Wrapping up Q2 earnings, we look at the numbers and key takeaways for the perishable food stocks, including Freshpet (NASDAQ: FRPT) and its peers.

The perishable food industry is diverse, encompassing large-scale producers and distributors to specialty and artisanal brands. These companies sell produce, dairy products, meats, and baked goods and have become integral to serving modern American consumers who prioritize freshness, quality, and nutritional value. Investing in perishable food stocks presents both opportunities and challenges. While the perishable nature of products can introduce risks related to supply chain management and shelf life, it also creates a constant demand driven by the necessity for fresh food. Companies that can efficiently manage inventory, distribution, and quality control are well-positioned to thrive in this competitive market. Navigating the perishable food industry requires adherence to strict food safety standards, regulations, and labeling requirements.

The 11 perishable food stocks we track reported a satisfactory Q2. As a group, revenues beat analysts’ consensus estimates by 1.4% while next quarter’s revenue guidance was 2.5% above.

Amidst this news, share prices of the companies have had a rough stretch. On average, they are down 7.2% since the latest earnings results.

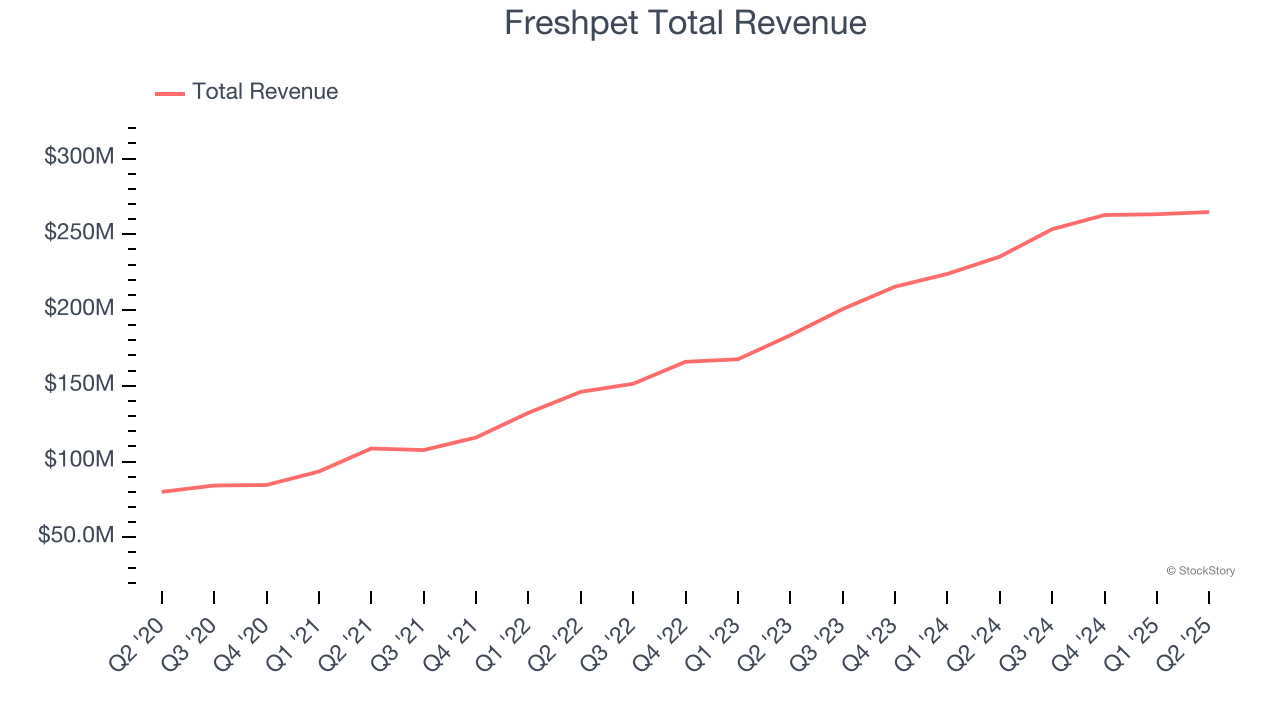

Freshpet (NASDAQ: FRPT)

Standing out from typical processed pet foods, Freshpet (NASDAQ: FRPT) is a pet food company whose product portfolio includes natural meals and treats for dogs and cats.

Freshpet reported revenues of $264.7 million, up 12.5% year on year. This print fell short of analysts’ expectations by 1.5%, but it was still a strong quarter for the company with a beat of analysts’ EPS and EBITDA estimates.

"Against a more challenging consumer sentiment backdrop, we continue to significantly outperform the dog food category - delivering both category leading sales growth and strong improvements in operations," commented Billy Cyr, Freshpet’s Chief Executive Officer.

Unsurprisingly, the stock is down 12.6% since reporting and currently trades at $57.55.

Is now the time to buy Freshpet? Access our full analysis of the earnings results here, it’s free for active Edge members.

