Over the past six months, Voya Financial has been a great trade, beating the S&P 500 by 8.1%. Its stock price has climbed to $75.77, representing a healthy 31.3% increase. This was partly due to its solid quarterly results, and the run-up might have investors contemplating their next move.

Is now the time to buy Voya Financial, or should you be careful about including it in your portfolio? Get the full breakdown from our expert analysts, it’s free for active Edge members.

Why Is Voya Financial Not Exciting?

We’re glad investors have benefited from the price increase, but we're sitting this one out for now. Here are three reasons why VOYA doesn't excite us and a stock we'd rather own.

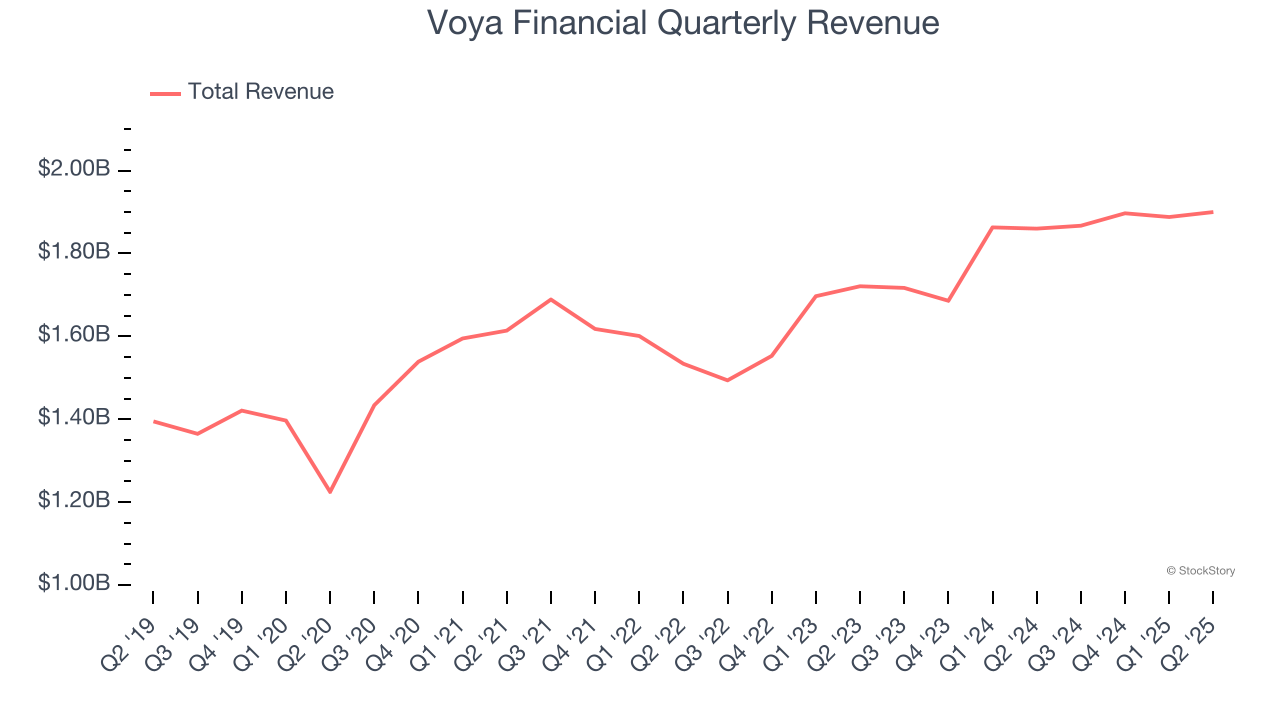

1. Long-Term Revenue Growth Disappoints

Reviewing a company’s long-term sales performance reveals insights into its quality. Any business can put up a good quarter or two, but many enduring ones grow for years.

Unfortunately, Voya Financial’s 6.9% annualized revenue growth over the last five years was mediocre. This was below our standard for the financials sector.

