Over the past six months, AAON has been a great trade, beating the S&P 500 by 6.1%. Its stock price has climbed to $103.81, representing a healthy 39.3% increase. This performance may have investors wondering how to approach the situation.

Is now the time to buy AAON, or should you be careful about including it in your portfolio? See what our analysts have to say in our full research report, it’s free for active Edge members.

Why Is AAON Not Exciting?

Despite the momentum, we don't have much confidence in AAON. Here are three reasons there are better opportunities than AAON and a stock we'd rather own.

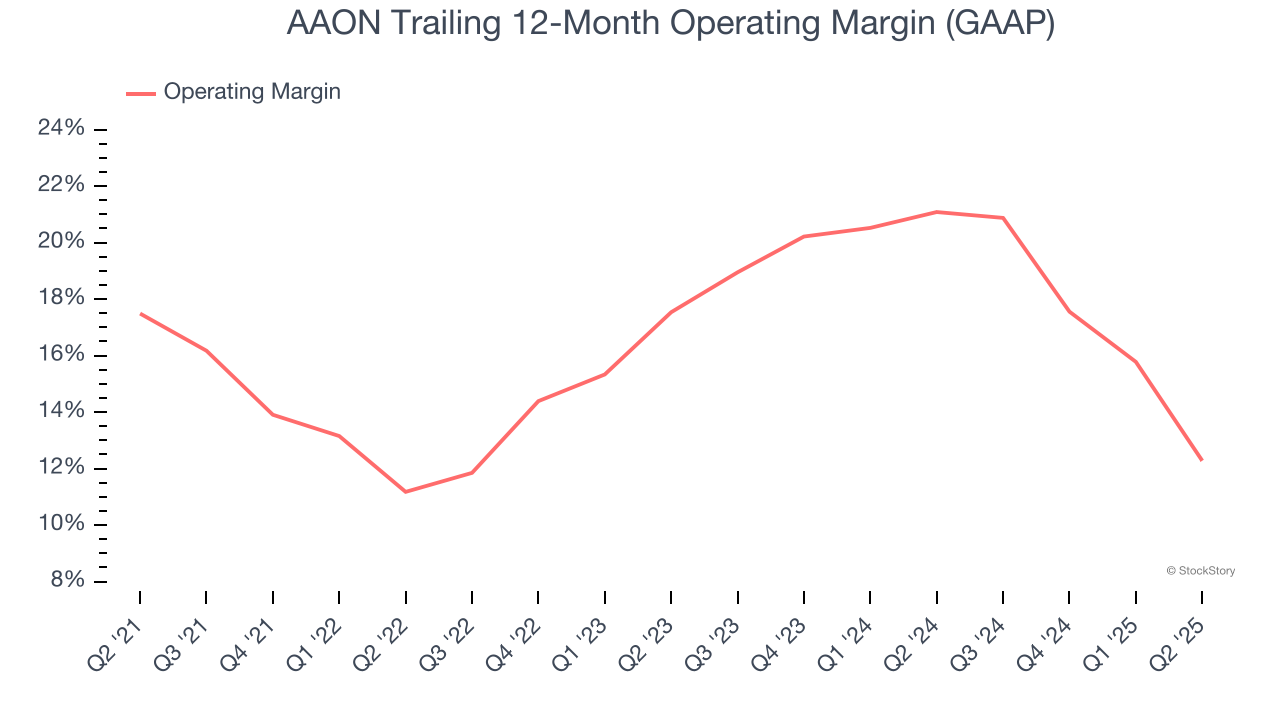

1. Shrinking Operating Margin

Operating margin is a key measure of profitability. Think of it as net income - the bottom line - excluding the impact of taxes and interest on debt, which are less connected to business fundamentals.

Analyzing the trend in its profitability, AAON’s operating margin decreased by 5.2 percentage points over the last five years. This raises questions about the company’s expense base because its revenue growth should have given it leverage on its fixed costs, resulting in better economies of scale and profitability. Its operating margin for the trailing 12 months was 12.3%.

