ePlus has followed the market’s trajectory closely, rising in tandem with the S&P 500 over the past six months. The stock has climbed by 31.5% to $72.04 per share while the index has gained 34.7%.

Is there a buying opportunity in ePlus, or does it present a risk to your portfolio? Dive into our full research report to see our analyst team’s opinion, it’s free for active Edge members.

Why Do We Think ePlus Will Underperform?

We're cautious about ePlus. Here are three reasons there are better opportunities than PLUS and a stock we'd rather own.

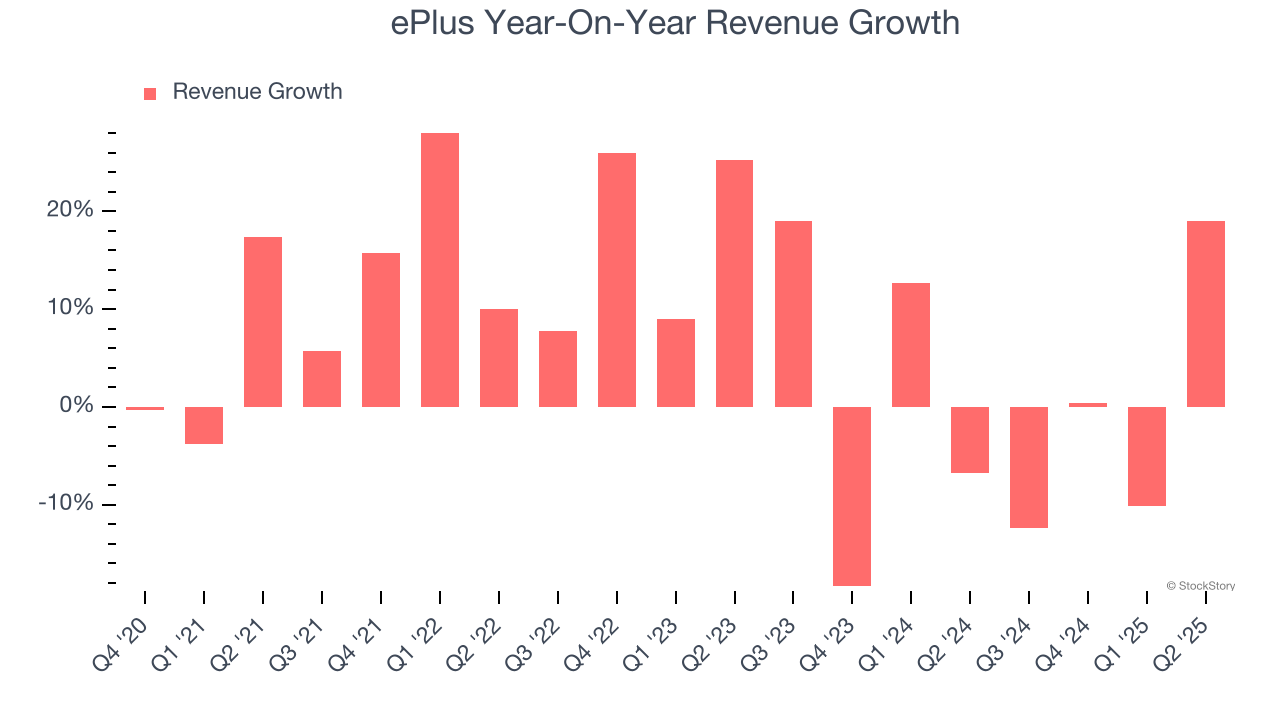

1. Revenue Growth Flatlining

Long-term growth is the most important, but within business services, a stretched historical view may miss new innovations or demand cycles. ePlus’s recent performance shows its demand has slowed as its revenue was flat over the last two years.

2. Revenue Projections Show Stormy Skies Ahead

Forecasted revenues by Wall Street analysts signal a company’s potential. Predictions may not always be accurate, but accelerating growth typically boosts valuation multiples and stock prices while slowing growth does the opposite.

Over the next 12 months, sell-side analysts expect ePlus’s revenue to drop by 3.1%, a decrease from its 7.4% annualized growth for the past five years. This projection doesn't excite us and suggests its products and services will face some demand challenges.

