Commercial real estate lender Franklin BSP Realty Trust (NYSE: FBRT) announced better-than-expected revenue in Q3 CY2025, with sales up 79.3% year on year to $89.55 million. Its non-GAAP profit of $0.22 per share was 25.4% below analysts’ consensus estimates.

Is now the time to buy Franklin BSP Realty Trust? Find out by accessing our full research report, it’s free for active Edge members.

Franklin BSP Realty Trust (FBRT) Q3 CY2025 Highlights:

- Net Interest Income: $29.68 million vs analyst estimates of $38.65 million (32.9% year-on-year decline, 23.2% miss)

- Revenue: $89.55 million vs analyst estimates of $81.39 million (79.3% year-on-year growth, 10% beat)

- Adjusted EPS: $0.22 vs analyst expectations of $0.30 (25.4% miss)

- Market Capitalization: $881.2 million

Michael Comparato, President of FBRT, said, “The third quarter was a transitional period for FBRT, highlighted by the successful $425 million acquisition of NewPoint. Integration is progressing very well, and we’ve made meaningful progress on the three-pronged plan to grow distributable earnings."

Company Overview

Operating as a specialized real estate investment trust (REIT) with roots dating back to 2012, Franklin BSP Realty Trust (NYSE: FBRT) originates and manages a diversified portfolio of commercial real estate debt investments secured by properties in the United States and abroad.