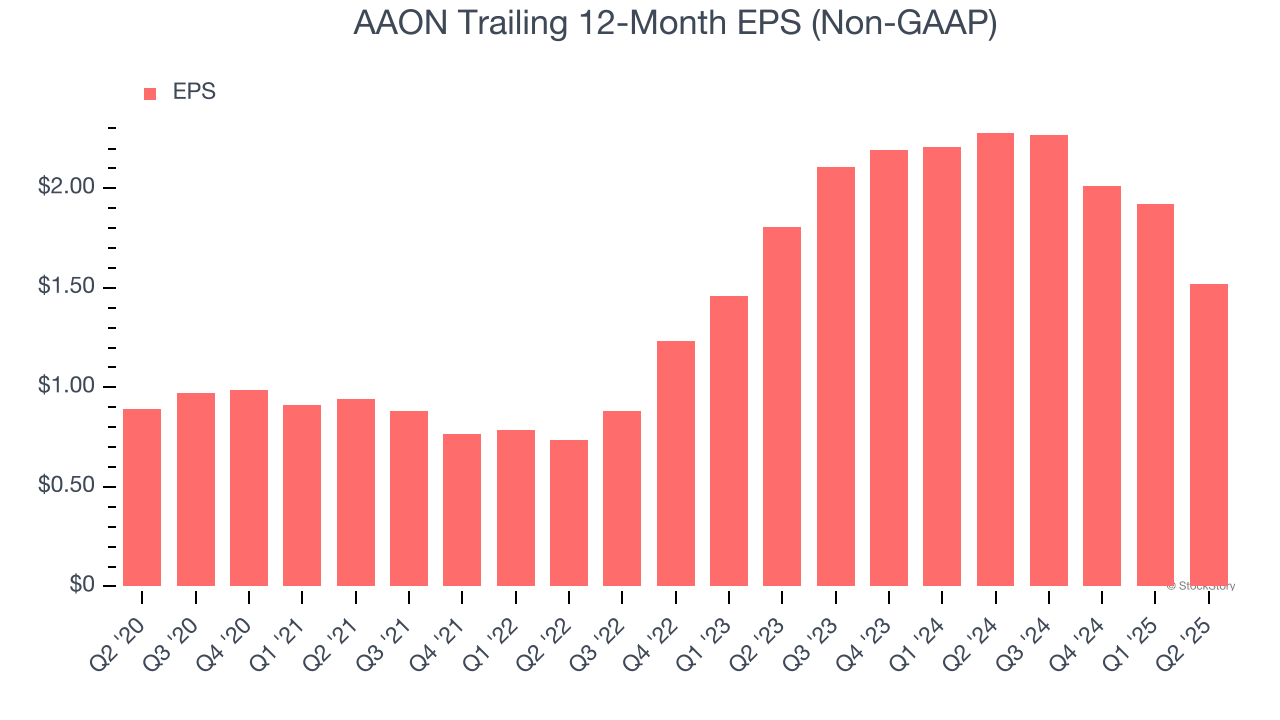

2. EPS Took a Dip Over the Last Two Years

Although long-term earnings trends give us the big picture, we like to analyze EPS over a shorter period to see if we are missing a change in the business.

Sadly for AAON, its EPS declined by 8.3% annually over the last two years while its revenue grew by 9.6%. This tells us the company became less profitable on a per-share basis as it expanded.

