As the craze of earnings season draws to a close, here’s a look back at some of the most exciting (and some less so) results from Q3. Today, we are looking at environmental and facilities services stocks, starting with ABM Industries (NYSE: ABM).

Many environmental and facility services are non-discretionary (sports stadiums need to be cleaned after events), recurring, and performed through longer-term contracts. This makes for more predictable and stickier revenue streams. Additionally, there has been an increasing focus on emissions and water conservation over the last decade, driving innovation in the sector and demand for new services. Despite these tailwinds, environmental and facility services companies are still at the whim of economic cycles. Interest rates, for example, can greatly impact commercial construction projects that drive incremental demand for these services.

The 14 environmental and facilities services stocks we track reported a slower Q3. As a group, revenues were in line with analysts’ consensus estimates while next quarter’s revenue guidance was 1.7% above.

While some environmental and facilities services stocks have fared somewhat better than others, they have collectively declined. On average, share prices are down 3.9% since the latest earnings results.

ABM Industries (NYSE: ABM)

Started with a $4.50 investment to purchase a bucket, sponge, and mop, ABM (NYSE: ABM) offers janitorial, parking, and facility services.

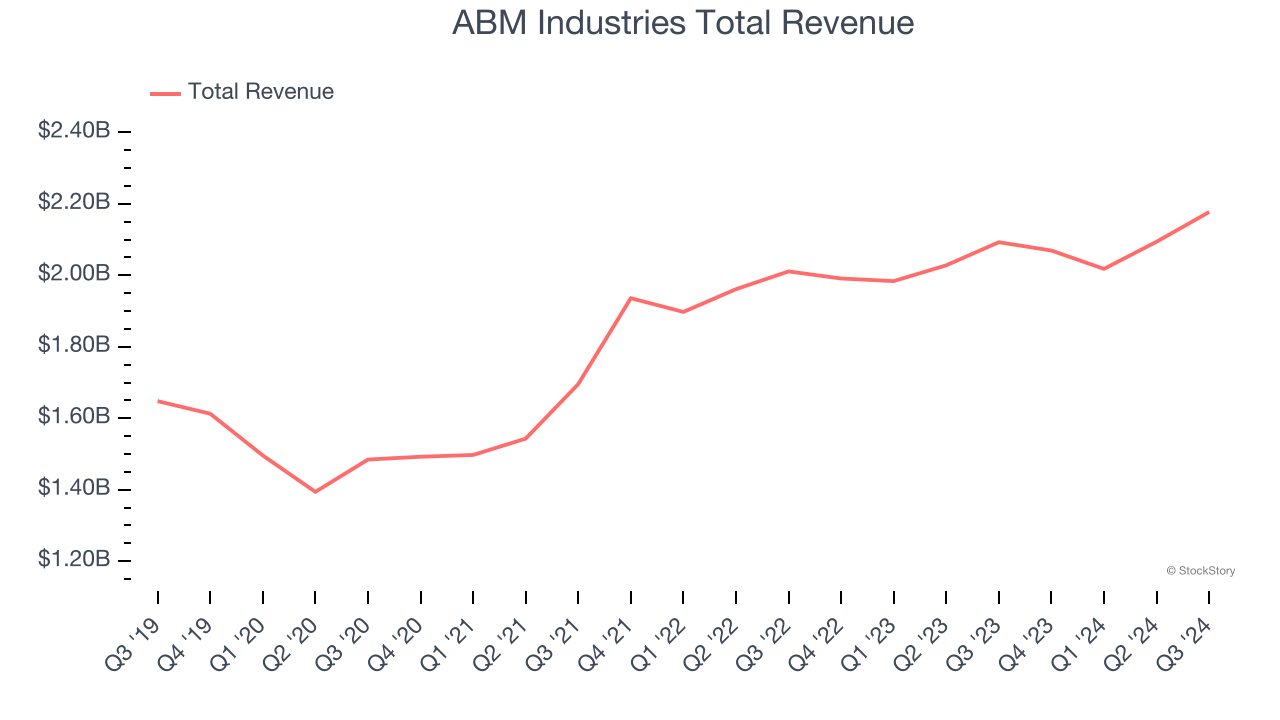

ABM Industries reported revenues of $2.18 billion, up 4% year on year. This print exceeded analysts’ expectations by 4.7%. Overall, it was a very strong quarter for the company with an impressive beat of analysts’ organic revenue estimates and full-year EPS guidance slightly topping analysts’ expectations.

“ABM finished the year well, with double-digit revenue growth in Technical Solutions and Aviation, and our performance also reflected the continued resilience of our Business & Industry segment. These fourth quarter results were highlighted by 3.2% organic revenue growth and adjusted EPS of $0.90 cents, both of which were a little higher than expected,” said Scott Salmirs, President and Chief Executive Officer.

Unsurprisingly, the stock is down 3.2% since reporting and currently trades at $53.16.

Is now the time to buy ABM Industries? Access our full analysis of the earnings results here, it’s free.

Best Q3: Aris Water (NYSE: ARIS)

Primarily serving the oil and gas industry, Aris Water (NYSE: ARIS) is a provider of water handling and recycling solutions.

