Microchip Technology has gotten torched over the last six months - since July 2024, its stock price has dropped 41.5% to $56.15 per share. This may have investors wondering how to approach the situation.

Is now the time to buy Microchip Technology, or should you be careful about including it in your portfolio? Get the full breakdown from our expert analysts, it’s free.Even with the cheaper entry price, we don't have much confidence in Microchip Technology. Here are three reasons why we avoid MCHP and a stock we'd rather own.

Why Do We Think Microchip Technology Will Underperform?

Spun out from General Instrument in 1987, Microchip Technology (NASDAQ: MCHP) is a leading provider of microcontrollers and integrated circuits used mainly in the automotive world, especially in electric vehicles and their charging devices.

1. Long-Term Revenue Growth Flatter Than a Pancake

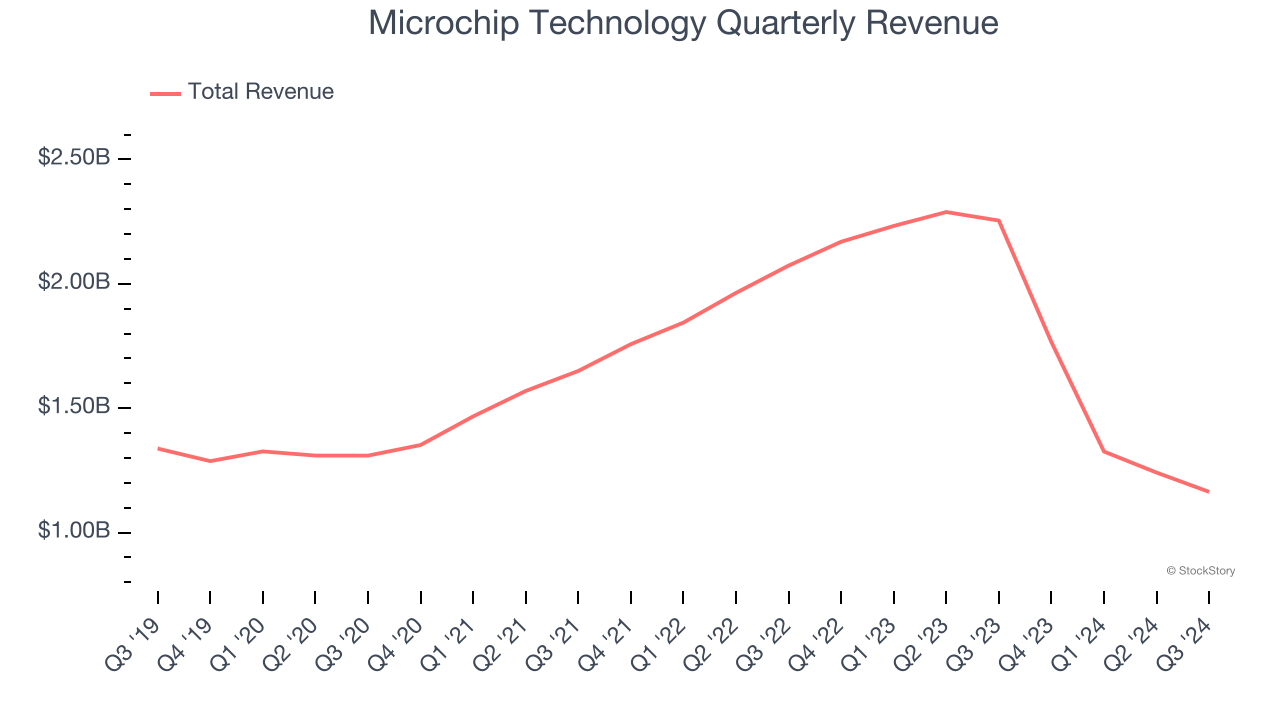

A company’s long-term sales performance can indicate its overall quality. Any business can put up a good quarter or two, but many enduring ones grow for years. Unfortunately, Microchip Technology struggled to consistently increase demand as its $5.50 billion of sales for the trailing 12 months was close to its revenue five years ago. This was below our standards and is a sign of poor business quality. Semiconductors are a cyclical industry, and long-term investors should be prepared for periods of high growth followed by periods of revenue contractions.

2. Free Cash Flow Margin Dropping

If you’ve followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills.

