Earnings results often indicate what direction a company will take in the months ahead. With Q2 behind us, let’s have a look at AppLovin (NASDAQ: APP) and its peers.

The digital advertising market is large, growing, and becoming more diverse, both in terms of audiences and media. As a result, there is a growing need for software that enables advertisers to use data to automate and optimize ad placements.

The 7 advertising software stocks we track reported a satisfactory Q2. As a group, revenues beat analysts’ consensus estimates by 2.6% while next quarter’s revenue guidance was in line.

While some advertising software stocks have fared somewhat better than others, they have collectively declined. On average, share prices are down 2.9% since the latest earnings results.

AppLovin (NASDAQ: APP)

Sitting at the crossroads of the mobile advertising ecosystem with over 200 free-to-play games in its portfolio, AppLovin (NASDAQ: APP) provides software solutions that help mobile app developers market, monetize, and grow their apps through AI-powered advertising and analytics tools.

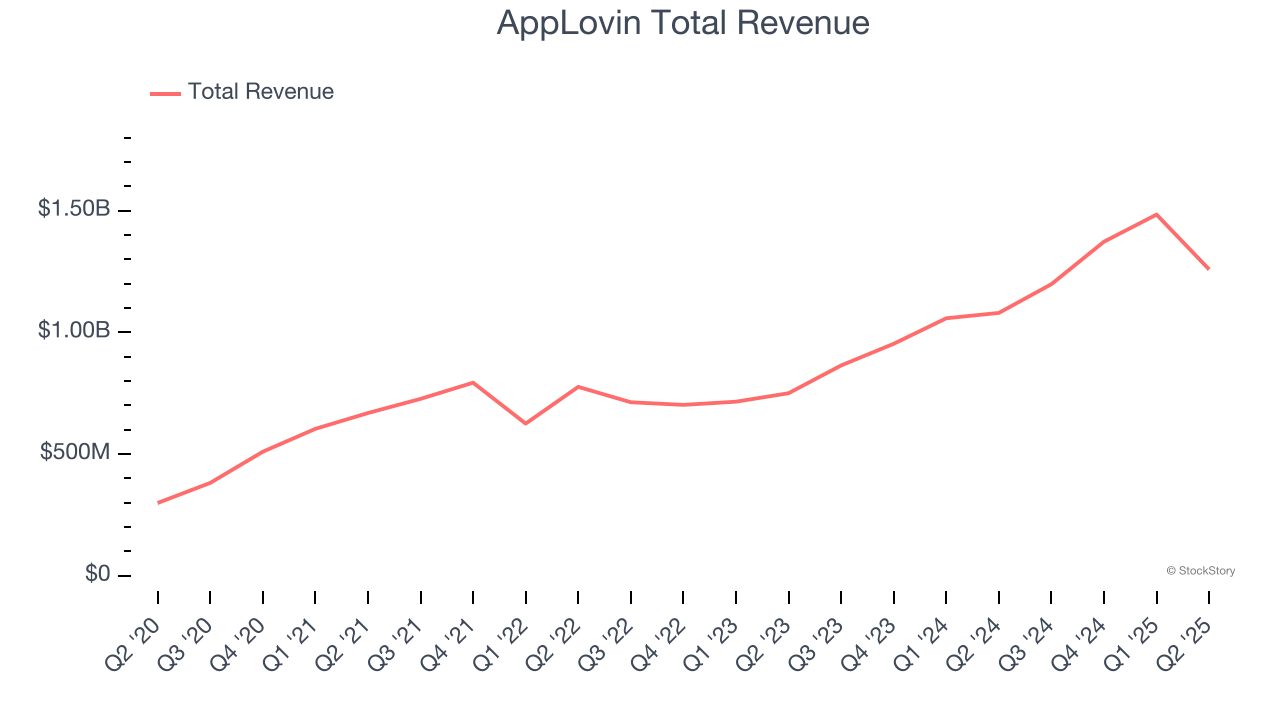

AppLovin reported revenues of $1.26 billion, up 16.5% year on year. This print fell short of analysts’ expectations by 1.2%. Overall, it was a mixed quarter for the company with EBITDA guidance for next quarter topping analysts’ expectations but a slight miss of analysts’ revenue estimates.

AppLovin delivered the weakest performance against analyst estimates of the whole group. Interestingly, the stock is up 52.9% since reporting and currently trades at $598.01.

Is now the time to buy AppLovin? Access our full analysis of the earnings results here, it’s free for active Edge members.

Best Q2: Zeta Global (NYSE: ZETA)

Powered by an AI engine that processes over one trillion consumer signals monthly, Zeta Global (NYSE: ZETA) operates a data-driven cloud platform that helps companies target, connect, and engage with consumers through personalized marketing across channels like email, social media, and video.

