Over the past six months, EVERTEC’s shares (currently trading at $31.03) have posted a disappointing 6.9% loss, well below the S&P 500’s 22.9% gain. This may have investors wondering how to approach the situation.

Following the drawdown, is now the time to buy EVTC? Find out in our full research report, it’s free for active Edge members.

Why Are We Positive On EVERTEC?

Operating one of Latin America's leading PIN debit networks called ATH, EVERTEC (NYSE: EVTC) is a payment transaction processor and financial technology provider that enables merchants and financial institutions across Latin America and the Caribbean to accept and process electronic payments.

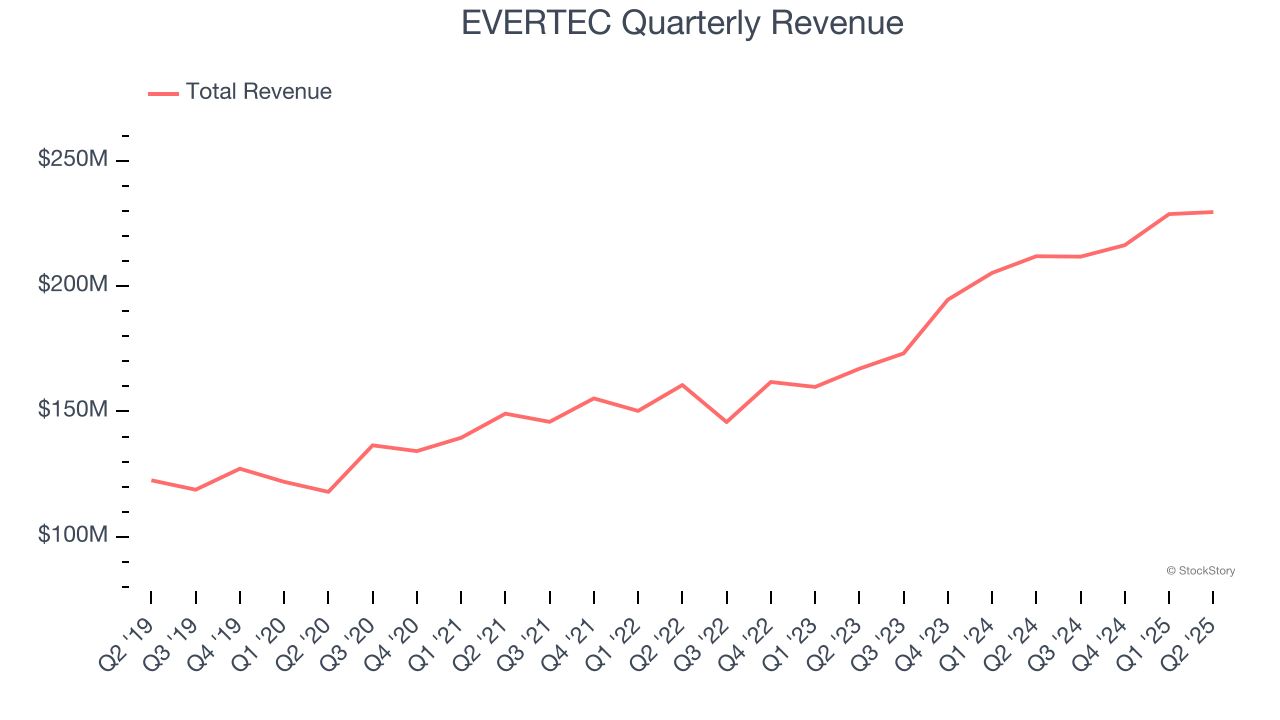

1. Long-Term Revenue Growth Shows Strong Momentum

A company’s long-term sales performance can indicate its overall quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years.

Thankfully, EVERTEC’s 12.8% annualized revenue growth over the last five years was solid. Its growth surpassed the average financials company and shows its offerings resonate with customers.