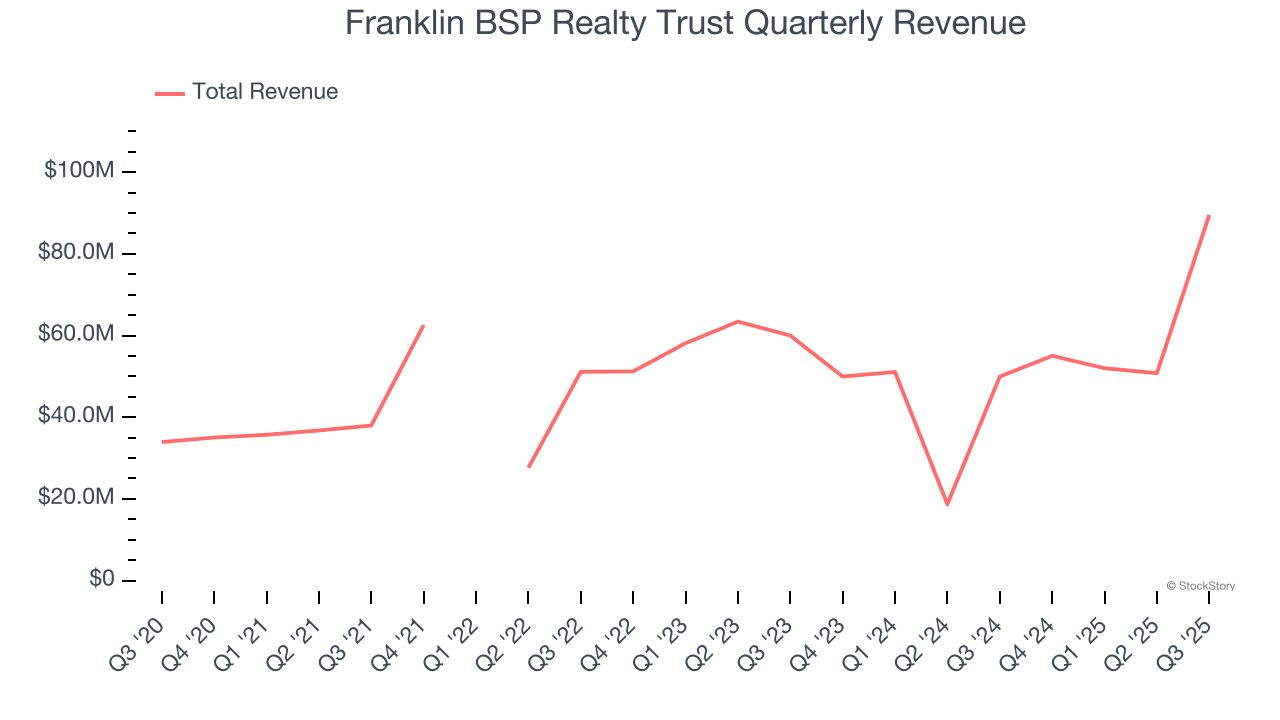

Sales Growth

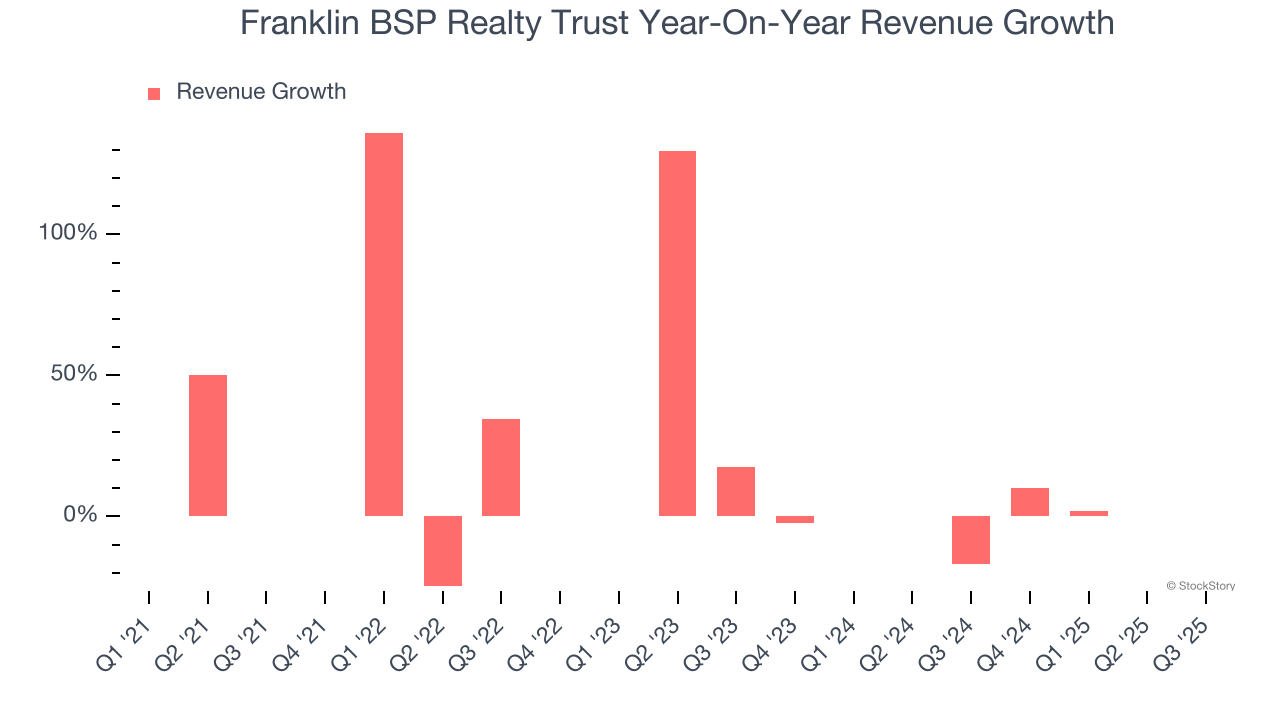

Two primary revenue streams drive bank earnings. While net interest income, which is earned by charging higher rates on loans than paid on deposits, forms the foundation, fee-based services across banking, credit, wealth management, and trading operations provide additional income. Thankfully, Franklin BSP Realty Trust’s 19.2% annualized revenue growth over the last five years was incredible. Its growth beat the average banking company and shows its offerings resonate with customers.

Note: Quarters not shown were determined to be outliers, impacted by outsized investment gains/losses that are not indicative of the recurring fundamentals of the business.

Note: Quarters not shown were determined to be outliers, impacted by outsized investment gains/losses that are not indicative of the recurring fundamentals of the business.Long-term growth is the most important, but within financials, a half-decade historical view may miss recent interest rate changes and market returns. Franklin BSP Realty Trust’s recent performance shows its demand has slowed significantly as its annualized revenue growth of 3.1% over the last two years was well below its five-year trend.  Note: Quarters not shown were determined to be outliers, impacted by outsized investment gains/losses that are not indicative of the recurring fundamentals of the business.

Note: Quarters not shown were determined to be outliers, impacted by outsized investment gains/losses that are not indicative of the recurring fundamentals of the business.

This quarter, Franklin BSP Realty Trust reported magnificent year-on-year revenue growth of 79.3%, and its $89.55 million of revenue beat Wall Street’s estimates by 10%.