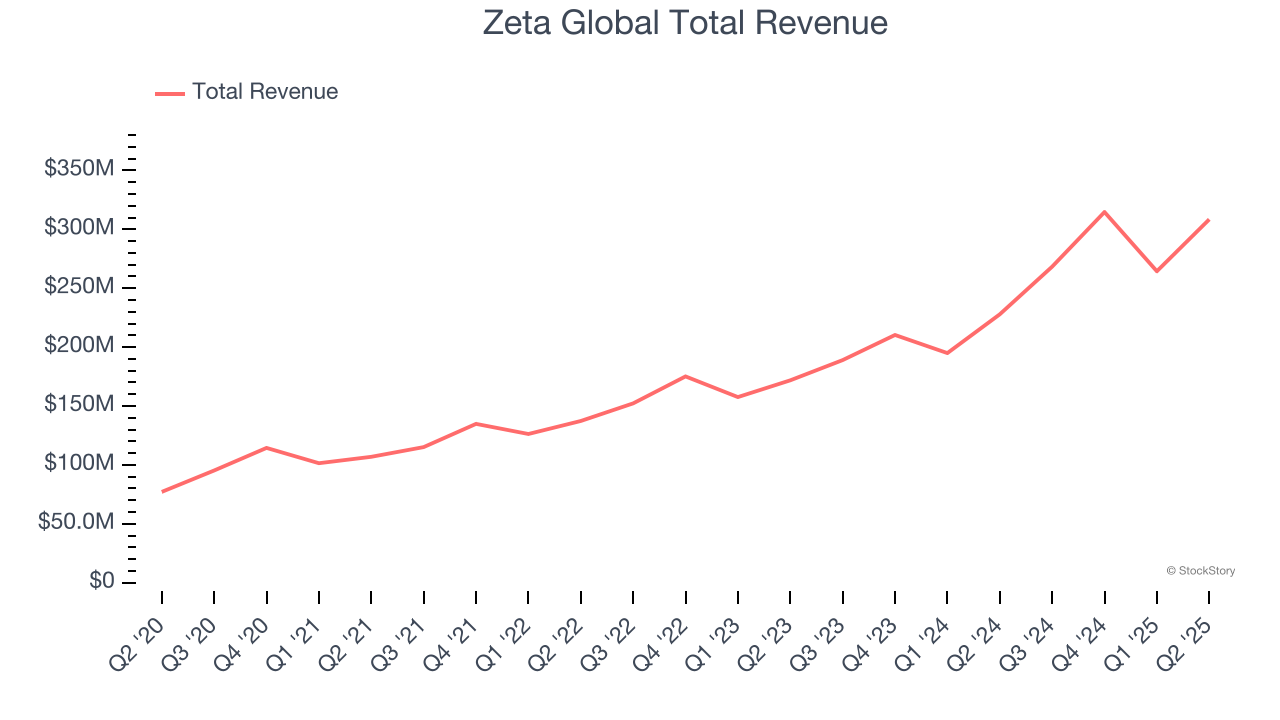

Zeta Global reported revenues of $308.4 million, up 35.4% year on year, outperforming analysts’ expectations by 3.9%. The business had a very strong quarter with a solid beat of analysts’ EBITDA estimates and full-year EBITDA guidance exceeding analysts’ expectations.

Zeta Global pulled off the fastest revenue growth and highest full-year guidance raise among its peers. The market seems happy with the results as the stock is up 12.7% since reporting. It currently trades at $17.90.

Is now the time to buy Zeta Global? Access our full analysis of the earnings results here, it’s free for active Edge members.

Weakest Q2: PubMatic (NASDAQ: PUBM)

Powering billions of daily ad impressions across the open internet, PubMatic (NASDAQ: PUBM) operates a technology platform that helps publishers maximize revenue from their digital advertising inventory while giving advertisers more control and transparency.

PubMatic reported revenues of $71.1 million, up 5.7% year on year, exceeding analysts’ expectations by 4.4%. Still, it was a slower quarter as it posted revenue and EBITDA guidance for next quarter missing analysts’ expectations.

PubMatic delivered the slowest revenue growth in the group. As expected, the stock is down 25.4% since the results and currently trades at $7.88.

Read our full analysis of PubMatic’s results here.

LiveRamp (NYSE: RAMP)

Serving as the digital middleman in an increasingly privacy-conscious world, LiveRamp (NYSE: RAMP) provides technology that helps companies securely share and connect their customer data with trusted partners while maintaining privacy compliance.

LiveRamp reported revenues of $194.8 million, up 10.7% year on year. This print beat analysts’ expectations by 1.9%. Zooming out, it was a mixed quarter as it also logged an impressive beat of analysts’ EBITDA estimates but revenue guidance for next quarter slightly missing analysts’ expectations.

The company lost 1 enterprise customer paying more than $1 million annually and ended up with a total of 127. The stock is down 16.2% since reporting and currently trades at $27.31.

Read our full, actionable report on LiveRamp here, it’s free for active Edge members.

The Trade Desk (NASDAQ: TTD)

Built as an alternative to "walled garden" advertising ecosystems, The Trade Desk (NASDAQ: TTD) provides a cloud-based platform that helps advertisers and agencies plan, manage, and optimize digital advertising campaigns across multiple channels and devices.

The Trade Desk reported revenues of $694 million, up 18.7% year on year. This result surpassed analysts’ expectations by 1.2%. Taking a step back, it was a mixed quarter as it also recorded a solid beat of analysts’ EBITDA estimates but a miss of analysts’ billings estimates.

The stock is down 43.1% since reporting and currently trades at $50.30.

Read our full, actionable report on The Trade Desk here, it’s free for active Edge members.

Market Update

In response to the Fed’s rate hikes in 2022 and 2023, inflation has been gradually trending down from its post-pandemic peak, trending closer to the Fed’s 2% target. Despite higher borrowing costs, the economy has avoided flashing recessionary signals. This is the much-desired soft landing that many investors hoped for. The recent rate cuts (0.5% in September and 0.25% in November 2024) have bolstered the stock market, making 2024 a strong year for equities. Donald Trump’s presidential win in November sparked additional market gains, sending indices to record highs in the days following his victory. However, debates continue over possible tariffs and corporate tax adjustments, raising questions about economic stability in 2025.

Want to invest in winners with rock-solid fundamentals? Check out our Strong Momentum Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.