Over the past six months, Okta’s stock price fell to $90.21. Shareholders have lost 10.6% of their capital, which is disappointing considering the S&P 500 has climbed by 22.9%. This may have investors wondering how to approach the situation.

Is there a buying opportunity in Okta, or does it present a risk to your portfolio? See what our analysts have to say in our full research report, it’s free for active Edge members.

Why Is Okta Not Exciting?

Even though the stock has become cheaper, we don't have much confidence in Okta. Here are three reasons we avoid OKTA and a stock we'd rather own.

1. Weak Billings Point to Soft Demand

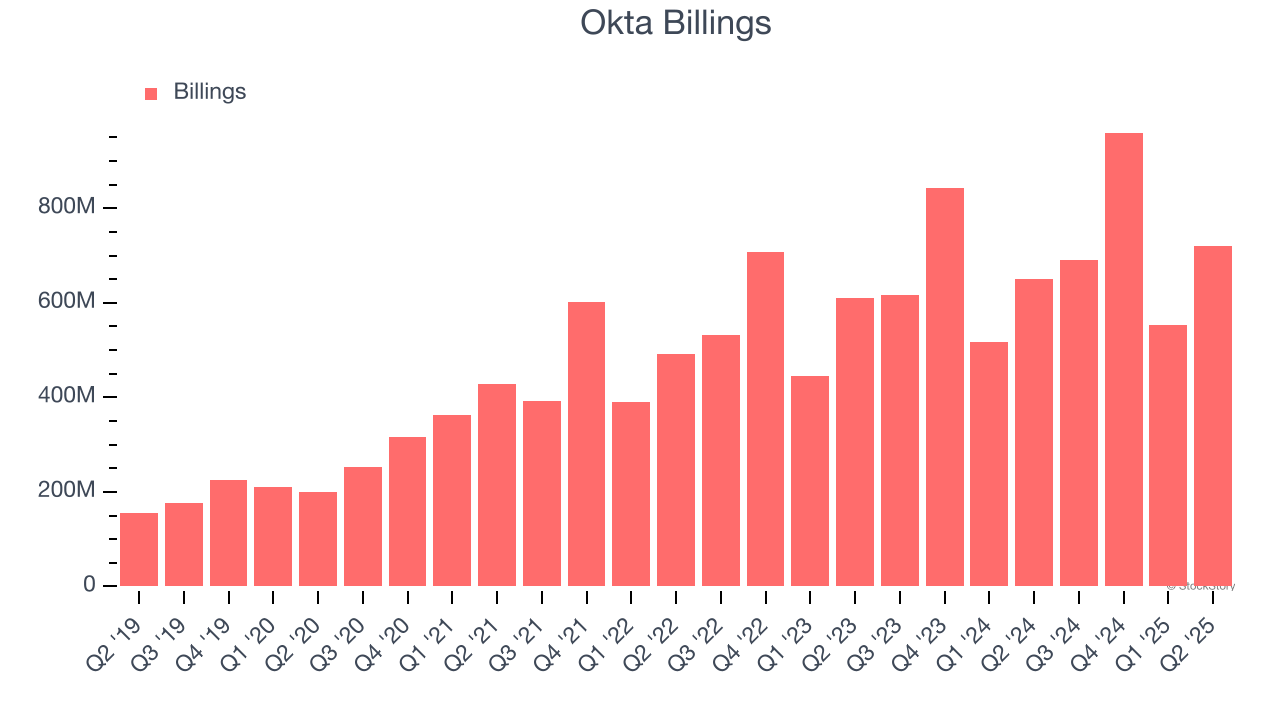

Billings is a non-GAAP metric that is often called “cash revenue” because it shows how much money the company has collected from customers in a certain period. This is different from revenue, which must be recognized in pieces over the length of a contract.

Okta’s billings came in at $720 million in Q2, and over the last four quarters, its year-on-year growth averaged 10.9%. This performance was underwhelming and suggests that increasing competition is causing challenges in acquiring/retaining customers.

2. Projected Revenue Growth Is Slim

Forecasted revenues by Wall Street analysts signal a company’s potential. Predictions may not always be accurate, but accelerating growth typically boosts valuation multiples and stock prices while slowing growth does the opposite.

Over the next 12 months, sell-side analysts expect Okta’s revenue to rise by 8.7%, a deceleration versus its 31.5% annualized growth for the past five years. This projection is underwhelming and indicates its products and services will see some demand headwinds.

3. Cash Flow Margin Set to Decline

If you’ve followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills.

Over the next year, analysts predict Okta’s cash conversion will fall. Their consensus estimates imply its free cash flow margin of 30.3% for the last 12 months will decrease to 27.7%.

Final Judgment

Okta’s business quality ultimately falls short of our standards. After the recent drawdown, the stock trades at 5.4× forward price-to-sales (or $90.21 per share). While this valuation is fair, the upside isn’t great compared to the potential downside. We're pretty confident there are superior stocks to buy right now. Let us point you toward the Amazon and PayPal of Latin America.

High-Quality Stocks for All Market Conditions

Trump’s April 2025 tariff bombshell triggered a massive market selloff, but stocks have since staged an impressive recovery, leaving those who panic sold on the sidelines.

Take advantage of the rebound by checking out our Top 9 Market-Beating Stocks. This is a curated list of our High Quality stocks that have generated a market-beating return of 183% over the last five years (as of March 31st 2025).

Stocks that made our list in 2020 include now familiar names such as Nvidia (+1,545% between March 2020 and March 2025) as well as under-the-radar businesses like the once-small-cap company Exlservice (+354% five-year return). Find your next big winner with StockStory today.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.