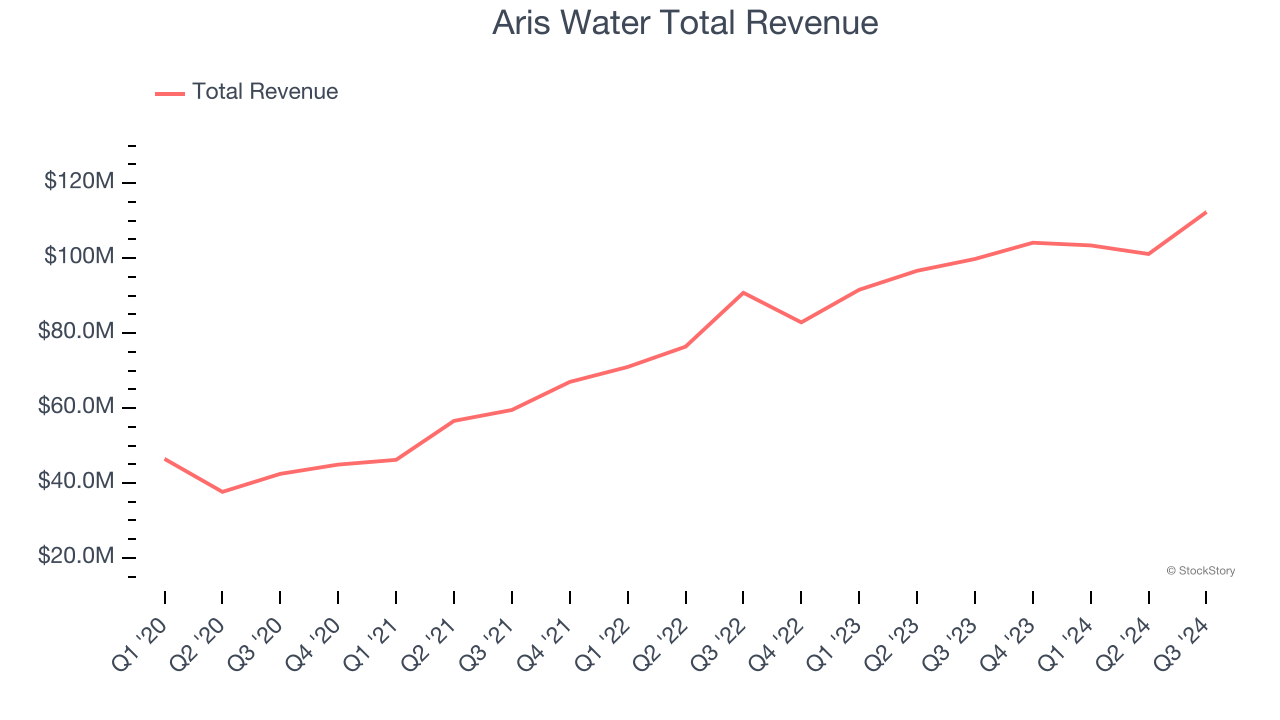

Aris Water reported revenues of $112.3 million, up 12.5% year on year, outperforming analysts’ expectations by 8.6%. The business had an exceptional quarter with a solid beat of analysts’ sales volume estimates and an impressive beat of analysts’ EBITDA estimates.

Aris Water pulled off the biggest analyst estimates beat among its peers. The market seems happy with the results as the stock is up 68.7% since reporting. It currently trades at $28.

Is now the time to buy Aris Water? Access our full analysis of the earnings results here, it’s free.

Weakest Q3: Perma-Fix (NASDAQ: PESI)

Tackling hazardous waste challenges since 1990, Perma-Fix (NASDAQ: PESI) provides environmental waste treatment services.

Perma-Fix reported revenues of $16.81 million, down 23.2% year on year, falling short of analysts’ expectations by 2.3%. It was a disappointing quarter as it posted a significant miss of analysts’ EBITDA and EPS estimates.

Perma-Fix delivered the slowest revenue growth in the group. As expected, the stock is down 27.2% since the results and currently trades at $10.68.

Read our full analysis of Perma-Fix’s results here.

Veralto (NYSE: VLTO)

Spun off from Danaher in 2023, Veralto (NYSE: VLTO) provides water analytics and treatment solutions.

Veralto reported revenues of $1.31 billion, up 4.7% year on year. This result topped analysts’ expectations by 0.6%. Aside from that, it was a satisfactory quarter as it also produced a decent beat of analysts’ adjusted operating income estimates but EPS guidance for next quarter missing analysts’ expectations.

The stock is down 7.7% since reporting and currently trades at $102.37.

Read our full, actionable report on Veralto here, it’s free.

Rollins (NYSE: ROL)

Operating under multiple brands like Orkin and HomeTeam Pest Defense, Rollins (NYSE: ROL) provides pest and wildlife control services to residential and commercial customers.

Rollins reported revenues of $916.3 million, up 9% year on year. This print surpassed analysts’ expectations by 0.5%. Zooming out, it was a slower quarter as it recorded a miss of analysts’ EPS and adjusted operating income estimates.

The stock is down 5% since reporting and currently trades at $47.28.

Read our full, actionable report on Rollins here, it’s free.

Market Update

Thanks to the Fed's series of rate hikes in 2022 and 2023, inflation has cooled significantly from its post-pandemic highs, drawing closer to the 2% goal. This disinflation has occurred without severely impacting economic growth, suggesting the success of a soft landing. The stock market has thrived in 2024, spurred by recent rate cuts (0.5% in September and 0.25% each in November and December), and a notable surge followed Donald Trump's presidential election win in November, propelling indices to historic highs. Nonetheless, the outlook for 2025 remains clouded by the pace and magnitude of future rate cuts as well as potential changes in trade policy and corporate taxes once the Trump administration takes over. The path forward is marked by uncertainty.

Want to invest in winners with rock-solid fundamentals? Check out our Top 5 Quality Compounder Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.