Quarterly earnings results are a good time to check in on a company’s progress, especially compared to its peers in the same sector. Today we are looking at Snap-on (NYSE: SNA) and the best and worst performers in the professional tools and equipment industry.

Automation that increases efficiency and connected equipment that collects analyzable data have been trending, creating new demand. Some professional tools and equipment companies also provide software to accompany measurement or automated machinery, adding a stream of recurring revenues to their businesses. On the other hand, professional tools and equipment companies are at the whim of economic cycles. Consumer spending and interest rates, for example, can greatly impact the industrial production that drives demand for these companies’ offerings.

The 10 professional tools and equipment stocks we track reported a satisfactory Q2. As a group, revenues beat analysts’ consensus estimates by 1.8% while next quarter’s revenue guidance was in line.

In light of this news, share prices of the companies have held steady. On average, they are relatively unchanged since the latest earnings results.

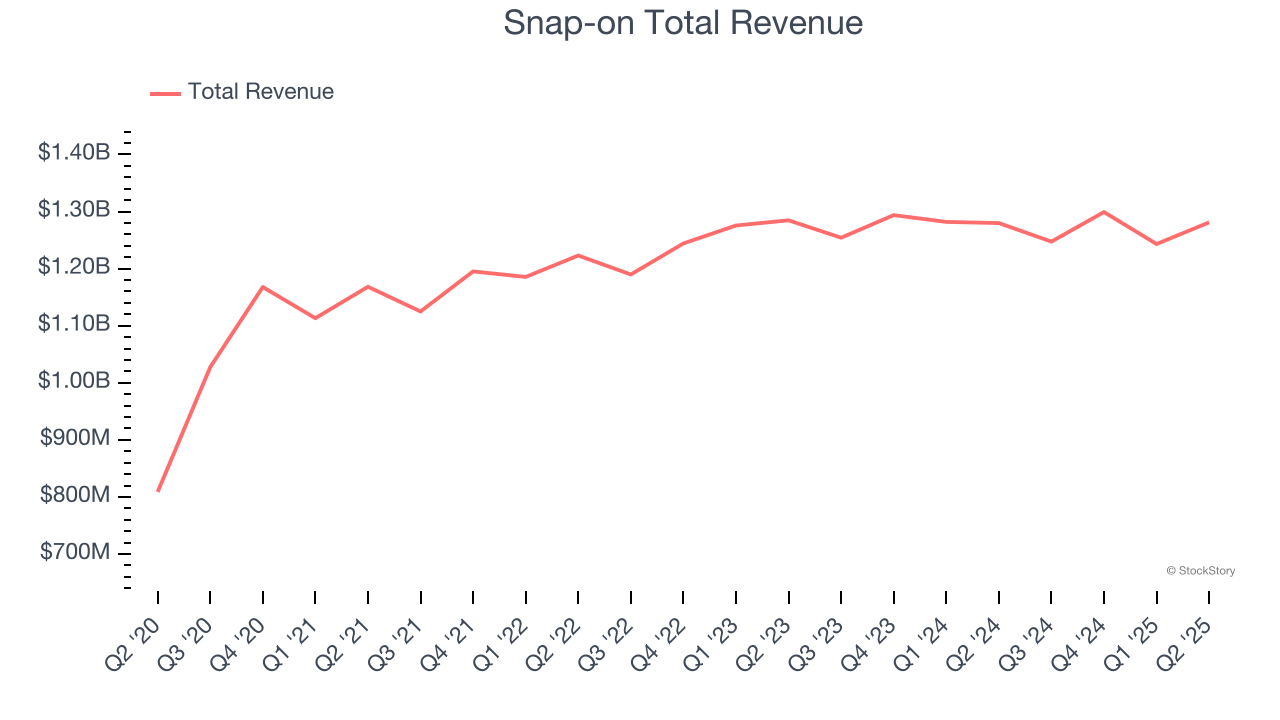

Snap-on (NYSE: SNA)

Founded in 1920, Snap-on (NYSE: SNA) is a global provider of tools, equipment, and diagnostics for various industries such as vehicle repair, aerospace, and the military.

Snap-on reported revenues of $1.28 billion, flat year on year. This print exceeded analysts’ expectations by 2.1%. Overall, it was a strong quarter for the company with an impressive beat of analysts’ organic revenue estimates and a narrow beat of analysts’ adjusted operating income estimates.

Interestingly, the stock is up 8.6% since reporting and currently trades at $340.56.

Is now the time to buy Snap-on? Access our full analysis of the earnings results here, it’s free for active Edge members.

