Tapestry has been on fire lately. In the past six months alone, the company’s stock price has rocketed 56.7%, reaching $65.80 per share. This was partly due to its solid quarterly results, and the run-up might have investors contemplating their next move.

Is there a buying opportunity in Tapestry, or does it present a risk to your portfolio? Dive into our full research report to see our analyst team’s opinion, it’s free.We’re glad investors have benefited from the price increase, but we don't have much confidence in Tapestry. Here are two reasons why we avoid TPR and a stock we'd rather own.

Why Is Tapestry Not Exciting?

Originally founded as Coach, Tapestry (NYSE: TPR) is an American fashion conglomerate with a portfolio of luxury brands offering high-quality accessories and fashion products.

1. Long-Term Revenue Growth Disappoints

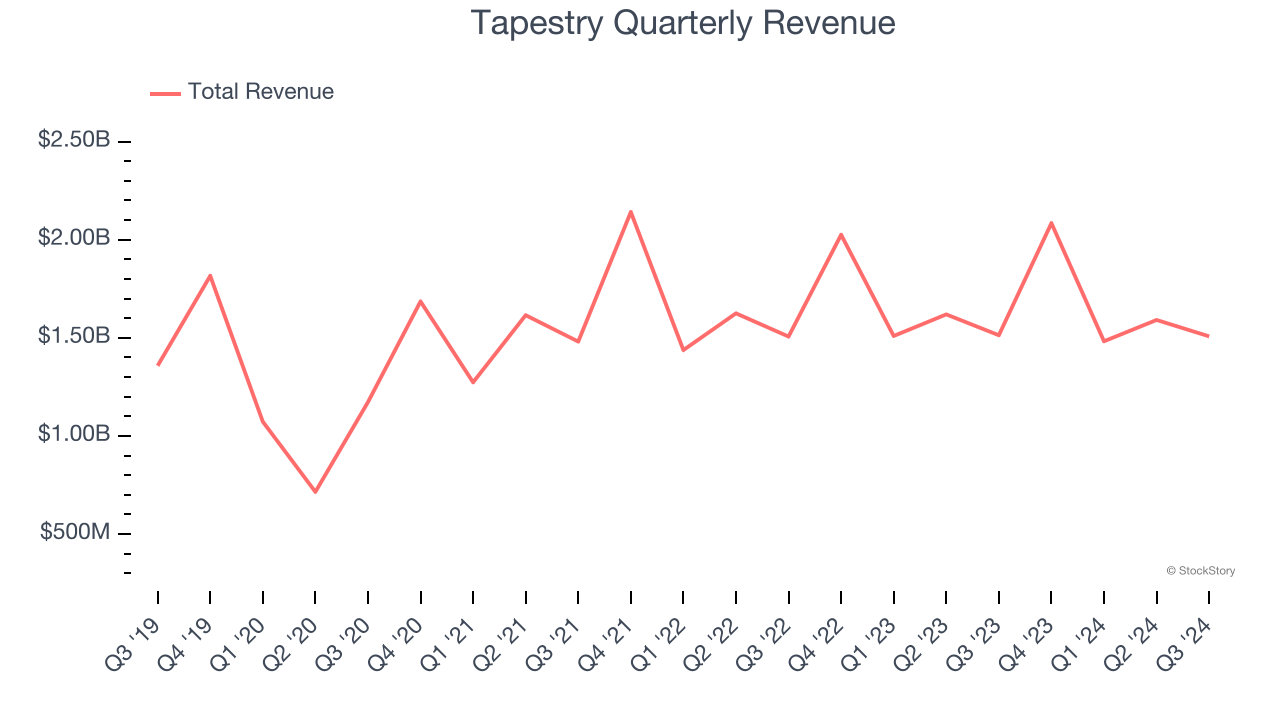

Examining a company’s long-term performance can provide clues about its quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul. Regrettably, Tapestry’s sales grew at a weak 2.1% compounded annual growth rate over the last five years. This fell short of our benchmarks.

