While the S&P 500 is up 23.9% since April 2025, Royalty Pharma (currently trading at $36.80 per share) has lagged behind, posting a return of 12.5%. This was partly due to its softer quarterly results and might have investors contemplating their next move.

Is now the time to buy Royalty Pharma, or should you be careful about including it in your portfolio? Dive into our full research report to see our analyst team’s opinion, it’s free for active Edge members.

Why Is Royalty Pharma Not Exciting?

We're swiping left on Royalty Pharma for now. Here are two reasons we avoid RPRX and a stock we'd rather own.

1. Long-Term Revenue Growth Disappoints

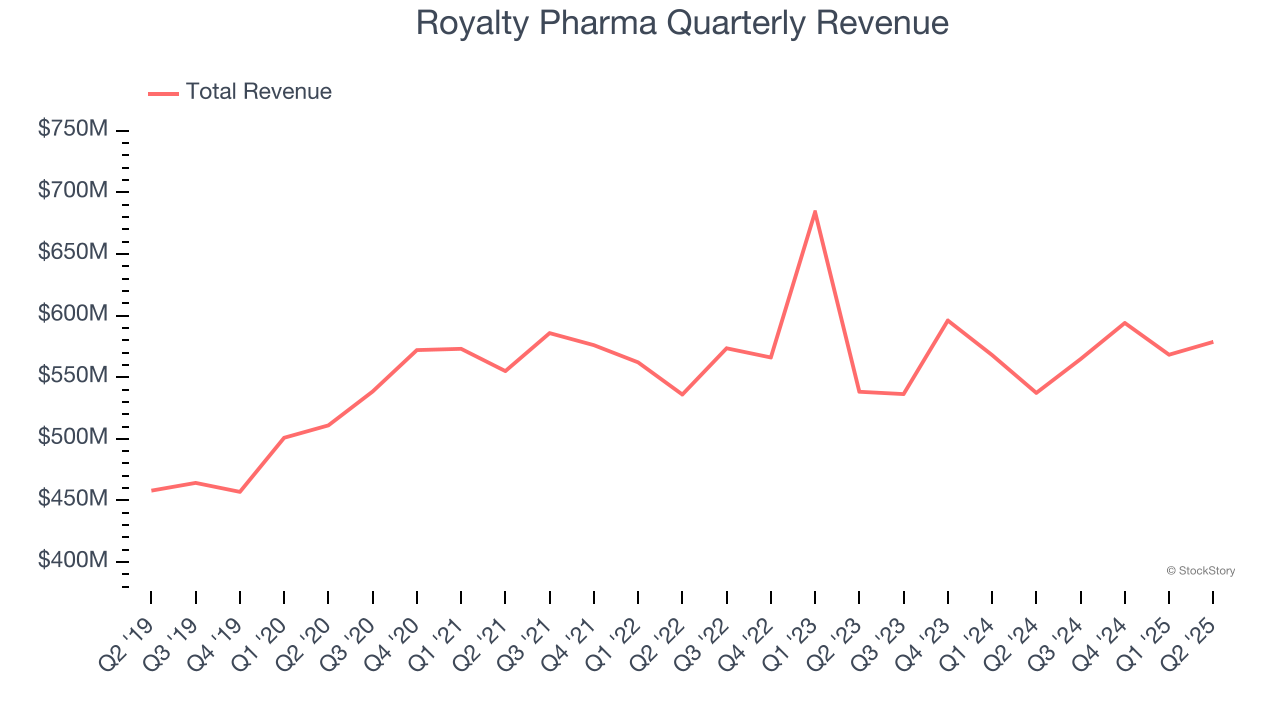

A company’s long-term performance is an indicator of its overall quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul. Unfortunately, Royalty Pharma’s 3.6% annualized revenue growth over the last five years was tepid. This was below our standard for the healthcare sector.

2. Fewer Distribution Channels than Larger Competitors

Larger companies benefit from economies of scale, where fixed costs like infrastructure, technology, and administration are spread over a higher volume of goods or services, reducing the cost per unit. Scale can also lead to bargaining power with suppliers, greater brand recognition, and more investment firepower. A virtuous cycle can ensue if a scaled company plays its cards right.

With just $2.31 billion in revenue over the past 12 months, Royalty Pharma lacks scale in an industry where it matters. This makes it difficult to build trust with customers because healthcare is heavily regulated, complex, and resource-intensive.

Final Judgment

Royalty Pharma isn’t a terrible business, but it doesn’t pass our bar. With its shares underperforming the market lately, the stock trades at 7.6× forward P/E (or $36.80 per share). This valuation is reasonable, but the company’s shakier fundamentals present too much downside risk. We're fairly confident there are better investments elsewhere. We’d recommend looking at one of our top digital advertising picks.

Stocks We Would Buy Instead of Royalty Pharma

Trump’s April 2025 tariff bombshell triggered a massive market selloff, but stocks have since staged an impressive recovery, leaving those who panic sold on the sidelines.

Take advantage of the rebound by checking out our Top 5 Growth Stocks for this month. This is a curated list of our High Quality stocks that have generated a market-beating return of 183% over the last five years (as of March 31st 2025).

Stocks that made our list in 2020 include now familiar names such as Nvidia (+1,545% between March 2020 and March 2025) as well as under-the-radar businesses like the once-micro-cap company Tecnoglass (+1,754% five-year return). Find your next big winner with StockStory today.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.