The end of an earnings season can be a great time to discover new stocks and assess how companies are handling the current business environment. Let’s take a look at how Toast (NYSE: TOST) and the rest of the vertical software stocks fared in Q3.

Software is eating the world, and while a large number of solutions such as project management or video conferencing software can be useful to a wide array of industries, some have very specific needs. As a result, vertical software, which addresses industry-specific workflows, is growing and fueled by the pressures to improve productivity, whether it be for a life sciences, education, or banking company.

The 15 vertical software stocks we track reported a strong Q3. As a group, revenues beat analysts’ consensus estimates by 3.4% while next quarter’s revenue guidance was 0.7% above.

Thankfully, share prices of the companies have been resilient as they are up 6% on average since the latest earnings results.

Toast (NYSE: TOST)

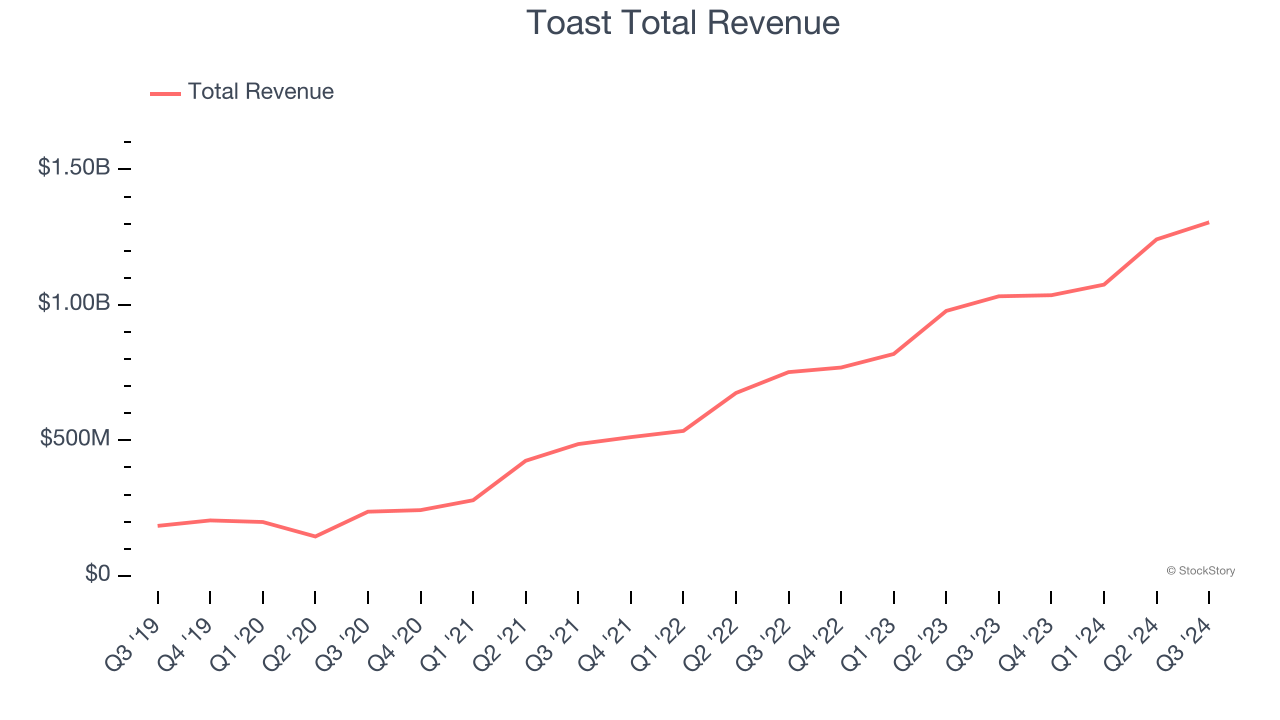

Founded by three MIT engineers at a local Cambridge bar, Toast (NYSE: TOST) provides integrated point-of-sale (POS) hardware, software, and payments solutions for restaurants.

Toast reported revenues of $1.31 billion, up 26.5% year on year. This print exceeded analysts’ expectations by 1.1%. Overall, it was a very strong quarter for the company with EBITDA guidance for next quarter exceeding analysts’ expectations and an impressive beat of analysts’ EBITDA estimates.

“Toast delivered a strong third quarter, adding approximately 7,000 net new locations, growing our recurring gross profit streams1 35%, and achieving Adjusted EBITDA of $113 million. We are well positioned to finish out the year strong and carry this momentum into 2025. Our differentiated vertical software platform is at the foundation of that success, and we continue to innovate to deliver more value to our customers: this fall we launched new products like Branded Mobile App and SMS Marketing alongside over a dozen feature updates,” said Toast CEO and Co-Founder Aman Narang.

Interestingly, the stock is up 16.4% since reporting and currently trades at $37.99.

We think Toast is a good business, but is it a buy today? Read our full report here, it’s free.

