Global investment bank Goldman Sachs (NYSE: GS) reported Q3 CY2025 results exceeding the market’s revenue expectations, with sales up 19.6% year on year to $15.18 billion. Its GAAP profit of $12.25 per share was 10.5% above analysts’ consensus estimates.

Is now the time to buy Goldman Sachs? Find out by accessing our full research report, it’s free for active Edge members.

Goldman Sachs (GS) Q3 CY2025 Highlights:

- Revenue: $15.18 billion vs analyst estimates of $14.21 billion (19.6% year-on-year growth, 6.8% beat)

- Pre-tax Profit: $5.39 billion (35.5% margin, 35.2% year-on-year growth)

- EPS (GAAP): $12.25 vs analyst estimates of $11.09 (10.5% beat)

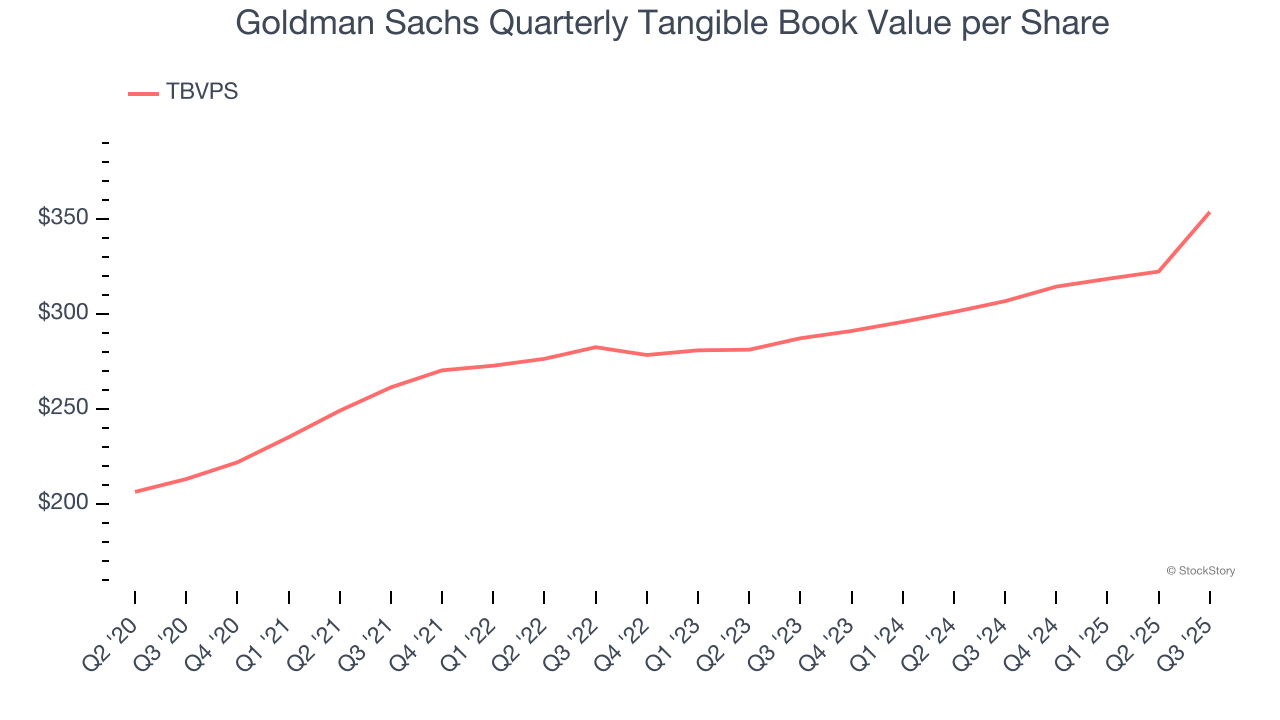

- Tangible Book Value per Share: $353.79 vs analyst estimates of $329.88 (15.3% year-on-year growth, 7.2% beat)

- Market Capitalization: $249 billion

Company Overview

Founded in 1869 as a small commercial paper business in New York City, Goldman Sachs (NYSE: GS) is a global financial institution that provides investment banking, securities, asset management, and consumer banking services to corporations, governments, and individuals.

