Advance Auto Parts has been on fire lately. In the past six months alone, the company’s stock price has rocketed 50.3%, reaching $49.41 per share. This run-up might have investors contemplating their next move.

Is there a buying opportunity in Advance Auto Parts, or does it present a risk to your portfolio? Dive into our full research report to see our analyst team’s opinion, it’s free for active Edge members.

Why Do We Think Advance Auto Parts Will Underperform?

We’re happy investors have made money, but we don't have much confidence in Advance Auto Parts. Here are three reasons there are better opportunities than AAP and a stock we'd rather own.

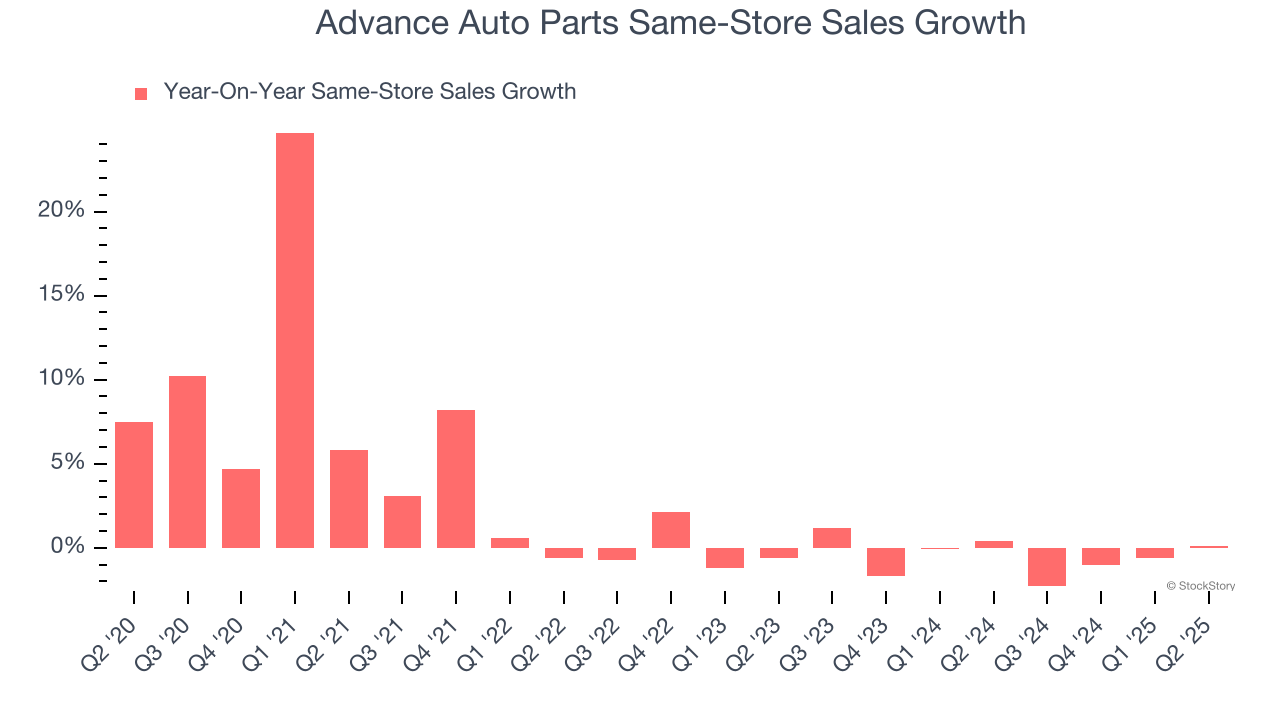

1. Flat Same-Store Sales Indicate Weak Demand

Same-store sales is an industry measure of whether revenue is growing at existing stores, and it is driven by customer visits (often called traffic) and the average spending per customer (ticket).

Advance Auto Parts’s demand within its existing locations has barely increased over the last two years as its same-store sales were flat.

