As the Q2 earnings season wraps, let’s dig into this quarter’s best and worst performers in the healthcare technology for providers industry, including Premier (NASDAQ: PINC) and its peers.

The healthcare technology sector provides software and data analytics to help hospitals and clinics streamline operations and improve patient outcomes, often through value-based care models. Future growth is expected as providers prioritize digital transformation to manage rising costs and patient demands. Tailwinds include the adoption of AI-driven tools and government incentives for digitization. There challenges as well, including long sales cycles and slow adoption by providers, who may be resistance to change. Tightening hospital budgets and cybersecurity threats are additional risks that could slow adoption.

The 5 healthcare technology for providers stocks we track reported a satisfactory Q2. As a group, revenues beat analysts’ consensus estimates by 4% while next quarter’s revenue guidance was in line.

Luckily, healthcare technology for providers stocks have performed well with share prices up 12.3% on average since the latest earnings results.

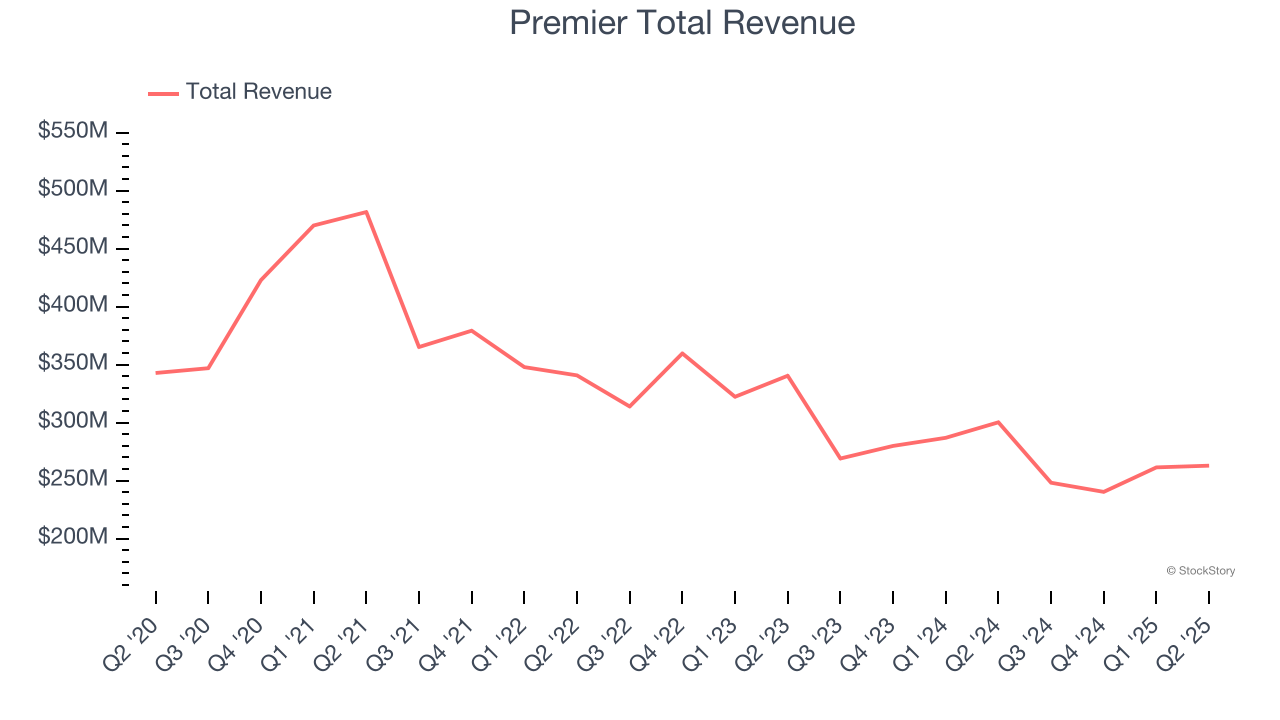

Premier (NASDAQ: PINC)

Operating one of the largest healthcare group purchasing organizations in the United States with over 4,350 hospital members, Premier (NASDAQ: PINC) is a technology-driven healthcare improvement company that helps hospitals, health systems, and other providers reduce costs and improve clinical outcomes.

