The past six months have been a windfall for Fiverr’s shareholders. The company’s stock price has jumped 47.3%, hitting $33.34 per share. This was partly thanks to its solid quarterly results, and the run-up might have investors contemplating their next move.

Is it too late to buy FVRR? Find out in our full research report, it’s free.

Why Does Fiverr Spark Debate?

Based in Tel Aviv, Fiverr (NYSE: FVRR) operates a fixed price global freelance marketplace for digital services.

Two Positive Attributes:

1. Eye-Popping Growth in Customer Spending

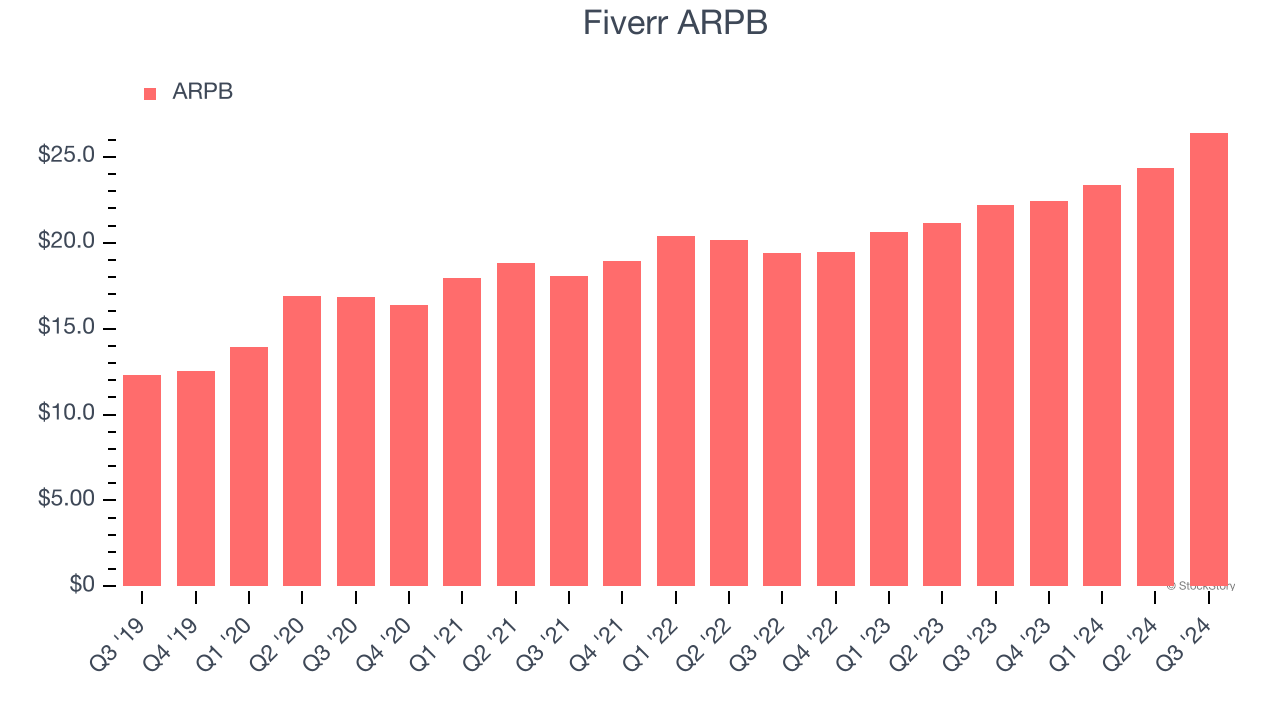

Average revenue per buyer (ARPB) is a critical metric to track for gig economy businesses like Fiverr because it measures how much the company earns in transaction fees from each buyer. This number also informs us about Fiverr’s take rate, which represents its pricing leverage over the ecosystem, or "cut" from each transaction.

