What a time it’s been for Dropbox. In the past six months alone, the company’s stock price has increased by a massive 46.6%, reaching $30.44 per share. This run-up might have investors contemplating their next move.

Is there a buying opportunity in Dropbox, or does it present a risk to your portfolio? Get the full breakdown from our expert analysts, it’s free.Despite the momentum, we're sitting this one out for now. Here are two reasons why you should be careful with DBX and a stock we'd rather own.

Why Is Dropbox Not Exciting?

Founded by the long-serving CEO Drew Houston and Arash Ferdowsi in 2007, Dropbox (NASDAQ: DBX) provides a file hosting cloud platform that helps organizations collaborate and share documents.

1. Long-Term Revenue Growth Disappoints

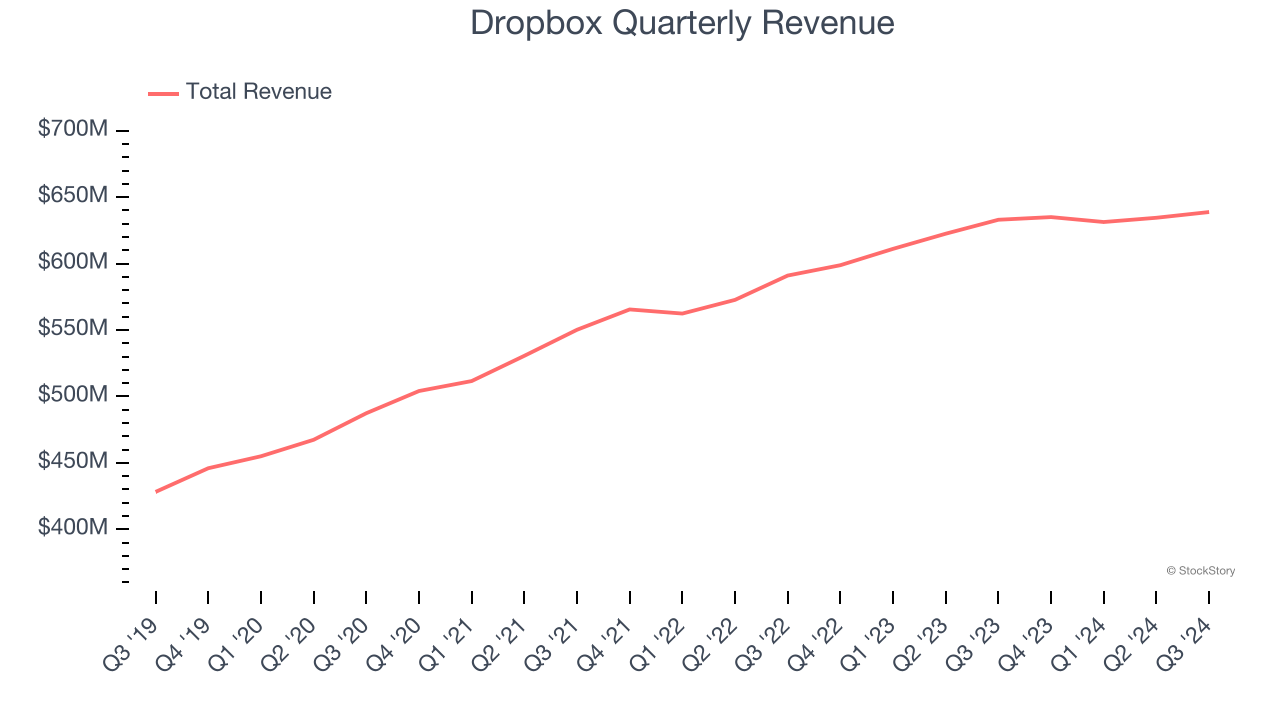

Reviewing a company’s long-term sales performance reveals insights into its quality. Any business can have short-term success, but a top-tier one grows for years. Over the last three years, Dropbox grew its sales at a weak 6.6% compounded annual growth rate. This was below our standard for the software sector.