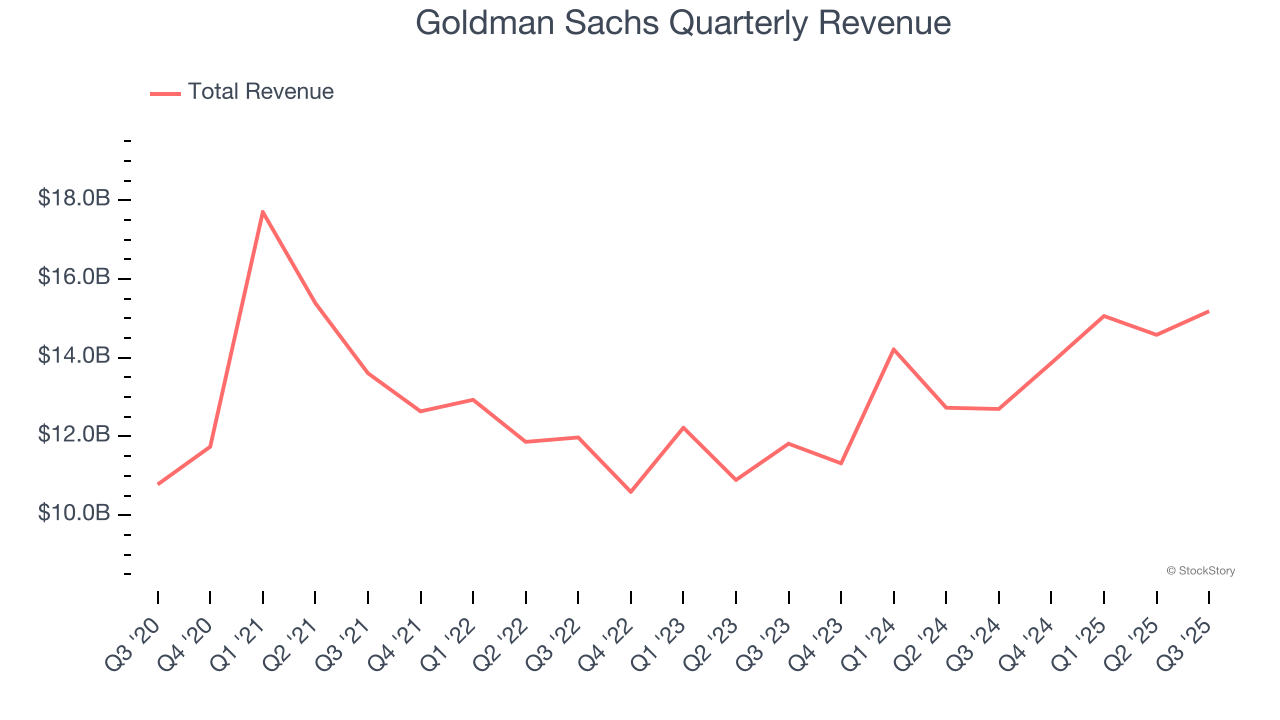

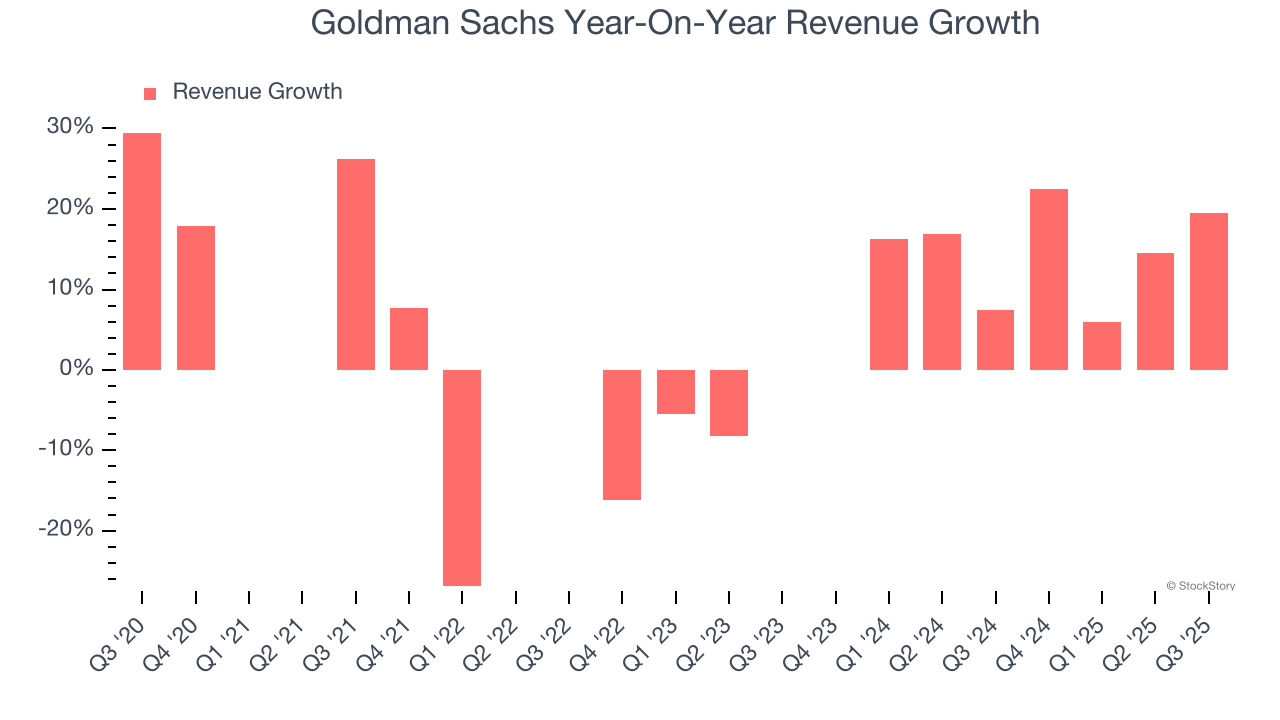

Revenue Growth

Examining a company’s long-term performance can provide clues about its quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul. Unfortunately, Goldman Sachs’s 6.5% annualized revenue growth over the last five years was mediocre. This wasn’t a great result compared to the rest of the financials sector, but there are still things to like about Goldman Sachs.

We at StockStory place the most emphasis on long-term growth, but within financials, a half-decade historical view may miss recent interest rate changes, market returns, and industry trends. Goldman Sachs’s annualized revenue growth of 13.5% over the last two years is above its five-year trend, suggesting its demand recently accelerated.  Note: Quarters not shown were determined to be outliers, impacted by outsized investment gains/losses that are not indicative of the recurring fundamentals of the business.

Note: Quarters not shown were determined to be outliers, impacted by outsized investment gains/losses that are not indicative of the recurring fundamentals of the business.

