Over the past six months, AvidXchange has been a great trade, beating the S&P 500 by 7.1%. Its stock price has climbed to $9.94, representing a healthy 28.3% increase. This run-up might have investors contemplating their next move.

Is it too late to buy AVDX? Find out in our full research report, it’s free for active Edge members.

Why Does AVDX Stock Spark Debate?

Born from the frustration of paper-based accounting processes in the early 2000s, AvidXchange (NASDAQ: AVDX) provides accounts payable automation software and payment solutions that help middle-market businesses digitize and streamline their invoice processing and payments.

Two Positive Attributes:

1. Skyrocketing Revenue Shows Strong Momentum

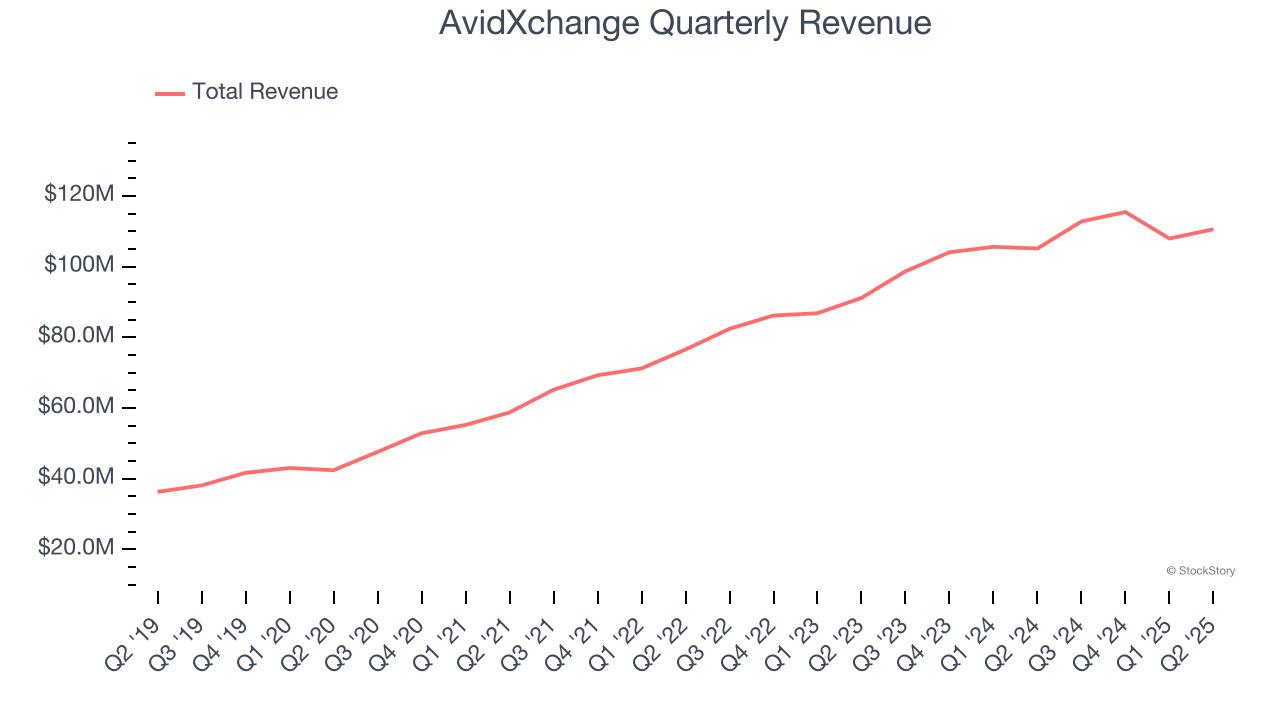

Reviewing a company’s long-term sales performance reveals insights into its quality. Any business can have short-term success, but a top-tier one grows for years.

Thankfully, AvidXchange’s 22% annualized revenue growth over the last five years was exceptional. Its growth surpassed the average financials company and shows its offerings resonate with customers.