Fiverr’s ARPB growth has been exceptional over the last two years, averaging 10.8%. Although its active buyers shrank during this time, the company’s ability to successfully increase monetization demonstrates its platform’s value for existing buyers.

2. Outstanding Long-Term EPS Growth

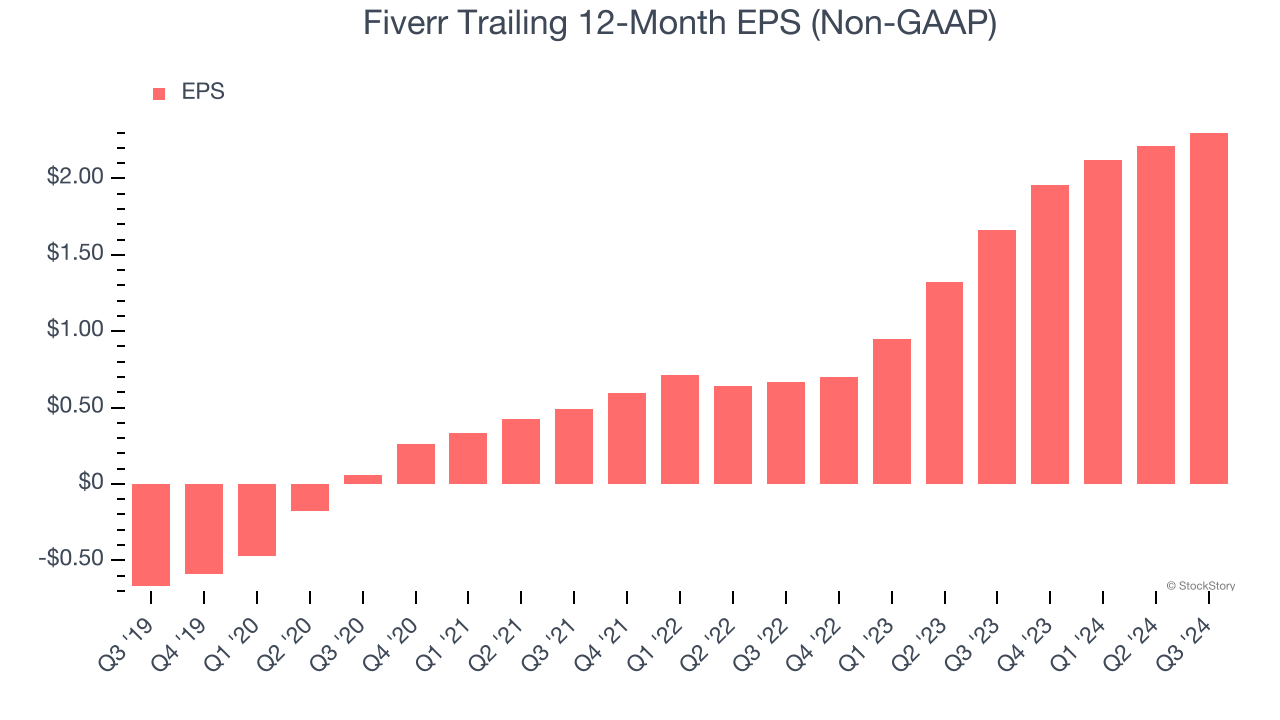

Analyzing the change in earnings per share (EPS) shows whether a company's incremental sales were profitable – for example, revenue could be inflated through excessive spending on advertising and promotions.

Fiverr’s EPS grew at an astounding 67.2% compounded annual growth rate over the last three years, higher than its 11.5% annualized revenue growth. This tells us the company became more profitable on a per-share basis as it expanded.

