Electronic component provider Littelfuse (NASDAQ: LFUS) beat Wall Street’s revenue expectations in Q4 CY2024, but sales were flat year on year at $529.5 million. The company expects next quarter’s revenue to be around $535 million, close to analysts’ estimates. Its non-GAAP profit of $2.04 per share was 1.1% below analysts’ consensus estimates.

Is now the time to buy Littelfuse? Find out by accessing our full research report, it’s free.

Littelfuse (LFUS) Q4 CY2024 Highlights:

- Revenue: $529.5 million vs analyst estimates of $524.7 million (flat year on year, 0.9% beat)

- Adjusted EPS: $2.04 vs analyst expectations of $2.06 (1.1% miss)

- Adjusted EBITDA: $95.8 million vs analyst estimates of $98.67 million (18.1% margin, 2.9% miss)

- Revenue Guidance for Q1 CY2025 is $535 million at the midpoint, roughly in line with what analysts were expecting

- Adjusted EPS guidance for Q1 CY2025 is $1.80 at the midpoint, below analyst estimates of $2.05

- Operating Margin: -6.9%, down from 12.1% in the same quarter last year

- Free Cash Flow Margin: 25.5%, up from 22.7% in the same quarter last year

- Market Capitalization: $5.69 billion

“Our fourth quarter performance, which was in-line with our expectations, reflects ongoing operational execution and our steadfast commitment to our diverse and global customer base,” said Dave Heinzmann, Littelfuse President and Chief Executive Officer.

Company Overview

The developer of the first blade-type automotive fuse, Littelfuse (NASDAQ: LFUS) provides electrical protection and control components for the automotive, industrial, electronics, and telecommunications industries.

Electronic Components

Like many equipment and component manufacturers, electronic components companies are buoyed by secular trends such as connectivity and industrial automation. More specific pockets of strong demand include data centers and telecommunications, which can benefit companies whose optical and transceiver offerings fit those markets. But like the broader industrials sector, these companies are also at the whim of economic cycles. Consumer spending, for example, can greatly impact these companies’ volumes.

