Let’s dig into the relative performance of JFrog (NASDAQ: FROG) and its peers as we unravel the now-completed Q2 software development earnings season.

As legendary VC investor Marc Andreessen says, "Software is eating the world", and it touches virtually every industry. That drives increasing demand for tools helping software developers do their jobs, whether it be monitoring critical cloud infrastructure, integrating audio and video functionality, or ensuring smooth content streaming.

The 11 software development stocks we track reported a strong Q2. As a group, revenues beat analysts’ consensus estimates by 2.6% while next quarter’s revenue guidance was in line.

Thankfully, share prices of the companies have been resilient as they are up 5.8% on average since the latest earnings results.

JFrog (NASDAQ: FROG)

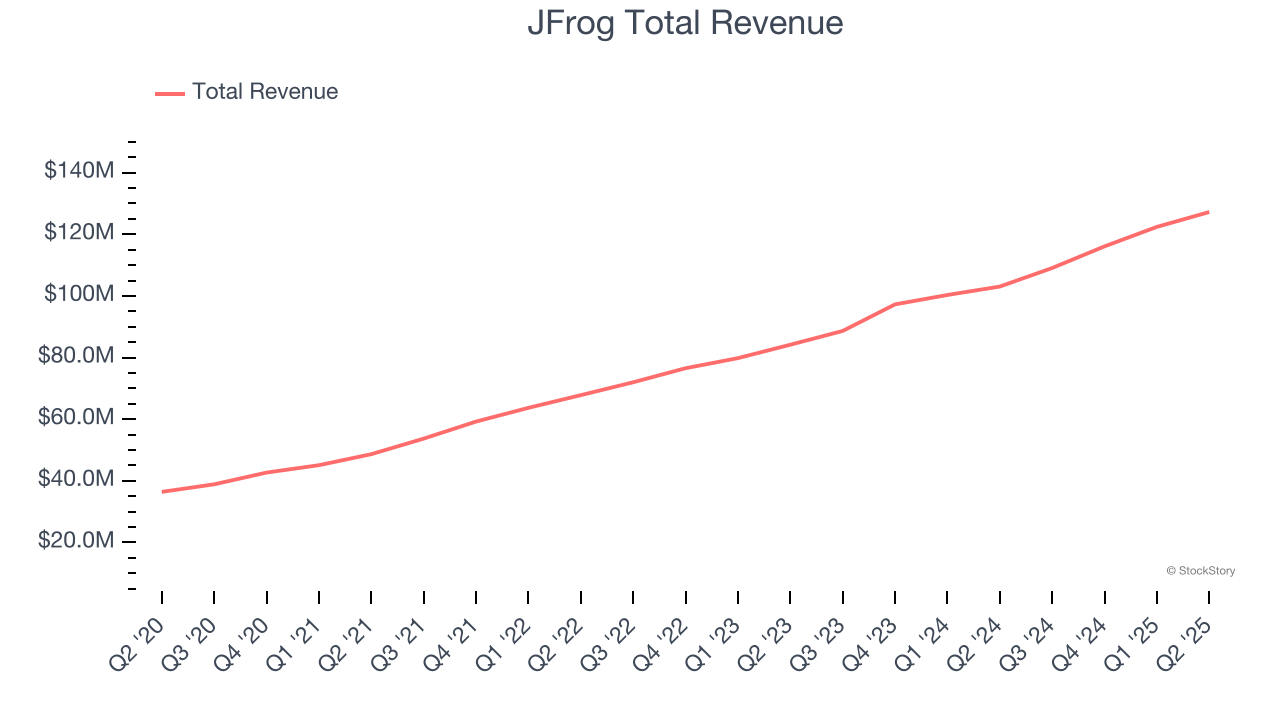

Named after the amphibian that continuously evolves from egg to tadpole to adult, JFrog (NASDAQ: FROG) provides a platform that helps organizations securely create, store, manage, and distribute software packages across any system.

JFrog reported revenues of $127.2 million, up 23.5% year on year. This print exceeded analysts’ expectations by 3.5%. Overall, it was a strong quarter for the company with an impressive beat of analysts’ EBITDA estimates and a solid beat of analysts’ billings estimates.

“With a unified focus on DevOps, Security, and MLOps, JFrog has positioned itself as a system of record for all software packages, and a leader in the fast-growing AI ecosystem as a gold-standard model registry,” said Shlomi Ben Haim, CEO, JFrog.

Interestingly, the stock is up 24.6% since reporting and currently trades at $48.40.

Best Q2: Fastly (NYSE: FSLY)

