The end of the earnings season is always a good time to take a step back and see who shined (and who not so much). Let’s take a look at how leisure products stocks fared in Q2, starting with Latham (NASDAQ: SWIM).

Leisure products cover a wide range of goods in the consumer discretionary sector. Maintaining a strong brand is key to success, and those who differentiate themselves will enjoy customer loyalty and pricing power while those who don’t may find themselves in precarious positions due to the non-essential nature of their offerings.

The 12 leisure products stocks we track reported a mixed Q2. As a group, revenues beat analysts’ consensus estimates by 3.5% while next quarter’s revenue guidance was 0.9% below.

In light of this news, share prices of the companies have held steady as they are up 3.3% on average since the latest earnings results.

Latham (NASDAQ: SWIM)

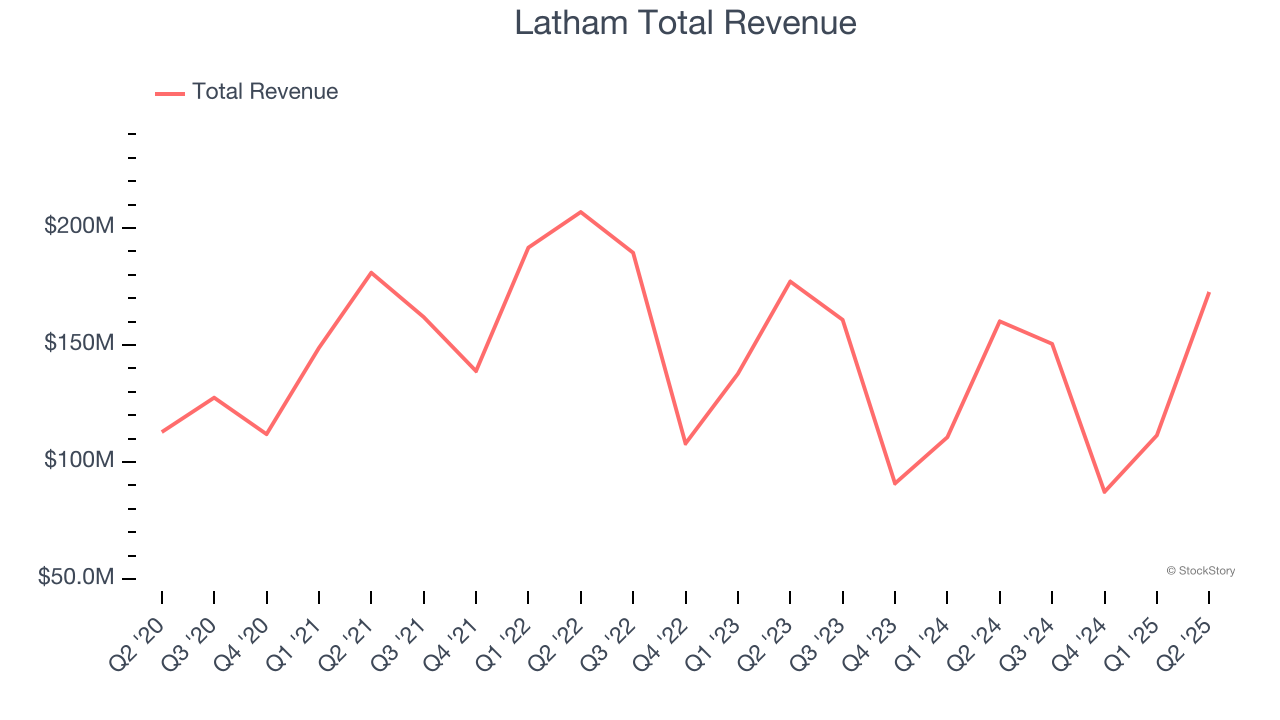

Started as a family business, Latham (NASDAQ: SWIM) is a global designer and manufacturer of in-ground residential swimming pools and related products.

Latham reported revenues of $172.6 million, up 7.8% year on year. This print fell short of analysts’ expectations by 1.4%. Overall, it was a mixed quarter for the company with an impressive beat of analysts’ adjusted operating income estimates but EPS in line with analysts’ estimates.

Commenting on the results, Scott Rajeski, President and CEO, said, “Our second quarter performance demonstrated the continued execution of our strategy to drive awareness and adoption of fiberglass pools and autocovers, expand our presence in the Sand State markets, and improve margins through lean manufacturing and value engineering initiatives and accretive acquisitions.

Latham achieved the highest full-year guidance raise of the whole group. Unsurprisingly, the stock is up 8.2% since reporting and currently trades at $7.40.

Is now the time to buy Latham? Access our full analysis of the earnings results here, it’s free for active Edge members.

