What a time it’s been for DocuSign. In the past six months alone, the company’s stock price has increased by a massive 60.5%, reaching $89.52 per share. This was partly due to its solid quarterly results, and the run-up might have investors contemplating their next move.

Is now the time to buy DocuSign, or should you be careful about including it in your portfolio? Get the full breakdown from our expert analysts, it’s free.

Despite the momentum, we don't have much confidence in DocuSign. Here are three reasons why there are better opportunities than DOCU and a stock we'd rather own.

Why Is DocuSign Not Exciting?

Founded by Seattle-based entrepreneur Tom Gonser, DocuSign (NASDAQ: DOCU) is the pioneer of e-signature and offers software as a service that allows people and organisations to sign legally binding documents electronically.

1. Weak Billings Point to Soft Demand

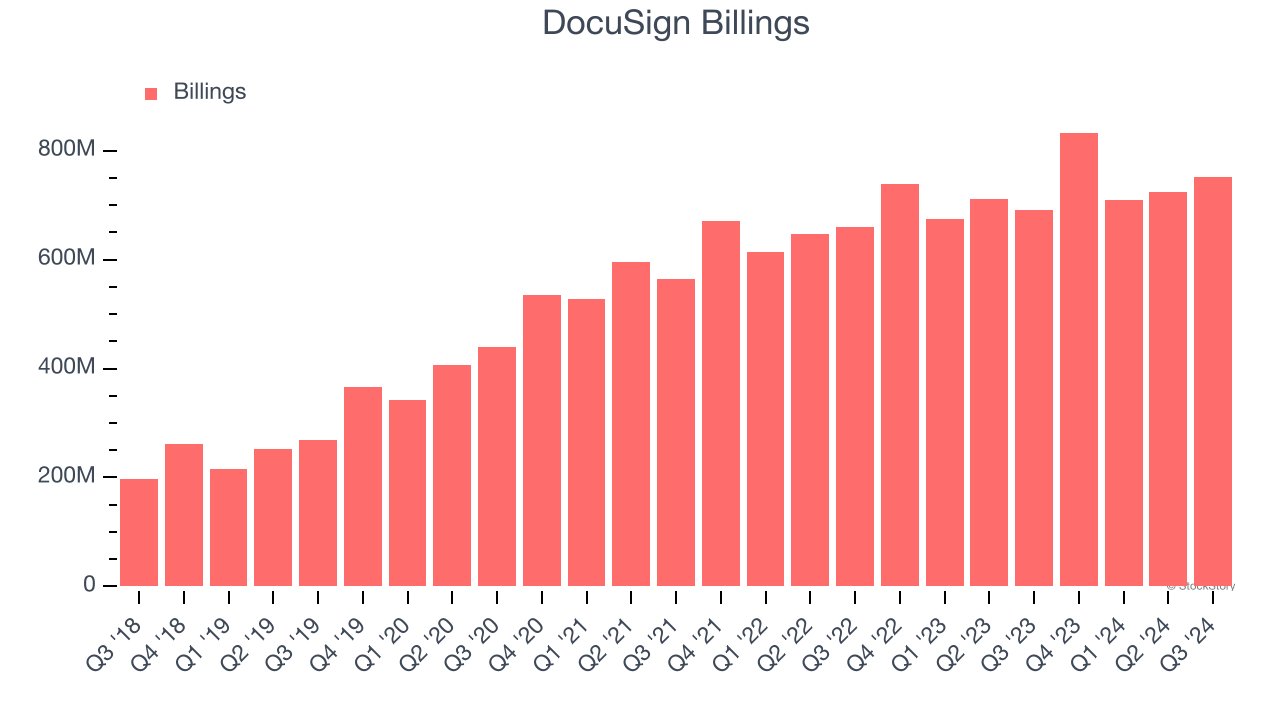

Billings is a non-GAAP metric that is often called “cash revenue” because it shows how much money the company has collected from customers in a certain period. This is different from revenue, which must be recognized in pieces over the length of a contract.

DocuSign’s billings came in at $752.3 million in Q3, and over the last four quarters, its year-on-year growth averaged 7.1%. This performance was underwhelming and suggests that increasing competition is causing challenges in acquiring/retaining customers.

