Nicolet Bankshares currently trades at $116.05 per share and has shown little upside over the past six months, posting a small loss of 0.7%. The stock also fell short of the S&P 500’s 22.6% gain during that period.

Given the weaker price action, is now a good time to buy NIC? Or should investors expect a bumpy road ahead? Find out in our full research report, it’s free for active Edge members.

Why Is NIC a Good Business?

Starting as Green Bay Financial Corporation in 2000 before rebranding in 2002, Nicolet Bankshares (NYSE: NIC) is a regional bank holding company that provides commercial, agricultural, and consumer banking services primarily in Wisconsin, Michigan, and Minnesota.

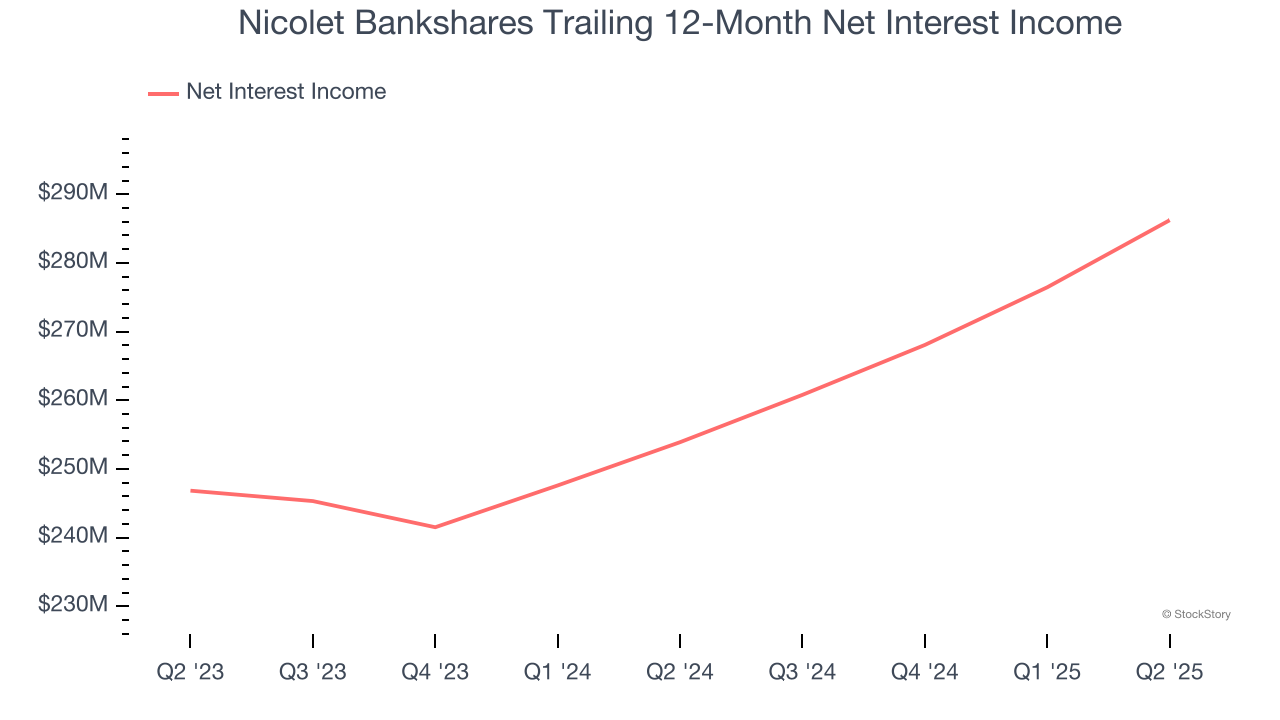

1. Net Interest Income Skyrockets, Fueling Growth Opportunities

Our experience and research show the market cares primarily about a bank’s net interest income growth as one-time fees are considered a lower-quality and non-recurring revenue source.

Nicolet Bankshares’s net interest income has grown at a 18.4% annualized rate over the last five years, much better than the broader banking industry and faster than its total revenue.