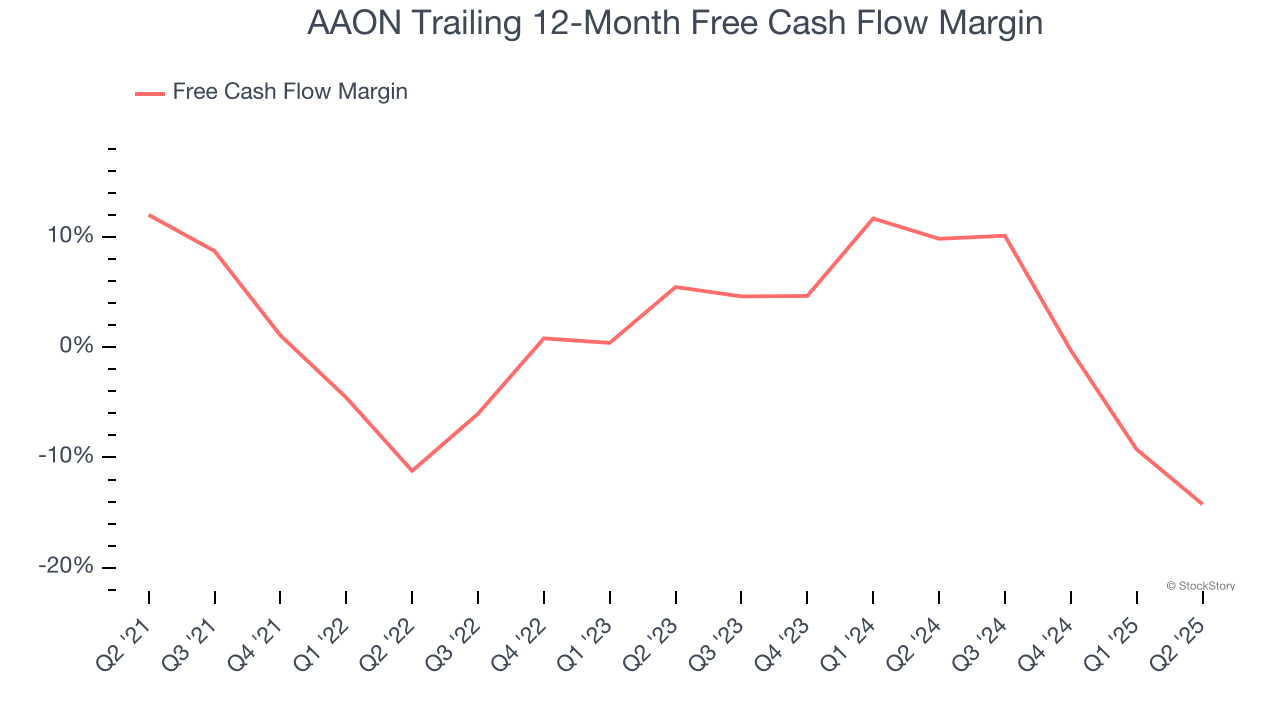

3. Free Cash Flow Margin Dropping

Free cash flow isn't a prominently featured metric in company financials and earnings releases, but we think it's telling because it accounts for all operating and capital expenses, making it tough to manipulate. Cash is king.

As you can see below, AAON’s margin dropped by 26.3 percentage points over the last five years. Almost any movement in the wrong direction is undesirable because of its already low cash conversion. If the trend continues, it could signal it’s becoming a more capital-intensive business. AAON’s free cash flow margin for the trailing 12 months was negative 14.2%.

Final Judgment

AAON isn’t a terrible business, but it doesn’t pass our bar. With its shares outperforming the market lately, the stock trades at 43.2× forward P/E (or $103.81 per share). This valuation tells us it’s a bit of a market darling with a lot of good news priced in - we think there are better stocks to buy right now. Let us point you toward a dominant Aerospace business that has perfected its M&A strategy.

Stocks We Would Buy Instead of AAON

Trump’s April 2025 tariff bombshell triggered a massive market selloff, but stocks have since staged an impressive recovery, leaving those who panic sold on the sidelines.

Take advantage of the rebound by checking out our Top 9 Market-Beating Stocks. This is a curated list of our High Quality stocks that have generated a market-beating return of 183% over the last five years (as of March 31st 2025).

Stocks that made our list in 2020 include now familiar names such as Nvidia (+1,545% between March 2020 and March 2025) as well as under-the-radar businesses like the once-small-cap company Comfort Systems (+782% five-year return). Find your next big winner with StockStory today.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.