Earnings results often indicate what direction a company will take in the months ahead. With Q2 behind us, let’s have a look at Kohl's (NYSE: KSS) and its peers.

General merchandise retailers–also called broadline retailers–know you’re busy and don’t want to drive around wasting time and gas, so they offer a one-stop shop. Convenience is the name of the game, so these stores may sell clothing in one section, toys in another, and home decor in a third. This concept has evolved over time from department stores to more niche concepts targeting bargain hunters or young adults, and e-commerce has forced these retailers to be extra sharp in their value propositions to consumers, whether that’s unique product or competitive prices.

The 8 general merchandise retail stocks we track reported a very strong Q2. As a group, revenues beat analysts’ consensus estimates by 2.1% while next quarter’s revenue guidance was 1.8% below.

Thankfully, share prices of the companies have been resilient as they are up 10% on average since the latest earnings results.

Best Q2: Kohl's (NYSE: KSS)

Founded as a corner grocery store in Milwaukee, Wisconsin, Kohl’s (NYSE: KSS) is a department store chain that sells clothing, cosmetics, electronics, and home goods.

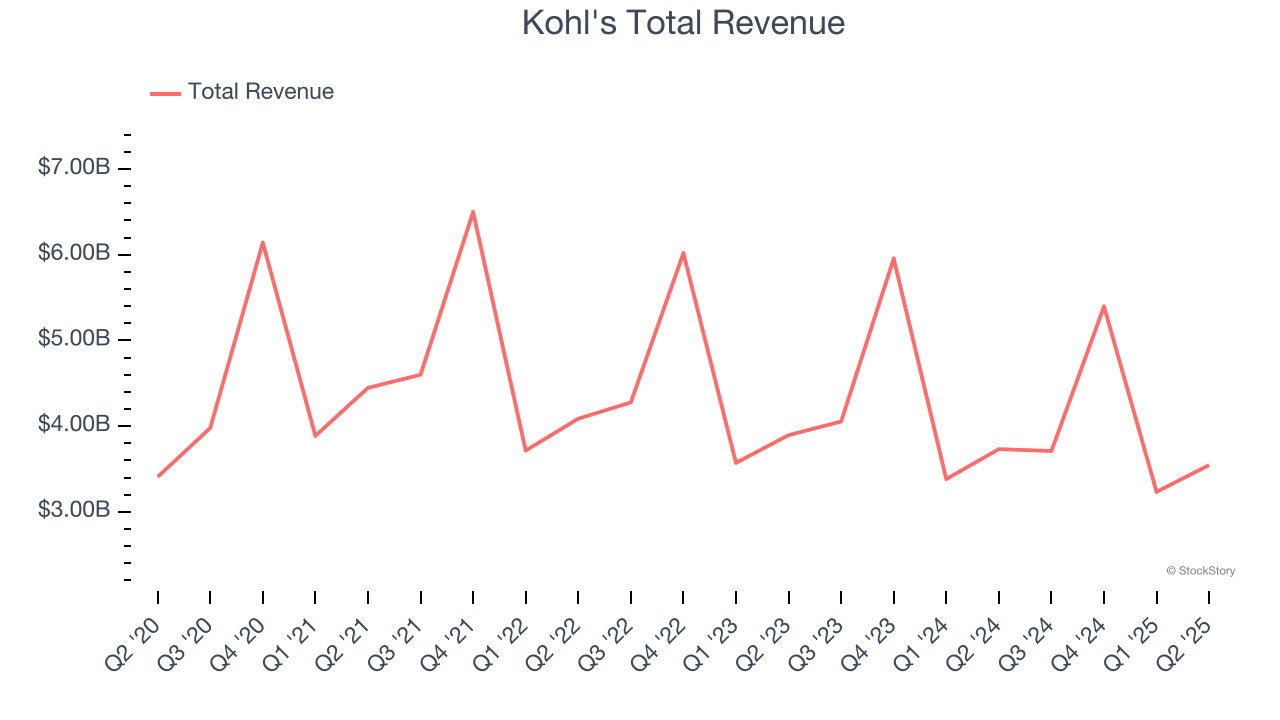

Kohl's reported revenues of $3.55 billion, down 5% year on year. This print exceeded analysts’ expectations by 1.4%. Overall, it was a stunning quarter for the company with a beat of analysts’ EPS and gross margin estimates.

Michael Bender, Kohl’s Interim Chief Executive Officer, said “Kohl’s second quarter performance is a testament to the progress we are making against our 2025 initiatives. This resulted in sales performance that came in ahead of our expectations. While it is clear that these initiatives are beginning to resonate with our customers, our team remains focused on delivering progressive improvement throughout the remainder of the year against a challenging economic backdrop.

Kohl's delivered the slowest revenue growth of the whole group. Interestingly, the stock is up 17.7% since reporting and currently trades at $15.34.

Is now the time to buy Kohl's? Access our full analysis of the earnings results here, it’s free.

Dillard's (NYSE: DDS)

With stores located largely in the Southern and Western US, Dillard’s (NYSE: DDS) is a department store chain that sells clothing, cosmetics, accessories, and home goods.