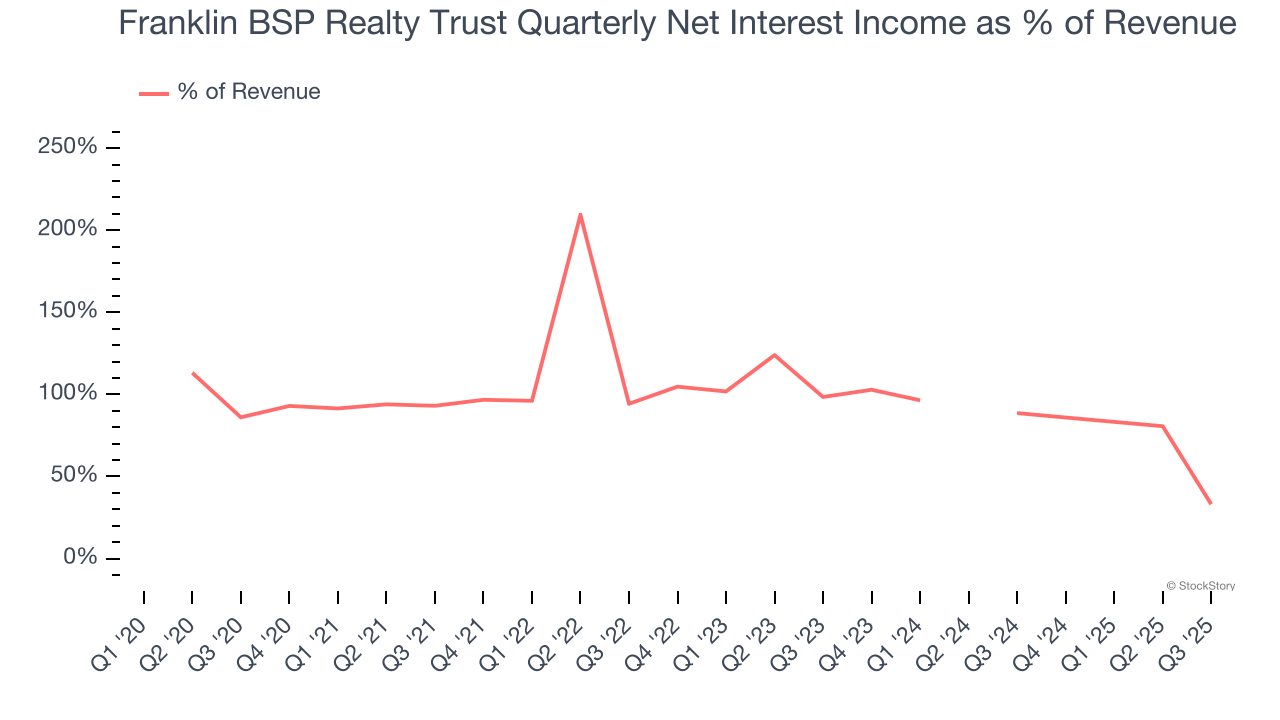

Since the company recorded losses on certain securities, it generated more net interest income than revenue (a 1.1x multiple of its revenue to be exact) during the last five years, meaning Franklin BSP Realty Trust lives and dies by its lending activities because non-interest income barely moves the needle.

Note: Quarters not shown were determined to be outliers, impacted by outsized investment gains/losses that are not indicative of the recurring fundamentals of the business.

Note: Quarters not shown were determined to be outliers, impacted by outsized investment gains/losses that are not indicative of the recurring fundamentals of the business.Our experience and research show the market cares primarily about a bank’s net interest income growth as non-interest income is considered a lower-quality and non-recurring revenue source.

Today’s young investors won’t have read the timeless lessons in Gorilla Game: Picking Winners In High Technology because it was written more than 20 years ago when Microsoft and Apple were first establishing their supremacy. But if we apply the same principles, then enterprise software stocks leveraging their own generative AI capabilities may well be the Gorillas of the future. So, in that spirit, we are excited to present our Special Free Report on a profitable, fast-growing enterprise software stock that is already riding the automation wave and looking to catch the generative AI next.

Key Takeaways from Franklin BSP Realty Trust’s Q3 Results

We were impressed by how significantly Franklin BSP Realty Trust blew past analysts’ revenue expectations this quarter. On the other hand, its net interest income missed and its EPS fell short of Wall Street’s estimates. Overall, this was a weaker quarter. The stock remained flat at $10.66 immediately following the results.

So do we think Franklin BSP Realty Trust is an attractive buy at the current price? When making that decision, it’s important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it’s free for active Edge members.