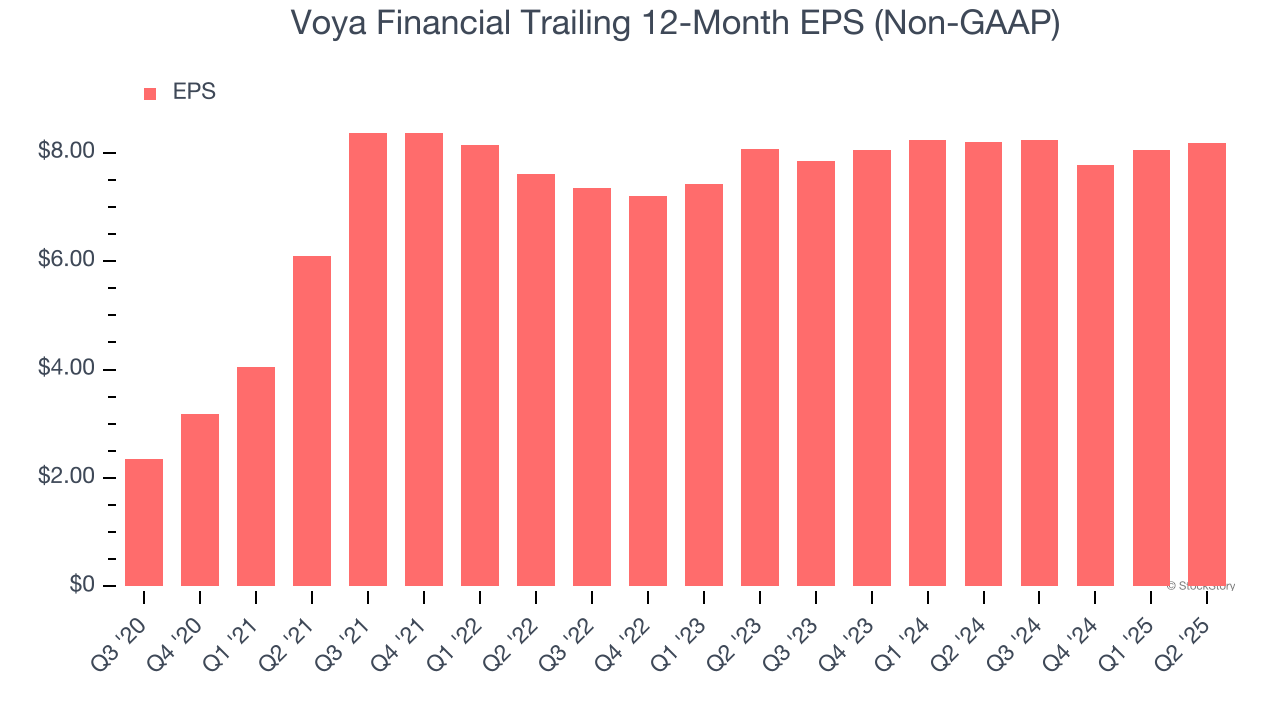

2. EPS Growth Has Stalled Over the Last Two Years

Although long-term earnings trends give us the big picture, we like to analyze EPS over a shorter period to see if we are missing a change in the business.

Voya Financial’s flat EPS over the last two years was worse than its 8.1% annualized revenue growth. This tells us the company became less profitable on a per-share basis as it expanded.