Sales Growth

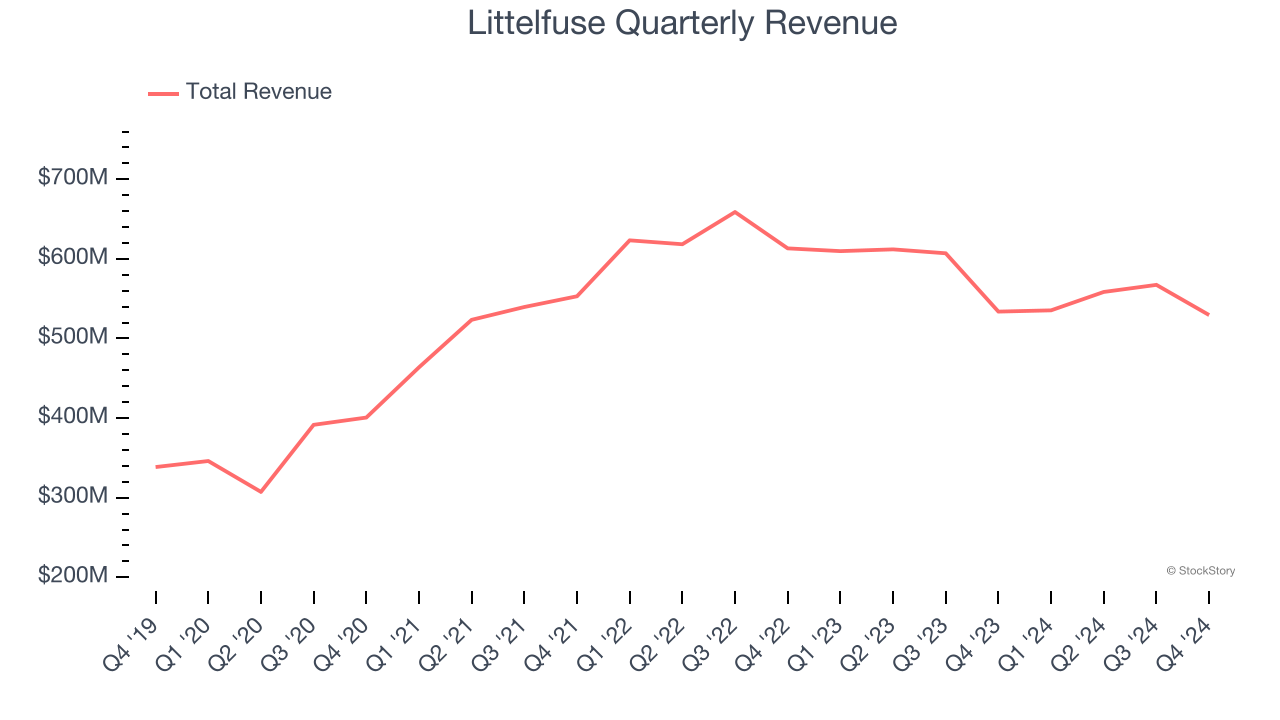

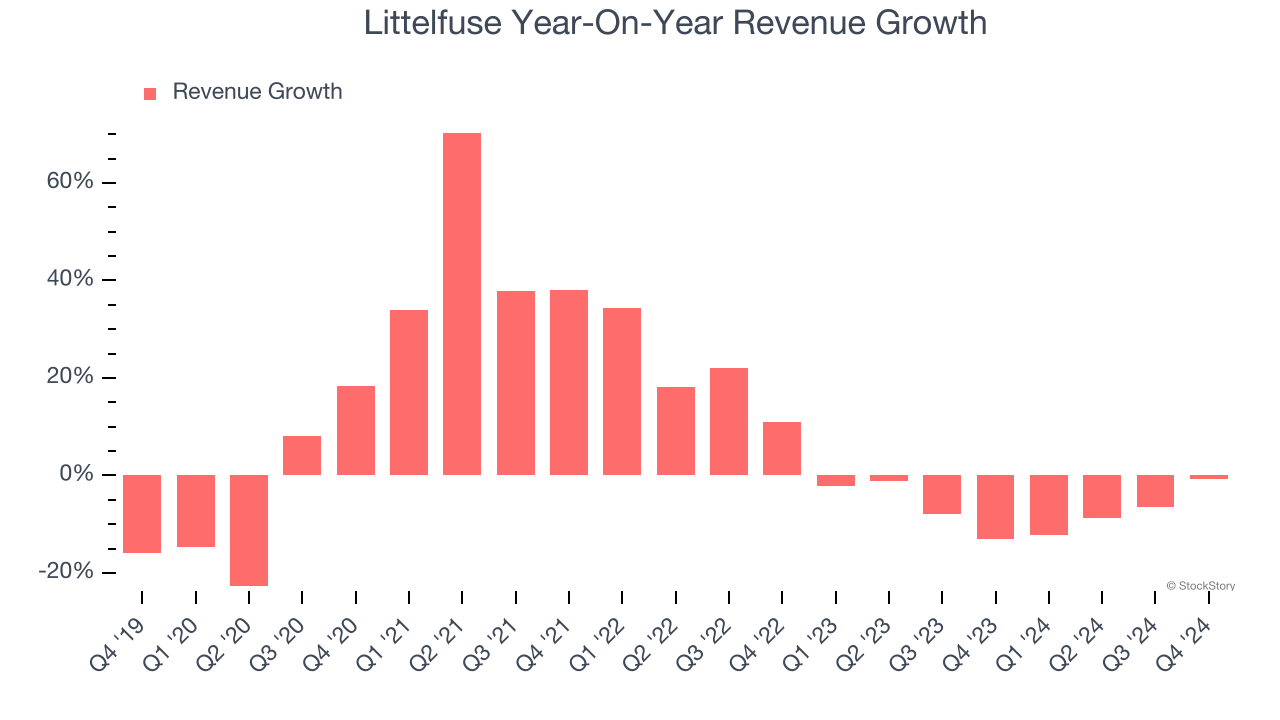

Reviewing a company’s long-term sales performance reveals insights into its quality. Any business can have short-term success, but a top-tier one grows for years. Over the last five years, Littelfuse grew its sales at a decent 7.8% compounded annual growth rate. Its growth was slightly above the average industrials company and shows its offerings resonate with customers.

We at StockStory place the most emphasis on long-term growth, but within industrials, a half-decade historical view may miss cycles, industry trends, or a company capitalizing on catalysts such as a new contract win or a successful product line. Littelfuse’s recent history marks a sharp pivot from its five-year trend as its revenue has shown annualized declines of 6.6% over the last two years.

We can dig further into the company’s revenue dynamics by analyzing its most important segments, Electronics and Automotive, which are 54% and 30.5% of revenue. Over the last two years, Littelfuse’s Electronics revenue (fuses and switches) averaged 10.6% year-on-year declines while its Automotive revenue (trucks, commercial machinery, marine) averaged 3% declines.

This quarter, Littelfuse’s $529.5 million of revenue was flat year on year but beat Wall Street’s estimates by 0.9%. Company management is currently guiding for flat sales next quarter.

