The end of the earnings season is always a good time to take a step back and see who shined (and who not so much). Let’s take a look at how traditional media & publishing stocks fared in Q2, starting with Wiley (NYSE: WLY).

The sector faces structural headwinds from declining linear TV viewership, shifts in advertising spend toward digital platforms, and ongoing challenges in monetizing print and broadcast content. However, for companies that invest wisely, tailwinds can include AI, the power of which can result in more personalized content creation and more detailed audience analysis. These can create a flywheel of success where one feeds into the other. Still there are outstanding questions around AI-generated content oversight, and the regulatory framework around this could evolve in unseen ways over the next few years.

The 4 traditional media & publishing stocks we track reported a mixed Q2. As a group, revenues beat analysts’ consensus estimates by 0.6% while next quarter’s revenue guidance was in line.

Luckily, traditional media & publishing stocks have performed well with share prices up 34.9% on average since the latest earnings results.

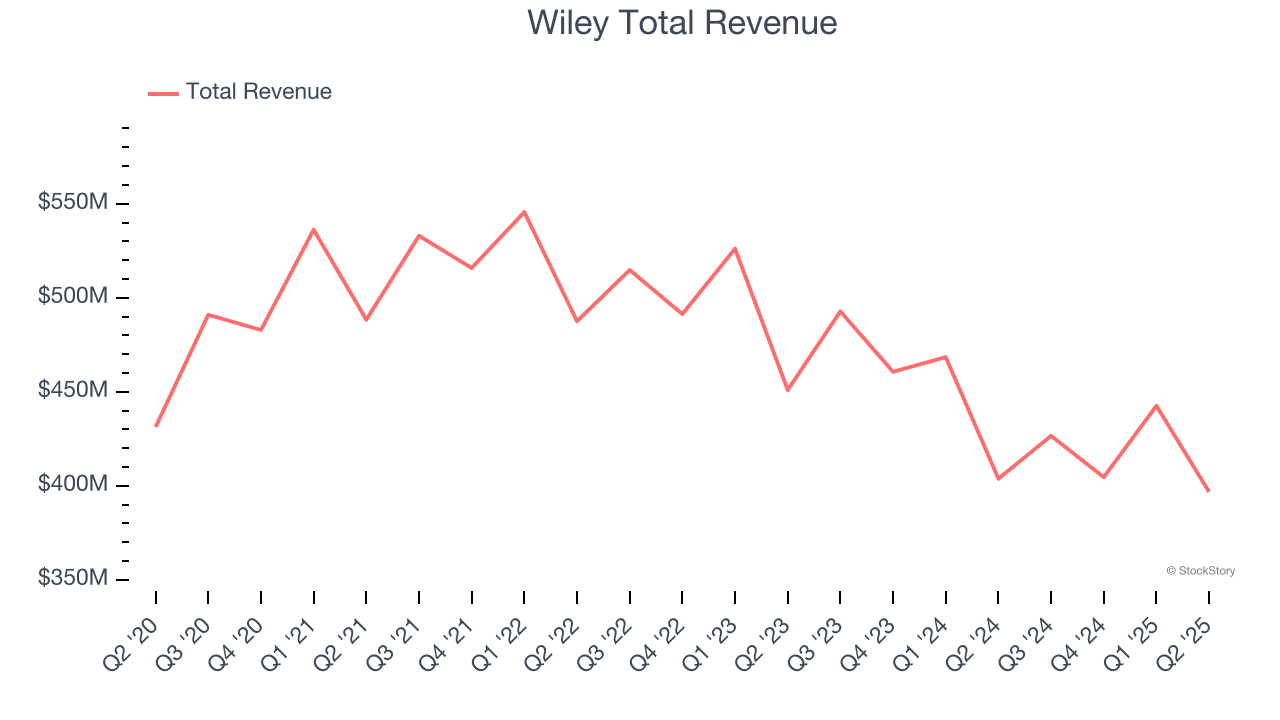

Wiley (NYSE: WLY)

With roots dating back to 1807 when Charles Wiley opened a small printing shop in Manhattan, John Wiley & Sons (NYSE: WLY) is a global academic publisher that provides scientific journals, books, digital courseware, and knowledge solutions for researchers, students, and professionals.

Wiley reported revenues of $396.8 million, down 1.7% year on year. This print exceeded analysts’ expectations by 5.8%. Despite the top-line beat, it was still a mixed quarter for the company with a solid beat of analysts’ revenue estimates but full-year revenue guidance missing analysts’ expectations.

“We continue to see strong demand trends in research as we open up new growth pathways in AI and corporate R&D,” said Matthew Kissner, President and CEO.

Wiley pulled off the biggest analyst estimates beat of the whole group. Still, the market seems discontent with the results. The stock is down 12.8% since reporting and currently trades at $38.

Read our full report on Wiley here, it’s free for active Edge members.