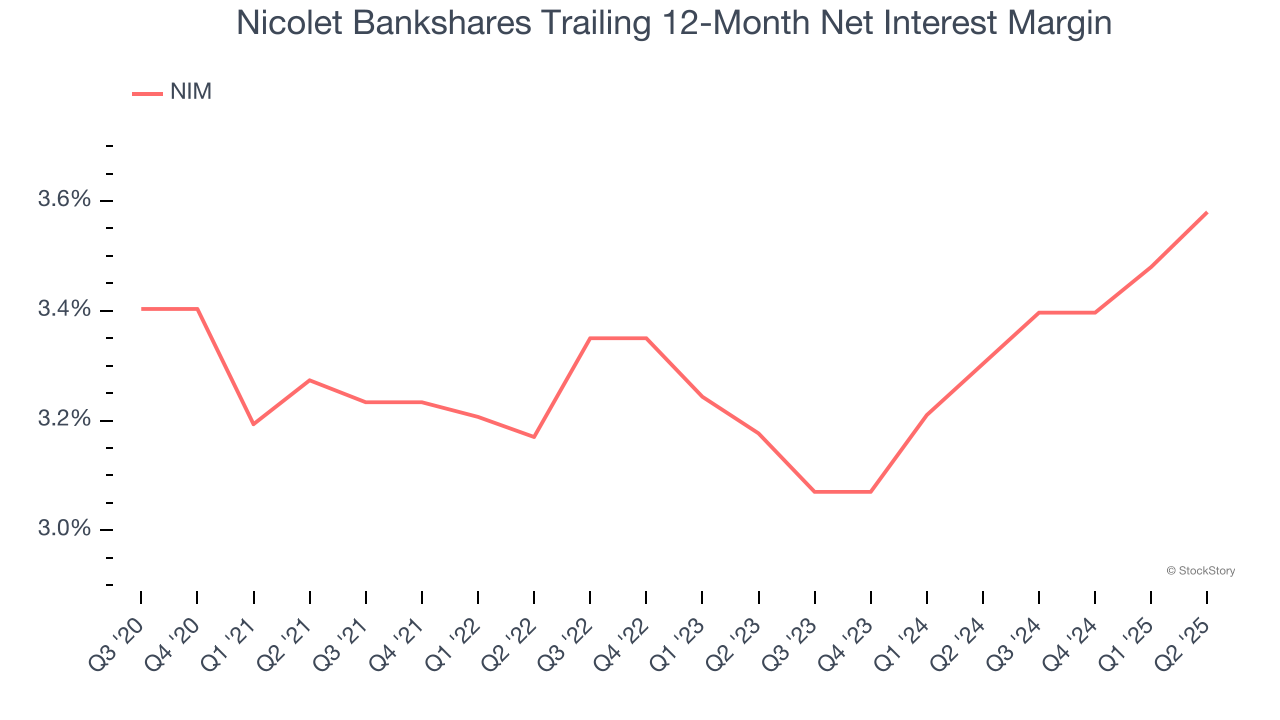

2. Increasing Net Interest Margin Juices Financials

The net interest margin (NIM) is a key profitability indicator that measures the difference between what a bank earns on its loans and what it pays on its deposits. This metric measures how efficiently one can generate income from its core lending activities.

Over the past two years, Nicolet Bankshares’s net interest margin averaged 3.4%. On the bright side, it climbed by 40.3 basis points (100 basis points = 1 percentage point) over that period.

This expansion was a tailwind for its net interest income, and while prevailing interest rates matter the most for industry net interest margins, banks that consistently increase this figure generally boast higher-earning loan books (all else equal such as the risk of those loans) or provide differentiated services that give them the ability to charge higher rates (pricing power).

