Earnings results often indicate what direction a company will take in the months ahead. With Q2 behind us, let’s have a look at Five9 (NASDAQ: FIVN) and its peers.

Work is becoming more distributed, both across geographies and devices. In order for businesses to keep functioning efficiently, they need to be able to communicate as well as they did when the teams were co-located, which drives the demand for integrated communication platforms.

The 4 video conferencing stocks we track reported a satisfactory Q2. As a group, revenues beat analysts’ consensus estimates by 1.8% while next quarter’s revenue guidance was in line.

Thankfully, share prices of the companies have been resilient as they are up 9.7% on average since the latest earnings results.

Best Q2: Five9 (NASDAQ: FIVN)

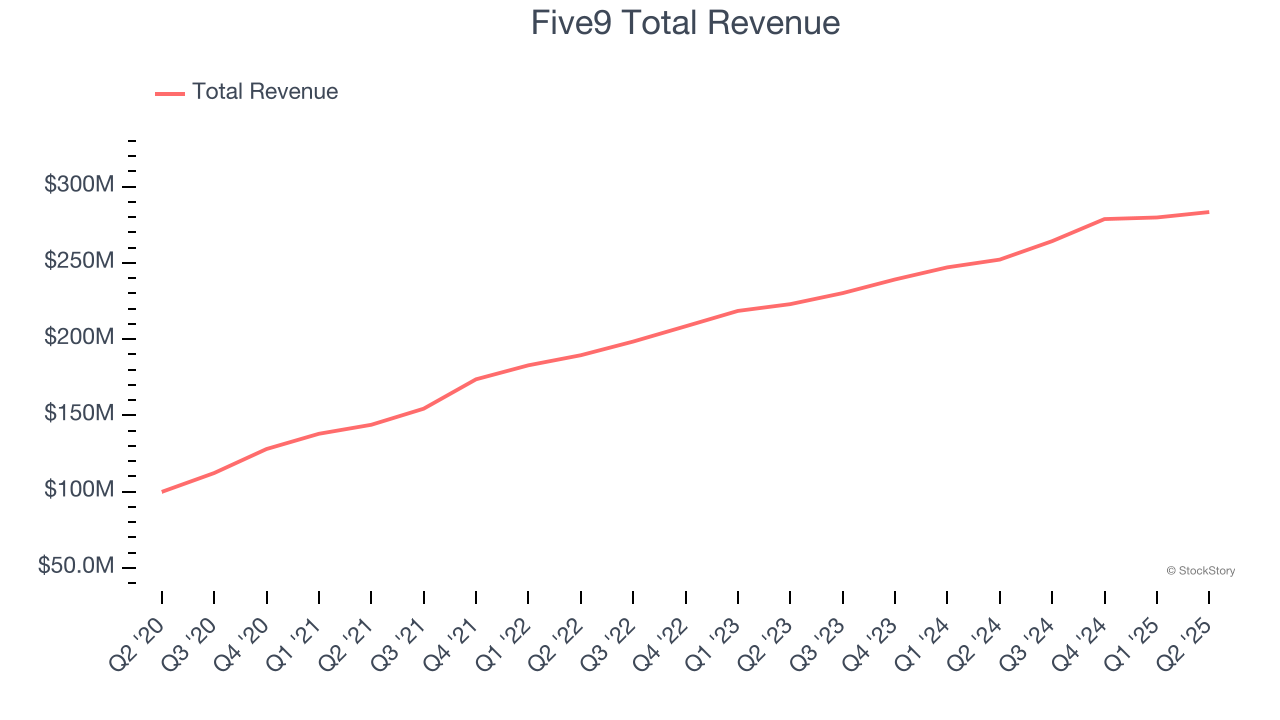

Taking its name from the "five nines" (99.999%) standard for optimal service reliability in telecommunications, Five9 (NASDAQ: FIVN) provides cloud-based software that enables businesses to run their contact centers with tools for customer service, sales, and marketing across multiple communication channels.

