Medical technology company Intuitive Surgical (NASDAQ: ISRG) beat Wall Street’s revenue expectations in Q3 CY2025, with sales up 22.9% year on year to $2.51 billion. Its non-GAAP profit of $2.40 per share was 20.7% above analysts’ consensus estimates.

Is now the time to buy Intuitive Surgical? Find out by accessing our full research report, it’s free for active Edge members.

Intuitive Surgical (ISRG) Q3 CY2025 Highlights:

- Revenue: $2.51 billion vs analyst estimates of $2.41 billion (22.9% year-on-year growth, 3.9% beat)

- Adjusted EPS: $2.40 vs analyst estimates of $1.99 (20.7% beat)

- Operating Margin: 30.3%, up from 28.3% in the same quarter last year

- Market Capitalization: $164.4 billion

“We’re pleased with our strong results this quarter, underscored by continued growth in customer use and adoption of our Ion and da Vinci platforms, including da Vinci 5,” said Dave Rosa, Intuitive CEO.

Company Overview

Pioneering minimally invasive surgery since its first da Vinci system was FDA-cleared in 2000, Intuitive Surgical (NASDAQ: ISRG) develops and manufactures robotic-assisted surgical systems that enable minimally invasive procedures across various medical specialties.

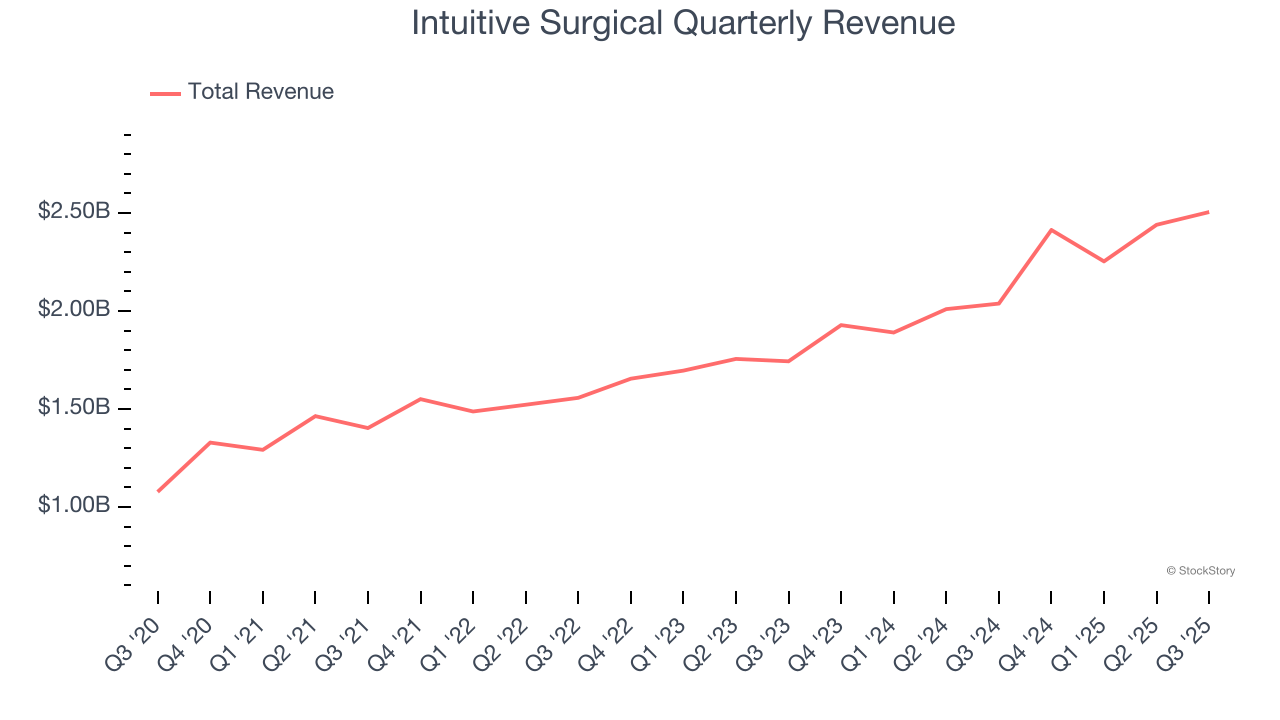

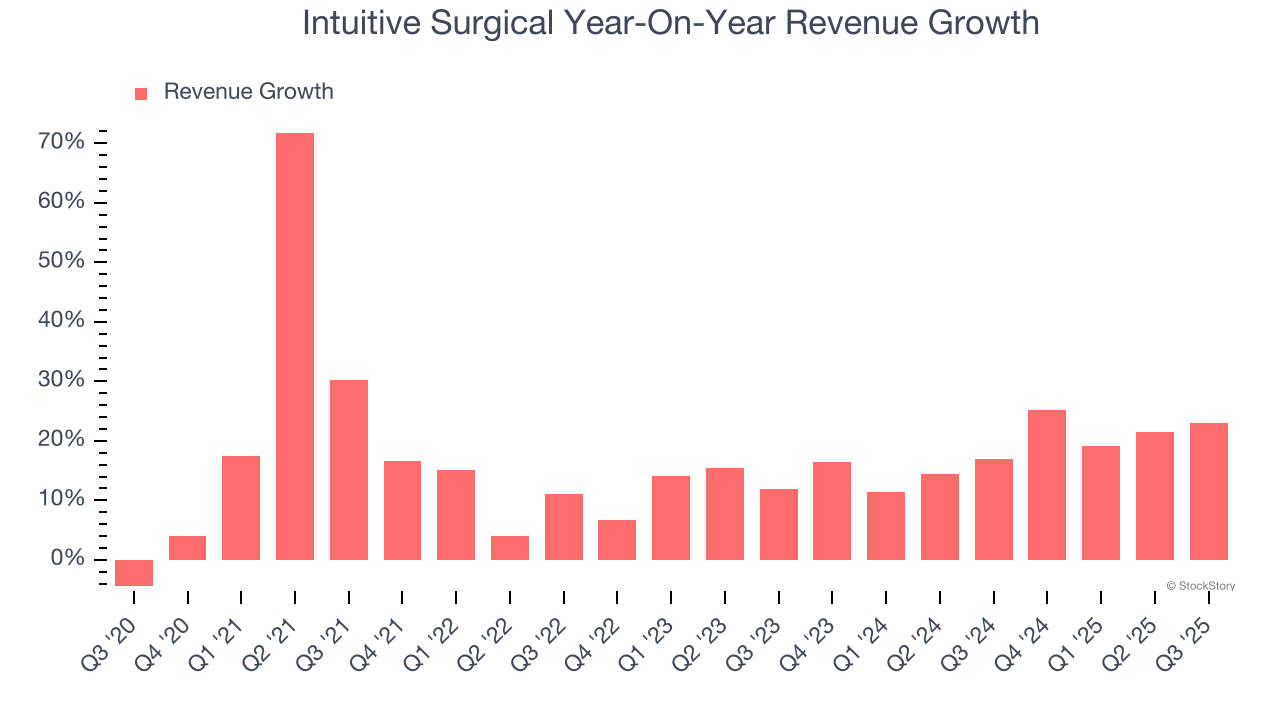

Revenue Growth

A company’s long-term performance is an indicator of its overall quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years. Over the last five years, Intuitive Surgical grew its sales at an impressive 17.4% compounded annual growth rate. Its growth beat the average healthcare company and shows its offerings resonate with customers, a helpful starting point for our analysis.

We at StockStory place the most emphasis on long-term growth, but within healthcare, a half-decade historical view may miss recent innovations or disruptive industry trends. Intuitive Surgical’s annualized revenue growth of 18.5% over the last two years is above its five-year trend, suggesting its demand was strong and recently accelerated.

This quarter, Intuitive Surgical reported robust year-on-year revenue growth of 22.9%, and its $2.51 billion of revenue topped Wall Street estimates by 3.9%.

Looking ahead, sell-side analysts expect revenue to grow 12.1% over the next 12 months, a deceleration versus the last two years. Despite the slowdown, this projection is commendable and implies the market is baking in success for its products and services.