Best Q2: Smith & Wesson (NASDAQ: SWBI)

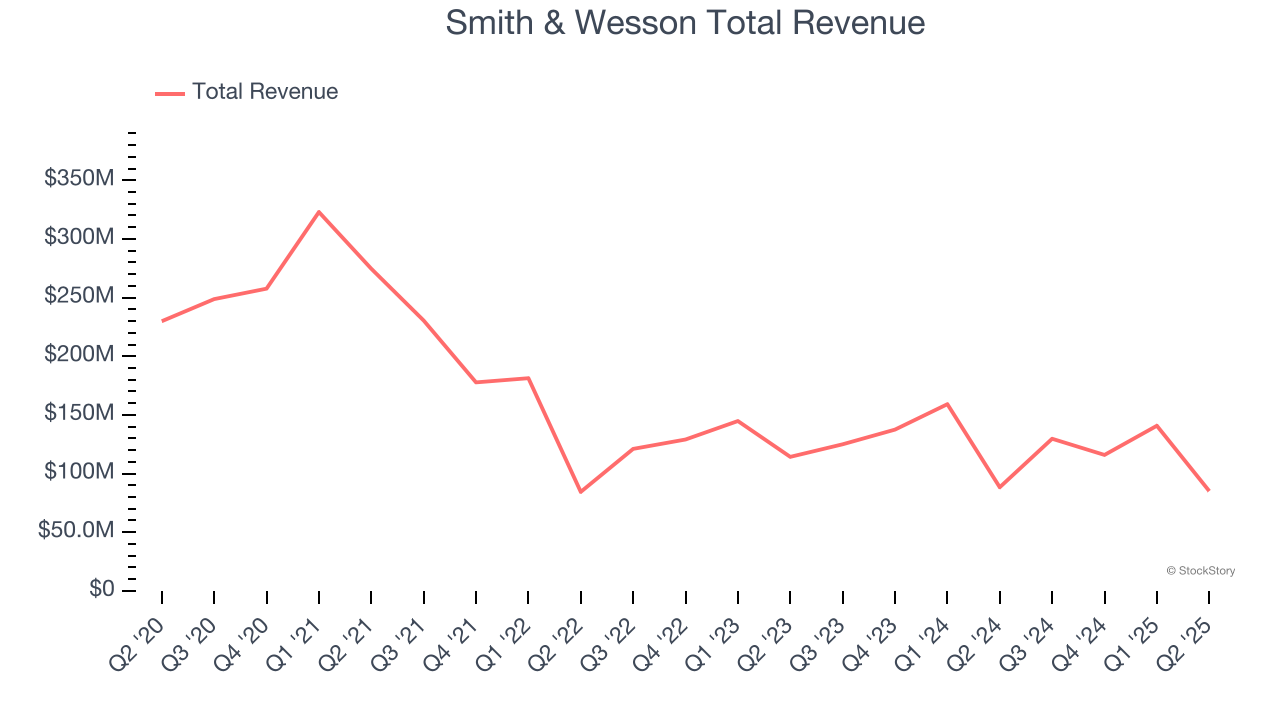

With a history dating back to 1852, Smith & Wesson (NASDAQ: SWBI) is a firearms manufacturer known for its handguns and rifles.

Smith & Wesson reported revenues of $85.08 million, down 3.7% year on year, outperforming analysts’ expectations by 7.4%. The business had an incredible quarter with a beat of analysts’ EPS and EBITDA estimates.

The market seems happy with the results as the stock is up 21.5% since reporting. It currently trades at $9.98.

Is now the time to buy Smith & Wesson? Access our full analysis of the earnings results here, it’s free for active Edge members.

Weakest Q2: American Outdoor Brands (NASDAQ: AOUT)

Spun off from Smith and Wesson in 2020, American Outdoor Brands (NASDAQ: AOUT) is an outdoor and recreational products company that offers outdoor and shooting sports products but does not sell firearms themselves.

American Outdoor Brands reported revenues of $29.7 million, down 28.7% year on year, falling short of analysts’ expectations by 17%. It was a disappointing quarter as it posted a significant miss of analysts’ revenue and EBITDA estimates.

American Outdoor Brands delivered the weakest performance against analyst estimates and slowest revenue growth in the group. As expected, the stock is down 21.9% since the results and currently trades at $8.11.

Read our full analysis of American Outdoor Brands’s results here.

YETI (NYSE: YETI)

Founded by two brothers from Texas, YETI (NYSE: YETI) specializes in durable outdoor goods including coolers, drinkware, and other gear tailored to adventure enthusiasts.

YETI reported revenues of $445.9 million, down 3.8% year on year. This result came in 3.7% below analysts' expectations. Taking a step back, it was still a very strong quarter as it produced full-year EPS guidance exceeding analysts’ expectations and a solid beat of analysts’ adjusted operating income estimates.

The stock is down 8.9% since reporting and currently trades at $33.20.

Read our full, actionable report on YETI here, it’s free for active Edge members.

Polaris (NYSE: PII)

Founded in 1954, Polaris (NYSE: PII) designs and manufactures high-performance off-road vehicles, snowmobiles, and motorcycles.

Polaris reported revenues of $1.88 billion, down 5.6% year on year. This number surpassed analysts’ expectations by 9.2%. Overall, it was an exceptional quarter as it also put up a beat of analysts’ EPS estimates and a solid beat of analysts’ revenue estimates.

The stock is up 29% since reporting and currently trades at $63.80.

Read our full, actionable report on Polaris here, it’s free for active Edge members.

Market Update

The Fed’s interest rate hikes throughout 2022 and 2023 have successfully cooled post-pandemic inflation, bringing it closer to the 2% target. Inflationary pressures have eased without tipping the economy into a recession, suggesting a soft landing. This stability, paired with recent rate cuts (0.5% in September 2024 and 0.25% in November 2024), fueled a strong year for the stock market in 2024. The markets surged further after Donald Trump’s presidential victory in November, with major indices reaching record highs in the days following the election. Still, questions remain about the direction of economic policy, as potential tariffs and corporate tax changes add uncertainty for 2025.

Want to invest in winners with rock-solid fundamentals? Check out our Top 6 Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.