2. Customer Churn Hurts Long-Term Outlook

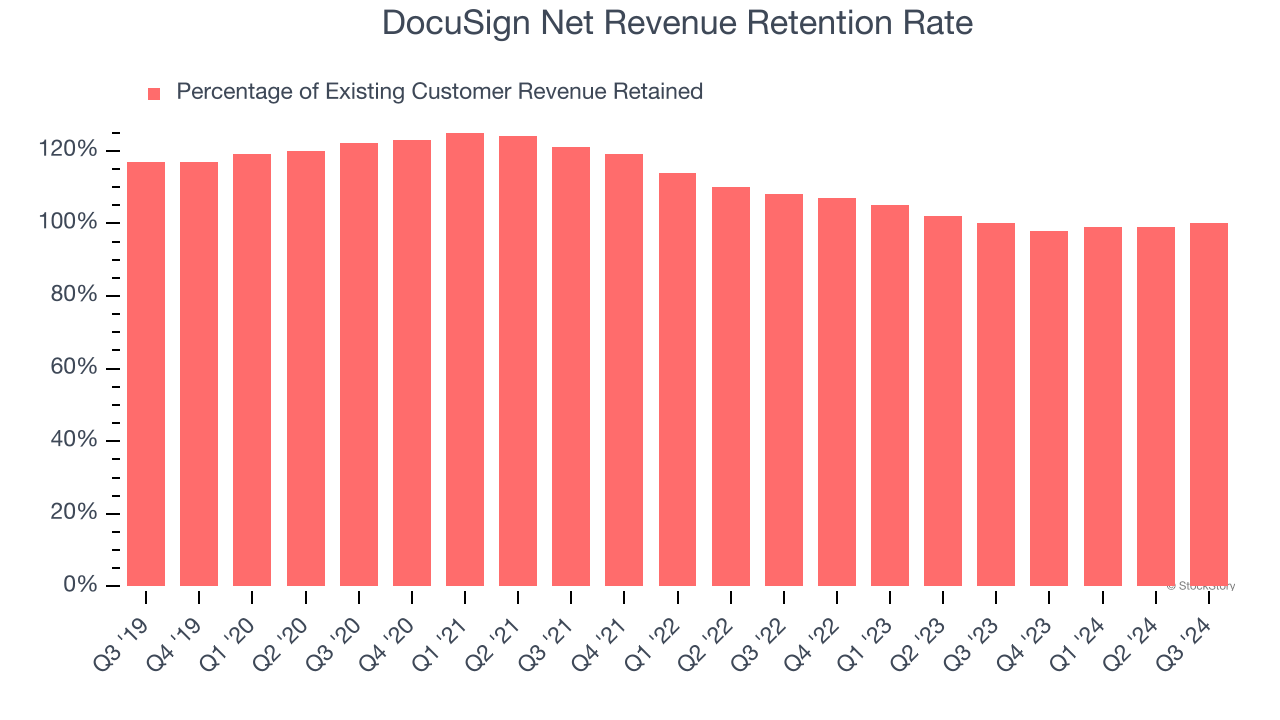

One of the best parts about the software-as-a-service business model (and a reason why they trade at high valuation multiples) is that customers typically spend more on a company’s products and services over time.

DocuSign’s net revenue retention rate, a key performance metric measuring how much money existing customers from a year ago are spending today, was 99% in Q3. This means DocuSign’s revenue would’ve decreased by 1% over the last 12 months if it didn’t win any new customers.

DocuSign has a weak net retention rate, signaling that some customers aren’t satisfied with its products, leading to lost contracts and revenue streams.

3. Long Payback Periods Delay Returns

The customer acquisition cost (CAC) payback period represents the months required to recover the cost of acquiring a new customer. Essentially, it’s the break-even point for sales and marketing investments. A shorter CAC payback period is ideal, as it implies better returns on investment and business scalability.

DocuSign’s recent customer acquisition efforts haven’t yielded returns as its CAC payback period was negative this quarter, meaning its sales and marketing investments outpaced its revenue. The company’s inefficiency indicates it operates in a highly competitive environment where there is little differentiation between DocuSign’s products and its peers.

Final Judgment

DocuSign isn’t a terrible business, but it doesn’t pass our quality test. Following the recent rally, the stock trades at 6.2× forward price-to-sales (or $89.52 per share). Beauty is in the eye of the beholder, but our analysis shows the upside isn’t great compared to the potential downside. We're fairly confident there are better investments elsewhere. We’d recommend looking at the most entrenched endpoint security platform on the market.

Stocks We Would Buy Instead of DocuSign

The elections are now behind us. With rates dropping and inflation cooling, many analysts expect a breakout market - and we’re zeroing in on the stocks that could benefit immensely.

Take advantage of the rebound by checking out our Top 9 Market-Beating Stocks. This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,183% between December 2019 and December 2024) as well as under-the-radar businesses like Sterling Infrastructure (+1,096% five-year return). Find your next big winner with StockStory today for free.