Today’s young investors won’t have read the timeless lessons in Gorilla Game: Picking Winners In High Technology because it was written more than 20 years ago when Microsoft and Apple were first establishing their supremacy. But if we apply the same principles, then enterprise software stocks leveraging their own generative AI capabilities may well be the Gorillas of the future. So, in that spirit, we are excited to present our Special Free Report on a profitable, fast-growing enterprise software stock that is already riding the automation wave and looking to catch the generative AI next.

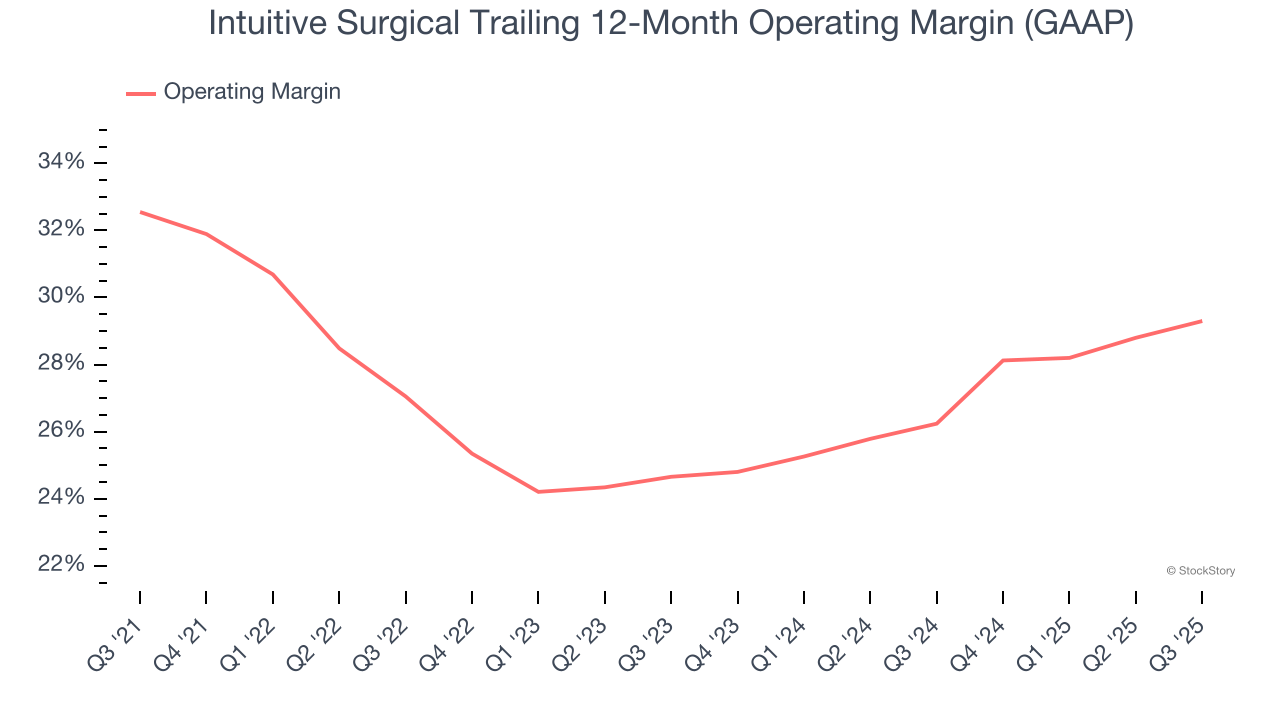

Operating Margin

Intuitive Surgical has been an efficient company over the last five years. It was one of the more profitable businesses in the healthcare sector, boasting an average operating margin of 27.9%.

Analyzing the trend in its profitability, Intuitive Surgical’s operating margin decreased by 3.3 percentage points over the last five years, but it rose by 4.6 percentage points on a two-year basis. We like Intuitive Surgical and hope it can right the ship.

In Q3, Intuitive Surgical generated an operating margin profit margin of 30.3%, up 2 percentage points year on year. This increase was a welcome development and shows it was more efficient.