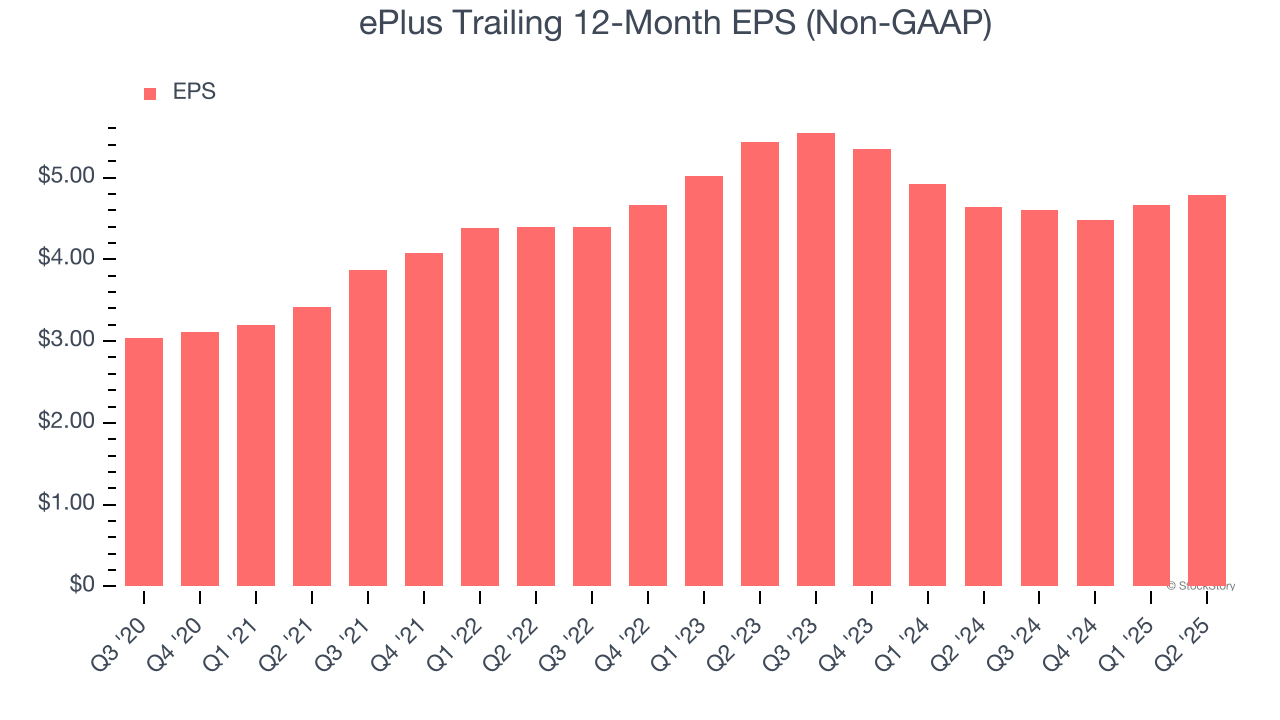

3. EPS Took a Dip Over the Last Two Years

Although long-term earnings trends give us the big picture, we like to analyze EPS over a shorter period to see if we are missing a change in the business.

Sadly for ePlus, its EPS declined by 6.2% annually over the last two years while its revenue was flat. This tells us the company struggled to adjust to choppy demand.

Final Judgment

ePlus doesn’t pass our quality test. That said, the stock currently trades at 18.2× forward P/E (or $72.04 per share). At this valuation, there’s a lot of good news priced in - we think there are better opportunities elsewhere. We’d suggest looking at the most dominant software business in the world.

High-Quality Stocks for All Market Conditions

Trump’s April 2025 tariff bombshell triggered a massive market selloff, but stocks have since staged an impressive recovery, leaving those who panic sold on the sidelines.

Take advantage of the rebound by checking out our Top 9 Market-Beating Stocks. This is a curated list of our High Quality stocks that have generated a market-beating return of 183% over the last five years (as of March 31st 2025).

Stocks that made our list in 2020 include now familiar names such as Nvidia (+1,545% between March 2020 and March 2025) as well as under-the-radar businesses like the once-small-cap company Comfort Systems (+782% five-year return). Find your next big winner with StockStory today.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.