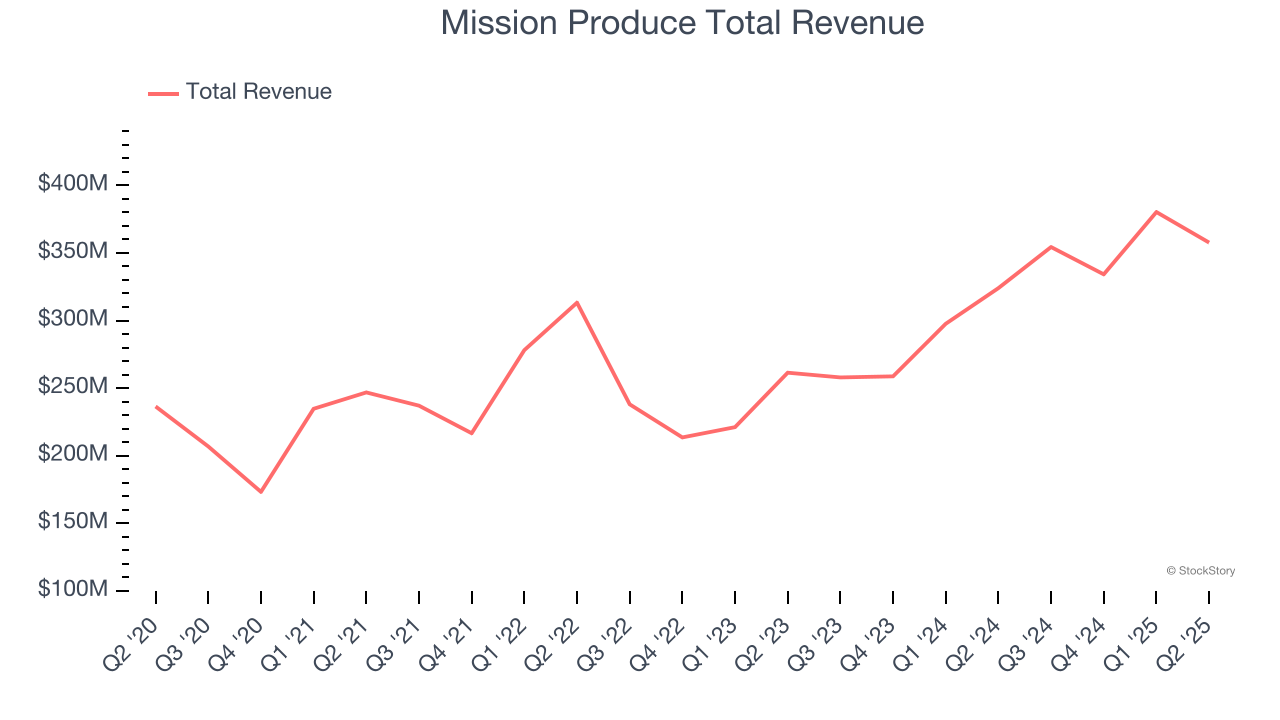

Best Q2: Mission Produce (NASDAQ: AVO)

Founded in 1983 in California, Mission Produce (NASDAQ: AVO) grows, packages, and distributes avocados.

Mission Produce reported revenues of $357.7 million, up 10.4% year on year, outperforming analysts’ expectations by 11.7%. The business had an incredible quarter with a beat of analysts’ EPS estimates and a solid beat of analysts’ gross margin estimates.

Mission Produce scored the biggest analyst estimates beat among its peers. Although it had a fine quarter compared its peers, the market seems unhappy with the results as the stock is down 9.6% since reporting. It currently trades at $11.63.

Is now the time to buy Mission Produce? Access our full analysis of the earnings results here, it’s free for active Edge members.

Weakest Q2: Cal-Maine (NASDAQ: CALM)

Known for brands such as Egg-Land’s Best and Land O’ Lakes, Cal-Maine (NASDAQ: CALM) produces, packages, and distributes eggs.

Cal-Maine reported revenues of $922.6 million, up 17.4% year on year, falling short of analysts’ expectations by 3.9%. It was a disappointing quarter as it posted a significant miss of analysts’ adjusted operating income estimates.

As expected, the stock is down 3.3% since the results and currently trades at $91.29.

Read our full analysis of Cal-Maine’s results here.

Pilgrim's Pride (NASDAQ: PPC)

Offering everything from pre-marinated to frozen chicken, Pilgrim’s Pride (NASDAQ: PPC) produces, processes, and distributes chicken products to retailers and food service customers.

Pilgrim's Pride reported revenues of $4.76 billion, up 4.3% year on year. This result surpassed analysts’ expectations by 2.9%. It was a very strong quarter as it also logged an impressive beat of analysts’ EBITDA estimates and a solid beat of analysts’ revenue estimates.

The stock is down 18.8% since reporting and currently trades at $38.76.

Read our full, actionable report on Pilgrim's Pride here, it’s free for active Edge members.

Flowers Foods (NYSE: FLO)

With Wonder Bread as its premier brand, Flower Foods (NYSE: FLO) is a packaged foods company that focuses on bakery products such as breads, buns, and cakes.

Flowers Foods reported revenues of $1.24 billion, up 1.5% year on year. This number came in 2% below analysts' expectations. It was a slower quarter as it also recorded a miss of analysts’ EBITDA and organic revenue estimates.

Flowers Foods scored the highest full-year guidance raise among its peers. The stock is down 21.7% since reporting and currently trades at $12.97.

Read our full, actionable report on Flowers Foods here, it’s free for active Edge members.

Market Update

The Fed’s interest rate hikes throughout 2022 and 2023 have successfully cooled post-pandemic inflation, bringing it closer to the 2% target. Inflationary pressures have eased without tipping the economy into a recession, suggesting a soft landing. This stability, paired with recent rate cuts (0.5% in September 2024 and 0.25% in November 2024), fueled a strong year for the stock market in 2024. The markets surged further after Donald Trump’s presidential victory in November, with major indices reaching record highs in the days following the election. Still, questions remain about the direction of economic policy, as potential tariffs and corporate tax changes add uncertainty for 2025.

Want to invest in winners with rock-solid fundamentals? Check out our Top 6 Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.