Looking further ahead, sell-side analysts expect revenue to grow 4.6% over the next 12 months. Although this projection indicates its newer products and services will spur better top-line performance, it is still below the sector average.

Here at StockStory, we certainly understand the potential of thematic investing. Diverse winners from Microsoft (MSFT) to Alphabet (GOOG), Coca-Cola (KO) to Monster Beverage (MNST) could all have been identified as promising growth stories with a megatrend driving the growth. So, in that spirit, we’ve identified a relatively under-the-radar profitable growth stock benefiting from the rise of AI, available to you FREE via this link.

Operating Margin

Operating margin is one of the best measures of profitability because it tells us how much money a company takes home after procuring and manufacturing its products, marketing and selling those products, and most importantly, keeping them relevant through research and development.

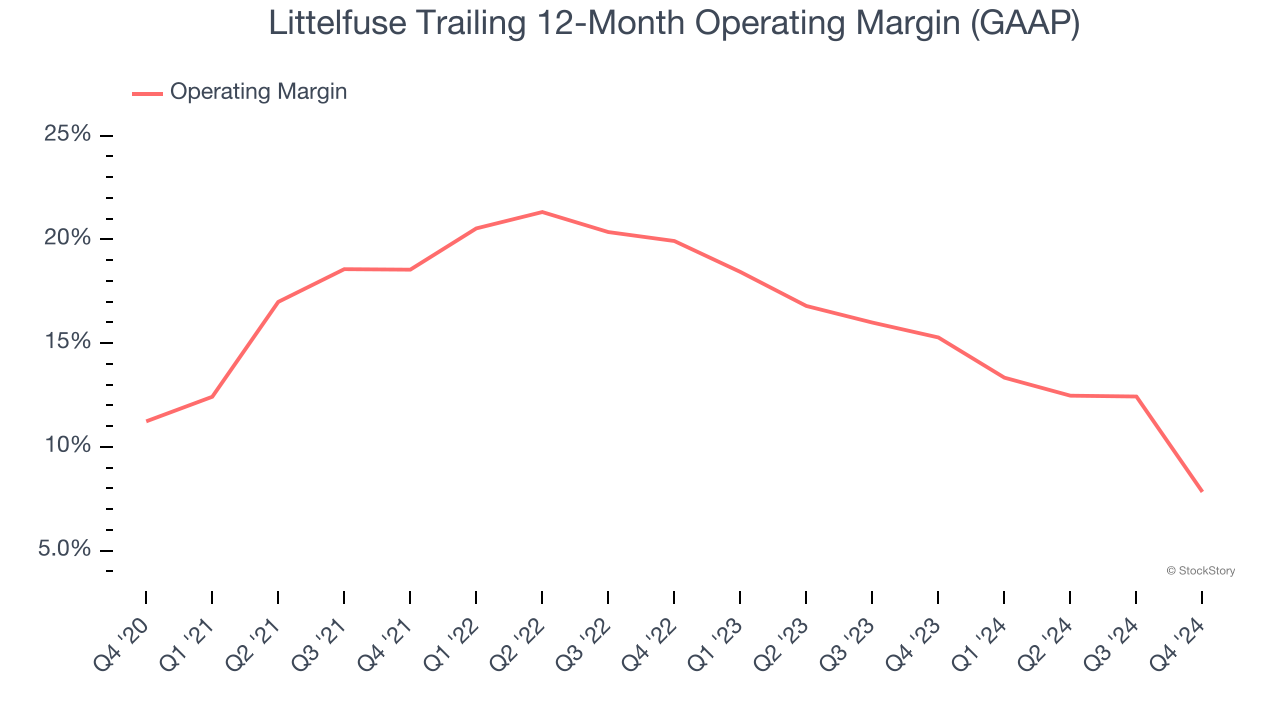

Littelfuse has been an optimally-run company over the last five years. It was one of the more profitable businesses in the industrials sector, boasting an average operating margin of 14.9%. This result isn’t surprising as its high gross margin gives it a favorable starting point.

Looking at the trend in its profitability, Littelfuse’s operating margin decreased by 3.4 percentage points over the last five years. Even though its historical margin is high, shareholders will want to see Littelfuse become more profitable in the future.

In Q4, Littelfuse generated an operating profit margin of negative 6.9%, down 19 percentage points year on year. Since Littelfuse’s operating margin decreased more than its gross margin, we can assume it was recently less efficient because expenses such as marketing, R&D, and administrative overhead increased.

