Online used car dealer Carvana (NYSE: CVNA) reported revenue ahead of Wall Streets expectations in Q3 CY2025, with sales up 54.5% year on year to $5.65 billion.

Is now the time to buy Carvana? Find out by accessing our full research report, it’s free for active Edge members.

Carvana (CVNA) Q3 CY2025 Highlights:

- Revenue: $5.65 billion vs analyst estimates of $5.08 billion (54.5% year-on-year growth, 11.1% beat)

- Adjusted EBITDA: $637 million vs analyst estimates of $600.2 million (11.3% margin, 6.1% beat)

- Operating Margin: 9.8%, in line with the same quarter last year

- Market Capitalization: $50.01 billion

Company Overview

Known for its glass tower car vending machines, Carvana (NYSE: CVNA) provides a convenient automotive shopping experience by offering an online platform for buying and selling used cars.

Revenue Growth

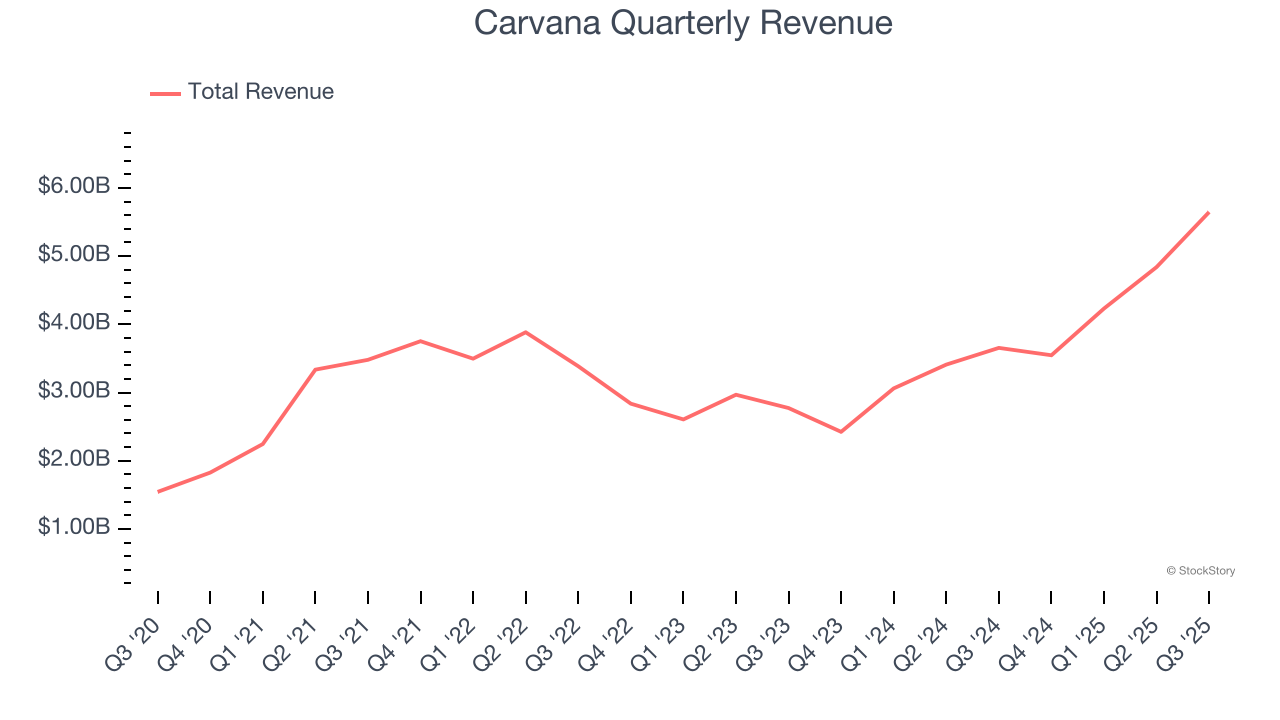

A company’s long-term sales performance can indicate its overall quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years. Regrettably, Carvana’s sales grew at a tepid 8% compounded annual growth rate over the last three years. This wasn’t a great result compared to the rest of the consumer internet sector, but there are still things to like about Carvana.

This quarter, Carvana reported magnificent year-on-year revenue growth of 54.5%, and its $5.65 billion of revenue beat Wall Street’s estimates by 11.1%.

Looking ahead, sell-side analysts expect revenue to grow 21.3% over the next 12 months, an acceleration versus the last three years. This projection is particularly healthy for a company of its scale and suggests its newer products and services will fuel better top-line performance.

