Granite Construction has been on fire lately. In the past six months alone, the company’s stock price has rocketed 52%, reaching $109.25 per share. This was partly due to its solid quarterly results, and the run-up might have investors contemplating their next move.

Is now still a good time to buy GVA? Or are investors being too optimistic? Find out in our full research report, it’s free for active Edge members.

Why Does GVA Stock Spark Debate?

Having played a role in the construction of the Hoover Dam, Granite Construction (NYSE: GVA) is a provider of infrastructure solutions for roads, bridges, and other projects.

Two Positive Attributes:

1. Skyrocketing Revenue Shows Strong Momentum

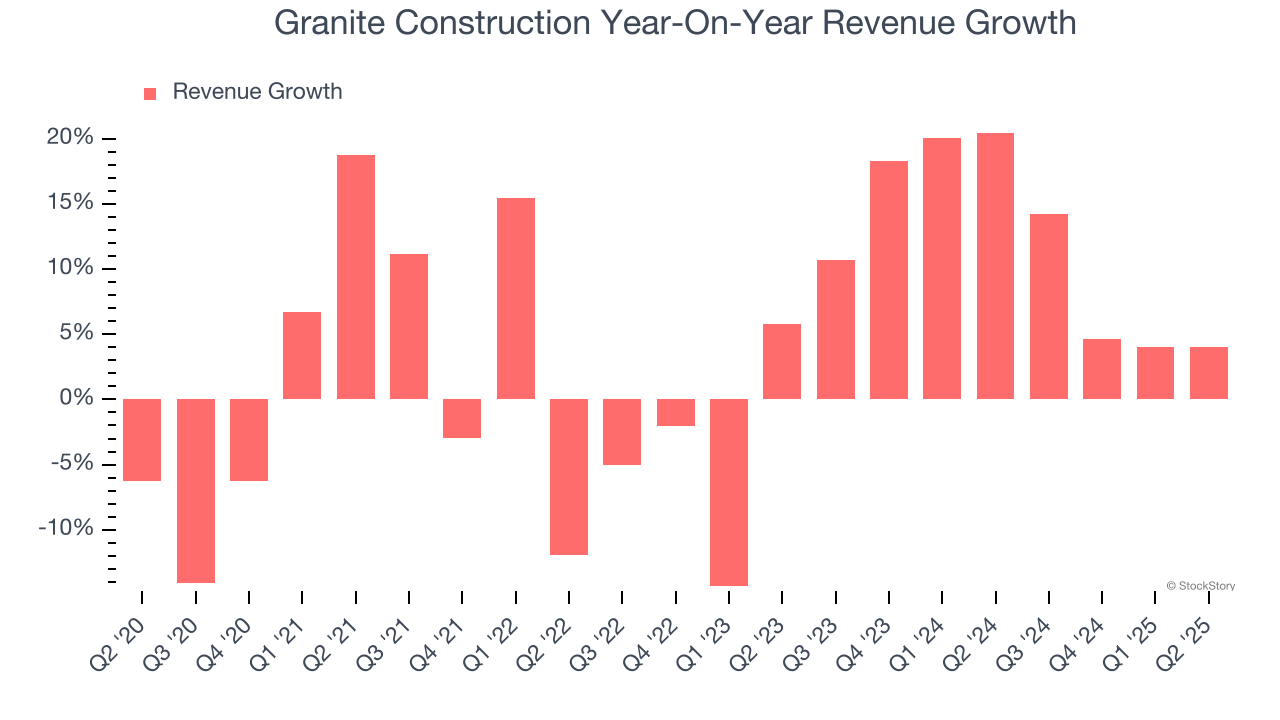

Long-term growth is the most important, but within industrials, a stretched historical view may miss new industry trends or demand cycles. Granite Construction’s annualized revenue growth of 11.9% over the last two years is above its five-year trend, suggesting its demand recently accelerated.