Premier reported revenues of $262.9 million, down 12.5% year on year. This print exceeded analysts’ expectations by 5%. Overall, it was a strong quarter for the company with a beat of analysts’ EPS estimates and an impressive beat of analysts’ revenue estimates.

"I'm pleased to report that we had a strong finish to the year despite the contract renewal headwinds, which are now mostly behind us. Our overall revenue and profitability for the year exceeded our expectations largely due to better-than-anticipated results in our Supply Chain Services segment," said Michael J. Alkire, Premier's President and CEO.

Interestingly, the stock is up 14.5% since reporting and currently trades at $28.

Is now the time to buy Premier? Access our full analysis of the earnings results here, it’s free for active Edge members.

Best Q2: Omnicell (NASDAQ: OMCL)

Driven by the vision of an "Autonomous Pharmacy" with zero medication errors, Omnicell (NASDAQ: OMCL) provides medication management automation and adherence tools that help healthcare systems and pharmacies reduce errors and improve efficiency.

Omnicell reported revenues of $290.6 million, up 5% year on year, outperforming analysts’ expectations by 4.9%. The business had a very strong quarter with a beat of analysts’ EPS and full-year EPS guidance estimates.

However, the results were likely priced into the stock as it’s traded sideways since reporting. Shares currently sit at $29.69.

Is now the time to buy Omnicell? Access our full analysis of the earnings results here, it’s free for active Edge members.

Weakest Q2: Evolent Health (NYSE: EVH)

Founded in 2011 to transform how healthcare is delivered to patients with complex needs, Evolent Health (NYSE: EVH) provides specialty care management services and technology solutions that help health plans and providers deliver better care for patients with complex conditions.

Evolent Health reported revenues of $444.3 million, down 31.3% year on year, falling short of analysts’ expectations by 3.3%. It was a softer quarter as it posted full-year revenue guidance missing analysts’ expectations and revenue guidance for next quarter missing analysts’ expectations.

Evolent Health delivered the weakest performance against analyst estimates and slowest revenue growth in the group. As expected, the stock is down 20.4% since the results and currently trades at $7.71.

Read our full analysis of Evolent Health’s results here.

Astrana Health (NASDAQ: ASTH)

Formerly known as Apollo Medical Holdings until early 2024, Astrana Health (NASDAQ: ASTH) operates a technology-powered healthcare platform that enables physicians to deliver coordinated care while successfully participating in value-based payment models.

Astrana Health reported revenues of $654.8 million, up 34.7% year on year. This print topped analysts’ expectations by 2.7%. It was a strong quarter as it also logged revenue guidance for next quarter exceeding analysts’ expectations and a beat of analysts’ EPS estimates.

Astrana Health pulled off the fastest revenue growth and highest full-year guidance raise among its peers. The stock is up 38.2% since reporting and currently trades at $29.65.

Read our full, actionable report on Astrana Health here, it’s free for active Edge members.

Privia Health (NASDAQ: PRVA)

Operating in 13 states and the District of Columbia with over 4,300 providers serving more than 4.8 million patients, Privia Health (NASDAQ: PRVA) is a technology-driven company that helps physicians optimize their practices, improve patient experiences, and transition to value-based care models.

Privia Health reported revenues of $521.2 million, up 23.4% year on year. This result beat analysts’ expectations by 10.9%. Overall, it was a strong quarter as it also recorded a solid beat of analysts’ revenue estimates and a beat of analysts’ EPS estimates.

Privia Health achieved the biggest analyst estimates beat but had the weakest full-year guidance update among its peers. The stock is up 29.5% since reporting and currently trades at $25.63.

Read our full, actionable report on Privia Health here, it’s free for active Edge members.

Market Update

In response to the Fed’s rate hikes in 2022 and 2023, inflation has been gradually trending down from its post-pandemic peak, trending closer to the Fed’s 2% target. Despite higher borrowing costs, the economy has avoided flashing recessionary signals. This is the much-desired soft landing that many investors hoped for. The recent rate cuts (0.5% in September and 0.25% in November 2024) have bolstered the stock market, making 2024 a strong year for equities. Donald Trump’s presidential win in November sparked additional market gains, sending indices to record highs in the days following his victory. However, debates continue over possible tariffs and corporate tax adjustments, raising questions about economic stability in 2025.

Want to invest in winners with rock-solid fundamentals? Check out our 9 Best Market-Beating Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.