2. Outstanding Long-Term EPS Growth

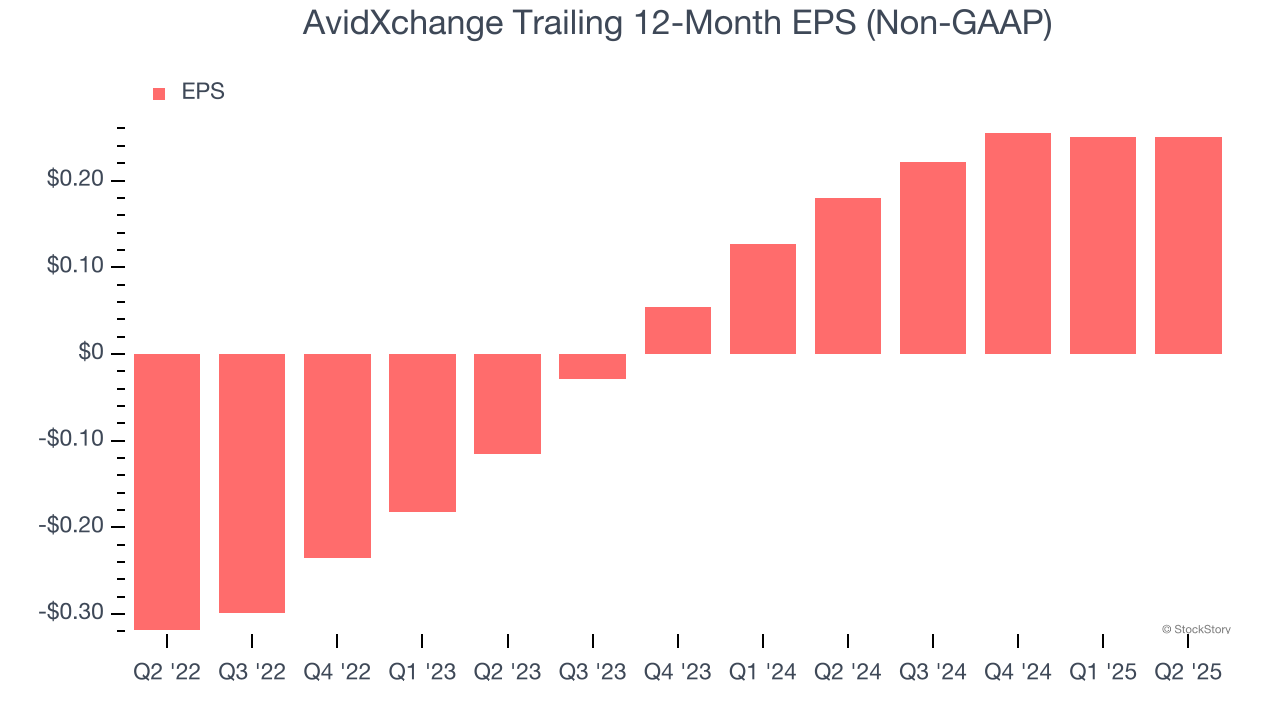

Analyzing the change in earnings per share (EPS) shows whether a company's incremental sales were profitable – for example, revenue could be inflated through excessive spending on advertising and promotions.

AvidXchange’s full-year EPS flipped from negative to positive over the last three years. This is a good sign and shows it’s at an inflection point.

