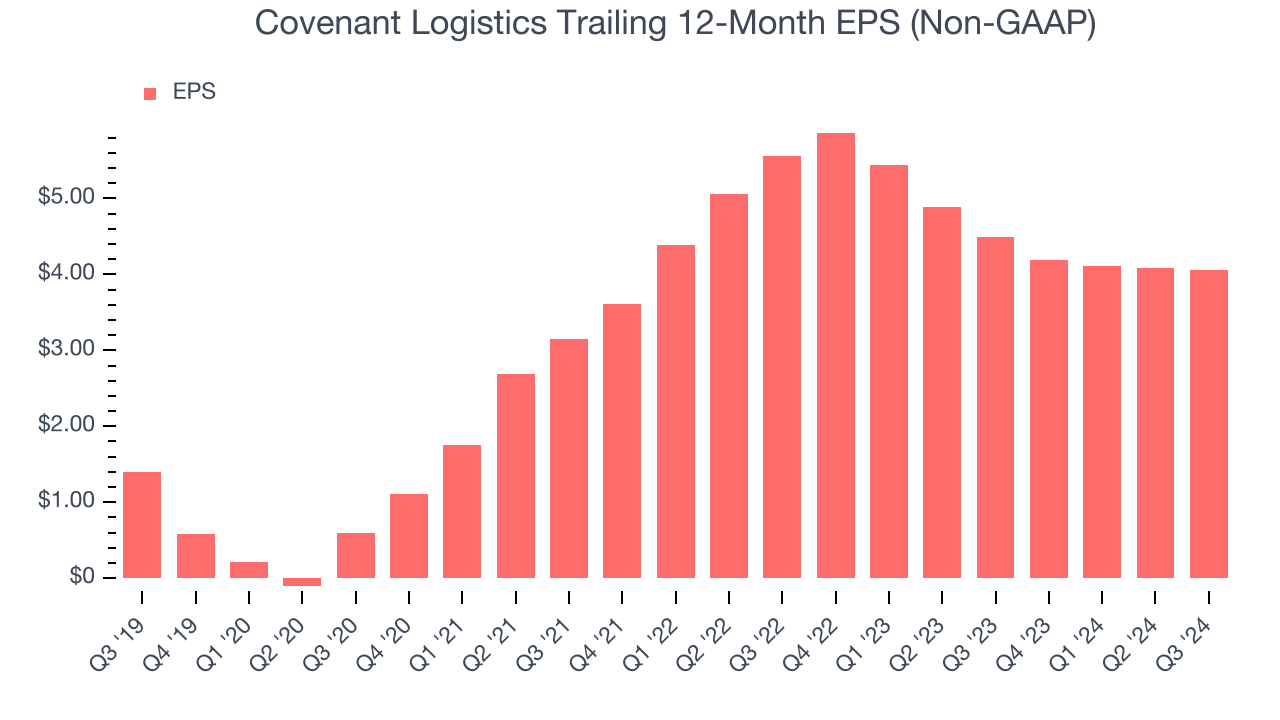

2. EPS Took a Dip Over the Last Two Years

Although long-term earnings trends give us the big picture, we like to analyze EPS over a shorter period to see if we are missing a change in the business.

Sadly for Covenant Logistics, its EPS declined by more than its revenue over the last two years, dropping 14.6%. This tells us the company struggled to adjust to shrinking demand.

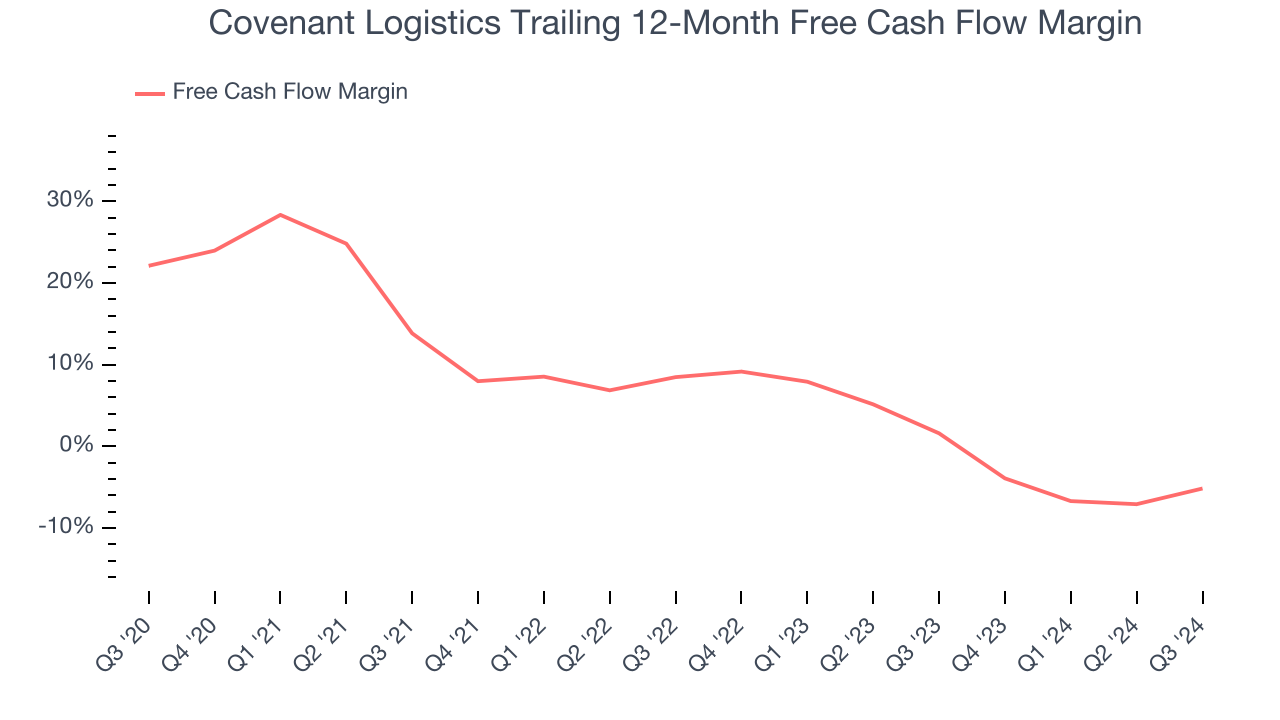

3. Free Cash Flow Margin Dropping

Free cash flow isn't a prominently featured metric in company financials and earnings releases, but we think it's telling because it accounts for all operating and capital expenses, making it tough to manipulate. Cash is king.

As you can see below, Covenant Logistics’s margin dropped by 27.3 percentage points over the last five years. If its declines continue, it could signal higher capital intensity. Covenant Logistics’s free cash flow margin for the trailing 12 months was negative 5.2%.

Final Judgment

Covenant Logistics doesn’t pass our quality test. With its shares topping the market in recent months, the stock trades at 11.9× forward price-to-earnings (or $60.46 per share). This valuation multiple is fair, but we don’t have much confidence in the company. There are more exciting stocks to buy at the moment. We’d recommend looking at Google, whose cloud computing and YouTube divisions are firing on all cylinders.

Stocks We Would Buy Instead of Covenant Logistics

With rates dropping, inflation stabilizing, and the elections in the rearview mirror, all signs point to the start of a new bull run - and we’re laser-focused on finding the best stocks for this upcoming cycle.

Put yourself in the driver’s seat by checking out our Top 9 Market-Beating Stocks. This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,691% between September 2019 and September 2024) as well as under-the-radar businesses like Comfort Systems (+783% five-year return). Find your next big winner with StockStory today for free.