Five9 reported revenues of $283.3 million, up 12.4% year on year. This print exceeded analysts’ expectations by 2.9%. Overall, it was a very strong quarter for the company with a solid beat of analysts’ EBITDA estimates and full-year EPS guidance exceeding analysts’ expectations.

“We are pleased to report strong second quarter results which exceeded our expectations across all key metrics. Subscription revenue accelerated to 16% year-over-year growth, primarily driven by Enterprise AI revenue accelerating to 42% year-over-year growth and now representing 10% of Enterprise subscription revenue. Adjusted EBITDA margin increased to 24%, reaching an all-time record and helping drive a Q2 record for both operating and free cash flow. As we drive balanced, profitable growth, we are also seeing strong momentum in our sales execution with Enterprise AI bookings more than tripling year-over-year in the second quarter. Our customers are realizing meaningful benefits through our Genius AI suite of products as we continue to drive innovation with the recent launch of Agentic AI Agents and AI Trust & Governance. We remain at the forefront of developing leading agentic CX solutions to help reshape the customer journey and experience, and I’m extremely excited about the future of Five9.”

Five9 scored the biggest analyst estimates beat and fastest revenue growth of the whole group. Investor expectations, however, were likely higher than Wall Street’s published projections, leaving some wishing for even better results (analysts’ consensus estimates are those published by big banks and advisory firms, not the investors who make buy and sell decisions). The stock is down 8.6% since reporting and currently trades at $23.60.

Is now the time to buy Five9? Access our full analysis of the earnings results here, it’s free for active Edge members.

Zoom (NASDAQ: ZM)