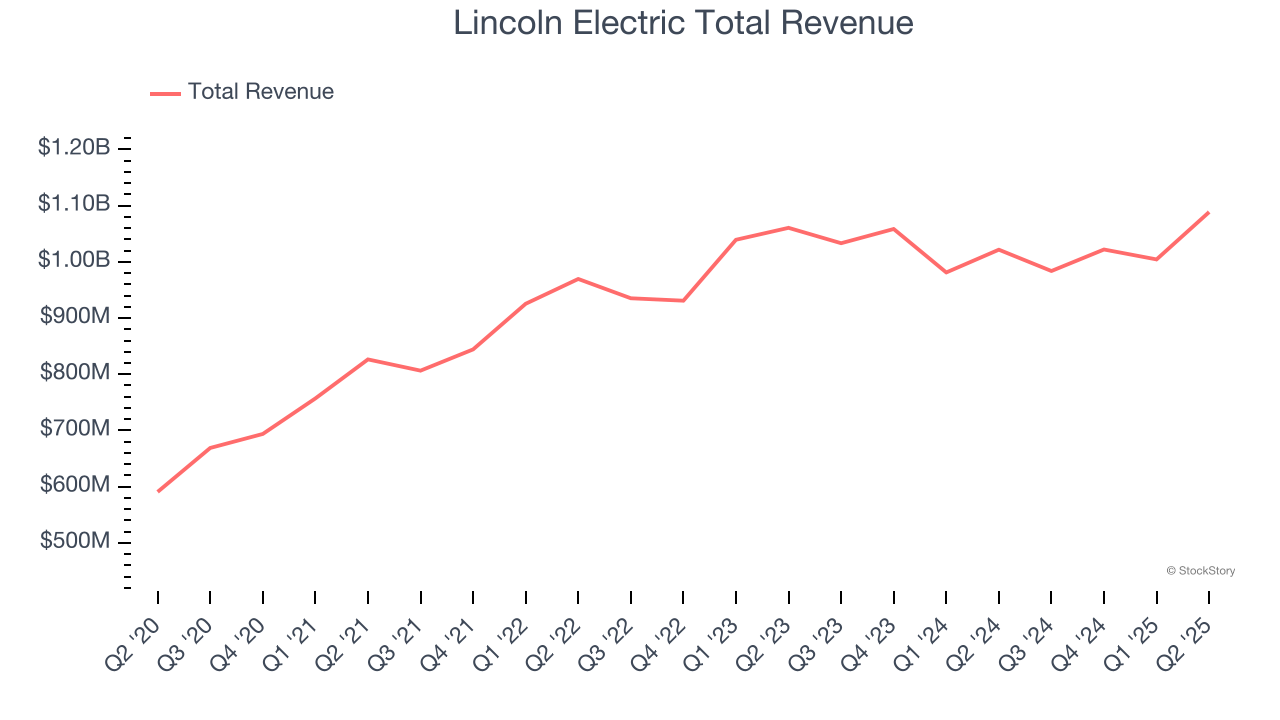

Best Q2: Lincoln Electric (NASDAQ: LECO)

Headquartered in Ohio, Lincoln Electric (NASDAQ: LECO) manufactures and sells welding equipment for various industries.

Lincoln Electric reported revenues of $1.09 billion, up 6.6% year on year, outperforming analysts’ expectations by 5.1%. The business had a stunning quarter with an impressive beat of analysts’ organic revenue estimates and a solid beat of analysts’ EBITDA estimates.

The market seems happy with the results as the stock is up 5.8% since reporting. It currently trades at $236.38.

Is now the time to buy Lincoln Electric? Access our full analysis of the earnings results here, it’s free for active Edge members.

Weakest Q2: Kennametal (NYSE: KMT)

Involved in manufacturing hard tips of anti-tank projectiles in World War II, Kennametal (NYSE: KMT) is a provider of industrial materials and tools for various sectors.

Kennametal reported revenues of $516.4 million, down 4.9% year on year, falling short of analysts’ expectations by 1.9%. It was a disappointing quarter as it posted full-year EPS guidance missing analysts’ expectations.

Kennametal delivered the weakest performance against analyst estimates and weakest full-year guidance update in the group. As expected, the stock is down 12.7% since the results and currently trades at $21.93.

Read our full analysis of Kennametal’s results here.

Nordson (NASDAQ: NDSN)

Founded in 1954, Nordson Corporation (NASDAQ: NDSN) manufactures dispensing equipment and industrial adhesives, sealants and coatings.

Nordson reported revenues of $741.5 million, up 12.1% year on year. This result surpassed analysts’ expectations by 2.7%. It was a very strong quarter as it also logged an impressive beat of analysts’ adjusted operating income estimates.

Nordson delivered the fastest revenue growth among its peers. The stock is up 9.7% since reporting and currently trades at $234.12.

Read our full, actionable report on Nordson here, it’s free for active Edge members.

Middleby (NASDAQ: MIDD)

Holding a Guinness World Record for creating the world’s fastest conveyor pizza oven, Middleby (NYSE: MIDD) is a food service and equipment manufacturer.

Middleby reported revenues of $977.9 million, down 1.4% year on year. This print beat analysts’ expectations by 0.6%. Aside from that, it was a slower quarter as it produced full-year EBITDA guidance missing analysts’ expectations.

The stock is down 3.5% since reporting and currently trades at $139.82.

Read our full, actionable report on Middleby here, it’s free for active Edge members.

Market Update

Thanks to the Fed’s rate hikes in 2022 and 2023, inflation has been on a steady path downward, easing back toward that 2% sweet spot. Fortunately (miraculously to some), all this tightening didn’t send the economy tumbling into a recession, so here we are, cautiously celebrating a soft landing. The cherry on top? Recent rate cuts (half a point in September 2024, a quarter in November) have propped up markets, especially after Trump’s November win lit a fire under major indices and sent them to all-time highs. However, there’s still plenty to ponder — tariffs, corporate tax cuts, and what 2025 might hold for the economy.

Want to invest in winners with rock-solid fundamentals? Check out our 9 Best Market-Beating Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.