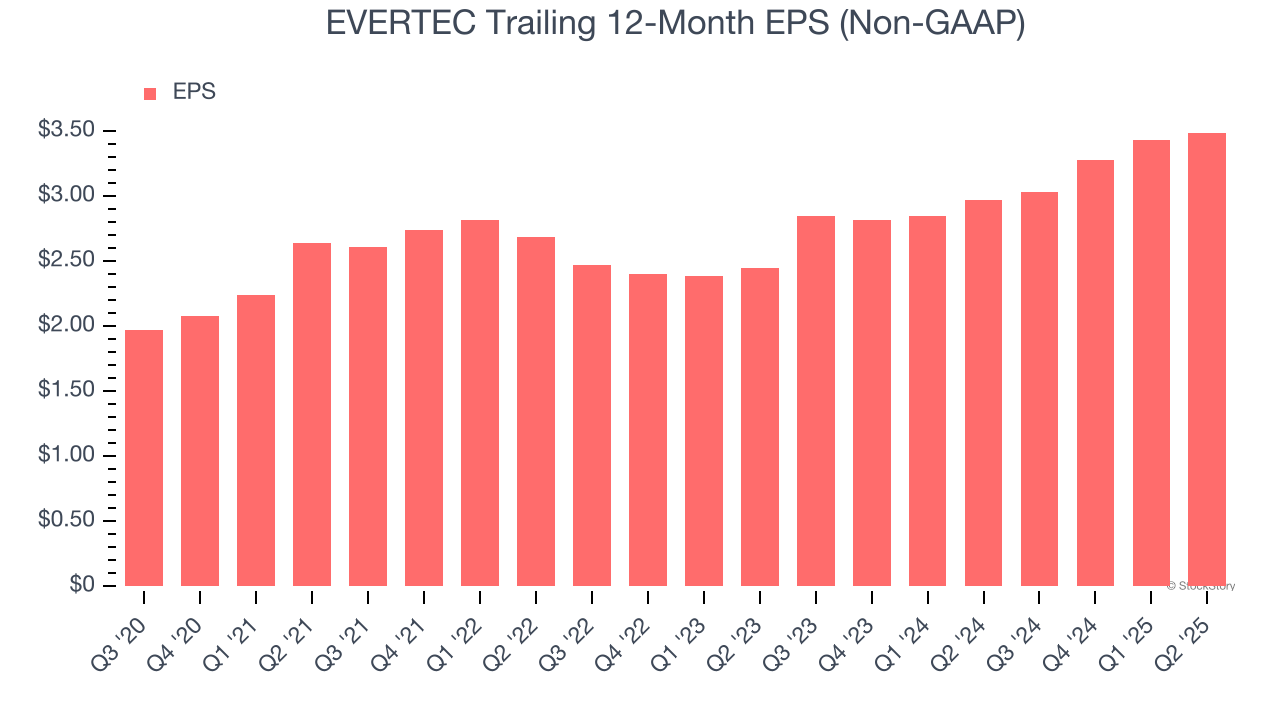

2. EPS Increasing Steadily

Analyzing the long-term change in earnings per share (EPS) shows whether a company's incremental sales were profitable – for example, revenue could be inflated through excessive spending on advertising and promotions.

EVERTEC’s EPS grew at a solid 14.8% compounded annual growth rate over the last five years, higher than its 12.8% annualized revenue growth. This tells us the company became more profitable on a per-share basis as it expanded.