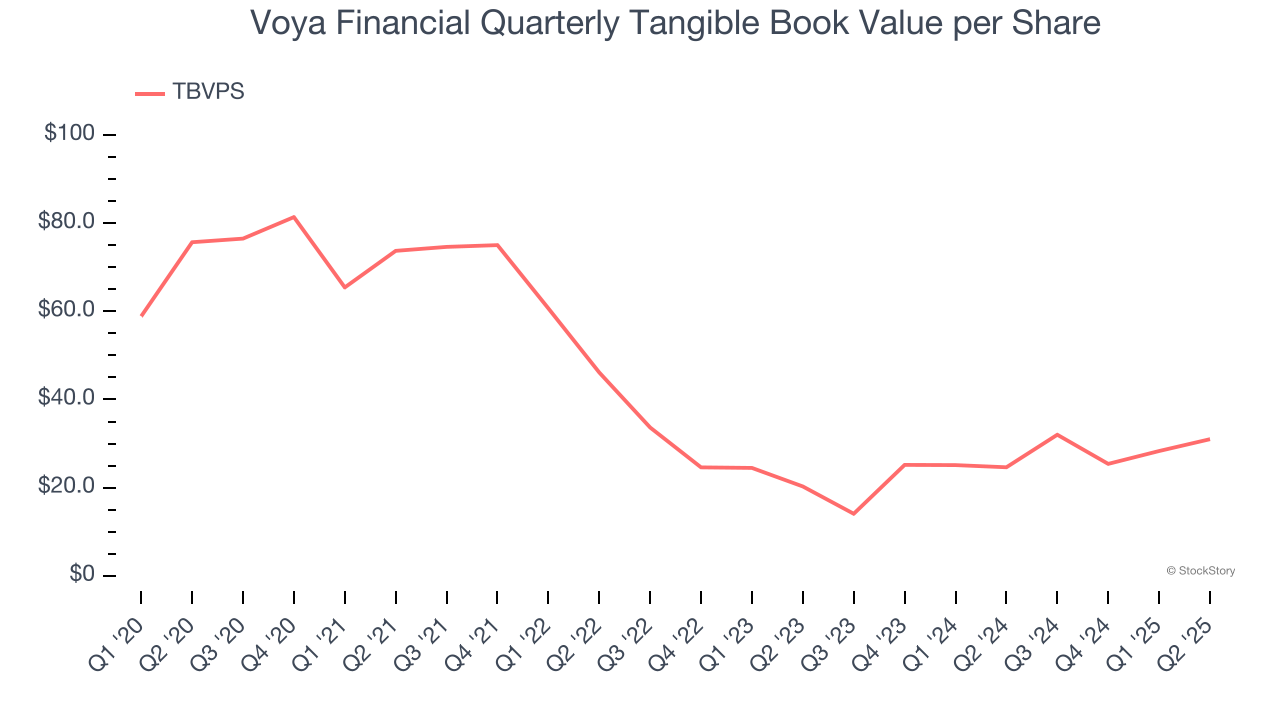

3. Growing TBVPS Reflects Strong Asset Base

We consider tangible book value per share (TBVPS) an important metric for financial firms. TBVPS represents the real, liquid net worth per share of a company, excluding intangible assets that have debatable value upon liquidation.

Although Voya Financial’s TBVPS declined at a 16.4% annual clip over the last five years. the good news is that its growth inflected positive over the past two years as TBVPS grew at an incredible 23.7% annual clip (from $20.27 to $30.99 per share).

Final Judgment

Voya Financial’s business quality ultimately falls short of our standards. With its shares topping the market in recent months, the stock trades at 8.1× forward P/E (or $75.77 per share). While this valuation is optically cheap, the potential downside is big given its shaky fundamentals. We're pretty confident there are superior stocks to buy right now. Let us point you toward our favorite semiconductor picks and shovels play.

Stocks We Like More Than Voya Financial

Trump’s April 2025 tariff bombshell triggered a massive market selloff, but stocks have since staged an impressive recovery, leaving those who panic sold on the sidelines.

Take advantage of the rebound by checking out our Top 5 Growth Stocks for this month. This is a curated list of our High Quality stocks that have generated a market-beating return of 183% over the last five years (as of March 31st 2025).

Stocks that made our list in 2020 include now familiar names such as Nvidia (+1,545% between March 2020 and March 2025) as well as under-the-radar businesses like the once-small-cap company Exlservice (+354% five-year return). Find your next big winner with StockStory today.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.