One Reason to be Careful:

Declining Active Buyers Reflect Product Weakness

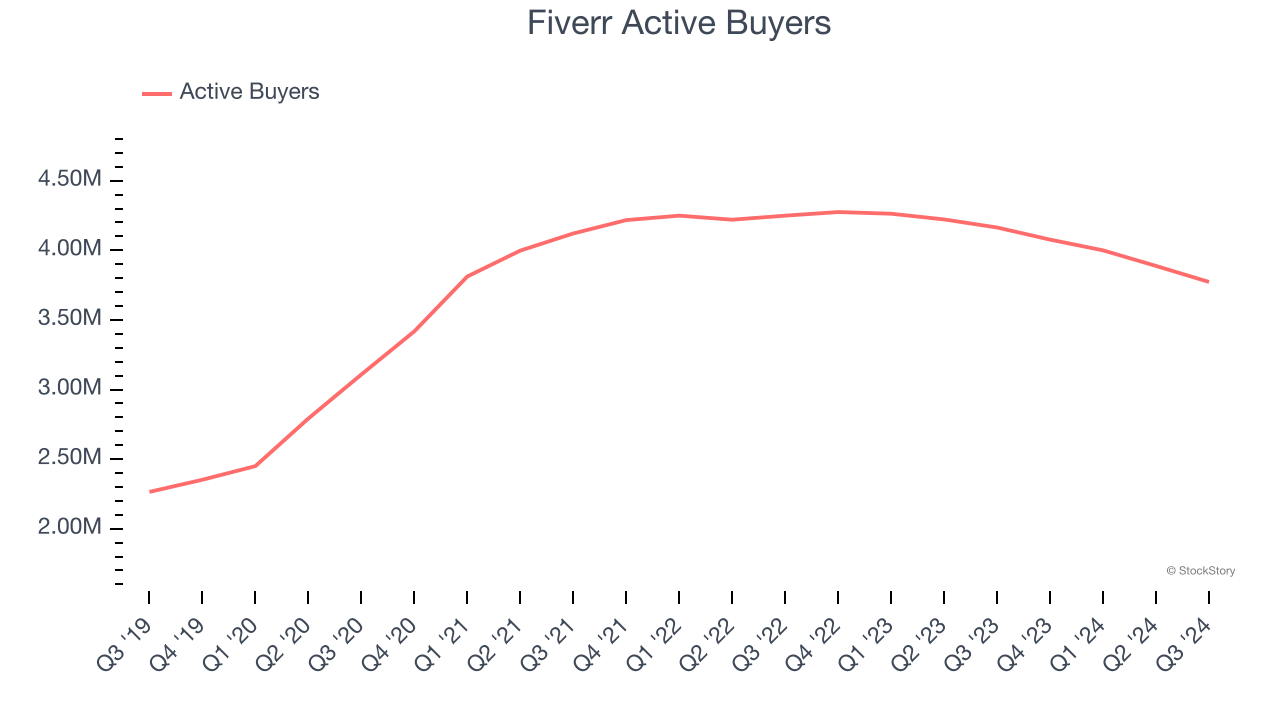

As a gig economy marketplace, Fiverr generates revenue growth by expanding the number of services on its platform (e.g. rides, deliveries, freelance jobs) and raising the commission fee from each service provided.

Fiverr struggled to engage its active buyers over the last two years as they have declined by 3.5% annually to 3.77 million in the latest quarter. This performance isn't ideal because internet usage is secular, meaning there are typically unaddressed market opportunities. If Fiverr wants to accelerate growth, it likely needs to enhance the appeal of its current offerings or innovate with new products.

Final Judgment

Fiverr’s merits more than compensate for its flaws, and with the recent rally, the stock trades at 14.7× forward EV-to-EBITDA (or $33.34 per share). Is now the time to initiate a position? See for yourself in our in-depth research report, it’s free.

Stocks We Like Even More Than Fiverr

The elections are now behind us. With rates dropping and inflation cooling, many analysts expect a breakout market to cap off the year - and we’re zeroing in on the stocks that could benefit immensely.

Take advantage of the rebound by checking out our Top 5 Strong Momentum Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,691% between September 2019 and September 2024) as well as under-the-radar businesses like Comfort Systems (+783% five-year return). Find your next big winner with StockStory today for free.