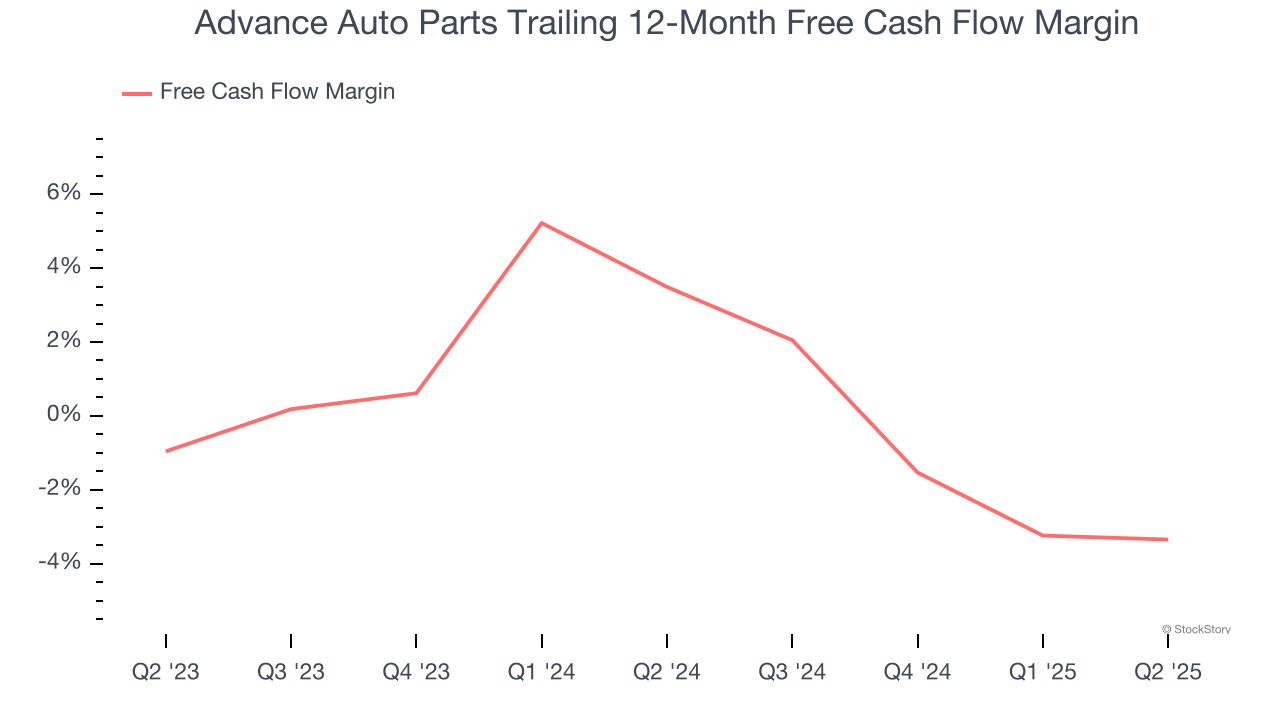

2. Free Cash Flow Margin Dropping

If you’ve followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills.

As you can see below, Advance Auto Parts’s margin dropped by 6.8 percentage points over the last year. Almost any movement in the wrong direction is undesirable because of its already low cash conversion. If the trend continues, it could signal it’s in the middle of a big investment cycle. Advance Auto Parts’s free cash flow margin for the trailing 12 months was negative 3.3%.