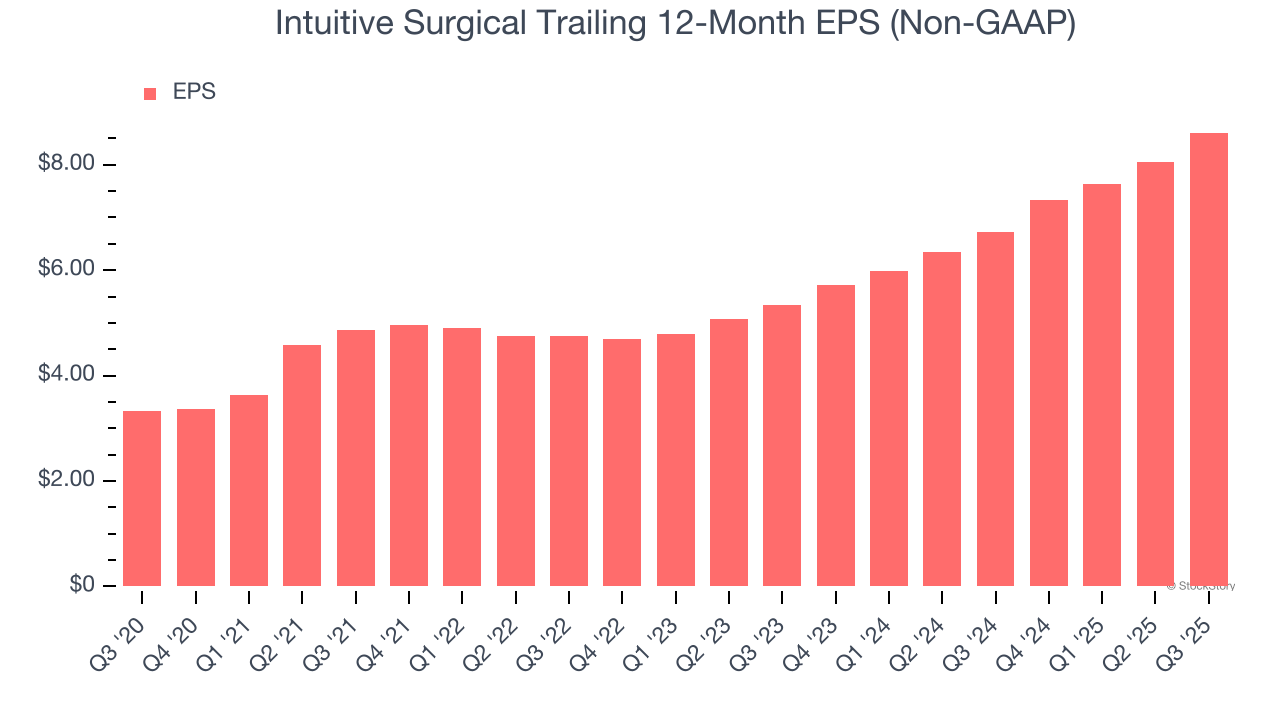

Earnings Per Share

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

Intuitive Surgical’s EPS grew at an astounding 20.9% compounded annual growth rate over the last five years, higher than its 17.4% annualized revenue growth. This tells us the company became more profitable on a per-share basis as it expanded.

In Q3, Intuitive Surgical reported adjusted EPS of $2.40, up from $1.84 in the same quarter last year. This print easily cleared analysts’ estimates, and shareholders should be content with the results. Over the next 12 months, Wall Street expects Intuitive Surgical’s full-year EPS of $8.61 to grow 2.8%.

Key Takeaways from Intuitive Surgical’s Q3 Results

It was good to see Intuitive Surgical beat analysts’ EPS expectations this quarter. We were also glad its revenue outperformed Wall Street’s estimates. Zooming out, we think this was a solid print. The stock traded up 17.2% to $542.46 immediately following the results.

Indeed, Intuitive Surgical had a rock-solid quarterly earnings result, but is this stock a good investment here? What happened in the latest quarter matters, but not as much as longer-term business quality and valuation, when deciding whether to invest in this stock. We cover that in our actionable full research report which you can read here, it’s free for active Edge members.