As the craze of earnings season draws to a close, here’s a look back at some of the most exciting (and some less so) results from Q2. Today, we are looking at leisure facilities stocks, starting with Xponential Fitness (NYSE: XPOF).

Leisure facilities companies often sell experiences rather than tangible products, and in the last decade-plus, consumers have slowly shifted their spending from "things" to "experiences". Leisure facilities seek to benefit but must innovate to do so because of the industry's high competition and capital intensity.

The 11 leisure facilities stocks we track reported a mixed Q2. As a group, revenues were in line with analysts’ consensus estimates while next quarter’s revenue guidance was 1.4% below.

While some leisure facilities stocks have fared somewhat better than others, they have collectively declined. On average, share prices are down 1.4% since the latest earnings results.

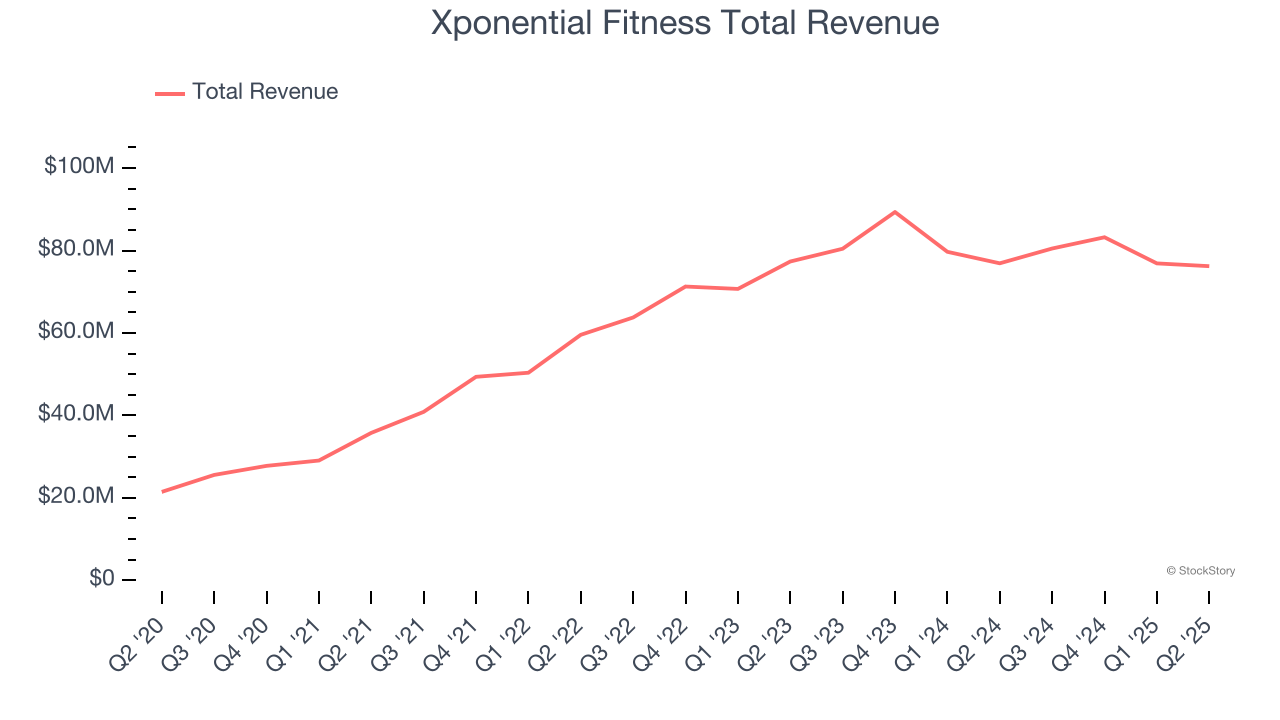

Xponential Fitness (NYSE: XPOF)

Owner of CycleBar, Rumble, and Club Pilates, Xponential Fitness (NYSE: XPOF) is a boutique fitness brand offering diverse and specialized exercise experiences.

Xponential Fitness reported revenues of $76.21 million, flat year on year. This print fell short of analysts’ expectations by 1.5%. Overall, it was a softer quarter for the company with full-year revenue and EBITDA guidance missing analysts’ expectations significantly.

Unsurprisingly, the stock is down 18% since reporting and currently trades at $7.89.

Read our full report on Xponential Fitness here, it’s free for active Edge members.