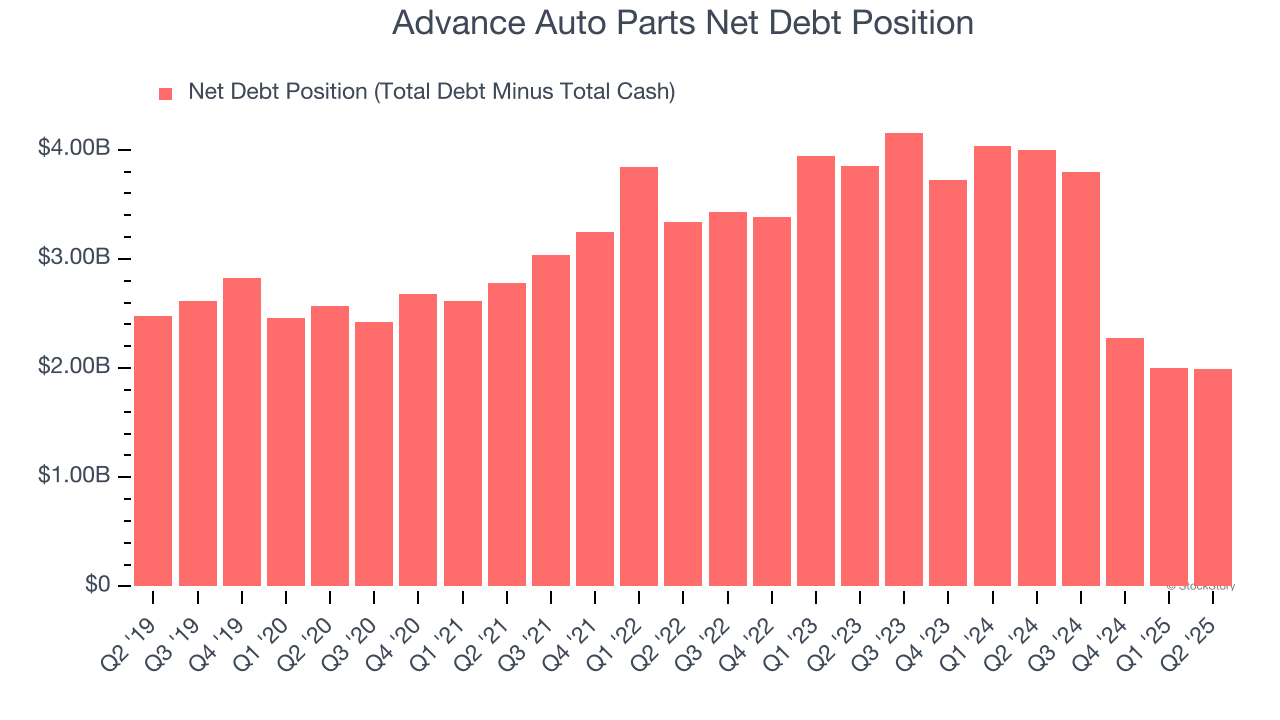

3. Short Cash Runway Exposes Shareholders to Potential Dilution

As long-term investors, the risk we care about most is the permanent loss of capital, which can happen when a company goes bankrupt or raises money from a disadvantaged position. This is separate from short-term stock price volatility, something we are much less bothered by.

Advance Auto Parts burned through $292.5 million of cash over the last year, and its $3.65 billion of debt exceeds the $1.66 billion of cash on its balance sheet. This is a deal breaker for us because indebted loss-making companies spell trouble.

Unless the Advance Auto Parts’s fundamentals change quickly, it might find itself in a position where it must raise capital from investors to continue operating. Whether that would be favorable is unclear because dilution is a headwind for shareholder returns.

We remain cautious of Advance Auto Parts until it generates consistent free cash flow or any of its announced financing plans materialize on its balance sheet.

Final Judgment

Advance Auto Parts doesn’t pass our quality test. After the recent rally, the stock trades at 20× forward P/E (or $49.41 per share). At this valuation, there’s a lot of good news priced in - you can find more timely opportunities elsewhere. We’d suggest looking at one of Charlie Munger’s all-time favorite businesses.

Stocks We Would Buy Instead of Advance Auto Parts

Donald Trump’s April 2025 "Liberation Day" tariffs sent markets into a tailspin, but stocks have since rebounded strongly, proving that knee-jerk reactions often create the best buying opportunities.

The smart money is already positioning for the next leg up. Don’t miss out on the recovery - check out our Top 6 Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 183% over the last five years (as of March 31st 2025).

Stocks that made our list in 2020 include now familiar names such as Nvidia (+1,545% between March 2020 and March 2025) as well as under-the-radar businesses like the once-micro-cap company Kadant (+351% five-year return). Find your next big winner with StockStory today.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.