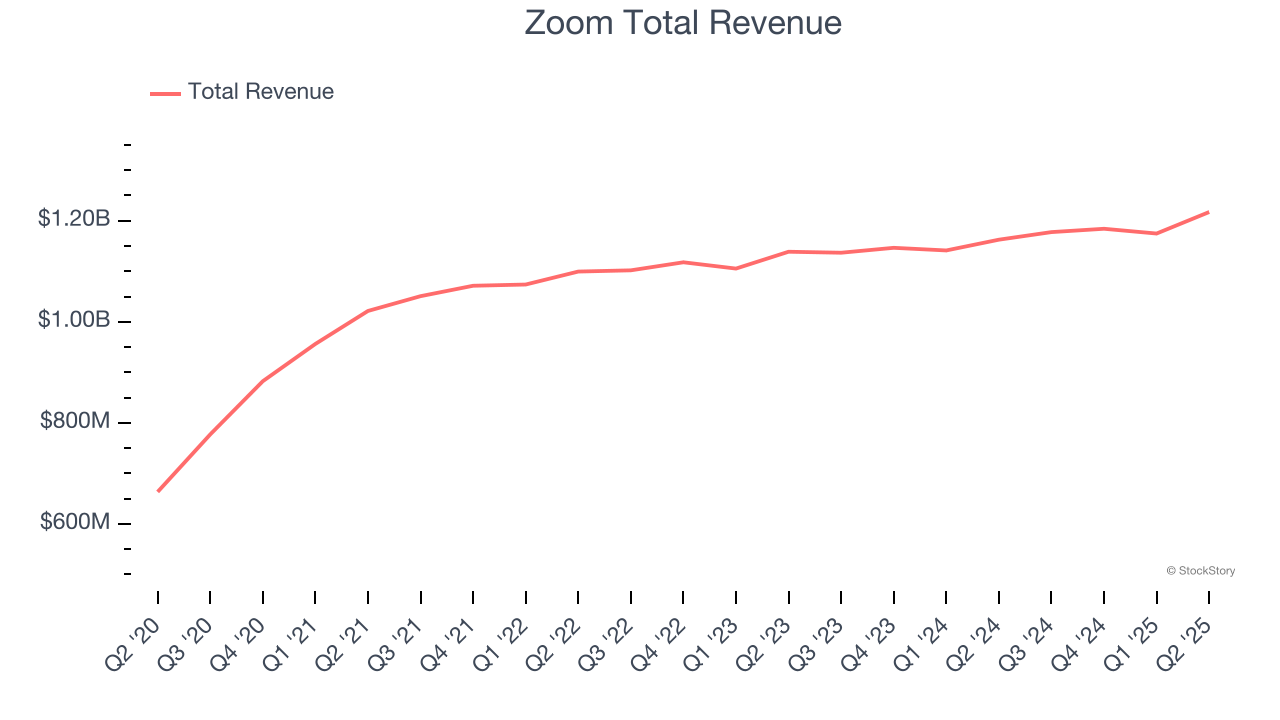

Once the verb that defined remote work during the pandemic ("let's Zoom later"), Zoom (NASDAQ: ZM) provides a cloud-based platform for video meetings, phone calls, team chat, and collaboration tools that helps businesses and individuals connect virtually.

Zoom reported revenues of $1.22 billion, up 4.7% year on year, outperforming analysts’ expectations by 1.8%. The business had a strong quarter with an impressive beat of analysts’ EBITDA estimates and full-year EPS guidance exceeding analysts’ expectations.

Zoom scored the highest full-year guidance raise among its peers. The company added 82 enterprise customers paying more than $100,000 annually to reach a total of 4,274. The market seems happy with the results as the stock is up 16.4% since reporting. It currently trades at $85.25.

Is now the time to buy Zoom? Access our full analysis of the earnings results here, it’s free for active Edge members.

Weakest Q2: 8x8 (NASDAQ: EGHT)

Named after its founding year (1987) with "8x8" representing binary code for communications, 8x8 (NASDAQ: EGHT) provides cloud-based contact center and unified communications solutions that enable businesses to manage customer interactions and internal communications through a single platform.

8x8 reported revenues of $181.4 million, up 1.8% year on year, exceeding analysts’ expectations by 2.2%. Still, it was a slower quarter as it posted revenue guidance for next quarter slightly missing analysts’ expectations and a significant miss of analysts’ EBITDA estimates.

8x8 delivered the slowest revenue growth and weakest full-year guidance update in the group. Interestingly, the stock is up 2.9% since the results and currently trades at $1.98.

Read our full analysis of 8x8’s results here.

RingCentral (NYSE: RNG)

Built on its proprietary Message Video Phone (MVP) platform that unifies multiple communication methods, RingCentral (NYSE: RNG) provides AI-driven cloud communications and collaboration solutions that enable businesses to connect through voice, video, messaging, and contact center services.

RingCentral reported revenues of $620.4 million, up 4.6% year on year. This number met analysts’ expectations. Aside from that, it was a satisfactory quarter as it also logged an impressive beat of analysts’ EBITDA estimates but revenue guidance for next quarter meeting analysts’ expectations.

RingCentral had the weakest performance against analyst estimates among its peers. The stock is up 28.1% since reporting and currently trades at $30.25.

Read our full, actionable report on RingCentral here, it’s free for active Edge members.

Market Update

As a result of the Fed’s rate hikes in 2022 and 2023, inflation has come down from frothy levels post-pandemic. The general rise in the price of goods and services is trending towards the Fed’s 2% goal as of late, which is good news. The higher rates that fought inflation also didn't slow economic activity enough to catalyze a recession. So far, soft landing. This, combined with recent rate cuts (half a percent in September 2024 and a quarter percent in November 2024) have led to strong stock market performance in 2024. The icing on the cake for 2024 returns was Donald Trump’s victory in the U.S. Presidential Election in early November, sending major indices to all-time highs in the week following the election. Still, debates around the health of the economy and the impact of potential tariffs and corporate tax cuts remain, leaving much uncertainty around 2025.

Want to invest in winners with rock-solid fundamentals? Check out our Top 5 Quality Compounder Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.