2. Weak Billings Point to Soft Demand

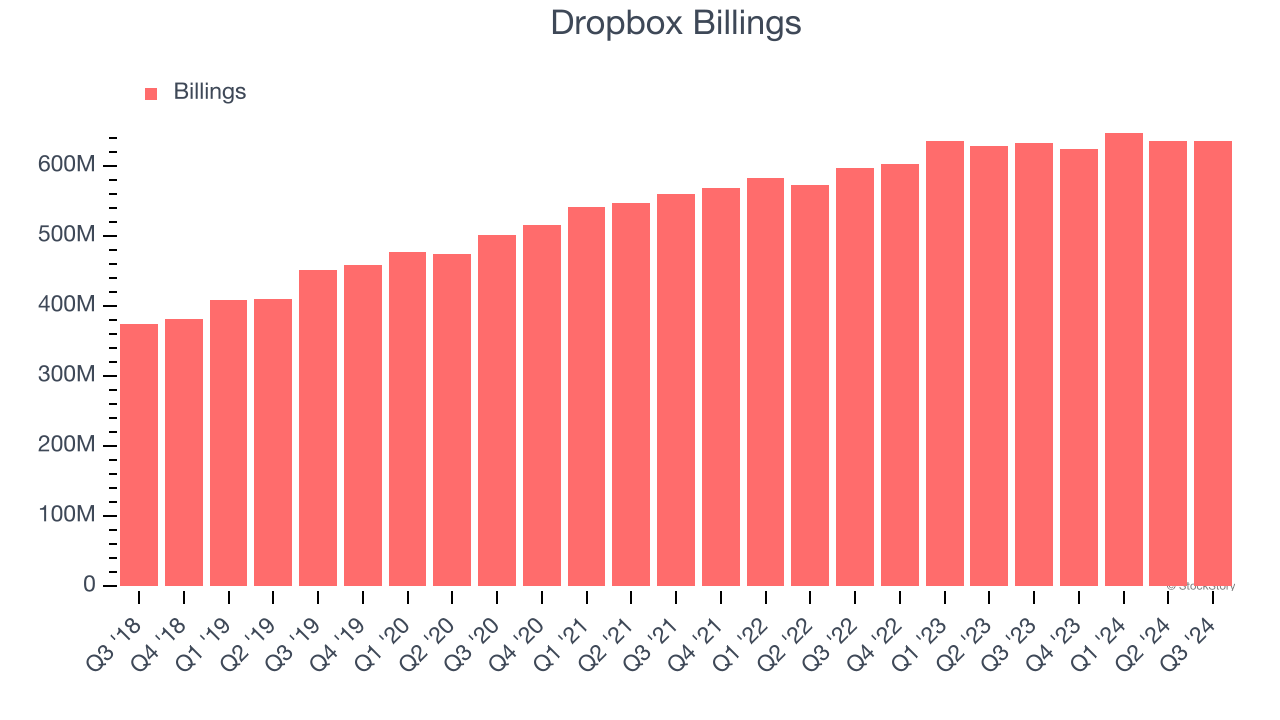

Billings is a non-GAAP metric that is often called “cash revenue” because it shows how much money the company has collected from customers in a certain period. This is different from revenue, which must be recognized in pieces over the length of a contract.

Dropbox’s billings came in at $635.6 million in Q3, and over the last four quarters, its year-on-year growth averaged 1.7%. This performance was underwhelming and suggests that increasing competition is causing challenges in acquiring/retaining customers.

Final Judgment

Dropbox’s business quality ultimately falls short of our standards. Following the recent rally, the stock trades at 3.8× forward price-to-sales (or $30.44 per share). While this valuation is reasonable, we don’t really see a big opportunity at the moment. We're fairly confident there are better stocks to buy right now. Let us point you toward Wabtec, a leading provider of locomotive services benefiting from an upgrade cycle.

Stocks We Would Buy Instead of Dropbox

The elections are now behind us. With rates dropping and inflation cooling, many analysts expect a breakout market to cap off the year - and we’re zeroing in on the stocks that could benefit immensely.

Take advantage of the rebound by checking out our Top 5 Strong Momentum Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,691% between September 2019 and September 2024) as well as under-the-radar businesses like Comfort Systems (+783% five-year return). Find your next big winner with StockStory today for free.