2. New Investments Bear Fruit as ROIC Jumps

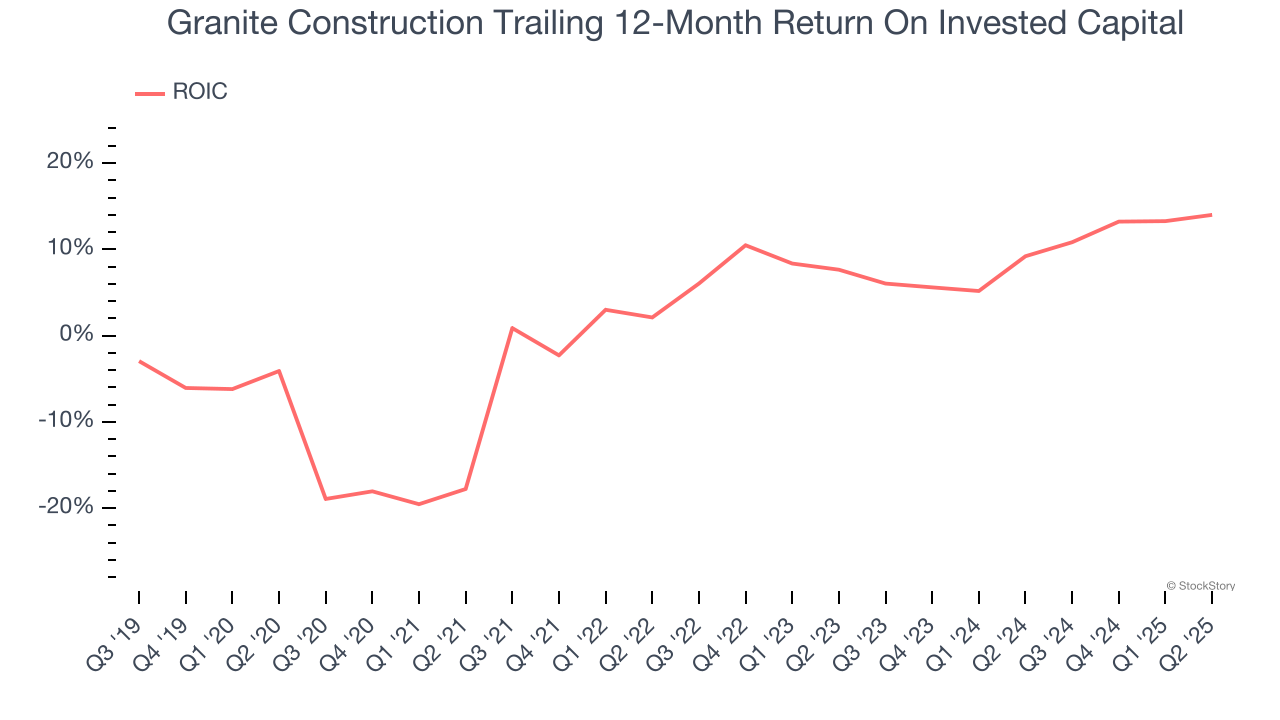

A company’s ROIC, or return on invested capital, shows how much operating profit it makes compared to the money it has raised (debt and equity).

We like to invest in businesses with high returns, but the trend in a company’s ROIC is what often surprises the market and moves the stock price. Over the last few years, Granite Construction’s ROIC has increased significantly. its rising ROIC is a good sign and could suggest its competitive advantage or profitable growth opportunities are expanding.

