As the craze of earnings season draws to a close, here’s a look back at some of the most exciting (and some less so) results from Q3. Today, we are looking at analog semiconductors stocks, starting with Universal Display (NASDAQ: OLED).

Demand for analog chips is generally linked to the overall level of economic growth, as analog chips serve as the building blocks of most electronic goods and equipment. Unlike digital chip designers, analog chip makers tend to produce the majority of their own chips, as analog chip production does not require expensive leading edge nodes. Less dependent on major secular growth drivers, analog product cycles are much longer, often 5-7 years.

The 15 analog semiconductors stocks we track reported a mixed Q3. As a group, revenues beat analysts’ consensus estimates by 0.8% while next quarter’s revenue guidance was 3.2% below.

Amidst this news, share prices of the companies have had a rough stretch. On average, they are down 7% since the latest earnings results.

Universal Display (NASDAQ: OLED)

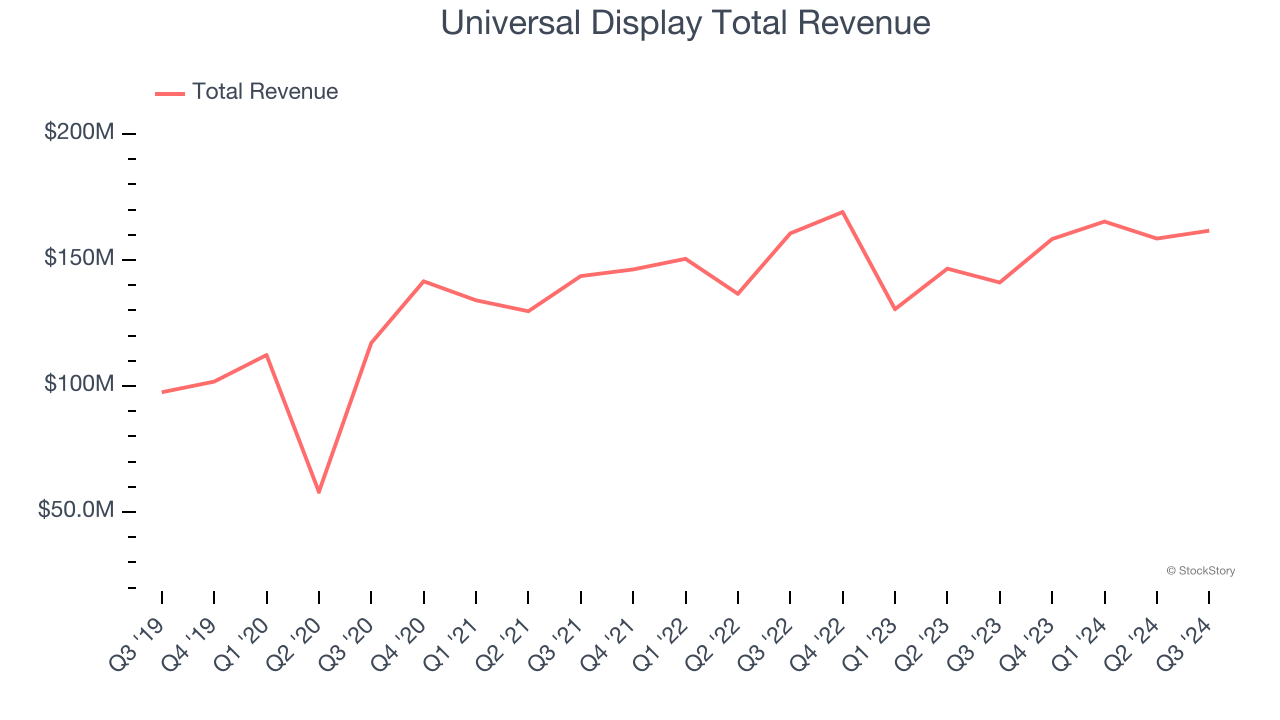

Serving major consumer electronics manufacturers, Universal Display (NASDAQ: OLED) is a provider of organic light emitting diode (OLED) technologies used in display and lighting applications.

Universal Display reported revenues of $161.6 million, up 14.6% year on year. This print fell short of analysts’ expectations by 2.1%. Overall, it was a slower quarter for the company with full-year revenue guidance missing analysts’ expectations.

“With strong year-to-date results, we are on track to achieve record revenues, earnings, and operating cash flow in 2024 as we continue our growth trajectory. The rate of growth this year, though, is expected to be more modest than previously projected. With recent updates to customer order expectations for the fourth quarter, we are lowering our 2024 revenue forecast range to $625 million to $645 million,” said Brian Millard, Vice President and Chief Financial Officer of Universal Display Corporation.

Universal Display scored the highest full-year guidance raise but had the weakest performance against analyst estimates of the whole group. Still, the market seems discontent with the results. The stock is down 32% since reporting and currently trades at $155.84.

Is now the time to buy Universal Display? Access our full analysis of the earnings results here, it’s free.