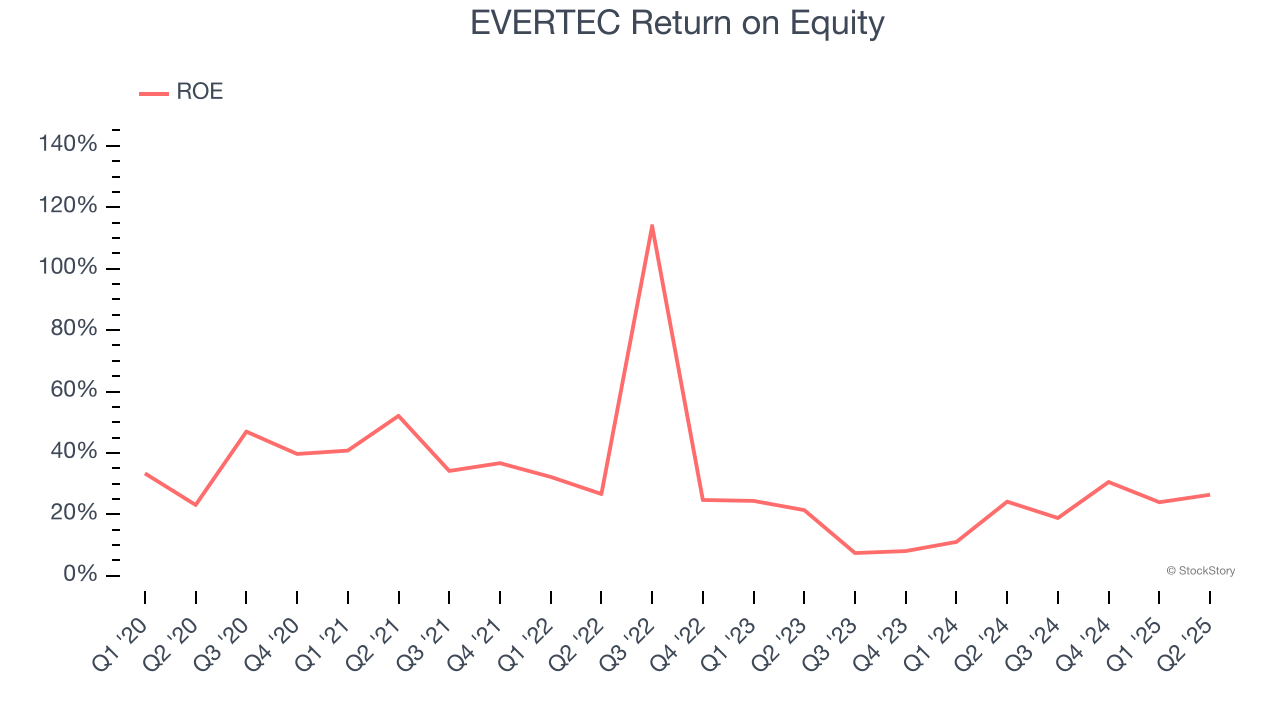

3. Stellar ROE Showcases Lucrative Growth Opportunities

Return on equity, or ROE, quantifies bank profitability relative to shareholder equity - an essential capital source for these institutions. Over extended periods, superior ROE performance drives faster shareholder wealth compounding through reinvestment, share repurchases, and dividend growth.

Over the last five years, EVERTEC has averaged an ROE of 32.2%, exceptional for a company operating in a sector where the average shakes out around 10% and those putting up 25%+ are greatly admired. This shows EVERTEC has a strong competitive moat.

Final Judgment

These are just a few reasons why we think EVERTEC is one of the best financials companies out there. After the recent drawdown, the stock trades at 8.8× forward P/E (or $31.03 per share). Is now a good time to initiate a position? See for yourself in our comprehensive research report, it’s free for active Edge members .

High-Quality Stocks for All Market Conditions

Donald Trump’s April 2025 "Liberation Day" tariffs sent markets into a tailspin, but stocks have since rebounded strongly, proving that knee-jerk reactions often create the best buying opportunities.

The smart money is already positioning for the next leg up. Don’t miss out on the recovery - check out our Top 5 Growth Stocks for this month. This is a curated list of our High Quality stocks that have generated a market-beating return of 183% over the last five years (as of March 31st 2025).

Stocks that made our list in 2020 include now familiar names such as Nvidia (+1,545% between March 2020 and March 2025) as well as under-the-radar businesses like the once-small-cap company Comfort Systems (+782% five-year return). Find your next big winner with StockStory today.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.