Earnings Per Share

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

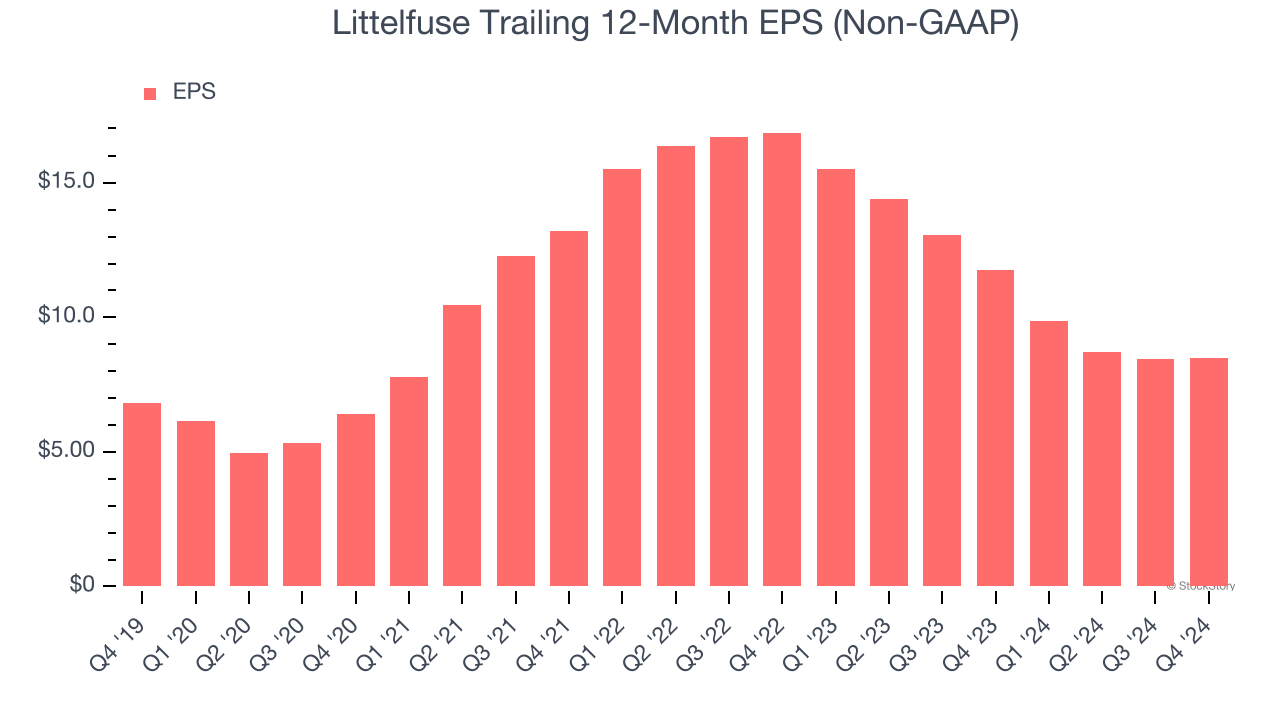

Littelfuse’s EPS grew at an unimpressive 4.5% compounded annual growth rate over the last five years, lower than its 7.8% annualized revenue growth. This tells us the company became less profitable on a per-share basis as it expanded.

Diving into the nuances of Littelfuse’s earnings can give us a better understanding of its performance. As we mentioned earlier, Littelfuse’s operating margin declined by 3.4 percentage points over the last five years. This was the most relevant factor (aside from the revenue impact) behind its lower earnings; taxes and interest expenses can also affect EPS but don’t tell us as much about a company’s fundamentals.

Like with revenue, we analyze EPS over a shorter period to see if we are missing a change in the business.

For Littelfuse, its two-year annual EPS declines of 29.1% show it’s continued to underperform. These results were bad no matter how you slice the data.

In Q4, Littelfuse reported EPS at $2.04, up from $2.02 in the same quarter last year. Despite growing year on year, this print slightly missed analysts’ estimates. Over the next 12 months, Wall Street expects Littelfuse’s full-year EPS of $8.48 to grow 19.6%.

Key Takeaways from Littelfuse’s Q4 Results

It was good to see Littelfuse narrowly top analysts’ revenue expectations this quarter. On the other hand, its EBITDA and EPS missed Wall Street’s estimates. Furthermore, EPS guidance for next quarter missed significantly. Overall, this quarter could have been better. The stock remained flat at $223 immediately following the results.

Littelfuse didn’t show it’s best hand this quarter, but does that create an opportunity to buy the stock right now? If you’re making that decision, you should consider the bigger picture of valuation, business qualities, as well as the latest earnings. We cover that in our actionable full research report which you can read here, it’s free.