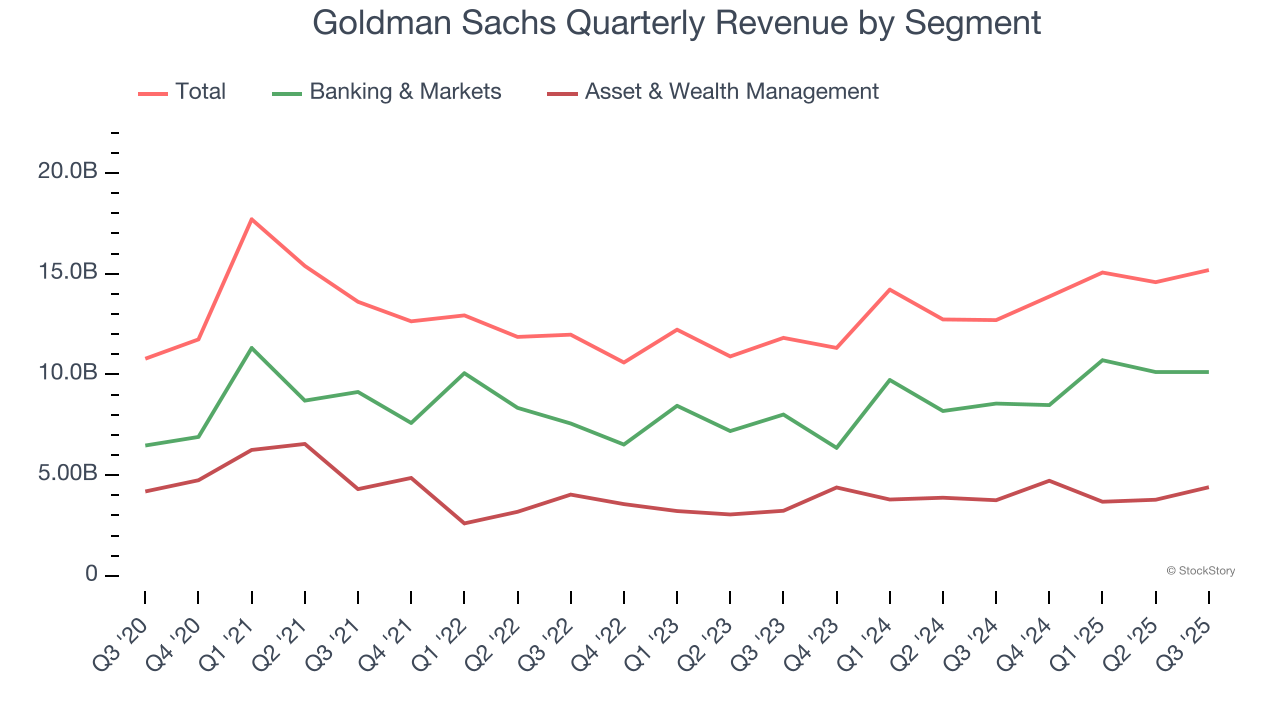

We can better understand the company’s revenue dynamics by analyzing its most important segments, Banking & Markets and Asset & Wealth Management, which are 66.6% and 29% of total revenue. Banking & Markets revenue grew by 6.4% and 14.3% annually over the past five and two years, respectively, both in line with its total revenue. At the same time, Asset & Wealth Management revenue increased by 6.7% and 12.7% per year over the past five and two years, respectively. These results aligned with its total revenue performance.

This quarter, Goldman Sachs reported year-on-year revenue growth of 19.6%, and its $15.18 billion of revenue exceeded Wall Street’s estimates by 6.8%.

Today’s young investors won’t have read the timeless lessons in Gorilla Game: Picking Winners In High Technology because it was written more than 20 years ago when Microsoft and Apple were first establishing their supremacy. But if we apply the same principles, then enterprise software stocks leveraging their own generative AI capabilities may well be the Gorillas of the future. So, in that spirit, we are excited to present our Special Free Report on a profitable, fast-growing enterprise software stock that is already riding the automation wave and looking to catch the generative AI next.

Tangible Book Value Per Share (TBVPS)