One Reason to be Careful:

Low Gross Margin Reveals Weak Structural Profitability

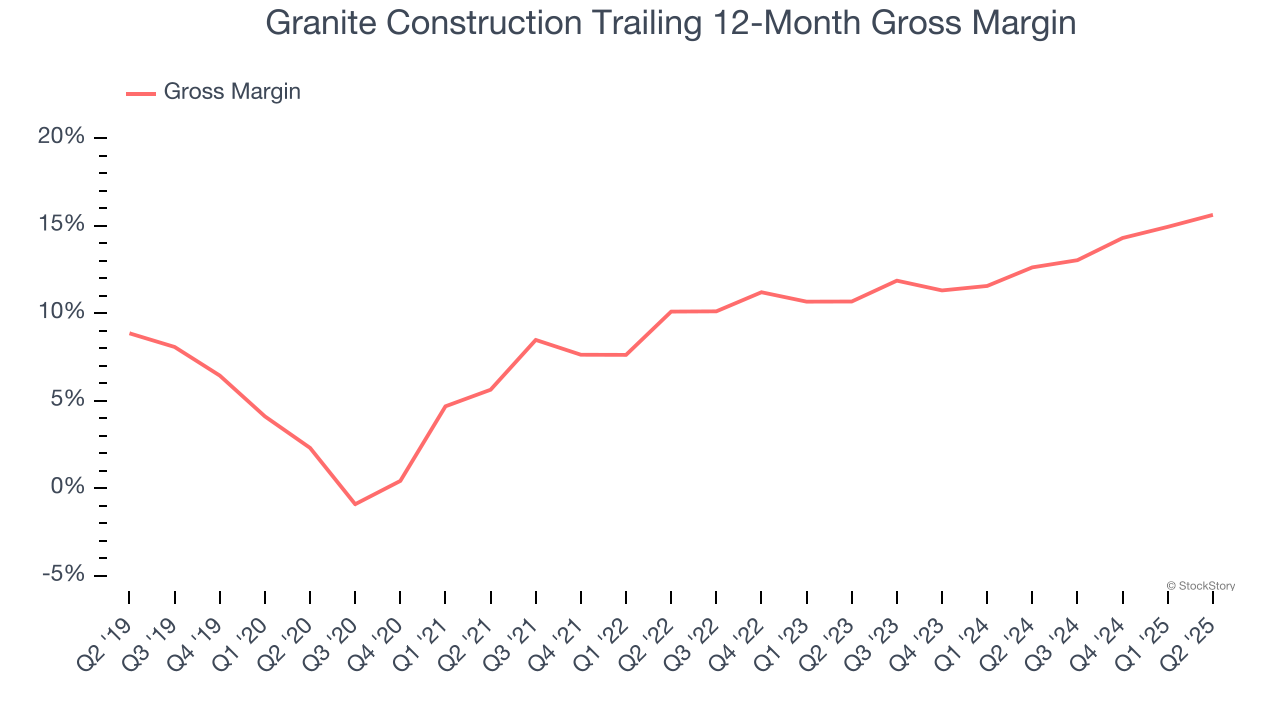

Cost of sales for an industrials business is usually comprised of the direct labor, raw materials, and supplies needed to offer a product or service. These costs can be impacted by inflation and supply chain dynamics.

Granite Construction has bad unit economics for an industrials business, signaling it operates in a competitive market. As you can see below, it averaged a 11.2% gross margin over the last five years. Said differently, Granite Construction had to pay a chunky $88.83 to its suppliers for every $100 in revenue.

Final Judgment

Granite Construction’s merits more than compensate for its flaws, and after the recent rally, the stock trades at 17.8× forward EV-to-EBITDA (or $109.25 per share). Is now the right time to buy? See for yourself in our comprehensive research report, it’s free for active Edge members .

Stocks We Like Even More Than Granite Construction

Trump’s April 2025 tariff bombshell triggered a massive market selloff, but stocks have since staged an impressive recovery, leaving those who panic sold on the sidelines.

Take advantage of the rebound by checking out our Top 6 Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 183% over the last five years (as of March 31st 2025).

Stocks that made our list in 2020 include now familiar names such as Nvidia (+1,545% between March 2020 and March 2025) as well as under-the-radar businesses like the once-micro-cap company Tecnoglass (+1,754% five-year return). Find your next big winner with StockStory today.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.