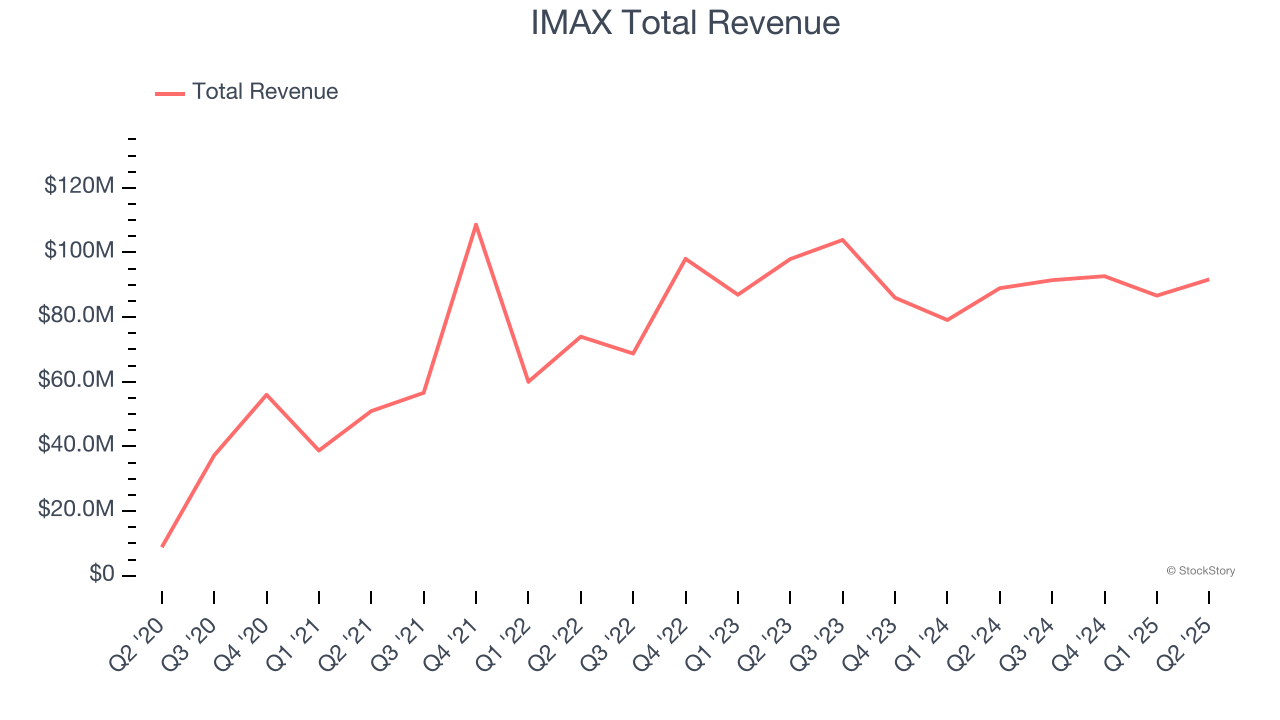

Best Q2: IMAX (NYSE: IMAX)

Originally developed for World Expo '67 in Montreal as an innovative projection system, IMAX (NYSE: IMAX) provides proprietary large-format cinema technology and systems that deliver immersive movie experiences with enhanced image quality and sound.

IMAX reported revenues of $91.68 million, up 3.1% year on year, outperforming analysts’ expectations by 1%. The business had an exceptional quarter with a beat of analysts’ EPS and revenue estimates.

IMAX achieved the fastest revenue growth among its peers. The market seems happy with the results as the stock is up 12.8% since reporting. It currently trades at $32.76.

Is now the time to buy IMAX? Access our full analysis of the earnings results here, it’s free for active Edge members.

Weakest Q2: EchoStar (NASDAQ: SATS)

Following its 2023 acquisition of DISH Network, EchoStar (NASDAQ: SATS) provides satellite communications, pay-TV services, wireless networks, and broadband solutions across consumer and enterprise markets.

EchoStar reported revenues of $3.72 billion, down 5.8% year on year, falling short of analysts’ expectations by 2.2%. It was a softer quarter as it posted a significant miss of analysts’ revenue and EPS estimates.

EchoStar delivered the weakest performance against analyst estimates and slowest revenue growth in the group. Interestingly, the stock is up 134% since the results and currently trades at $76.09.

Read our full analysis of EchoStar’s results here.

Sinclair (NASDAQ: SBGI)

With over 2,400 hours of local news produced weekly and 640 broadcast channels reaching millions of American homes, Sinclair (NASDAQ: SBGI) operates a network of 185 local television stations across 86 U.S. markets, producing news programming and distributing content from major networks.

Sinclair reported revenues of $784 million, down 5.4% year on year. This result lagged analysts' expectations by 2.2%. It was a slower quarter as it also logged revenue guidance for next quarter missing analysts’ expectations and a significant miss of analysts’ revenue estimates.

The stock is down 2.2% since reporting and currently trades at $13.84.

Read our full, actionable report on Sinclair here, it’s free for active Edge members.

Market Update

The Fed’s interest rate hikes throughout 2022 and 2023 have successfully cooled post-pandemic inflation, bringing it closer to the 2% target. Inflationary pressures have eased without tipping the economy into a recession, suggesting a soft landing. This stability, paired with recent rate cuts (0.5% in September 2024 and 0.25% in November 2024), fueled a strong year for the stock market in 2024. The markets surged further after Donald Trump’s presidential victory in November, with major indices reaching record highs in the days following the election. Still, questions remain about the direction of economic policy, as potential tariffs and corporate tax changes add uncertainty for 2025.

Want to invest in winners with rock-solid fundamentals? Check out our Top 5 Quality Compounder Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.