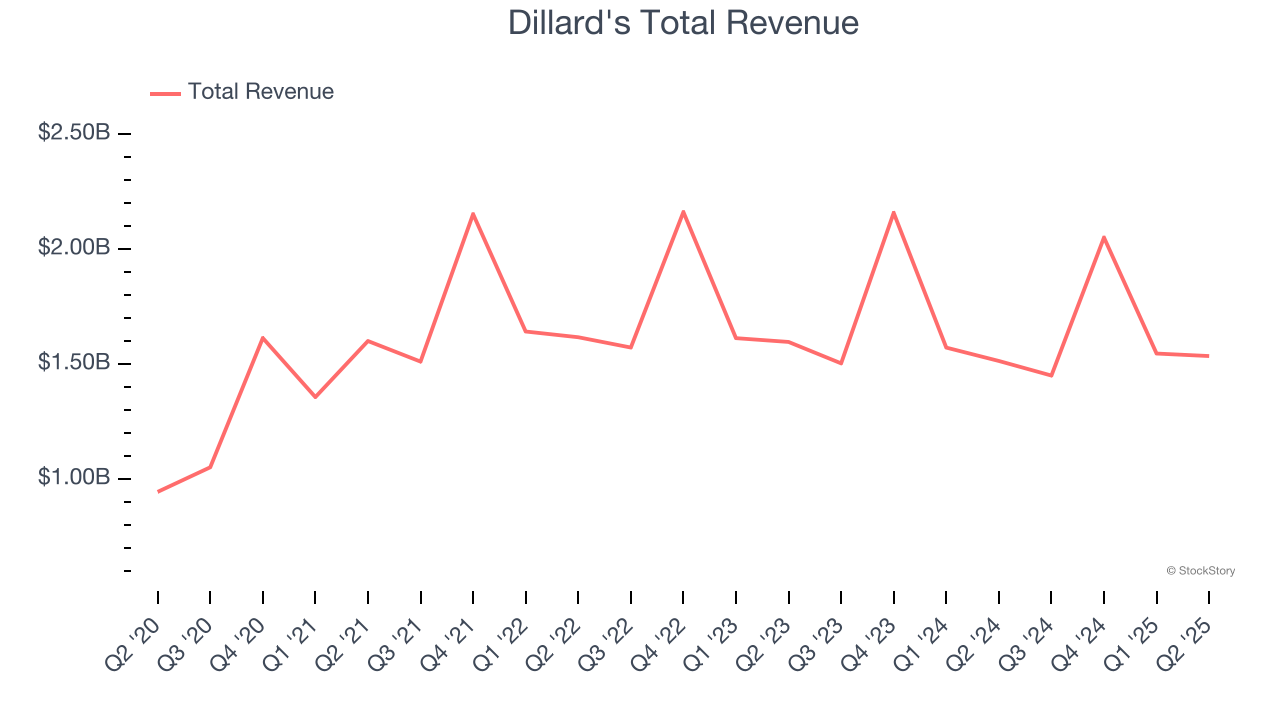

Dillard's reported revenues of $1.54 billion, up 1.4% year on year, outperforming analysts’ expectations by 2.6%. The business had a stunning quarter with a beat of analysts’ EPS and EBITDA estimates.

The market seems happy with the results as the stock is up 23.3% since reporting. It currently trades at $613.76.

Is now the time to buy Dillard's? Access our full analysis of the earnings results here, it’s free.

TJX (NYSE: TJX)

Initially based on a strategy of buying excess inventory from manufacturers or other retailers, TJX (NYSE: TJX) is an off-price retailer that sells brand-name apparel and other goods at prices much lower than department stores.

TJX reported revenues of $14.4 billion, up 6.9% year on year, exceeding analysts’ expectations by 1.7%. It was a satisfactory quarter as it also posted an impressive beat of analysts’ EBITDA estimates but EPS guidance for next quarter missing analysts’ expectations.

Interestingly, the stock is up 6.1% since the results and currently trades at $142.85.

Read our full analysis of TJX’s results here.

Macy's (NYSE: M)

With a storied history that began with its 1858 founding, Macy’s (NYSE: M) is a department store chain that sells clothing, cosmetics, accessories, and home goods.

Macy's reported revenues of $5.00 billion, down 1.9% year on year. This number surpassed analysts’ expectations by 2.7%. Overall, it was an exceptional quarter as it also produced a beat of analysts’ EPS estimates and a solid beat of analysts’ EBITDA estimates.

Macy's had the weakest full-year guidance update among its peers. The stock is up 32.1% since reporting and currently trades at $17.84.

Read our full, actionable report on Macy's here, it’s free.

Five Below (NASDAQ: FIVE)

Often facilitating a treasure hunt shopping experience, Five Below (NASDAQ: FIVE) is an American discount retailer that sells a variety of products from mobile phone cases to candy to sports equipment for largely $5 or less.

Five Below reported revenues of $1.03 billion, up 23.7% year on year. This print topped analysts’ expectations by 3.5%. It was an exceptional quarter as it also put up EPS guidance for next quarter exceeding analysts’ expectations and an impressive beat of analysts’ EBITDA estimates.

Five Below scored the biggest analyst estimates beat and fastest revenue growth among its peers. The stock is up 7% since reporting and currently trades at $154.70.

Read our full, actionable report on Five Below here, it’s free.

Market Update

Thanks to the Fed’s rate hikes in 2022 and 2023, inflation has been on a steady path downward, easing back toward that 2% sweet spot. Fortunately (miraculously to some), all this tightening didn’t send the economy tumbling into a recession, so here we are, cautiously celebrating a soft landing. The cherry on top? Recent rate cuts (half a point in September 2024, a quarter in November) have propped up markets, especially after Trump’s November win lit a fire under major indices and sent them to all-time highs. However, there’s still plenty to ponder — tariffs, corporate tax cuts, and what 2025 might hold for the economy.

Want to invest in winners with rock-solid fundamentals? Check out our 9 Best Market-Beating Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.