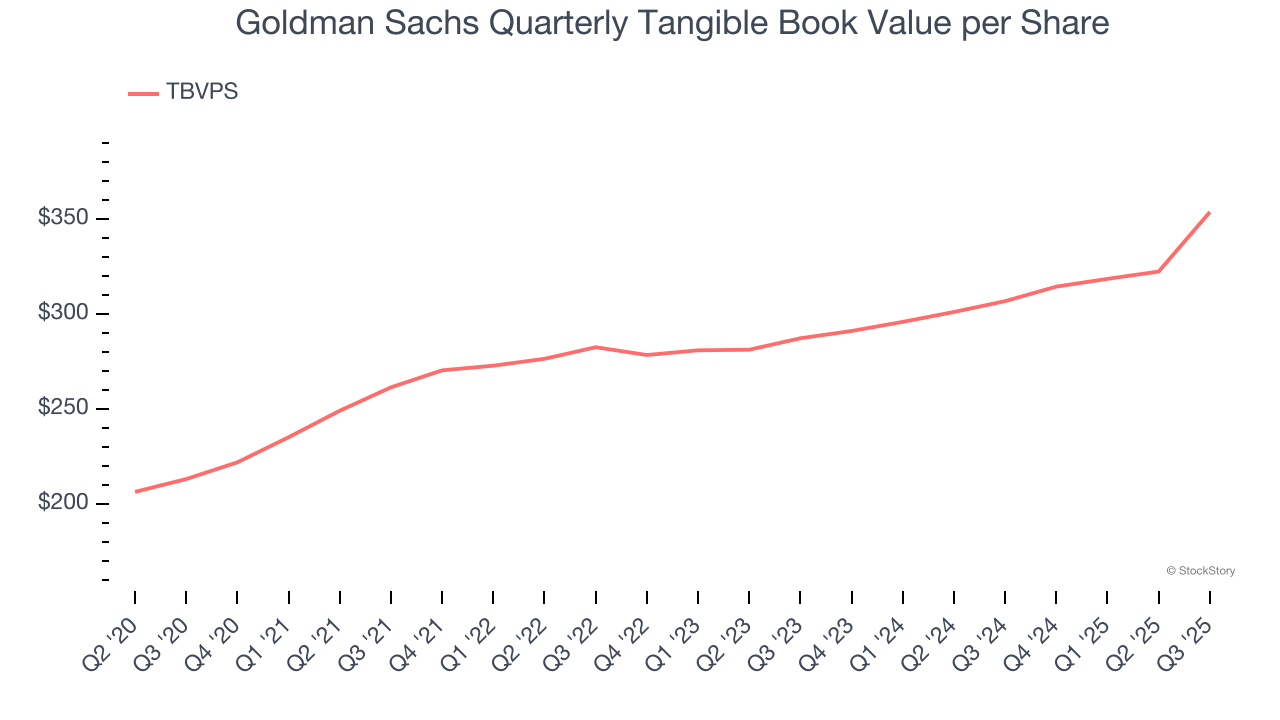

Financial firms profit by providing a wide range of services, making them fundamentally balance sheet-driven enterprises with multiple intermediation roles. Market participants emphasize balance sheet quality and sustained book value growth when evaluating these multifaceted institutions.

When analyzing this sector, tangible book value per share (TBVPS) takes precedence over many other metrics. This measure isolates genuine per-share value and provides insight into the institution’s capital position across diverse operations. Traditional metrics like EPS are helpful but face distortion from the complexity of diversified operations, M&A activity, and various accounting rules that can obscure true performance across multiple business lines.

Goldman Sachs’s TBVPS grew at a solid 10.7% annual clip over the last five years. The last two years show a similar trajectory as TBVPS grew by 11% annually from $287.32 to $353.79 per share.

Tangible Book Value Per Share (TBVPS)

The balance sheet drives profitability for financial firms since earnings flow from managing diverse assets and liabilities across multiple business lines. As such, valuations for these companies concentrate on capital strength and sustainable equity accumulation potential across their varied operations.

This explains why tangible book value per share (TBVPS) is a premier metric for the sector. TBVPS provides concrete per-share net worth that investors can trust when evaluating companies with complex, multi-faceted business models. Other (and more commonly known) per-share metrics like EPS can sometimes be murky due to the complexity of multiple business lines, M&A activity, or accounting rules that vary across different financial services segments.

Goldman Sachs’s TBVPS grew at a solid 10.7% annual clip over the last five years. The last two years show a similar trajectory as TBVPS grew by 11% annually from $287.32 to $353.79 per share.

Key Takeaways from Goldman Sachs’s Q3 Results

We were impressed by how significantly Goldman Sachs blew past analysts’ Banking & Markets segment expectations this quarter. We were also excited its Asset & Wealth Management segment outperformed Wall Street’s estimates by a wide margin. Zooming out, we think this was a good print with some key areas of upside. Investors were likely hoping for more, and shares traded down 3.2% to $762.50 immediately after reporting.

So should you invest in Goldman Sachs right now? When making that decision, it’s important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it’s free for active Edge members.