Best Q3: Impinj (NASDAQ: PI)

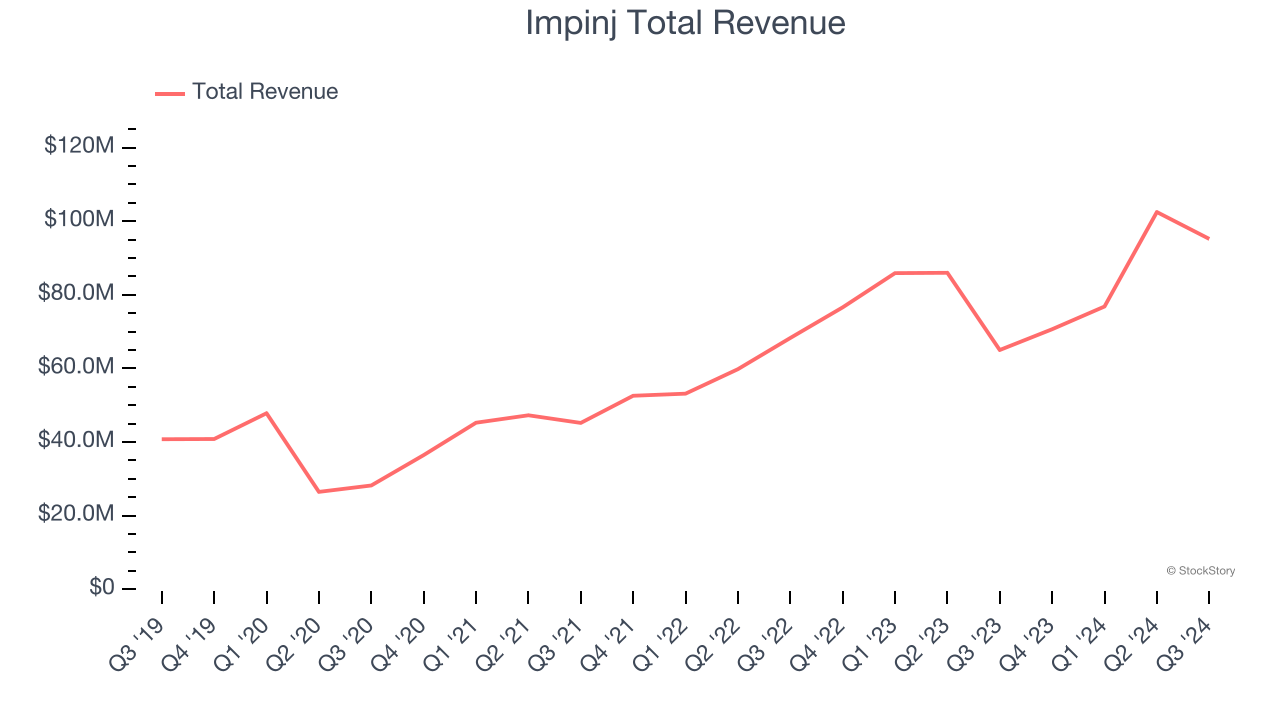

Founded by Caltech professor Carver Mead and one of his students Chris Diorio, Impinj (NASDAQ: PI) is a maker of radio-frequency identification (RFID) hardware and software.

Impinj reported revenues of $95.2 million, up 46.4% year on year, outperforming analysts’ expectations by 2.5%. The business had a very strong quarter with a solid beat of analysts’ EPS estimates and an impressive beat of analysts’ adjusted operating income estimates.

Impinj delivered the fastest revenue growth among its peers. Although it had a fine quarter compared its peers, the market seems unhappy with the results as the stock is down 32% since reporting. It currently trades at $150.40.

Is now the time to buy Impinj? Access our full analysis of the earnings results here, it’s free.

Slowest Q3: Vishay Intertechnology (NYSE: VSH)

Named after the founder's ancestral village in present-day Lithuania, Vishay Intertechnology (NYSE: VSH) manufactures simple chips and electronic components that are building blocks of virtually all types of electronic devices.

Vishay Intertechnology reported revenues of $735.4 million, down 13.9% year on year, falling short of analysts’ expectations by 1.8%. It was a disappointing quarter as it posted full-year revenue guidance missing analysts’ expectations.

Vishay Intertechnology delivered the weakest full-year guidance update in the group. Interestingly, the stock is up 4.6% since the results and currently trades at $17.83.

Read our full analysis of Vishay Intertechnology’s results here.

MACOM (NASDAQ: MTSI)

Founded in the 1950s as Microwave Associates, a communications supplier to the US Army Signal Corp, today MACOM Technology Solutions (NASDAQ: MTSI) is a provider of analog chips used in optical, wireless, and satellite networks.

MACOM reported revenues of $200.7 million, up 33.5% year on year. This number was in line with analysts’ expectations. Aside from that, it was a mixed quarter as it also recorded revenue guidance for next quarter beating analysts’ expectations but a miss of analysts’ adjusted operating income estimates.

The stock is up 13% since reporting and currently trades at $138.

Read our full, actionable report on MACOM here, it’s free.

Monolithic Power Systems (NASDAQ: MPWR)

Founded in 1997 by its longtime CEO Michael Hsing, Monolithic Power Systems (NASDAQ: MPWR) is an analog and mixed signal chipmaker that specializes in power management chips meant to minimize total energy consumption.

Monolithic Power Systems reported revenues of $620.1 million, up 30.6% year on year. This print topped analysts’ expectations by 3.3%. Overall, it was a strong quarter as it also put up a significant improvement in its inventory levels and a decent beat of analysts’ adjusted operating income estimates.

The stock is down 31.4% since reporting and currently trades at $630.

Read our full, actionable report on Monolithic Power Systems here, it’s free.

Market Update

Thanks to the Fed’s rate hikes in 2022 and 2023, inflation has been on a steady path downward, easing back toward that 2% sweet spot. Fortunately (miraculously to some), all this tightening didn’t send the economy tumbling into a recession, so here we are, cautiously celebrating a soft landing. The cherry on top? Recent rate cuts (half a point in September, a quarter in November) have kept 2024 stock markets frothy, especially after Trump’s November win lit a fire under major indices and sent them to all-time highs. However, there's still plenty to ponder — tariffs, corporate tax cuts, and what 2025 might hold for the economy.

Want to invest in winners with rock-solid fundamentals? Check out our Strong Momentum Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.