Today’s young investors won’t have read the timeless lessons in Gorilla Game: Picking Winners In High Technology because it was written more than 20 years ago when Microsoft and Apple were first establishing their supremacy. But if we apply the same principles, then enterprise software stocks leveraging their own generative AI capabilities may well be the Gorillas of the future. So, in that spirit, we are excited to present our Special Free Report on a profitable, fast-growing enterprise software stock that is already riding the automation wave and looking to catch the generative AI next.

Cash Is King

If you’ve followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills.

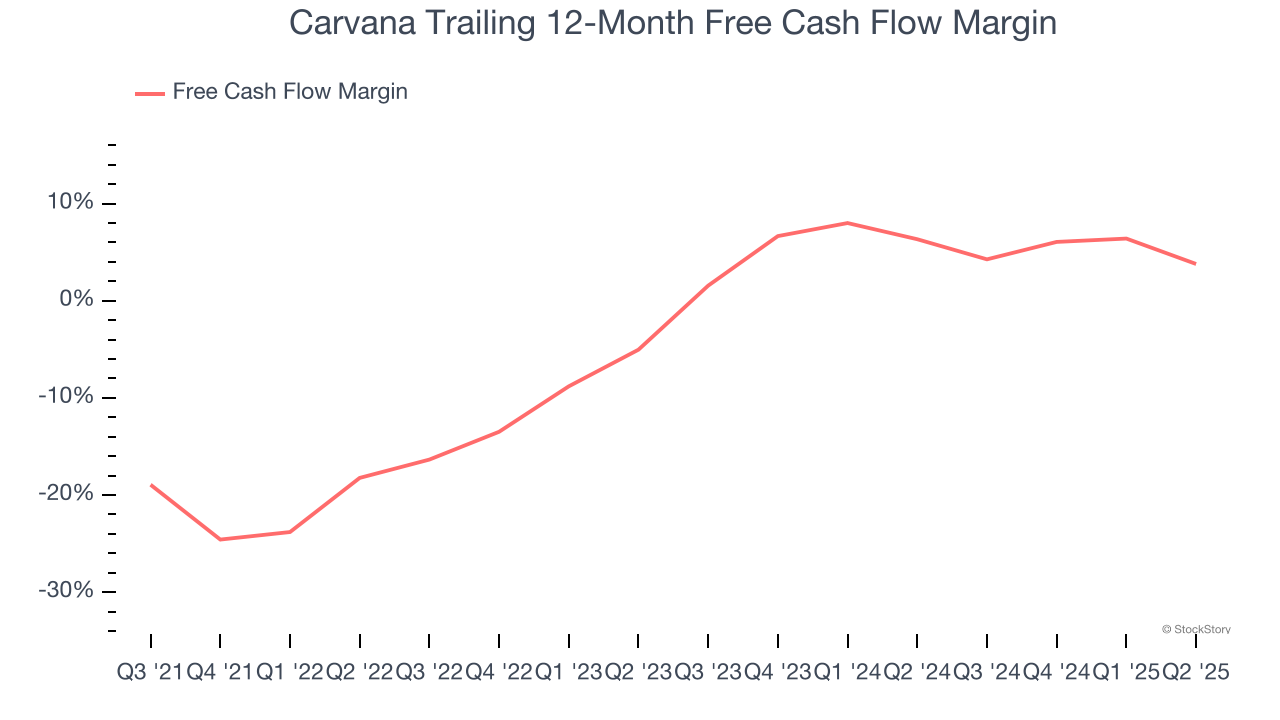

Carvana has shown mediocre cash profitability over the last two years, giving the company limited opportunities to return capital to shareholders. Its free cash flow margin averaged 3.1%, subpar for a consumer internet business. The divergence from its good EBITDA margin stems from its capital-intensive business model, which requires Carvana to make large cash investments in working capital (i.e., stocking inventories) and capital expenditures (i.e., building new facilities).

Taking a step back, an encouraging sign is that Carvana’s margin expanded by 21.5 percentage points over the last few years. The company’s improvement shows it’s heading in the right direction, and we can see it became a less capital-intensive business because its free cash flow profitability rose more than its operating profitability.

Key Takeaways from Carvana’s Q3 Results

We were impressed by how significantly Carvana blew past analysts’ revenue expectations this quarter. We were also glad its EBITDA outperformed Wall Street’s estimates. On the other hand, its outlook for next quarter's number of used car unit sales slightly missed. Zooming out, we think this was a solid print, but investors were likely hoping for stronger guidance given the recent macro jitters. Shares traded down 9.5% to $320.32 immediately following the results.

Big picture, is Carvana a buy here and now? When making that decision, it’s important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it’s free for active Edge members.