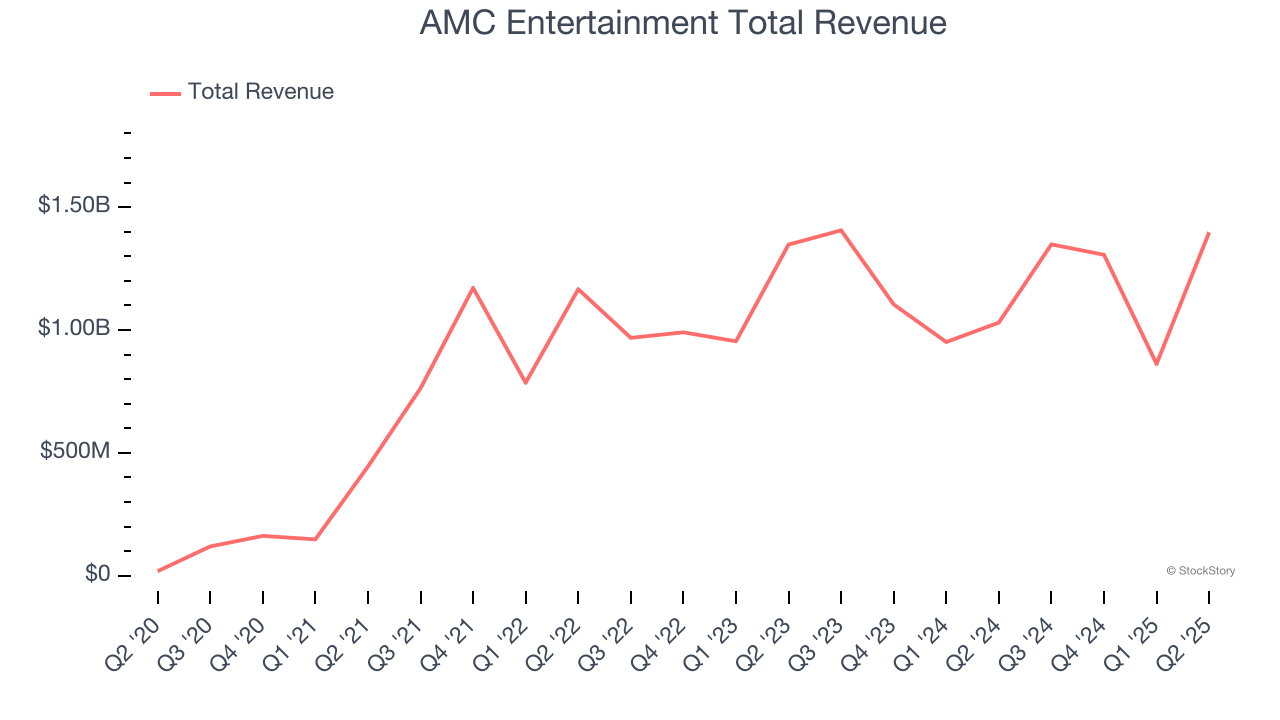

Best Q2: AMC Entertainment (NYSE: AMC)

With a profile that was raised due to meme stock mania beginning in 2021, AMC Entertainment (NYSE: AMC) operates movie theaters primarily in the US and Europe.

AMC Entertainment reported revenues of $1.40 billion, up 35.6% year on year, outperforming analysts’ expectations by 3.1%. The business had a stunning quarter with a beat of analysts’ EPS estimates and an impressive beat of analysts’ adjusted operating income estimates.

AMC Entertainment delivered the fastest revenue growth among its peers. Although it had a fine quarter compared its peers, the market seems unhappy with the results as the stock is down 2.9% since reporting. It currently trades at $2.85.

Is now the time to buy AMC Entertainment? Access our full analysis of the earnings results here, it’s free for active Edge members.

Weakest Q2: Dave & Buster's (NASDAQ: PLAY)

Founded by a former game parlor and bar operator, Dave & Buster’s (NASDAQ: PLAY) operates a chain of arcades providing immersive entertainment experiences.

Dave & Buster's reported revenues of $557.4 million, flat year on year, falling short of analysts’ expectations by 0.9%. It was a softer quarter as it posted a significant miss of analysts’ adjusted operating income and EPS estimates.

As expected, the stock is down 26.8% since the results and currently trades at $17.73.

Read our full analysis of Dave & Buster’s results here.

Live Nation (NYSE: LYV)

Owner of Ticketmaster and operator of music festival EDC, Live Nation (NYSE: LYV) is a company specializing in live event promotion, venue management, and ticketing services for concerts and shows.

Live Nation reported revenues of $7.01 billion, up 16.3% year on year. This print topped analysts’ expectations by 3.4%. Overall, it was an exceptional quarter as it also logged a solid beat of analysts’ EBITDA estimates and an impressive beat of analysts’ adjusted operating income estimates.

Live Nation delivered the biggest analyst estimates beat among its peers. The stock is up 1.6% since reporting and currently trades at $151.

Read our full, actionable report on Live Nation here, it’s free for active Edge members.

European Wax Center (NASDAQ: EWCZ)

Founded by two siblings, European Wax Center (NASDAQ: EWCZ) is a beauty and waxing salon chain specializing in professional wax services and skincare products.

European Wax Center reported revenues of $55.91 million, down 6.6% year on year. This number came in 1.7% below analysts' expectations. Taking a step back, it was a mixed quarter as it also logged a solid beat of analysts’ adjusted operating income estimates but full-year revenue guidance missing analysts’ expectations.

European Wax Center had the slowest revenue growth among its peers. The stock is down 21.5% since reporting and currently trades at $3.47.

Read our full, actionable report on European Wax Center here, it’s free for active Edge members.

Market Update

The Fed’s interest rate hikes throughout 2022 and 2023 have successfully cooled post-pandemic inflation, bringing it closer to the 2% target. Inflationary pressures have eased without tipping the economy into a recession, suggesting a soft landing. This stability, paired with recent rate cuts (0.5% in September 2024 and 0.25% in November 2024), fueled a strong year for the stock market in 2024. The markets surged further after Donald Trump’s presidential victory in November, with major indices reaching record highs in the days following the election. Still, questions remain about the direction of economic policy, as potential tariffs and corporate tax changes add uncertainty for 2025.

Want to invest in winners with rock-solid fundamentals? Check out our Hidden Gem Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.