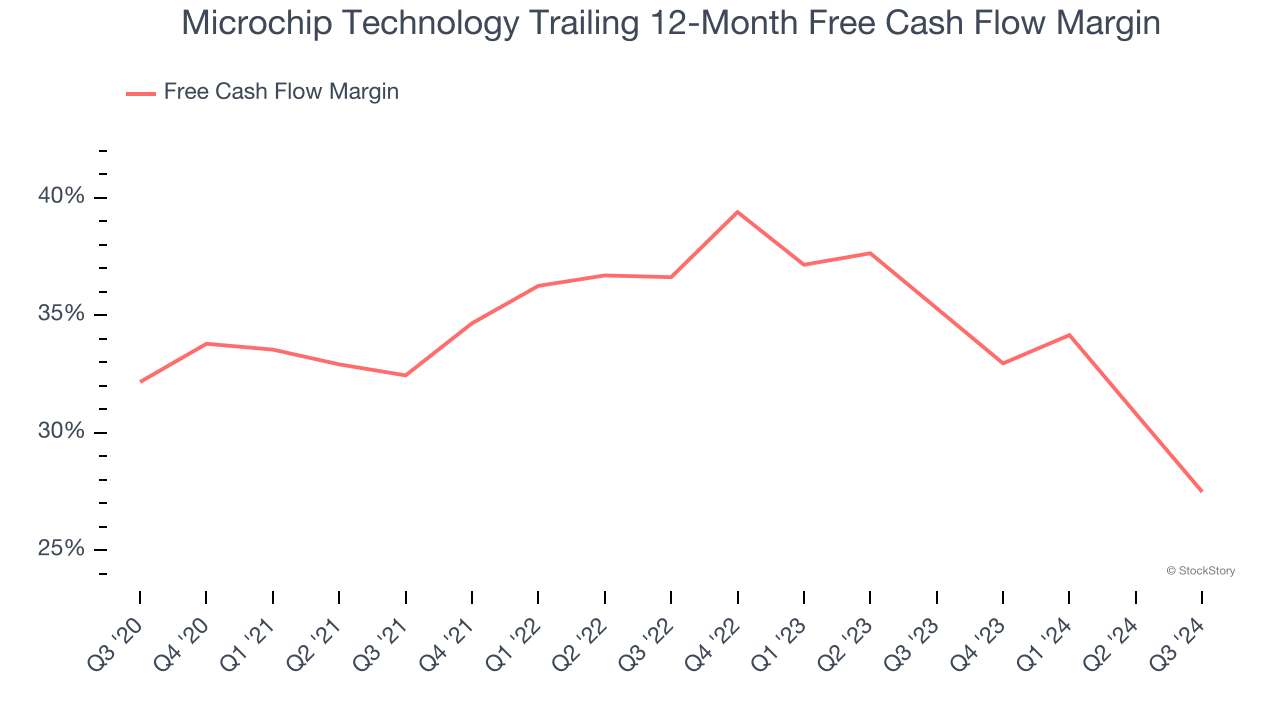

As you can see below, Microchip Technology’s margin dropped by 4.7 percentage points over the last five years. If its declines continue, it could signal higher capital intensity. Microchip Technology’s free cash flow margin for the trailing 12 months was 27.5%.

3. Revenue Projections Show Stormy Skies Ahead

Forecasted revenues by Wall Street analysts signal a company’s potential. Predictions may not always be accurate, but accelerating growth typically boosts valuation multiples and stock prices while slowing growth does the opposite.

Over the next 12 months, sell-side analysts expect Microchip Technology’s revenue to drop by 2.2%. While this projection is better than its two-year trend, it's hard to get excited about a company that is struggling with demand.

Final Judgment

We see the value of companies furthering technological innovation, but in the case of Microchip Technology, we’re out. Following the recent decline, the stock trades at 22.5× forward price-to-earnings (or $56.15 per share). At this valuation, there’s a lot of good news priced in - we think there are better stocks to buy right now. We’d suggest looking at Cloudflare, one of our top software picks that could be a home run with edge computing.

Stocks We Like More Than Microchip Technology

The elections are now behind us. With rates dropping and inflation cooling, many analysts expect a breakout market to cap off the year - and we’re zeroing in on the stocks that could benefit immensely.

Take advantage of the rebound by checking out our Top 5 Strong Momentum Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,691% between September 2019 and September 2024) as well as under-the-radar businesses like Comfort Systems (+783% five-year return). Find your next big winner with StockStory today for free.