Best Q3: Upstart (NASDAQ: UPST)

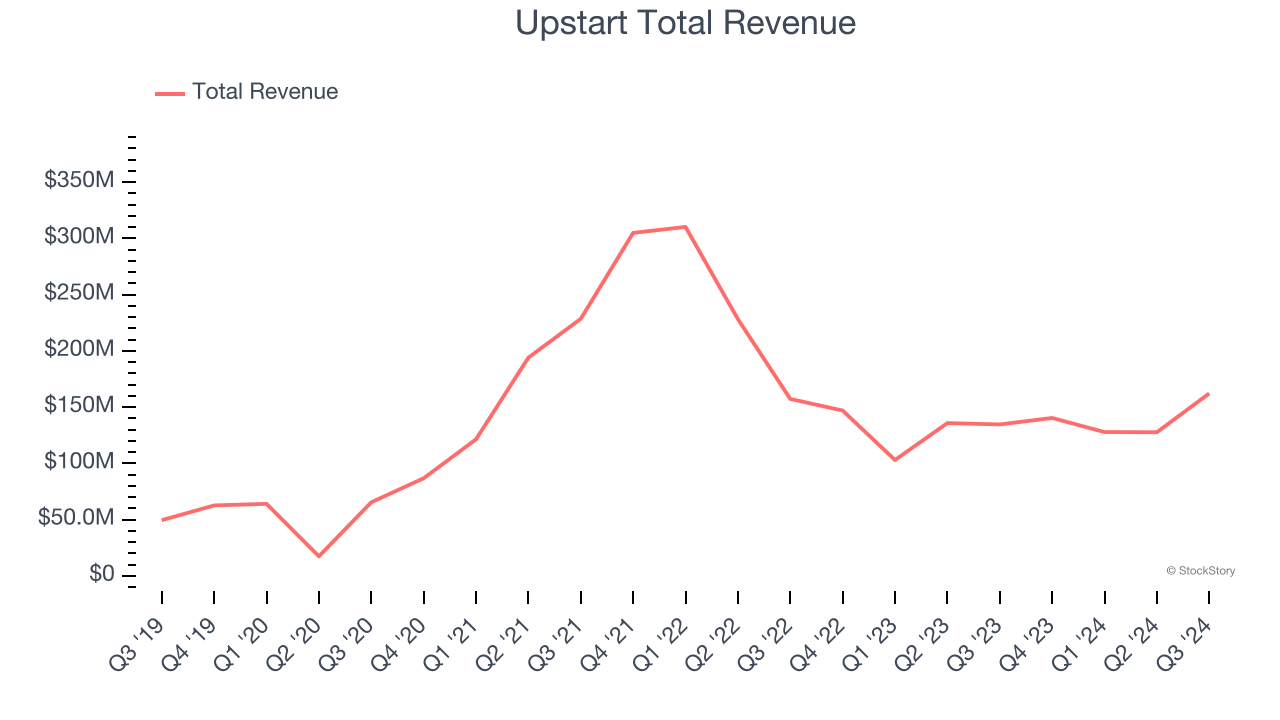

Founded by the former head of Google's enterprise business, Upstart (NASDAQ: UPST) is an AI-powered lending platform facilitating loans for banks and consumers.

Upstart reported revenues of $162.1 million, up 20.5% year on year, outperforming analysts’ expectations by 7.9%. The business had a stunning quarter with a solid beat of analysts’ EBITDA estimates and revenue guidance for next quarter exceeding analysts’ expectations.

The market seems happy with the results as the stock is up 17.3% since reporting. It currently trades at $65.09.

Is now the time to buy Upstart? Access our full analysis of the earnings results here, it’s free.

Weakest Q3: Adobe (NASDAQ: ADBE)

One of the most well-known Silicon Valley software companies around, Adobe (NASDAQ: ADBE) is a leading provider of software as service in the digital design and document management space.

Adobe reported revenues of $5.61 billion, up 11.1% year on year, exceeding analysts’ expectations by 1.2%. Still, it was a slower quarter as it posted revenue guidance for next quarter slightly missing analysts’ expectations and a miss of analysts’ billings estimates.

As expected, the stock is down 22.3% since the results and currently trades at $427.02.

Read our full analysis of Adobe’s results here.

Procore (NYSE: PCOR)

Used to manage the multi-year expansion of the Panama Canal that began in 2007, Procore (NYSE: PCOR) offers a software-as-service project, finance, and quality management platform for the construction industry.

Procore reported revenues of $295.9 million, up 19.4% year on year. This result topped analysts’ expectations by 2.9%. Overall, it was a strong quarter as it also logged a solid beat of analysts’ EBITDA estimates and accelerating customer growth.

The company added 225 customers to reach a total of 16,975. The stock is up 23.5% since reporting and currently trades at $77.37.

Read our full, actionable report on Procore here, it’s free.

ANSYS (NASDAQ: ANSS)

Used to help design the Mars Rover, Ansys (NASDAQ: ANSS) offers a software-as-a-service platform that enables simulation for engineering and design.

ANSYS reported revenues of $601.9 million, up 31.2% year on year. This print surpassed analysts’ expectations by 14.9%. It was a stunning quarter as it also recorded an impressive beat of analysts’ EBITDA estimates and a solid beat of analysts’ annual contract value estimates.

ANSYS delivered the biggest analyst estimates beat and fastest revenue growth among its peers. The stock is up 2.8% since reporting and currently trades at $342.51.

Read our full, actionable report on ANSYS here, it’s free.

Market Update

Thanks to the Fed's series of rate hikes in 2022 and 2023, inflation has cooled significantly from its post-pandemic highs, drawing closer to the 2% goal. This disinflation has occurred without severely impacting economic growth, suggesting the success of a soft landing. The stock market has thrived in 2024, spurred by recent rate cuts (0.5% in September and 0.25% each in November and December), and a notable surge followed Donald Trump's presidential election win in November, propelling indices to historic highs. Nonetheless, the outlook for 2025 remains clouded by the pace and magnitude of future rate cuts as well as potential changes in trade policy and corporate taxes once the Trump administration takes over. The path forward is marked by uncertainty.

Want to invest in winners with rock-solid fundamentals? Check out our Hidden Gem Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.