One Reason to be Careful:

Previous Growth Initiatives Have Lost Money

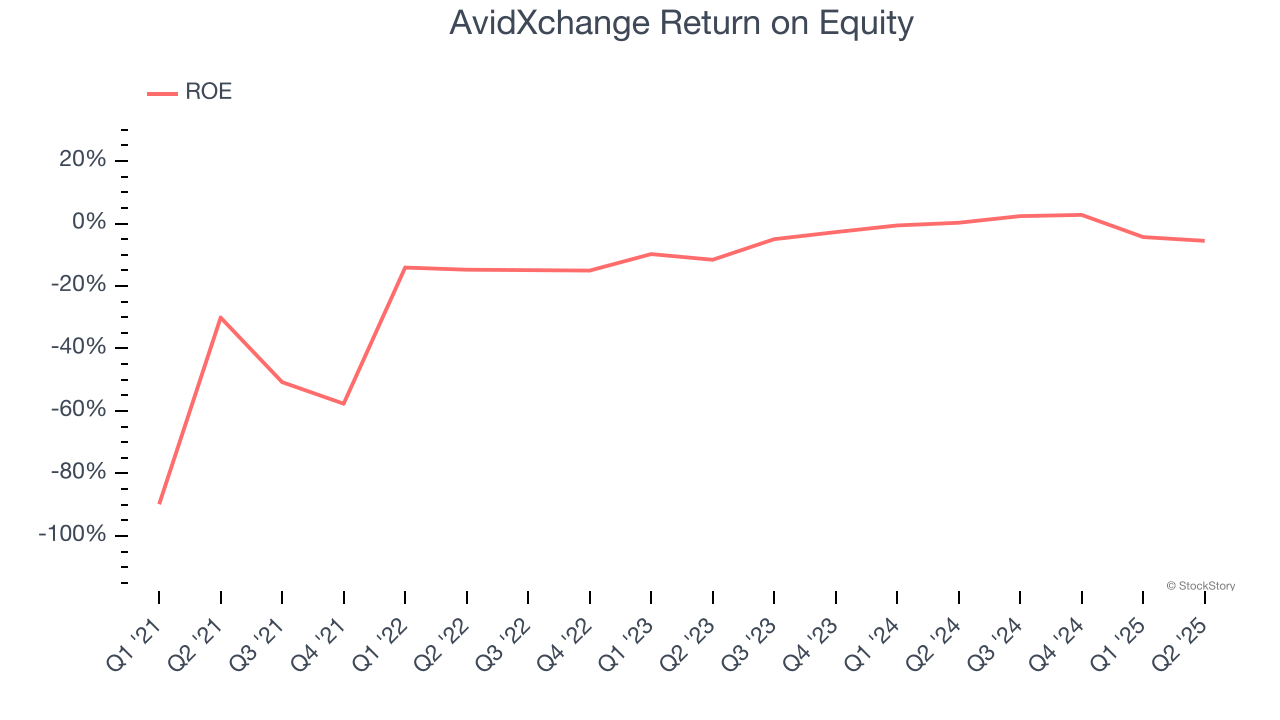

Return on equity, or ROE, quantifies bank profitability relative to shareholder equity - an essential capital source for these institutions. Over extended periods, superior ROE performance drives faster shareholder wealth compounding through reinvestment, share repurchases, and dividend growth.

Over the last five years, AvidXchange has averaged an ROE of negative 17.9%, a disappointing result relative to the majority of firms putting up 25%+. But we wouldn’t write off AvidXchange given its success in other measures of financial health.

Final Judgment

AvidXchange’s positive characteristics outweigh the negatives, and with its shares outperforming the market lately, the stock trades at 32.6× forward P/E (or $9.94 per share). Is now the time to initiate a position? See for yourself in our in-depth research report, it’s free for active Edge members.

High-Quality Stocks for All Market Conditions

Donald Trump’s April 2025 "Liberation Day" tariffs sent markets into a tailspin, but stocks have since rebounded strongly, proving that knee-jerk reactions often create the best buying opportunities.

The smart money is already positioning for the next leg up. Don’t miss out on the recovery - check out our Top 5 Growth Stocks for this month. This is a curated list of our High Quality stocks that have generated a market-beating return of 183% over the last five years (as of March 31st 2025).

Stocks that made our list in 2020 include now familiar names such as Nvidia (+1,545% between March 2020 and March 2025) as well as under-the-radar businesses like the once-micro-cap company Kadant (+351% five-year return). Find your next big winner with StockStory today.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.