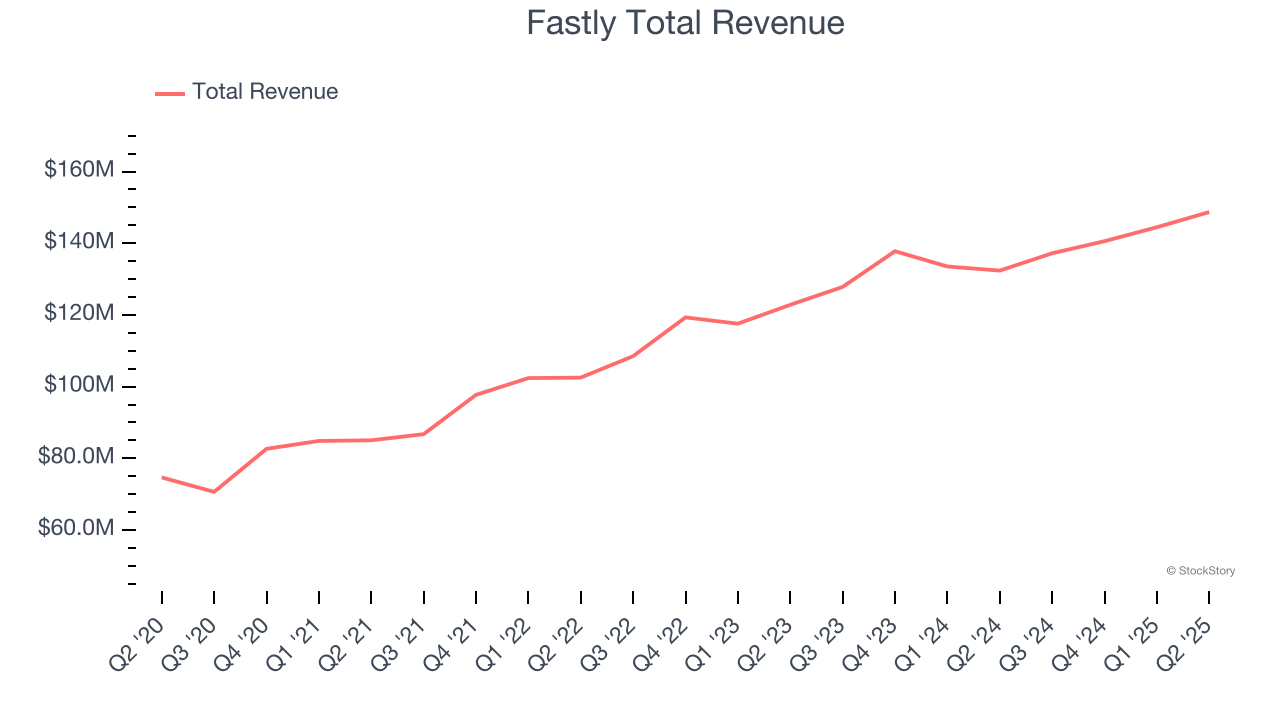

Taking its name from the core advantage it delivers to customers, Fastly (NYSE: FSLY) operates an edge cloud platform that processes, secures, and delivers web content as close to end users as possible, enabling faster digital experiences.

Fastly reported revenues of $148.7 million, up 12.3% year on year, outperforming analysts’ expectations by 2.7%. The business had an exceptional quarter with EPS guidance for next quarter exceeding analysts’ expectations and an impressive beat of analysts’ EBITDA estimates.

The market seems happy with the results as the stock is up 26.4% since reporting. It currently trades at $8.23.

Is now the time to buy Fastly? Access our full analysis of the earnings results here, it’s free for active Edge members.

Slowest Q2: PagerDuty (NYSE: PD)

Born from the frustration of developers being woken up by unprioritized alerts, PagerDuty (NYSE: PD) is a digital operations management platform that helps organizations detect and respond to IT incidents, outages, and other critical issues in real-time.

PagerDuty reported revenues of $123.4 million, up 6.4% year on year, in line with analysts’ expectations. It was a slower quarter as it posted EPS guidance for next quarter missing analysts’ expectations and a significant miss of analysts’ billings estimates.

PagerDuty delivered the weakest performance against analyst estimates in the group. The company added 75 customers to reach a total of 15,322. Interestingly, the stock is up 4% since the results and currently trades at $16.24.

Read our full analysis of PagerDuty’s results here.

Cloudflare (NYSE: NET)

With a massive network spanning more than 310 cities in over 120 countries, Cloudflare (NYSE: NET) provides a global network that delivers security, performance and reliability services to protect websites, applications, and corporate networks.

Cloudflare reported revenues of $512.3 million, up 27.8% year on year. This result surpassed analysts’ expectations by 2.3%. It was an exceptional quarter as it also produced a solid beat of analysts’ billings estimates and EPS guidance for next quarter exceeding analysts’ expectations.

The stock is up 2.1% since reporting and currently trades at $212.

Read our full, actionable report on Cloudflare here, it’s free for active Edge members.

Datadog (NASDAQ: DDOG)

Named after a database the founders had to painstakingly look after at their previous company, Datadog (NASDAQ: DDOG) provides a software platform that helps organizations monitor and secure their cloud applications, infrastructure, and services.

Datadog reported revenues of $826.8 million, up 28.1% year on year. This print topped analysts’ expectations by 4.5%. Overall, it was a very strong quarter as it also recorded a solid beat of analysts’ annual recurring revenue estimates and EPS guidance for next quarter exceeding analysts’ expectations.

Datadog achieved the biggest analyst estimates beat but had the weakest full-year guidance update among its peers. The company added 80 enterprise customers paying more than $100,000 annually to reach a total of 3,850. The stock is up 13.5% since reporting and currently trades at $155.53.

Read our full, actionable report on Datadog here, it’s free for active Edge members.

Market Update

The Fed’s interest rate hikes throughout 2022 and 2023 have successfully cooled post-pandemic inflation, bringing it closer to the 2% target. Inflationary pressures have eased without tipping the economy into a recession, suggesting a soft landing. This stability, paired with recent rate cuts (0.5% in September 2024 and 0.25% in November 2024), fueled a strong year for the stock market in 2024. The markets surged further after Donald Trump’s presidential victory in November, with major indices reaching record highs in the days following the election. Still, questions remain about the direction of economic policy, as potential tariffs and corporate tax changes add uncertainty for 2025.

Want to invest in winners with rock-solid fundamentals? Check out our 9 Best Market-Beating Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.