2. Weak Constant Currency Growth Points to Soft Demand

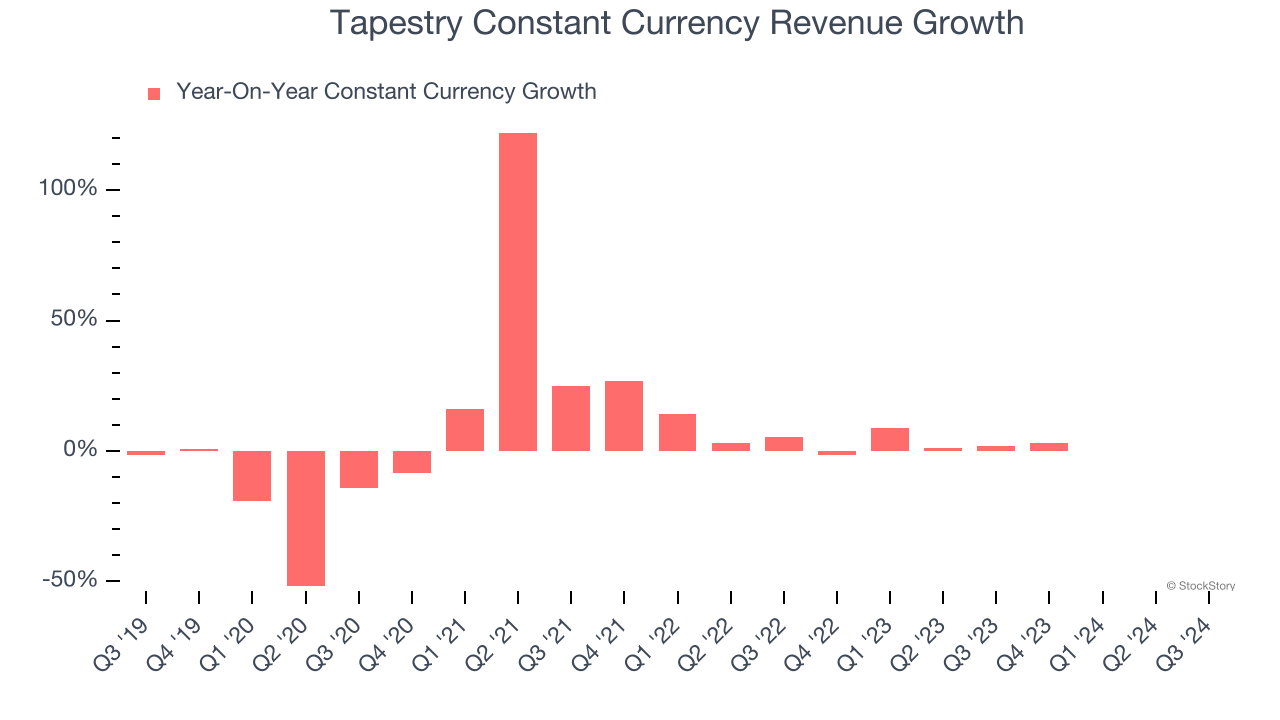

We can better understand Apparel and Accessories companies by analyzing their constant currency revenue. This metric excludes currency movements, which are outside of Tapestry’s control and are not indicative of underlying demand.

Over the last two years, Tapestry’s constant currency revenue averaged 1.6% year-on-year growth. This performance was underwhelming and suggests it might have to lower prices or invest in product improvements to accelerate growth, factors that can hinder near-term profitability.

Final Judgment

Tapestry isn’t a terrible business, but it doesn’t pass our quality test. Following the recent rally, the stock trades at $65.80 per share (or a 2.3× trailing 12-month price-to-sales ratio). The market typically values companies like Tapestry based on their anticipated profits for the next 12 months, but there aren’t enough published estimates to arrive at a reliable number. You should avoid this stock for now - better opportunities lie elsewhere. We’d suggest looking at TransDigm, a dominant Aerospace business that has perfected its M&A strategy.

Stocks We Would Buy Instead of Tapestry

With rates dropping, inflation stabilizing, and the elections in the rearview mirror, all signs point to the start of a new bull run - and we’re laser-focused on finding the best stocks for this upcoming cycle.

Put yourself in the driver’s seat by checking out our Top 6 Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,691% between September 2019 and September 2024) as well as under-the-radar businesses like Comfort Systems (+783% five-year return). Find your next big winner with StockStory today for free.