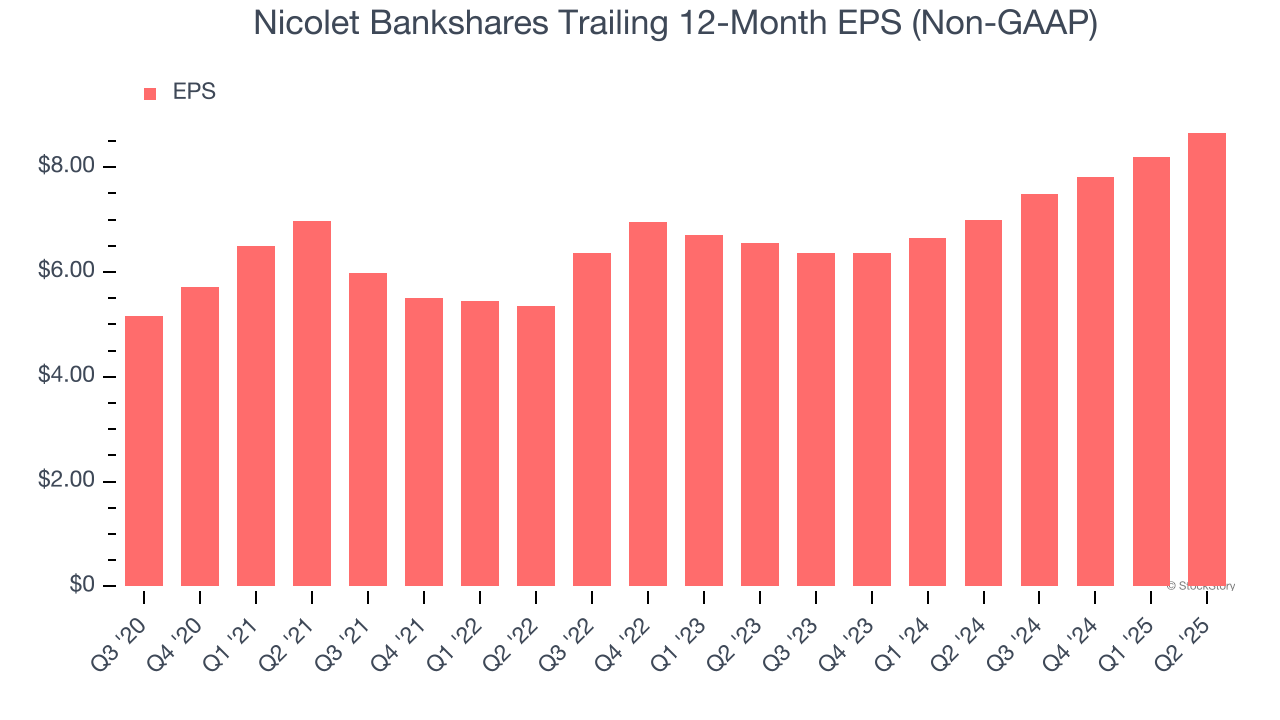

3. Outstanding Long-Term EPS Growth

We track the long-term change in earnings per share (EPS) because it highlights whether a company’s growth is profitable.

Nicolet Bankshares’s EPS grew at an astounding 14% compounded annual growth rate over the last five years. This performance was better than most banking businesses.

Final Judgment

These are just a few reasons why we think Nicolet Bankshares is one of the best banking companies out there. With its shares trailing the market in recent months, the stock trades at 1.4× forward P/B (or $116.05 per share). Is now a good time to initiate a position? See for yourself in our in-depth research report, it’s free for active Edge members.

High-Quality Stocks for All Market Conditions

Donald Trump’s April 2025 "Liberation Day" tariffs sent markets into a tailspin, but stocks have since rebounded strongly, proving that knee-jerk reactions often create the best buying opportunities.

The smart money is already positioning for the next leg up. Don’t miss out on the recovery - check out our Top 5 Growth Stocks for this month. This is a curated list of our High Quality stocks that have generated a market-beating return of 183% over the last five years (as of March 31st 2025).

Stocks that made our list in 2020 include now familiar names such as Nvidia (+1,545% between March 2020 and March 2025) as well as under-the-radar businesses like the once-micro-cap company Kadant (+351% five-year return). Find your next big winner with StockStory today.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.